H.Res.1032 — Providing for consideration of the Senate amendments to the bill (H.R. 7148); providing for consideration of the joint resolution (H.J.Res. 142); and providing for consideration of the bill (H.R. 4090)

House Roll Call

H.Res.1032

Roll 52 • Congress 119, Session 2 • Feb 3, 2026 12:34 PM • Result: Passed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.Res.1032 — Providing for consideration of the Senate amendments to the bill (H.R. 7148); providing for consideration of the joint resolution (H.J.Res. 142); and providing for consideration of the bill (H.R. 4090) |

|---|---|

| Vote question | On Agreeing to the Resolution |

| Vote type | Recorded Vote |

| Result | Passed |

| Totals | Yea 217 / Nay 215 / Present 0 / Not Voting 0 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 217 | 1 | 0 | 0 |

| D | 0 | 214 | 0 | 0 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Agreeing to the Resolution

Bill Analysis

H.Res. 1032 is a House rules (procedural) resolution that sets the terms for floor consideration of three separate measures; it does not itself appropriate money, change tax law, or regulate mining, but governs how the House will debate and amend those bills.

Senate amendments to H.R. 7148 (FY2026 consolidated appropriations)

- Provides a special rule for taking up and disposing of Senate amendments to a large FY2026 consolidated appropriations bill.

- Typically:

- Deems the House to have agreed or disagreed to specified Senate amendments under structured procedures.

- May specify whether further amendments are in order, time limits for debate, and how motions to concur or concur with amendment are handled.

- Affects: House floor process, not agencies directly. Substantive impact occurs through H.R. 7148 itself (funding for federal departments and programs through Sept. 30, 2026).

H.J. Res. 142 (disapproval of D.C. tax legislation)

- Sets the terms for considering a joint resolution that would overturn the District of Columbia’s “Income and Franchise Tax Conformity and Revision Temporary Amendment Act of 2025” under the Home Rule Act.

- Likely includes:

- One hour of debate, controlled by specified committees.

- Waiver of points of order and restrictions on amendments (often a closed rule).

- Affects:

- D.C. government tax policy authority.

- D.C. taxpayers and businesses, depending on whether the disapproval is ultimately enacted.

H.R. 4090 (domestic mining and hardrock minerals)

- Establishes procedures for considering a bill to codify portions of existing Executive Orders related to domestic mining and hardrock mineral resources.

- Likely provides:

- Structured or closed rule, defined debate time, and amendment limits.

- Substantive effects (on mining companies, federal land managers, permitting, and supply chains) would come from H.R. 4090, not this resolution.

Timelines and procedural effects

- H.Res. 1032 takes effect upon House adoption and applies only to the consideration of these three measures during the specified legislative window.

- It centralizes control of debate and amendment opportunities in the Rules Committee and House majority, shaping—but not itself determining—the final policy outcomes on appropriations, D.C. tax law, and mineral policy.

Yea (217)

