H.J.Res.142 — Disapproving the action of the District of Columbia Council in approving the D.C. Income and Franchise Tax Conformity and Revision Temporary Amendment Act of 2025

House Roll Call

H.J.Res.142

Roll 56 • Congress 119, Session 2 • Feb 4, 2026 4:13 PM • Result: Passed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.J.Res.142 — Disapproving the action of the District of Columbia Council in approving the D.C. Income and Franchise Tax Conformity and Revision Temporary Amendment Act of 2025 |

|---|---|

| Vote question | On Passage |

| Vote type | Yea-and-Nay |

| Result | Passed |

| Totals | Yea 215 / Nay 210 / Present 0 / Not Voting 7 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 215 | 0 | 0 | 3 |

| D | 0 | 210 | 0 | 4 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Passage

Bill Analysis

H.J. Res. 142 is a joint resolution under the District of Columbia Home Rule Act that would nullify a specific D.C. law: the “D.C. Income and Franchise Tax Conformity and Revision Temporary Amendment Act of 2025,” as approved by the D.C. Council.

Core function and legal effect

- The resolution exercises Congress’s authority to review and disapprove D.C. legislation.

- If enacted, it would prevent the temporary D.C. tax conformity and revision act from taking effect or continuing in effect (depending on timing), as if it had never become law.

- This is a disapproval resolution, not a freestanding tax bill: it does not itself set tax rates or rules, but blocks D.C.’s chosen changes.

Scope and subject matter

- The targeted D.C. act concerns the District’s income and franchise tax laws, including:

- Conformity to federal Internal Revenue Code provisions (e.g., which tax year’s federal code D.C. “piggybacks” on).

- Revisions to how individuals and businesses are taxed in the District.

- The disapproval would maintain prior D.C. tax law rather than allowing the Council’s 2025 temporary revisions to operate.

Agencies and programs affected

- Primary: District of Columbia Office of Tax and Revenue and related D.C. fiscal authorities administering income and business (franchise) taxes.

- Indirectly: D.C. budget planning and any D.C. programs whose funding assumptions relied on revenue or distribution changes in the temporary act.

Who is affected

- District residents and businesses subject to D.C. income and franchise taxes, whose tax treatment would remain under pre‑2025 rules rather than the Council’s updated framework.

- D.C. government (Mayor, Council, Chief Financial Officer), whose tax policy discretion is constrained by congressional override.

Process, timing, and funding

- As a joint resolution of disapproval, it must pass the House and Senate and be signed by the President (or enacted over veto) within the statutory review window for D.C. acts.

- The measure does not authorize or appropriate federal funds; fiscal effects are indirect, via D.C.’s own tax base and revenue structure.

- Latest procedural step: a House rule (H. Res. 1032) provides for floor consideration of H.J. Res. 142 under a closed rule, limiting amendments and expediting debate.

Yea (215)

