H.Res.1032 — Providing for consideration of the Senate amendments to the bill (H.R. 7148); providing for consideration of the joint resolution (H.J.Res. 142); and providing for consideration of the bill (H.R. 4090)

House Roll Call

H.Res.1032

Roll 51 • Congress 119, Session 2 • Feb 3, 2026 11:42 AM • Result: Passed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.Res.1032 — Providing for consideration of the Senate amendments to the bill (H.R. 7148); providing for consideration of the joint resolution (H.J.Res. 142); and providing for consideration of the bill (H.R. 4090) |

|---|---|

| Vote question | On Ordering the Previous Question |

| Vote type | Yea-and-Nay |

| Result | Passed |

| Totals | Yea 212 / Nay 210 / Present 0 / Not Voting 10 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 212 | 1 | 0 | 5 |

| D | 0 | 209 | 0 | 5 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Ordering the Previous Question

Bill Analysis

H.Res. 1032 is a House rules (procedural) resolution that sets the terms for floor consideration of three separate measures; it does not itself appropriate money, change tax law, or regulate mining, but it controls how those substantive bills move forward.

Senate amendments to H.R. 7148 (FY2026 consolidated appropriations)

- Provides a special rule for the House to consider Senate amendments to a large FY2026 consolidated appropriations bill.

- Typically specifies:

- How debate time is allocated and controlled (e.g., total hours, which committees manage time).

- Whether amendments to the Senate amendments are allowed, and if so, which (often “closed” or “structured” rule).

- Procedures for motions (e.g., motion to concur, concur with amendment, or reject).

- Affects all agencies funded in H.R. 7148 by determining how easily the House can accept or modify the Senate’s funding and policy language before the September 30, 2026 fiscal year deadline.

H.J. Res. 142 (disapproval of a D.C. tax law)

- Sets the rule for considering a joint resolution that would overturn the District of Columbia’s “Income and Franchise Tax Conformity and Revision Temporary Amendment Act of 2025.”

- Typically provides for limited debate, bars floor amendments, and sets the vote sequence.

- Affects D.C. government and D.C. taxpayers by enabling Congress to fast-track a disapproval vote under the Home Rule Act timeline.

H.R. 4090 (domestic mining and hardrock minerals)

- Establishes terms for House consideration of a bill to codify parts of existing Executive Orders on domestic mining and hardrock mineral resources.

- Usually defines debate time, amendment rules, and points of order that are waived.

- Affects federal land and resource agencies (e.g., Interior, possibly Defense/Energy) and the mining sector by shaping how easily the House can advance statutory backing for those executive policies.

Beneficiaries/regulated parties: House leadership gains procedural control; sponsors of the three measures gain a defined path to a vote; affected stakeholders are indirect—federal agencies, D.C. government, miners, and taxpayers—through the underlying bills, not this resolution itself.

Yea (212)