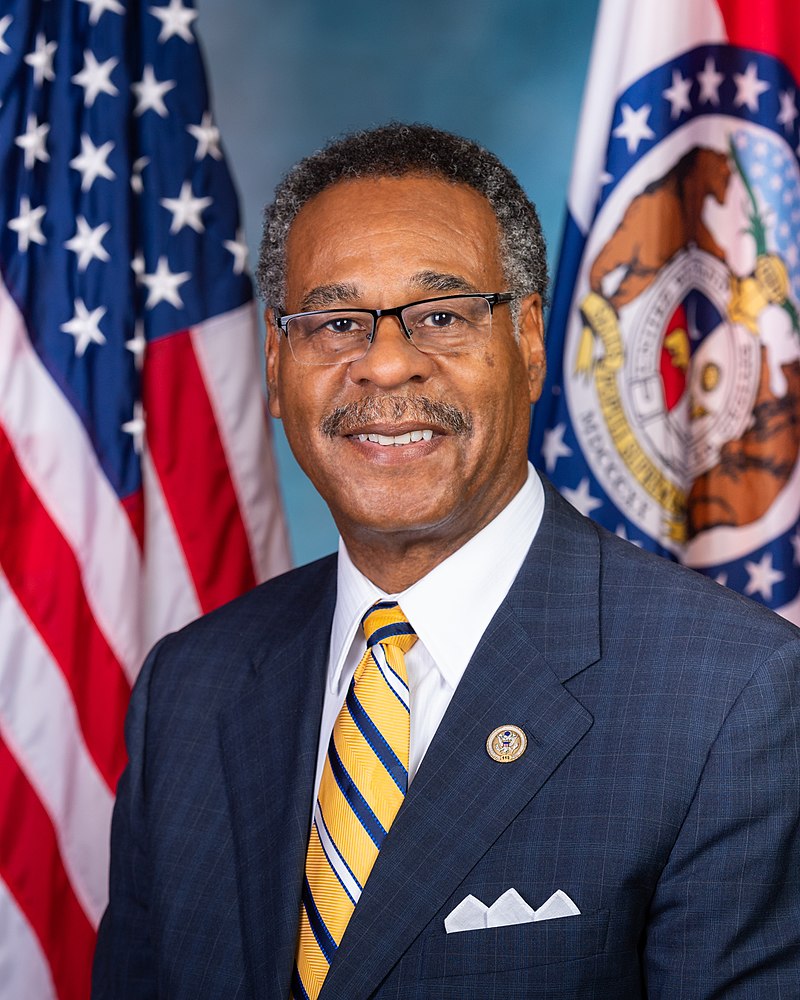

MO • R • Aye

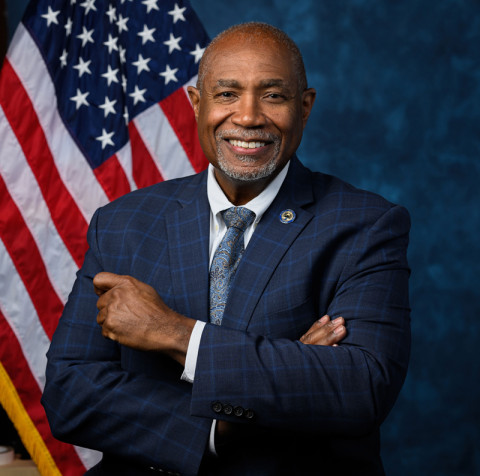

GA • R • Aye

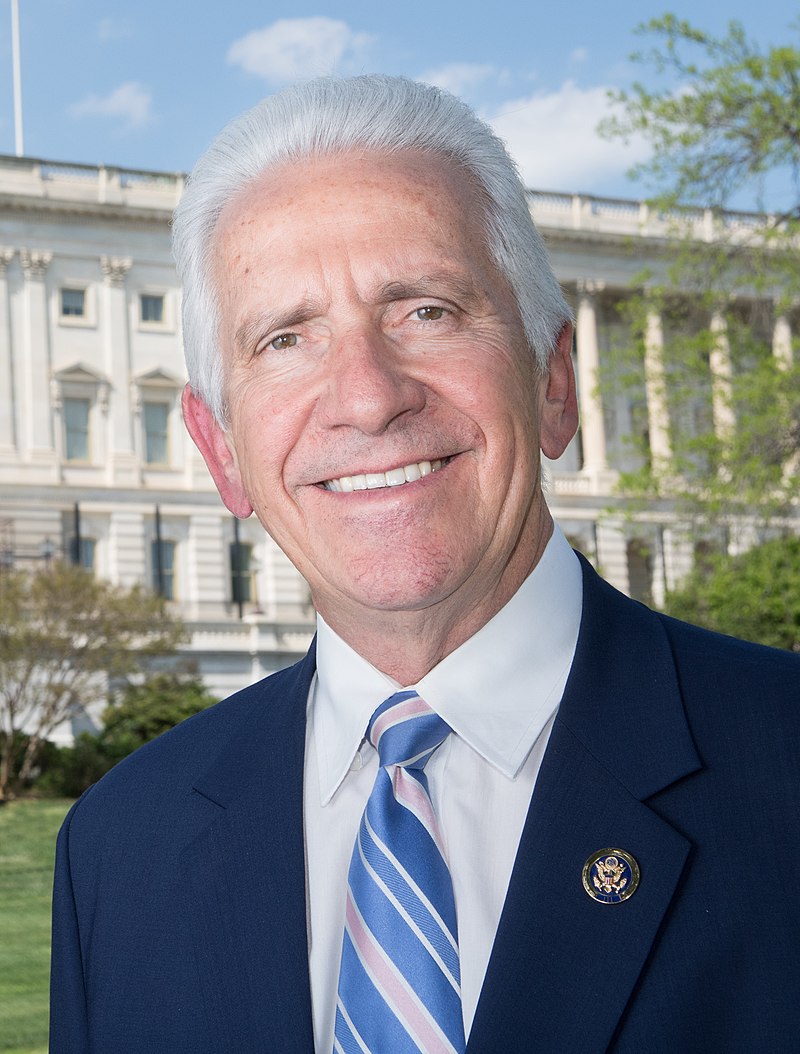

NV • R • Aye

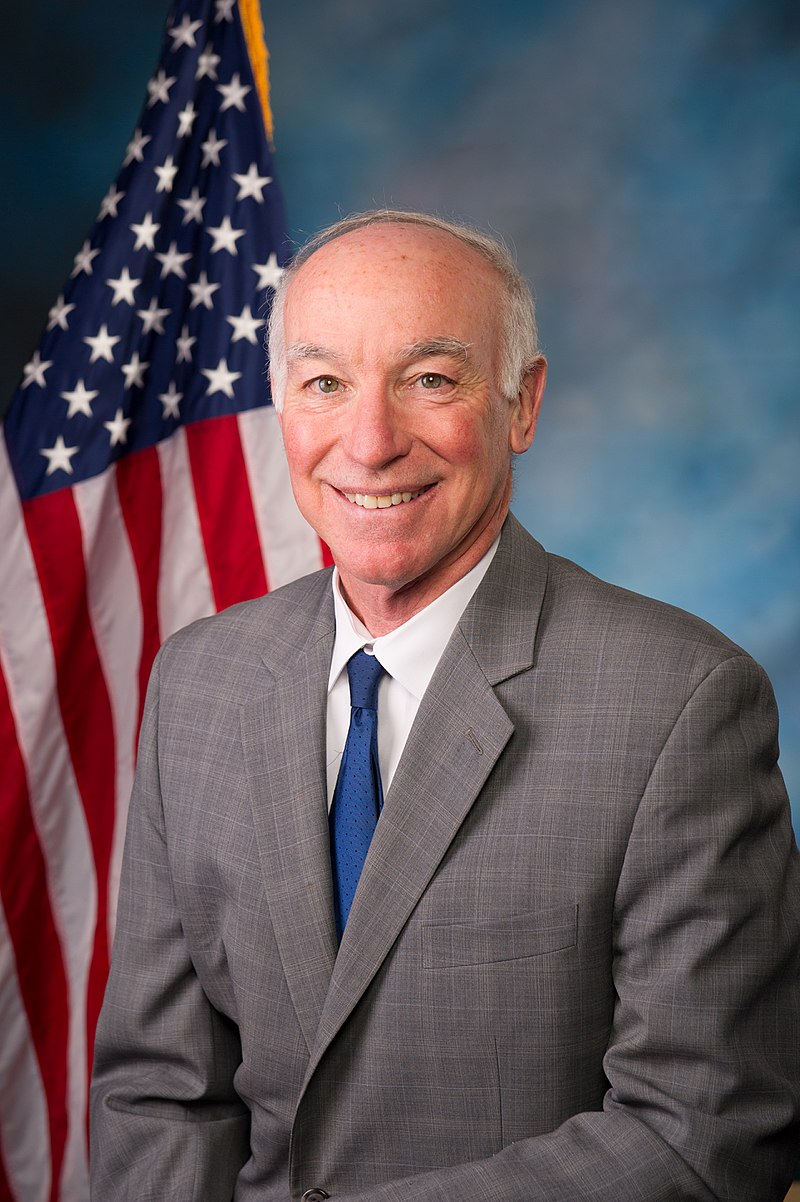

TX • R • Aye

TX • R • Aye

NE • R • Aye

IN • R • Aye

OH • R • Aye

KY • R • Aye

MI • R • Aye

WA • R • Aye

FL • R • Aye

AK • R • Aye

OR • R • Aye

MI • R • Aye

OK • R • Aye

AZ • R • Aye

SC • R • Aye

FL • R • Aye

CO • R • Aye

IL • R • Aye

OK • R • Aye

PA • R • Aye

FL • R • Aye

TN • R • Aye

MO • R • Aye

CA • R • Aye

FL • R • Aye

OH • R • Aye

TX • R • Aye

GA • R • Aye

AZ • R • Aye

VA • R • Aye

TX • R • Aye

GA • R • Aye

OK • R • Aye

GA • R • Aye

KY • R • Aye

AZ • R • Aye

CO • R • Aye

AR • R • Aye

TX • R • Aye

OH • R • Aye

TX • R • Aye

TN • R • Aye

FL • R • Aye

FL • R • Aye

MT • R • Aye

FL • R • Aye

NC • R • Aye

TX • R • Aye

MN • R • Aye

KS • R • Aye

CO • R • Aye

MS • R • Aye

TX • R • Aye

ND • R • Aye

IA • R • Aye

FL • R • Aye

MN • R • Aye

MN • R • Aye

WI • R • Aye

PA • R • Aye

TN • R • Aye

