H.R.7148

House Roll Call

H.R.7148

Roll 44 • Congress 119, Session 2 • Jan 22, 2026 4:51 PM • Result: Failed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.7148 |

|---|---|

| Vote question | On Agreeing to the Amendment |

| Vote type | Recorded Vote |

| Result | Failed |

| Totals | Yea 136 / Nay 291 / Present 0 / Not Voting 9 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 136 | 76 | 0 | 8 |

| D | 0 | 215 | 0 | 1 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Agreeing to the Amendment

Bill Analysis

I don’t yet have access to the text or section-by-section summary of H.R. 7148 (119th Congress), the “Consolidated Appropriations Act, 2026.” Without that underlying bill text, I can’t reliably describe its specific funding levels, policy riders, or affected programs.

However, based on how consolidated appropriations acts are structured and operate, here is what such a bill typically does and how H.R. 7148 is likely organized and intended to function:

Purpose and scope

A consolidated appropriations act bundles multiple annual appropriations bills into a single omnibus measure to fund most or all federal agencies for a fiscal year (here, FY2026). It generally provides discretionary budget authority across all major appropriations subcommittees (Defense; Labor-HHS-Education; Transportation-HUD; Homeland Security; Interior-Environment; Agriculture; Commerce-Justice-Science; Energy-Water; Financial Services; Legislative Branch; Military Construction–VA; State-Foreign Operations).Funding and authorities

It sets dollar amounts, conditions of use, and time availability for agency operating funds, grants, contracts, and major projects. It may include:- Program increases/cuts and hiring or pay provisions.

- Transfer and reprogramming authorities.

- Limitations on using funds for specified activities (policy riders).

- One-year, multi-year, and no-year appropriations.

Programs and agencies affected

Virtually all cabinet departments and many independent agencies (e.g., EPA, NASA, SBA, SSA’s administrative expenses) are covered. Mandatory programs (e.g., Social Security benefits, Medicare) are mostly outside the bill, but some related administrative costs and certain mandatory changes or “offsets” can appear.Who benefits or is regulated

- Federal agencies receiving operating and grant funds.

- State, local, tribal governments and nonprofits via formula and competitive grants.

- Contractors and grantees in defense, infrastructure, health, research, education, and social services.

- Indirectly, individuals and businesses using federally funded services.

Budget and tax components

Referral to the Budget and Ways and Means Committees signals that the bill likely includes:- Adjustments to budget enforcement, caps, or scorekeeping rules.

- Limited changes to revenue or tax-related provisions used as offsets or policy add-ons.

Timelines

- Normally intended to fund the government for FY2026 (Oct. 1, 2025–Sept. 30, 2026).

- Contains obligation and expenditure deadlines for specific accounts and projects.

- May extend or sunset particular authorities or pilot programs.

For a precise, research-grade summary, the actual legislative text or official committee summaries of H.R. 7148 would be required.

Yea (136)