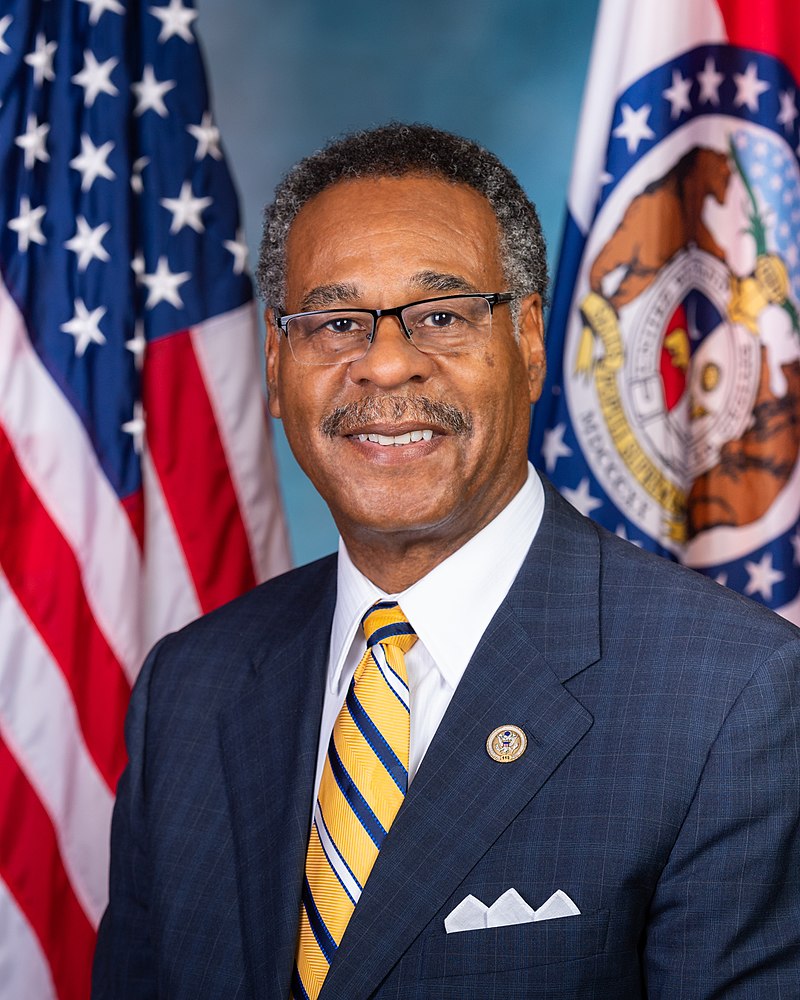

MO • R • Yea

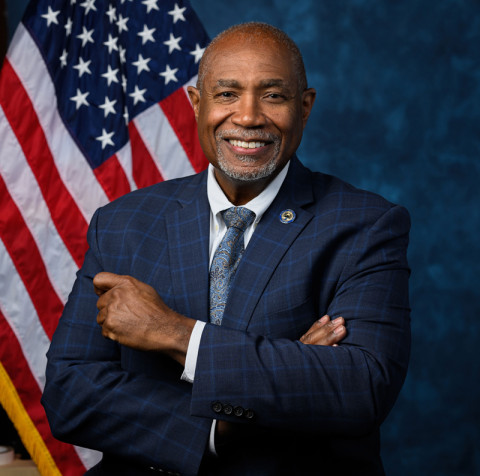

GA • R • Yea

NV • R • Yea

TX • R • Yea

TX • R • Yea

NE • R • Yea

OH • R • Yea

KY • R • Yea

MI • R • Yea

WA • R • Yea

FL • R • Yea

AK • R • Yea

OR • R • Yea

MI • R • Yea

OK • R • Yea

AZ • R • Yea

SC • R • Yea

FL • R • Yea

CO • R • Yea

IL • R • Yea

OK • R • Yea

PA • R • Yea

FL • R • Yea

TN • R • Yea

MO • R • Yea

CA • R • Yea

FL • R • Yea

OH • R • Yea

TX • R • Yea

GA • R • Yea

AZ • R • Yea

VA • R • Yea

TX • R • Yea

GA • R • Yea

OK • R • Yea

GA • R • Yea

KY • R • Yea

AZ • R • Yea

CO • R • Yea

AR • R • Yea

TX • R • Yea

OH • R • Yea

TX • R • Yea

TN • R • Yea

FL • R • Yea

FL • R • Yea

MT • R • Yea

FL • R • Yea

NC • R • Yea

TX • R • Yea

MN • R • Yea

KS • R • Yea

CO • R • Yea

MS • R • Yea

TX • R • Yea

ND • R • Yea

IA • R • Yea

FL • R • Yea

MN • R • Yea

MN • R • Yea

WI • R • Yea

PA • R • Yea

TN • R • Yea

NE • R • Yea

CA • R • Yea

NC • R • Yea

FL • R • Yea

SC • R • Yea

ID • R • Yea

NY • R • Yea

TX • R • Yea

FL • R • Yea

TX • R • Yea

TX • R • Yea

TX • R • Yea

AZ • R • Yea

MO • R • Yea

VA • R • Yea

WI • R • Yea

MS • R • Yea

KY • R • Yea

WY • R • Yea

AZ • R • Yea

FL • R • Yea

NC • R • Yea

MD • R • Yea

NC • R • Yea

TN • R • Yea

OK • R • Yea

LA • R • Yea

AR • R • Yea

IA • R • Yea

IN • R • Yea

NC • R • Yea

MI • R • Yea

CO • R • Yea

CA • R • Yea

GA • R • Yea

TX • R • Yea

MI • R • Yea

LA • R • Yea

SD • R • Yea

OH • R • Yea

OH • R • Yea