NE • R • Aye

CA • R • Aye

NC • R • Aye

FL • R • Aye

SC • R • Aye

ID • R • Aye

NY • R • Aye

TX • R • Aye

FL • R • Aye

TX • R • Aye

TX • R • Aye

TX • R • Aye

AZ • R • Aye

MO • R • Aye

VA • R • Aye

WI • R • Aye

MS • R • Aye

KY • R • Aye

WY • R • Aye

AZ • R • Aye

FL • R • Aye

NC • R • Aye

MD • R • Aye

NC • R • Aye

TN • R • Aye

OK • R • Aye

LA • R • Aye

AR • R • Aye

IA • R • Aye

IN • R • Aye

NC • R • Aye

MI • R • Aye

TX • R • Aye

CO • R • Aye

CA • R • Aye

GA • R • Aye

TX • R • Aye

MI • R • Aye

LA • R • Aye

SD • R • Aye

OH • R • Aye

OH • R • Aye

PA • R • Aye

NJ • R • Aye

PA • R • Aye

MS • R • Aye

UT • R • Aye

VA • R • Aye

CA • R • Aye

CA • R • Aye

NC • R • Aye

TN • R • Aye

IL • R • Aye

NY • R • Aye

NY • R • Aye

OH • R • Aye

NY • R • Aye

FL • R • Aye

LA • R • Aye

GA • R • Aye

OK • R • Aye

FL • R • Aye

TX • R • Aye

SC • R • Aye

PA • R • Aye

NY • R • Aye

UT • R • Aye

KS • R • Aye

FL • R • Aye

TX • R • Aye

MI • R • Aye

CA • R • Aye

GA • R • Aye

NC • R • Aye

VA • R • Aye

IN • R • Aye

PA • R • Aye