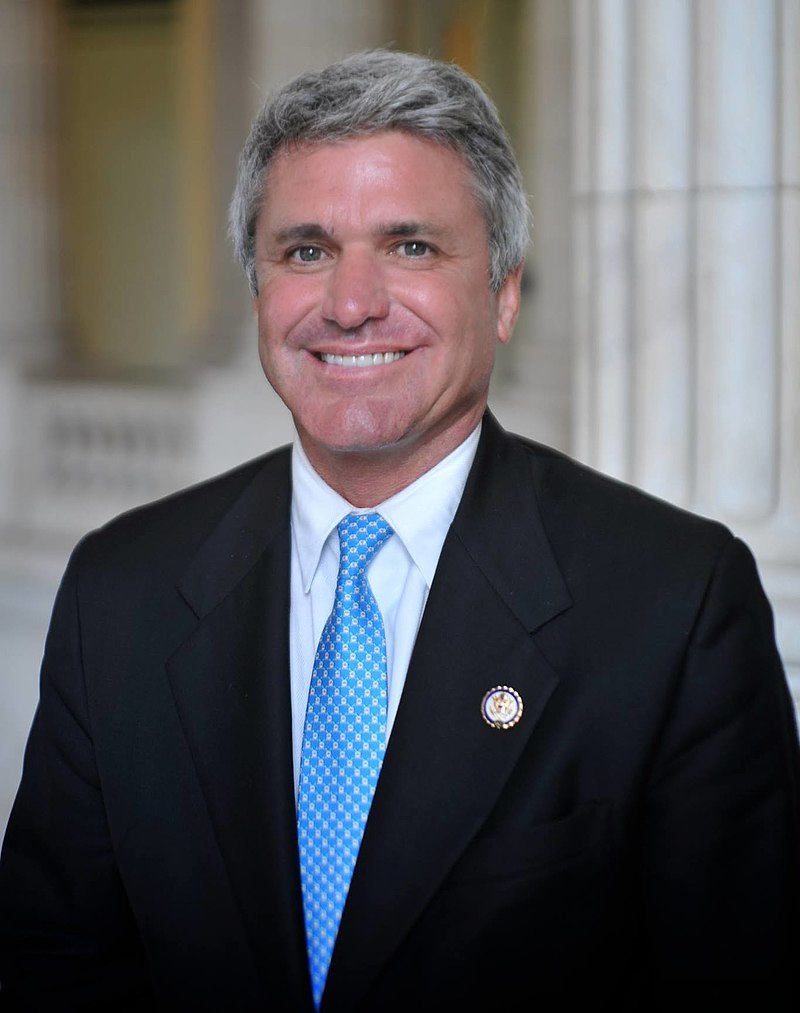

TX • R • Aye

TX • R • Aye

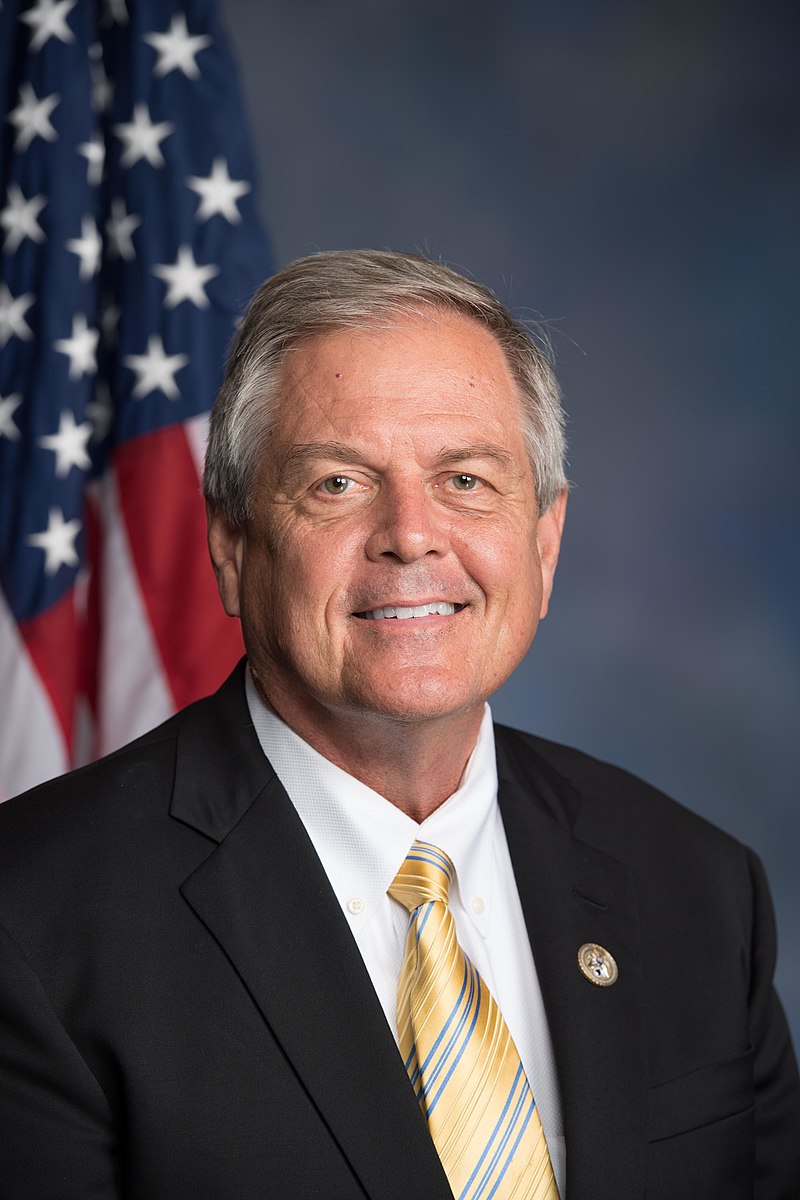

IN • R • Aye

OH • R • Aye

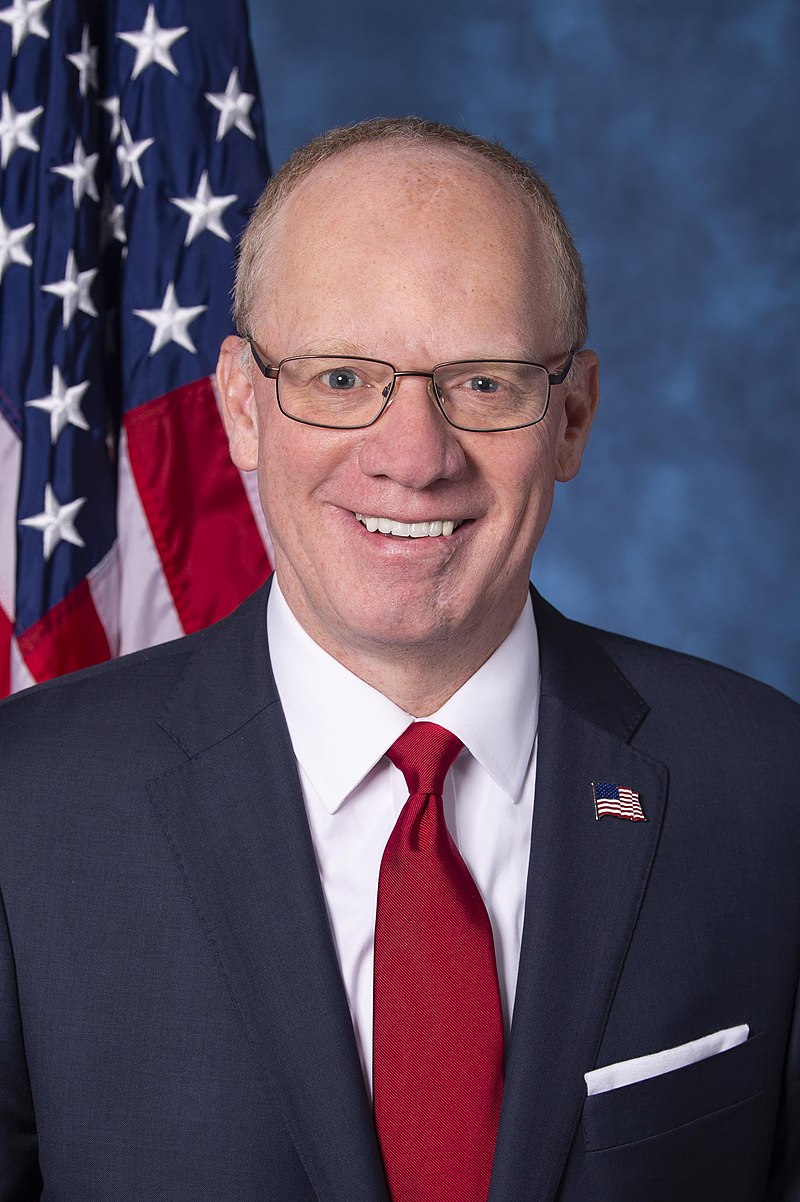

MI • R • Aye

WA • R • Aye

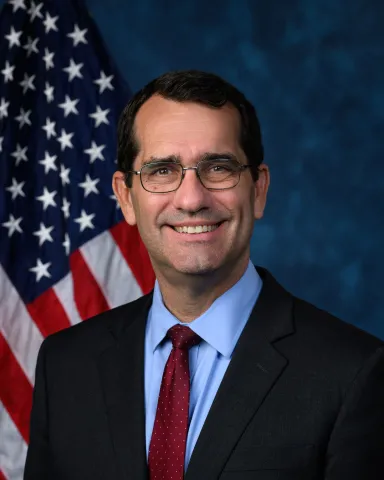

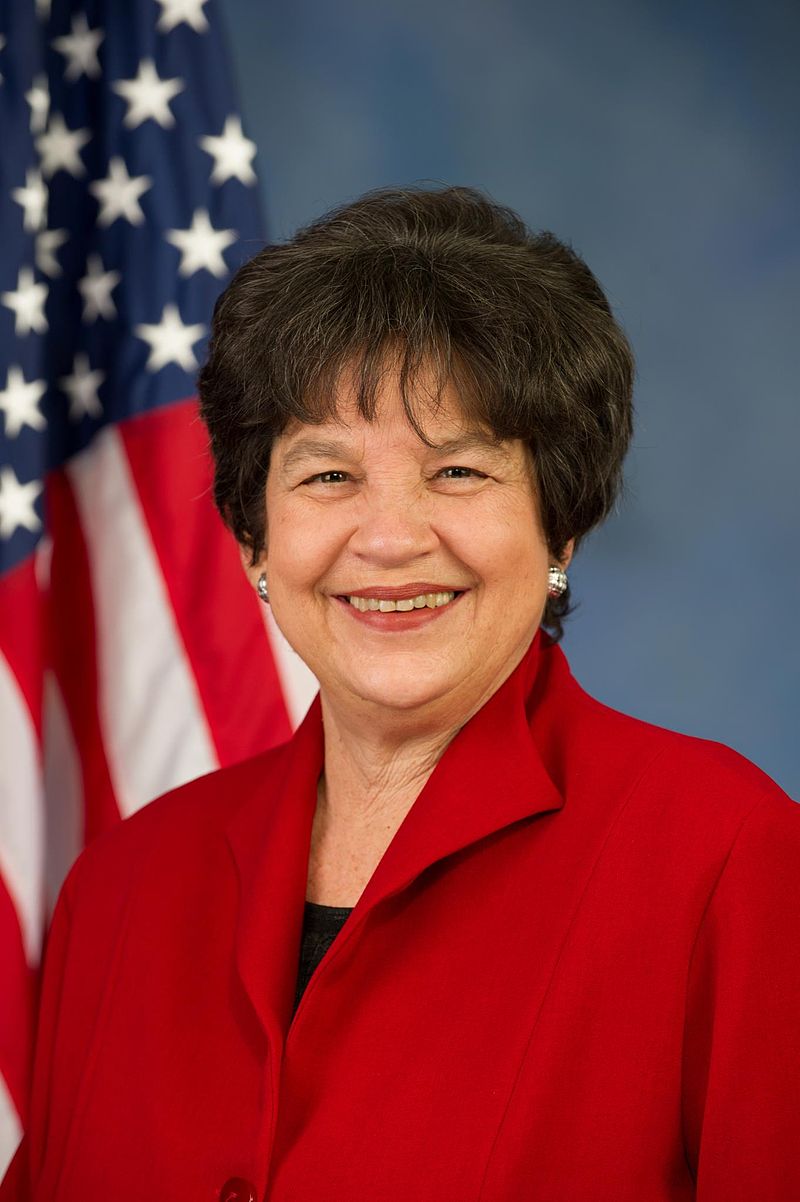

FL • R • Aye

AK • R • Aye

AZ • R • Aye

SC • R • Aye

FL • R • Aye

CO • R • Aye

OK • R • Aye

TN • R • Aye

MO • R • Aye

FL • R • Aye

GA • R • Aye

AZ • R • Aye

VA • R • Aye

TX • R • Aye

GA • R • Aye

GA • R • Aye

KY • R • Aye