PA • R • Yea

NJ • R • Yea

PA • R • Yea

MS • R • Yea

UT • R • Yea

VA • R • Yea

CA • R • Yea

CA • R • Yea

NC • R • Yea

TN • R • Yea

IL • R • Yea

NY • R • Yea

NY • R • Yea

OH • R • Yea

NY • R • Yea

FL • R • Yea

LA • R • Yea

GA • R • Yea

OK • R • Yea

FL • R • Yea

TX • R • Yea

SC • R • Yea

PA • R • Yea

NY • R • Yea

UT • R • Yea

KS • R • Yea

KY • R • Yea

FL • R • Yea

TX • R • Yea

MI • R • Yea

CA • R • Yea

GA • R • Yea

NC • R • Yea

VA • R • Yea

IN • R • Yea

PA • R • Yea

WV • R • Yea

IL • R • Yea

OH • R • Yea

IA • R • Yea

FL • R • Yea

MI • R • Yea

AL • R • Yea

UT • R • Yea

WV • R • Yea

NC • R • Yea

TX • R • Yea

NC • R • Yea

TX • R • Yea

WA • R • Yea

SC • R • Yea

IA • R • Yea

CA • R • Yea

TN • R • Yea

MO • R • Yea

UT • R • Yea

AL • R • Yea

FL • R • Yea

PA • R • Yea

TX • R • Yea

PA • R • Yea

KY • R • Yea

AL • R • Yea

TN • R • Yea

NC • R • Yea

TX • R • Yea

OH • R • Yea

FL • R • Yea

FL • R • Yea

LA • R • Yea

KS • R • Yea

AZ • R • Yea

GA • R • Yea

TX • R • Yea

TX • R • Yea

IN • R • Yea

ID • R • Yea

NJ • R • Yea

NE • R • Yea

MO • R • Yea

PA • R • Yea

IN • R • Yea

MN • R • Yea

NY • R • Yea

WI • R • Yea

FL • R • Yea

AL • R • Yea

IN • R • Yea

OH • R • Yea

NY • R • Yea

PA • R • Yea

WI • R • Yea

OH • R • Yea

CA • R • Yea

NJ • D • Yea

TX • R • Yea

TN • R • Yea

WI • R • Yea

MO • R • Yea

MI • R • Yea

TX • R • Yea

FL • R • Yea

AR • R • Yea

WI • R • Yea

TX • R • Yea

SC • R • Yea

VA • R • Yea

AR • R • Yea

IN • R • Yea

MT • R • Yea

Nay (210)