WV • R • Aye

IL • R • Aye

OH • R • Aye

IA • R • Aye

FL • R • Aye

MI • R • Aye

AL • R • Aye

UT • R • Aye

WV • R • Aye

NC • R • Aye

TX • R • Aye

NC • R • Aye

TX • R • Aye

WA • R • Aye

SC • R • Aye

IA • R • Aye

CA • R • Aye

TN • R • Aye

MO • R • Aye

UT • R • Aye

AL • R • Aye

FL • R • Aye

PA • R • Aye

TX • R • Aye

PA • R • Aye

KY • R • Aye

AL • R • Aye

TN • R • Aye

NC • R • Aye

TX • R • Aye

OH • R • Aye

FL • R • Aye

FL • R • Aye

LA • R • Aye

KS • R • Aye

AZ • R • Aye

GA • R • Aye

TX • R • Aye

TX • R • Aye

IN • R • Aye

ID • R • Aye

NJ • R • Aye

NE • R • Aye

MO • R • Aye

PA • R • Aye

IN • R • Aye

MN • R • Aye

NY • R • Aye

WI • R • Aye

FL • R • Aye

AL • R • Aye

IN • R • Aye

OH • R • Aye

NY • R • Aye

PA • R • Aye

WI • R • Aye

SC • R • Aye

OH • R • Aye

CA • R • Aye

NJ • D • Aye

TX • R • Aye

TN • R • Aye

WI • R • Aye

MO • R • Aye

MI • R • Aye

TX • R • Aye

FL • R • Aye

AR • R • Aye

WI • R • Aye

TX • R • Aye

SC • R • Aye

VA • R • Aye

AR • R • Aye

IN • R • Aye

MT • R • Aye

Nay (215)