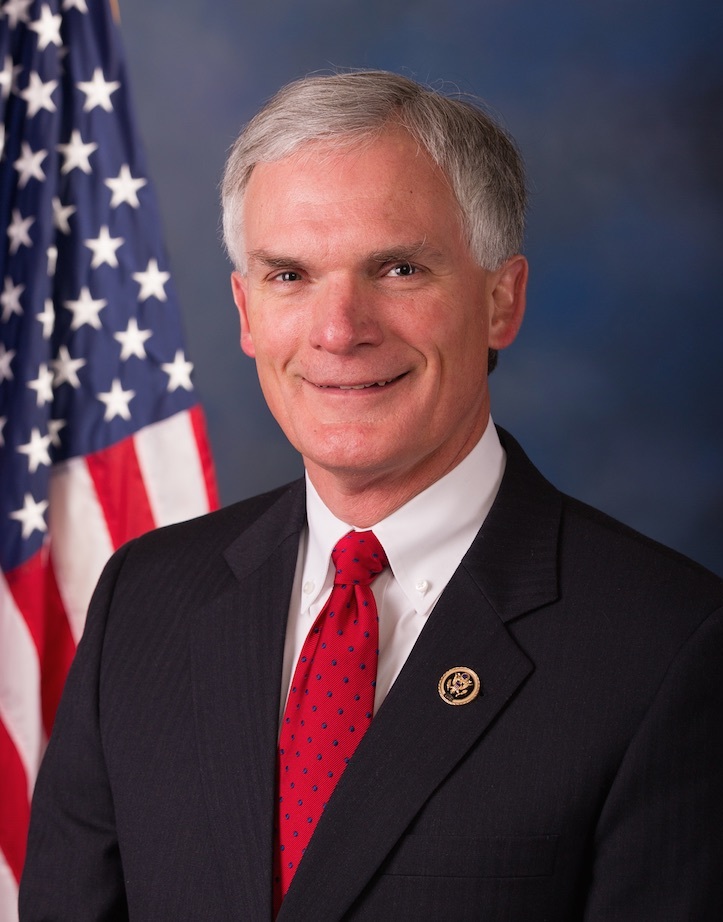

MO • R • Yea

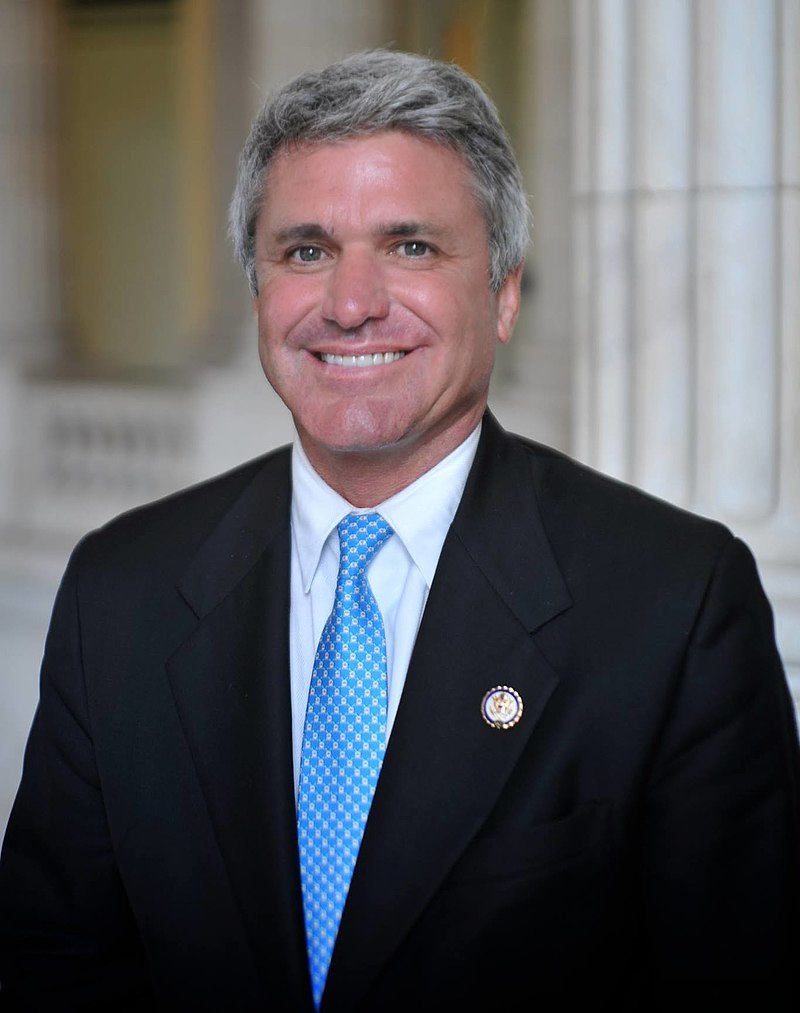

NV • R • Yea

TX • R • Yea

TX • R • Yea

NE • R • Yea

IN • R • Yea

OH • R • Yea

KY • R • Yea

MI • R • Yea

WA • R • Yea

FL • R • Yea

AK • R • Yea

OR • R • Yea

MI • R • Yea

OK • R • Yea

AZ • R • Yea

SC • R • Yea

FL • R • Yea

CO • R • Yea

IL • R • Yea

OK • R • Yea

PA • R • Yea

FL • R • Yea

TN • R • Yea

MO • R • Yea

CA • R • Yea

FL • R • Yea

OH • R • Yea

TX • R • Yea

GA • R • Yea

AZ • R • Yea

VA • R • Yea

TX • R • Yea

GA • R • Yea

OK • R • Yea

GA • R • Yea

KY • R • Yea

AZ • R • Yea

CO • R • Yea

AR • R • Yea

TX • R • Yea

OH • R • Yea

TX • R • Yea

TN • R • Yea

FL • R • Yea

FL • R • Yea

MT • R • Yea

FL • R • Yea

NC • R • Yea

TX • R • Yea

MN • R • Yea

KS • R • Yea

CO • R • Yea

MS • R • Yea

TX • R • Yea

ND • R • Yea

IA • R • Yea

FL • R • Yea

MN • R • Yea

MN • R • Yea

WI • R • Yea

PA • R • Yea

TN • R • Yea

NE • R • Yea

CA • R • Yea

NC • R • Yea

FL • R • Yea

SC • R • Yea

ID • R • Yea

NY • R • Yea

TX • R • Yea

FL • R • Yea

TX • R • Yea

TX • R • Yea

TX • R • Yea

AZ • R • Yea

MO • R • Yea

VA • R • Yea

WI • R • Yea

MS • R • Yea

KY • R • Yea

WY • R • Yea

AZ • R • Yea

FL • R • Yea

NC • R • Yea

MD • R • Yea

NC • R • Yea

OK • R • Yea

LA • R • Yea

AR • R • Yea

IA • R • Yea

IN • R • Yea

NC • R • Yea

MI • R • Yea

TX • R • Yea

CO • R • Yea

CA • R • Yea

GA • R • Yea

TX • R • Yea

LA • R • Yea

SD • R • Yea

OH • R • Yea

OH • R • Yea