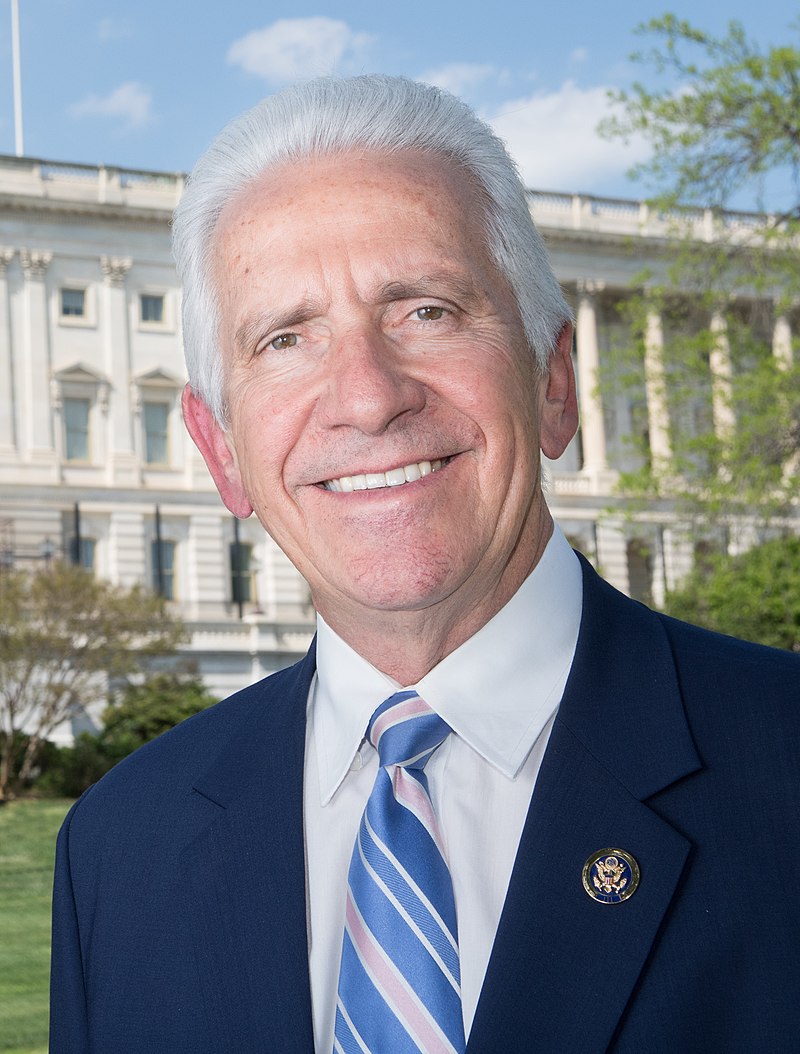

NC • D • Nay

CA • D • Nay

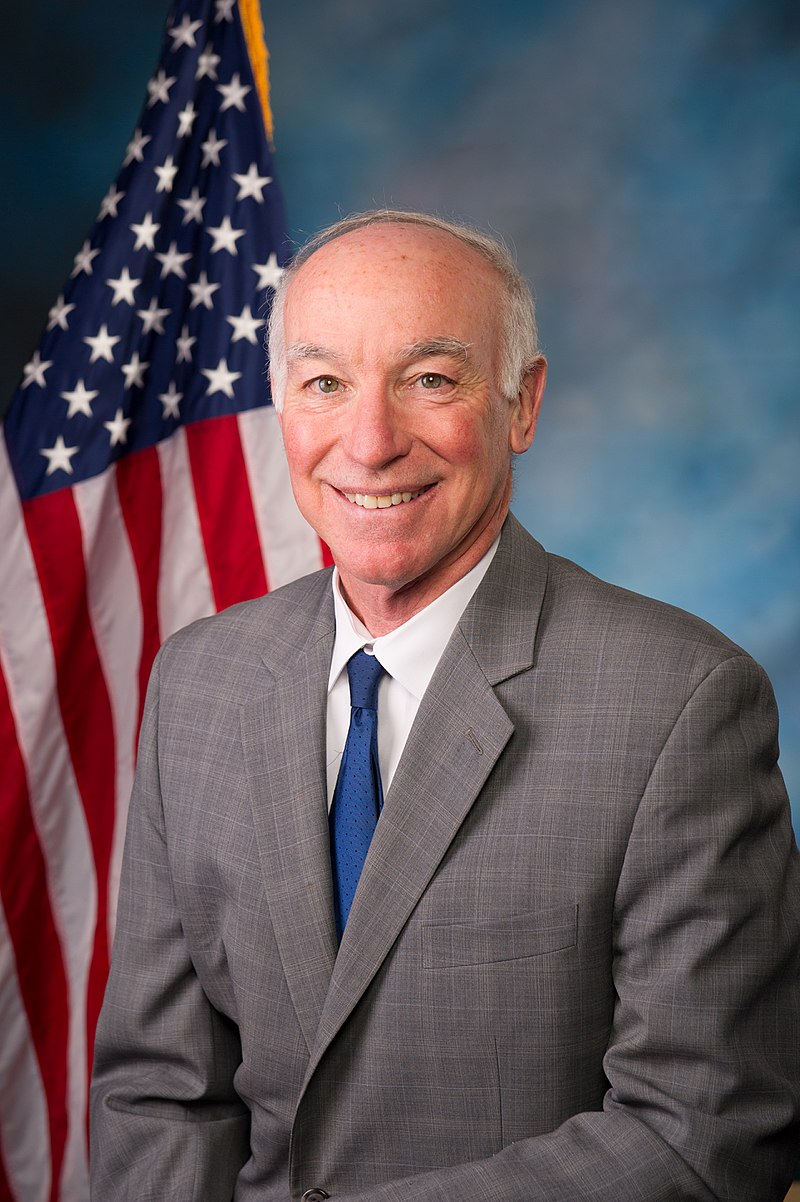

RI • D • Nay

AZ • D • Nay

MA • D • Nay

VT • D • Nay

CA • D • Nay

OH • D • Nay

MO • D • Nay

CA • D • Nay

VA • D • Nay

GA • D • Nay

OR • D • Nay

PA • D • Nay

OH • D • Nay

CA • D • Nay

IL • D • Nay

OR • D • Nay

CA • D • Nay

IN • D • Nay

LA • D • Nay

TX • D • Nay

HI • D • Nay

IL • D • Nay

FL • D • Nay

TX • D • Nay

FL • D • Nay

CA • D • Nay

CA • D • Nay

MA • D • Nay

NY • D • Nay

MO • D • Nay

SC • D • Nay

TN • D • Nay

NJ • D • Nay

CA • D • Nay

CA • D • Nay

CT • D • Nay

MN • D • Nay

CO • D • Nay

TX • D • Nay

KS • D • Nay

IL • D • Nay

NC • D • Nay

PA • D • Nay

CO • D • Nay

CT • D • Nay

WA • D • Nay

PA • D • Nay

CA • D • Nay

OR • D • Nay

MI • D • Nay

MD • D • Nay

TX • D • Nay

NY • D • Nay

PA • D • Nay

LA • D • Nay

AL • D • Nay

TX • D • Nay

IL • D • Nay

NC • D • Nay

FL • D • Nay

CA • D • Nay

FL • D • Nay

CA • D • Nay

TX • D • Nay

CA • D • Nay

IL • D • Nay

NY • D • Nay

ME • D • Nay

NY • D • Nay

CA • D • Nay

TX • D • Nay

NH • D • Nay

NJ • D • Nay

CA • D • Nay

TX • D • Nay

AZ • D • Nay

CA • D • Nay

CT • D • Nay

CT • D • Nay

NV • D • Nay

PA • D • Nay

MD • D • Nay

OR • D • Nay

CA • D • Nay

MD • D • Nay

IL • D • Nay

CA • D • Nay

WA • D • Nay

NY • D • Nay

GA • D • Nay

TX • D • Nay

CA • D • Nay

OH • D • Nay

MA • D • Nay

IL • D • Nay

NY • D • Nay

CA • D • Nay

IL • D • Nay

OH • D • Nay

WA • D • Nay

CT • D • Nay

NY • D • Nay

NV • D • Nay

PA • D • Nay

NM • D • Nay

CA • D • Nay