AZ • R • Aye

CO • R • Aye

TX • R • Aye

OH • R • Aye

TX • R • Aye

TN • R • Aye

FL • R • Aye

MT • R • Aye

KS • R • Aye

MS • R • Aye

TX • R • Aye

ND • R • Aye

IA • R • Aye

FL • R • Aye

MN • R • Aye

MN • R • Aye

WI • R • Aye

NC • R • Aye

FL • R • Aye

SC • R • Aye

ID • R • Aye

TX • R • Aye

TX • R • Aye

TX • R • Aye

TX • R • Aye

AZ • R • Aye

WI • R • Aye

MS • R • Aye

WY • R • Aye

AZ • R • Aye

FL • R • Aye

NC • R • Aye

MD • R • Aye

NC • R • Aye

TN • R • Aye

OK • R • Aye

LA • R • Aye

IA • R • Aye

IN • R • Aye

NC • R • Aye

MI • R • Aye

GA • R • Aye

TX • R • Aye

SD • R • Aye

OH • R • Aye

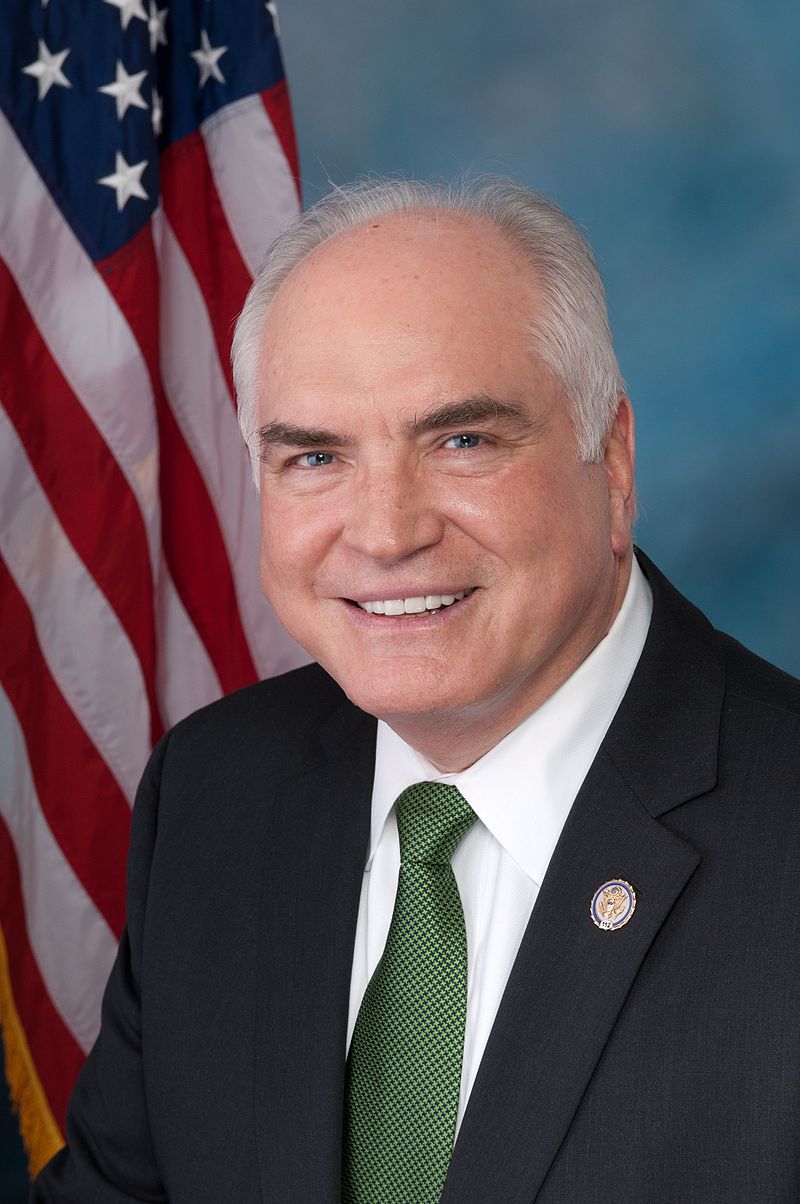

PA • R • Aye

MS • R • Aye

UT • R • Aye

CA • R • Aye

NC • R • Aye

TN • R • Aye

NY • R • Aye

FL • R • Aye

LA • R • Aye

GA • R • Aye

FL • R • Aye

SC • R • Aye

PA • R • Aye

KS • R • Aye

KY • R • Aye

FL • R • Aye

TX • R • Aye

GA • R • Aye

NC • R • Aye

IN • R • Aye

IL • R • Aye

FL • R • Aye

AL • R • Aye

WV • R • Aye

NC • R • Aye

TX • R • Aye

TX • R • Aye

SC • R • Aye

TN • R • Aye

MO • R • Aye

AL • R • Aye

FL • R • Aye

PA • R • Aye

TX • R • Aye

TN • R • Aye

NC • R • Aye

TX • R • Aye

OH • R • Aye

FL • R • Aye

KS • R • Aye

AZ • R • Aye

GA • R • Aye

TX • R • Aye

TX • R • Aye

IN • R • Aye

NJ • R • Aye

NE • R • Aye

MO • R • Aye

PA • R • Aye

IN • R • Aye

WI • R • Aye

FL • R • Aye

IN • R • Aye

OH • R • Aye

WI • R • Aye

SC • R • Aye

TX • R • Aye

TN • R • Aye

MO • R • Aye

TX • R • Aye

FL • R • Aye

AR • R • Aye

WI • R • Aye

TX • R • Aye

SC • R • Aye

IN • R • Aye

MT • R • Aye

Nay (291)