NC • D • No

CA • D • No

RI • D • No

AZ • D • No

MA • D • No

VT • D • No

CA • D • No

OH • D • No

MO • D • No

CA • D • No

VA • D • No

GA • D • No

OR • D • No

PA • D • No

OH • D • No

CA • D • No

IL • D • No

OR • D • No

CA • D • No

IN • D • No

LA • D • No

TX • D • No

HI • D • No

IL • D • No

FL • D • No

TX • D • No

FL • D • No

CA • D • No

CA • D • No

MA • D • No

NY • D • No

MO • D • No

SC • D • No

TN • D • No

NJ • D • No

CA • D • No

CA • D • No

CT • D • No

MN • D • No

TX • D • No

CO • D • No

TX • D • No

KS • D • No

IL • D • No

NC • D • No

PA • D • No

CO • D • No

CT • D • No

WA • D • No

PA • D • No

CA • D • No

OR • D • No

MI • D • No

TX • D • No

MD • D • No

TX • D • No

NY • D • No

PA • D • No

LA • D • No

AL • D • No

TX • D • No

IL • D • No

NC • D • No

FL • D • No

CA • D • No

FL • D • No

CA • D • No

TX • D • No

CA • D • No

IL • D • No

NY • D • No

ME • D • No

NY • D • No

CA • D • No

TX • D • No

NH • D • No

NJ • D • No

CA • D • No

TX • D • No

AZ • D • No

CA • D • No

CT • D • No

CT • D • No

NV • D • No

PA • D • No

MD • D • No

OR • D • No

CA • D • No

MD • D • No

IL • D • No

CA • D • No

WA • D • No

NY • D • No

GA • D • No

TX • D • No

CA • D • No

OH • D • No

MA • D • No

IL • D • No

NY • D • No

CA • D • No

IL • D • No

OH • D • No

WA • D • No

CT • D • No

NY • D • No

NV • D • No

PA • D • No

NM • D • No

CA • D • No

CA • D • No

CA • D • No

CA • D • No

MA • D • No

RI • D • No

NY • D • No

KY • R • No

CA • D • No

GA • D • No

DE • D • No

MD • D • No

VA • D • No

MN • D • No

MI • D • No

KY • D • No

MA • D • No

NJ • D • No

NY • D • No

TX • D • No

NJ • D • No

NY • D • No

MD • D • No

CA • D • No

WI • D • No

NY • D • No

MN • D • No

FL • D • No

MA • D • No

IN • D • No

CA • D • No

NY • D • No

MA • D • No

CO • D • No

NJ • D • No

NY • D • No

MD • D • No

MN • D • No

NJ • D • No

CA • D • No

NH • D • No

CA • D • No

WA • D • No

CA • D • No

CO • D • No

ME • D • No

WI • D • No

NJ • D • No

MA • D • No

IL • D • No

IL • D • No

WA • D • No

MD • D • No

NY • D • No

CA • D • No

NC • D • No

CA • D • No

NY • D • No

OR • D • No

CA • D • No

PA • D • No

IL • D • No

IL • D • No

MI • D • No

WA • D • No

VA • D • No

GA • D • No

AL • D • No

CA • D • No

CA • D • No

WA • D • No

IL • D • No

FL • D • No

NM • D • No

AZ • D • No

MI • D • No

WA • D • No

VA • D • No

NY • D • No

CA • D • No

OH • D • No

CA • D • No

MI • D • No

MS • D • No

CA • D • No

NV • D • No

MI • D • No

HI • D • No

NY • D • No

CA • D • No

NY • D • No

MA • D • No

CA • D • No

IL • D • No

CA • D • No

NM • D • No

TX • D • No

NY • D • No

VA • D • No

VA • D • No

FL • D • No

CA • D • No

NJ • D • No

CA • D • No

GA • D • No

FL • D • No