CA • D • Nay

CA • D • Nay

CA • D • Nay

MA • D • Nay

RI • D • Nay

NY • D • Nay

CA • D • Nay

GA • D • Nay

DE • D • Nay

MD • D • Nay

VA • D • Nay

MN • D • Nay

MI • D • Nay

KY • D • Nay

MA • D • Nay

NJ • D • Nay

NY • D • Nay

TX • D • Nay

NJ • D • Nay

NY • D • Nay

MD • D • Nay

CA • D • Nay

WI • D • Nay

NY • D • Nay

MN • D • Nay

FL • D • Nay

MA • D • Nay

IN • D • Nay

CA • D • Nay

NY • D • Nay

MA • D • Nay

CO • D • Nay

NJ • D • Nay

NY • D • Nay

MD • D • Nay

MN • D • Nay

NJ • D • Nay

CA • D • Nay

NH • D • Nay

CA • D • Nay

WA • D • Nay

CA • D • Nay

CO • D • Nay

ME • D • Nay

WI • D • Nay

NJ • D • Nay

MA • D • Nay

IL • D • Nay

IL • D • Nay

WA • D • Nay

MD • D • Nay

NY • D • Nay

CA • D • Nay

NC • D • Nay

CA • D • Nay

NY • D • Nay

OR • D • Nay

CA • D • Nay

PA • D • Nay

IL • D • Nay

IL • D • Nay

MI • D • Nay

WA • D • Nay

VA • D • Nay

GA • D • Nay

AL • D • Nay

CA • D • Nay

CA • D • Nay

WA • D • Nay

IL • D • Nay

FL • D • Nay

NM • D • Nay

AZ • D • Nay

MI • D • Nay

WA • D • Nay

VA • D • Nay

NY • D • Nay

OH • D • Nay

CA • D • Nay

MI • D • Nay

MS • D • Nay

CA • D • Nay

NV • D • Nay

MI • D • Nay

HI • D • Nay

NY • D • Nay

CA • D • Nay

NY • D • Nay

MA • D • Nay

CA • D • Nay

IL • D • Nay

CA • D • Nay

NM • D • Nay

TX • D • Nay

NY • D • Nay

VA • D • Nay

VA • D • Nay

FL • D • Nay

CA • D • Nay

NJ • D • Nay

CA • D • Nay

GA • D • Nay

Not Voting (7)

IN • R • Not Voting

TX • D • Not Voting

TX • D • Not Voting

TX • R • Not Voting

CA • D • Not Voting

SC • R • Not Voting

FL • D • Not Voting