NC • D • No

AL • R • No

CA • D • No

MO • R • No

RI • D • No

NV • R • No

AZ • D • No

MA • D • No

NE • R • No

VT • D • No

CA • D • No

OH • D • No

MO • D • No

OR • R • No

CA • D • No

MI • R • No

VA • D • No

OK • R • No

GA • D • No

OR • D • No

IL • R • No

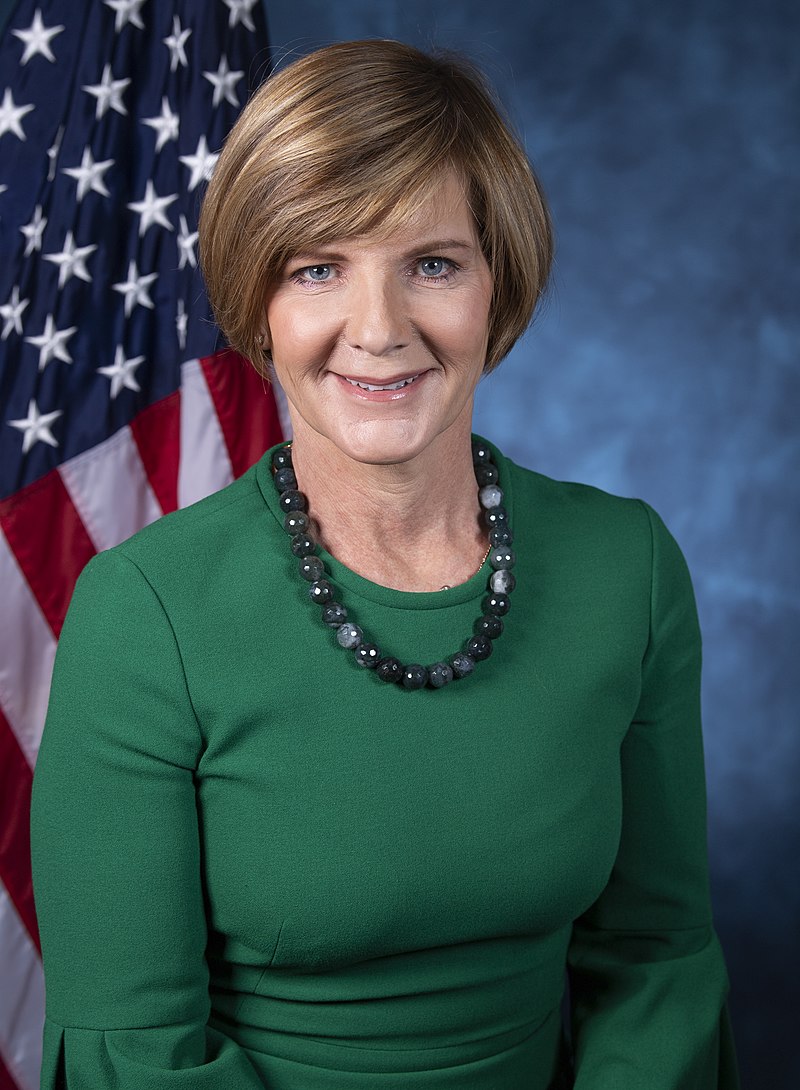

PA • D • No

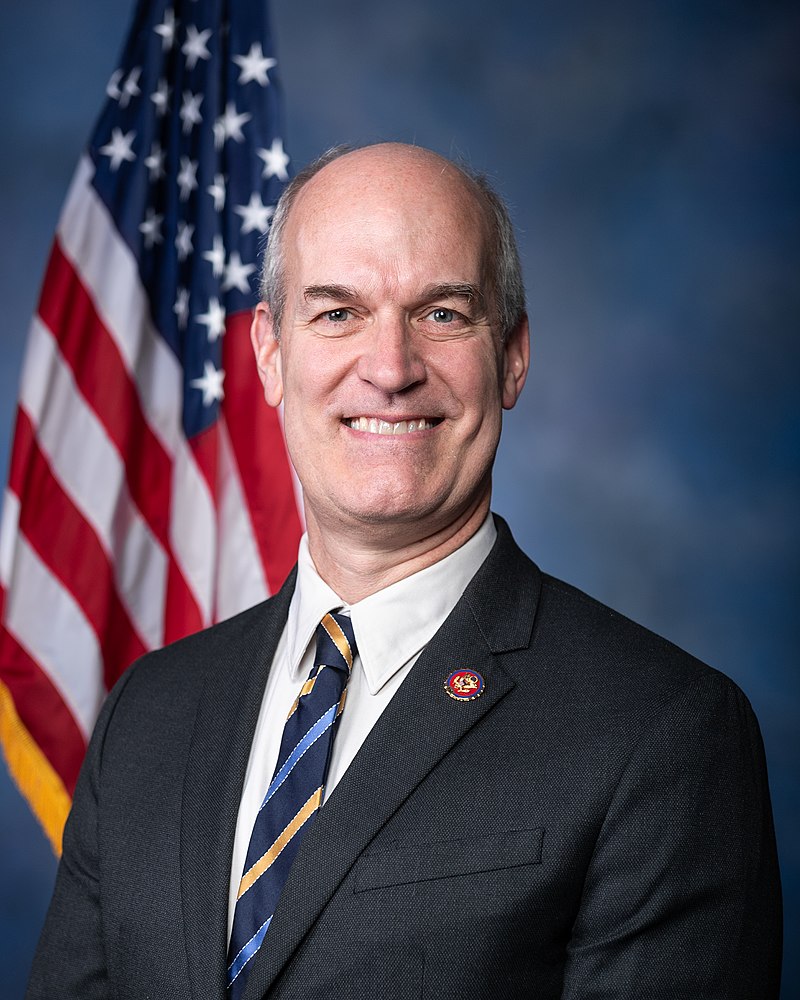

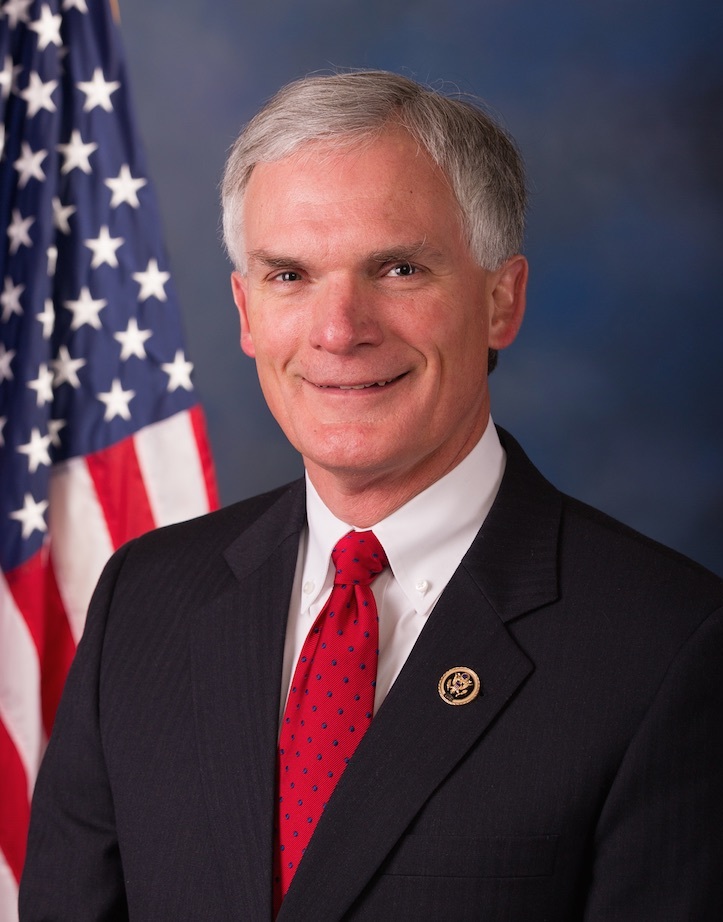

PA • R • No

OH • D • No

CA • D • No

FL • R • No

IL • D • No

OR • D • No

CA • R • No

CA • D • No

OH • R • No

IN • D • No

TX • R • No

LA • D • No

TX • D • No

HI • D • No

IL • D • No

FL • D • No

TX • D • No

FL • D • No

CA • D • No

CA • D • No

MA • D • No

NY • D • No

MO • D • No

SC • D • No

TN • D • No

OK • R • No

NJ • D • No

CA • D • No

CA • D • No

CT • D • No

MN • D • No

AR • R • No

TX • D • No

CO • D • No

TX • D • No

KS • D • No

IL • D • No

NC • D • No

PA • D • No

CO • D • No

CT • D • No

WA • D • No

PA • D • No

CA • D • No

OR • D • No

FL • R • No

MI • D • No

TX • D • No

FL • R • No

NC • R • No

MD • D • No

TX • R • No

TX • D • No

NY • D • No

PA • D • No

CO • R • No

LA • D • No

AL • D • No

PA • R • No

TN • R • No

TX • D • No

NE • R • No

CA • R • No

IL • D • No

NC • D • No

FL • D • No

CA • D • No

FL • D • No

CA • D • No

NY • R • No

TX • D • No

CA • D • No

IL • D • No

NY • D • No