NJ • R • Yea

PA • R • Yea

MS • R • Yea

UT • R • Yea

VA • R • Yea

CA • R • Yea

CA • R • Yea

NC • R • Yea

TN • R • Yea

IL • R • Yea

NY • R • Yea

NY • R • Yea

OH • R • Yea

NY • R • Yea

FL • R • Yea

LA • R • Yea

GA • R • Yea

OK • R • Yea

FL • R • Yea

TX • R • Yea

SC • R • Yea

PA • R • Yea

NY • R • Yea

UT • R • Yea

KS • R • Yea

KY • R • Yea

FL • R • Yea

TX • R • Yea

MI • R • Yea

CA • R • Yea

GA • R • Yea

NC • R • Yea

VA • R • Yea

IN • R • Yea

PA • R • Yea

WV • R • Yea

IL • R • Yea

OH • R • Yea

IA • R • Yea

FL • R • Yea

MI • R • Yea

AL • R • Yea

UT • R • Yea

WV • R • Yea

NC • R • Yea

TX • R • Yea

NC • R • Yea

TX • R • Yea

WA • R • Yea

SC • R • Yea

IA • R • Yea

CA • R • Yea

TN • R • Yea

MO • R • Yea

UT • R • Yea

AL • R • Yea

FL • R • Yea

PA • R • Yea

TX • R • Yea

PA • R • Yea

KY • R • Yea

AL • R • Yea

NC • R • Yea

TX • R • Yea

OH • R • Yea

FL • R • Yea

FL • R • Yea

LA • R • Yea

KS • R • Yea

AZ • R • Yea

GA • R • Yea

TX • R • Yea

TX • R • Yea

IN • R • Yea

ID • R • Yea

NJ • R • Yea

NE • R • Yea

MO • R • Yea

PA • R • Yea

IN • R • Yea

MN • R • Yea

NY • R • Yea

WI • R • Yea

FL • R • Yea

AL • R • Yea

IN • R • Yea

OH • R • Yea

NY • R • Yea

PA • R • Yea

WI • R • Yea

SC • R • Yea

OH • R • Yea

CA • R • Yea

NJ • D • Yea

TX • R • Yea

TN • R • Yea

WI • R • Yea

MO • R • Yea

MI • R • Yea

TX • R • Yea

FL • R • Yea

AR • R • Yea

WI • R • Yea

TX • R • Yea

VA • R • Yea

AR • R • Yea

IN • R • Yea

MT • R • Yea

Nay (210)

