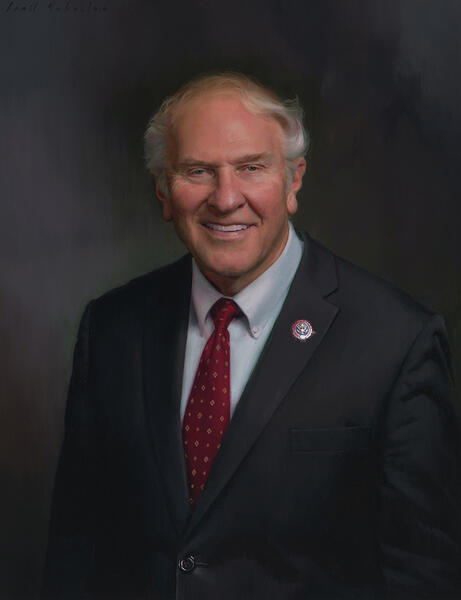

Willis David “Bill” Gradison Jr. (born December 28, 1928) is an American politician and public servant from Ohio who served as a Republican member of the United States House of Representatives from 1975 to 1993. Over the course of 10 terms in Congress, he contributed significantly to federal tax, Social Security, and health policy, representing first Ohio’s 1st congressional district and, after redistricting, the 2nd district. He was the first Jewish Representative elected to the U.S. Congress from Ohio.

Gradison was born in Cincinnati, Hamilton County, Ohio, where he was raised and educated. He attended Walnut Hills High School in Cincinnati before enrolling at Yale University, from which he received a Bachelor of Arts degree in 1949. He then pursued graduate studies in business at Harvard University, earning a master’s degree in business administration from Harvard’s Graduate School of Business Administration in 1951. He continued his academic work at Harvard Business School, where he completed a doctor of commercial science degree in 1954, preparing him for a career at the intersection of finance, public administration, and economic policy.

Before entering elective office, Gradison worked as an investment broker and began his federal public service in Washington, D.C. He served as assistant to the Under Secretary of the Treasury from 1953 to 1955, gaining early experience in national fiscal policy. From 1955 to 1957 he was assistant to the Secretary of Health, Education, and Welfare, a role that provided him with insight into federal health and social programs that would later inform his legislative work in Congress. Returning to Cincinnati, he entered local politics and was elected to the Cincinnati City Council, on which he served from 1961 to 1974. During his tenure on the council he held the rotating position of mayor of Cincinnati in 1971, reflecting the confidence of his colleagues in his leadership.

Gradison was first elected to the U.S. House of Representatives in 1974 and took office in January 1975 as a member of the 94th Congress. A Republican, he represented Ohio’s 1st congressional district, based in the Cincinnati area. Following the 1980 census and subsequent redistricting, he and fellow Cincinnati-area Representative Tom Luken effectively switched districts, with Gradison’s constituency renumbered as Ohio’s 2nd congressional district. He continued to serve in the House through successive reelections, with his service spanning from January 3, 1975, until his resignation in 1993. During this period he participated actively in the legislative process and represented the interests of his Ohio constituents during a significant era in American political and economic history. The vacancy created by his 1993 resignation was filled in a special election won by fellow Republican Rob Portman.

During his congressional career, Gradison became particularly influential on tax and Social Security matters through his long service on the House Committee on Ways and Means, where he served from the 95th through the 101st Congresses. He played a key role in several major legislative efforts of the 1980s. He was the original sponsor of legislation to index federal income tax brackets to inflation, a provision designed to prevent “bracket creep,” in which taxpayers are pushed into higher tax brackets solely because of inflation rather than real income gains. This indexing provision was later incorporated into the Conable-Hance substitute tax bill, H.R. 4260, which formed the basis of President Ronald Reagan’s Economic Recovery Tax Act of 1981, a three-year, 25 percent across-the-board tax cut that also included estate tax relief and tax rate indexing beginning in 1985. The indexing proposal enjoyed broad bipartisan support, as indicated by its co-sponsorship by a majority of House members, and became a central feature of the 1981 tax act.

Gradison also served as the ranking Republican on the Ways and Means Subcommittee on Social Security during the early 1980s, a period marked by concern over the long-term solvency of the Social Security system. He was closely involved in the negotiations that led to the Social Security Amendments of 1983. Provisions he had originated as House bills were incorporated into the final reform package, including a requirement to computerize death records of Social Security beneficiaries to prevent fraudulent continuation of benefits after a beneficiary’s death. Another key provision he advanced placed the Social Security Trust Funds “off-budget,” separating them from the general Treasury revenue budget in order to reduce political interference in Social Security financing and to clarify the program’s long-term fiscal status.

In the mid-1980s, Gradison continued to shape federal tax policy. He sponsored legislation clarifying how the Internal Revenue Service should treat non-statutory fringe benefits for tax purposes at a time when the issue was so contentious that Congress had repeatedly imposed moratoriums on new IRS regulations in this area. His clarifying measure, which specified which commonly used fringe benefits should be taxed and which should be exempt, was enacted as a major component of the Tax Reform Act of 1984 and granted explicit tax exemptions for many widely used fringe benefits. Gradison also played a role in the development of the Tax Reform Act of 1986. At his request, the Joint Committee on Taxation studied how far corporate tax rates could be reduced on a revenue-neutral basis if the 10 percent investment tax credit were eliminated. The study concluded that the top corporate rate could be lowered from 46 percent to 39 percent while eliminating the credit and maintaining overall revenue. The eventual legislation went further, eliminating the investment tax credit and reducing the top corporate tax rate to 34 percent, changes that were incorporated into both the House and Senate versions of the 1986 tax reform bill.

Gradison’s congressional service also extended to health policy. He served on the Health Subcommittee of the Ways and Means Committee and was vice chairman of the U.S. Bipartisan Commission on Comprehensive Health Care, commonly known as the Pepper Commission, which examined options for expanding health coverage and controlling costs. His experience in health and social policy, combined with his earlier service at the Department of Health, Education, and Welfare, made him a recognized figure in debates over Medicare and broader health care reform. In 1993, after nearly 18 years in the House, he resigned his seat to become president of the Health Insurance Association of America, reflecting his growing focus on health care financing and insurance issues.

In the years following his congressional career, Gradison continued to hold significant public and quasi-public positions. In 2002, the Securities and Exchange Commission appointed him as a founding member of the Public Company Accounting Oversight Board (PCAOB), created by the Sarbanes–Oxley Act of 2002 to oversee the audits of public companies and restore confidence in financial reporting. He was unanimously reappointed to a full five-year term in August 2004, served as acting chairman of the PCAOB from December 2005 to July 2006, and remained a board member until February 2011. He was also appointed a commissioner of the Medicare Payment Advisory Commission (MedPAC), an independent congressional agency established by the Balanced Budget Act of 1997 to advise Congress on issues affecting the Medicare program. Gradison served as a MedPAC commissioner for six years, drawing on his prior experience with the Ways and Means Health Subcommittee, the Pepper Commission, his earlier role as assistant to the Secretary of Health, Education, and Welfare, and his vice chairmanship of the Commonwealth Fund Task Force on Academic Health Centers. As of 2022, he has continued his engagement with fiscal policy as a member of the board of directors of the Committee for a Responsible Federal Budget.

Congressional Record