FL • R • No

ME • D • No

NY • D • No

CA • D • No

TX • D • No

NH • D • No

NJ • D • No

MO • R • No

CA • D • No

TX • D • No

VA • R • No

AZ • D • No

KY • R • No

CA • D • No

CT • D • No

AR • R • No

CT • D • No

NV • D • No

PA • D • No

MD • D • No

OR • D • No

CA • D • No

CO • R • No

CA • R • No

MD • D • No

IL • D • No

CA • D • No

MI • R • No

WA • D • No

NY • D • No

GA • D • No

TX • D • No

OH • R • No

CA • D • No

OH • D • No

NJ • R • No

MA • D • No

PA • R • No

IL • D • No

NY • D • No

CA • D • No

VA • R • No

CA • R • No

MP • R • No

IL • D • No

IL • R • No

NY • R • No

OH • D • No

WA • D • No

CT • D • No

NY • D • No

OH • R • No

NY • R • No

NV • D • No

PA • D • No

NM • D • No

CA • D • No

CA • D • No

CA • D • No

CA • D • No

OK • R • No

TX • R • No

MA • D • No

RI • D • No

NY • R • No

UT • R • No

NY • D • No

CA • D • No

GA • D • No

DE • D • No

MI • R • No

MD • D • No

VA • D • No

MN • D • No

MI • D • No

KY • D • No

MA • D • No

NJ • D • No

NY • D • No

NJ • D • No

NY • D • No

PA • R • No

MD • D • No

WV • R • No

OH • R • No

IA • R • No

CA • D • No

MI • R • No

WI • D • No

UT • R • No

NY • D • No

MN • D • No

FL • D • No

MA • D • No

GU • R • No

IN • D • No

CA • D • No

NC • R • No

NY • D • No

MA • D • No

CO • D • No

WA • R • No

NJ • D • No

DC • D • No

IA • R • No