NC • D • Nay

CA • D • Nay

RI • D • Nay

AZ • D • Nay

MA • D • Nay

VT • D • Nay

CA • D • Nay

OH • D • Nay

MO • D • Nay

CA • D • Nay

VA • D • Nay

GA • D • Nay

OR • D • Nay

PA • D • Nay

OH • D • Nay

CA • D • Nay

IL • D • Nay

OR • D • Nay

CA • D • Nay

IN • D • Nay

LA • D • Nay

TX • D • Nay

HI • D • Nay

IL • D • Nay

FL • D • Nay

TX • D • Nay

FL • D • Nay

CA • D • Nay

CA • D • Nay

MA • D • Nay

MO • D • Nay

SC • D • Nay

TN • D • Nay

NJ • D • Nay

CA • D • Nay

CA • D • Nay

CT • D • Nay

MN • D • Nay

TX • D • Nay

CO • D • Nay

TX • D • Nay

KS • D • Nay

IL • D • Nay

NC • D • Nay

PA • D • Nay

CO • D • Nay

CT • D • Nay

WA • D • Nay

PA • D • Nay

OR • D • Nay

MI • D • Nay

TX • D • Nay

MD • D • Nay

TX • D • Nay

NY • D • Nay

PA • D • Nay

LA • D • Nay

AL • D • Nay

TX • D • Nay

IL • D • Nay

NC • D • Nay

FL • D • Nay

CA • D • Nay

FL • D • Nay

CA • D • Nay

TX • D • Nay

CA • D • Nay

IL • D • Nay

NY • D • Nay

ME • D • Nay

NY • D • Nay

CA • D • Nay

TX • D • Nay

NH • D • Nay

NJ • D • Nay

CA • D • Nay

TX • D • Nay

AZ • D • Nay

CA • D • Nay

CT • D • Nay

CT • D • Nay

NV • D • Nay

PA • D • Nay

MD • D • Nay

OR • D • Nay

CA • D • Nay

MD • D • Nay

IL • D • Nay

CA • D • Nay

WA • D • Nay

NY • D • Nay

GA • D • Nay

TX • D • Nay

CA • D • Nay

OH • D • Nay

MA • D • Nay

IL • D • Nay

NY • D • Nay

CA • D • Nay

IL • D • Nay

OH • D • Nay

WA • D • Nay

CT • D • Nay

NY • D • Nay

PA • D • Nay

NM • D • Nay

CA • D • Nay

CA • D • Nay

CA • D • Nay

CA • D • Nay

MA • D • Nay

RI • D • Nay

NY • D • Nay

CA • D • Nay

GA • D • Nay

DE • D • Nay

MD • D • Nay

VA • D • Nay

MN • D • Nay

MI • D • Nay

KY • D • Nay

MA • D • Nay

NJ • D • Nay

NY • D • Nay

TX • D • Nay

NJ • D • Nay

NY • D • Nay

MD • D • Nay

CA • D • Nay

WI • D • Nay

NY • D • Nay

MN • D • Nay

FL • D • Nay

MA • D • Nay

IN • D • Nay

CA • D • Nay

NY • D • Nay

MA • D • Nay

CO • D • Nay

NJ • D • Nay

NY • D • Nay

MD • D • Nay

MN • D • Nay

NJ • D • Nay

CA • D • Nay

NH • D • Nay

CA • D • Nay

WA • D • Nay

CA • D • Nay

CO • D • Nay

ME • D • Nay

WI • D • Nay

NJ • D • Nay

MA • D • Nay

IL • D • Nay

IL • D • Nay

WA • D • Nay

MD • D • Nay

NY • D • Nay

CA • D • Nay

TN • R • Nay

NC • D • Nay

CA • D • Nay

NY • D • Nay

OR • D • Nay

CA • D • Nay

PA • D • Nay

IL • D • Nay

IL • D • Nay

MI • D • Nay

VA • D • Nay

GA • D • Nay

AL • D • Nay

CA • D • Nay

CA • D • Nay

WA • D • Nay

IL • D • Nay

FL • D • Nay

NM • D • Nay

AZ • D • Nay

MI • D • Nay

WA • D • Nay

VA • D • Nay

NY • D • Nay

CA • D • Nay

OH • D • Nay

CA • D • Nay

MI • D • Nay

MS • D • Nay

CA • D • Nay

NV • D • Nay

MI • D • Nay

HI • D • Nay

CA • D • Nay

NY • D • Nay

MA • D • Nay

CA • D • Nay

IL • D • Nay

CA • D • Nay

NM • D • Nay

TX • D • Nay

NY • D • Nay

VA • D • Nay

VA • D • Nay

FL • D • Nay

CA • D • Nay

NJ • D • Nay

CA • D • Nay

GA • D • Nay

FL • D • Nay

Not Voting (10)

GA • R • Not Voting

NY • D • Not Voting

CA • D • Not Voting

TN • R • Not Voting

MI • R • Not Voting

PA • R • Not Voting

NV • D • Not Voting

WA • D • Not Voting

NY • D • Not Voting

SC • R • Not Voting