CA • R • No

NY • D • No

MD • D • No

MN • D • No

UT • R • No

NJ • D • No

CA • D • No

NH • D • No

CA • D • No

WA • D • No

CA • D • No

CO • D • No

ME • D • No

VI • D • No

WI • D • No

NJ • D • No

MA • D • No

IL • D • No

IL • D • No

WA • D • No

MD • D • No

PA • R • No

NY • D • No

CA • D • No

KY • R • No

AL • R • No

NC • D • No

CA • D • No

NY • D • No

OR • D • No

CA • D • No

PA • D • No

IL • D • No

IL • D • No

MI • D • No

WA • D • No

VA • D • No

GA • D • No

AL • D • No

CA • D • No

CA • D • No

ID • R • No

WA • D • No

IL • D • No

FL • D • No

NM • D • No

AZ • D • No

MN • R • No

NY • R • No

MI • D • No

WA • D • No

AL • R • No

VA • D • No

NY • D • No

CA • D • No

OH • D • No

CA • D • No

NY • R • No

MI • D • No

MS • D • No

CA • D • No

PA • R • No

NV • D • No

MI • D • No

HI • D • No

NY • D • No

CA • D • No

NY • D • No

MA • D • No

CA • D • No

OH • R • No

IL • D • No

CA • R • No

NJ • D • No

WI • R • No

CA • D • No

NM • D • No

TX • D • No

NY • D • No

VA • D • No

MI • R • No

VA • D • No

FL • D • No

CA • D • No

NJ • D • No

CA • D • No

GA • D • No

FL • D • No

VA • R • No

AR • R • No

Not Voting (9)

KY • R • Not Voting

MN • R • Not Voting

PR • D • Not Voting

TX • R • Not Voting

CA • R • Not Voting

VA • R • Not Voting

AS • R • Not Voting

FL • R • Not Voting

LA • R • Not Voting