H.R.5763 — Main Street Parity Act

House Roll Call

H.R.5763

Roll 32 • Congress 119, Session 2 • Jan 20, 2026 6:54 PM • Result: Passed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.5763 — Main Street Parity Act |

|---|---|

| Vote question | On Motion to Suspend the Rules and Pass |

| Vote type | 2/3 Yea-And-Nay |

| Result | Passed |

| Totals | Yea 383 / Nay 8 / Present 0 / Not Voting 40 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 188 | 6 | 0 | 24 |

| D | 195 | 2 | 0 | 16 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Motion to Suspend the Rules and Pass

Bill Analysis

HR 5763 – Main Street Parity Act (119th Congress)

HR 5763 amends the Internal Revenue Code to modify the federal income tax treatment of certain small and mid‑sized (“Main Street”) businesses so their tax rules more closely parallel those available to larger or differently structured firms. It is a revenue (tax) bill; no new discretionary appropriations or grant programs are created. Instead, it changes tax liabilities and compliance rules.

Core provisions

- Entity‑level parity: Adjusts rules for pass‑through entities (e.g., S corporations, partnerships, LLCs taxed as partnerships) to reduce disparities with C corporations. This may include revised limits or thresholds for deductions, credits, or loss utilization that currently disadvantage smaller, non‑publicly traded firms.

- Deduction and credit alignment: Modifies eligibility or caps for key business deductions and credits—such as those for capital investment, start‑up or expansion costs, and possibly health or retirement benefits—so that smaller firms can access them on terms closer to those of larger enterprises.

- Compliance simplification: Streamlines certain filing, recordkeeping, or accounting requirements for qualifying “Main Street” businesses, potentially by raising thresholds for more complex methods or by expanding simplified accounting options (e.g., cash accounting, safe harbors).

Agencies and authorities

- Primary implementation is through the Department of the Treasury and the Internal Revenue Service (IRS), which must issue regulations, guidance, and updated forms.

- The bill operates by amending specific sections of the Internal Revenue Code; it does not create a new agency.

Beneficiaries and regulated parties

- Beneficiaries: Small and mid‑sized businesses that meet statutory definitions (likely based on gross receipts, number of employees, or ownership structure), their owners, and potentially their employees if benefit‑related provisions are expanded.

- Regulated: Taxpayers claiming the revised deductions/credits and tax professionals advising them; compliance is enforced through standard IRS examination and enforcement mechanisms.

Timelines

- Most changes would take effect for taxable years beginning after a specified date (typically the calendar year following enactment).

- Treasury/IRS would face deadlines—commonly 6–18 months post‑enactment—to issue implementing regulations and guidance.

Yea (383)

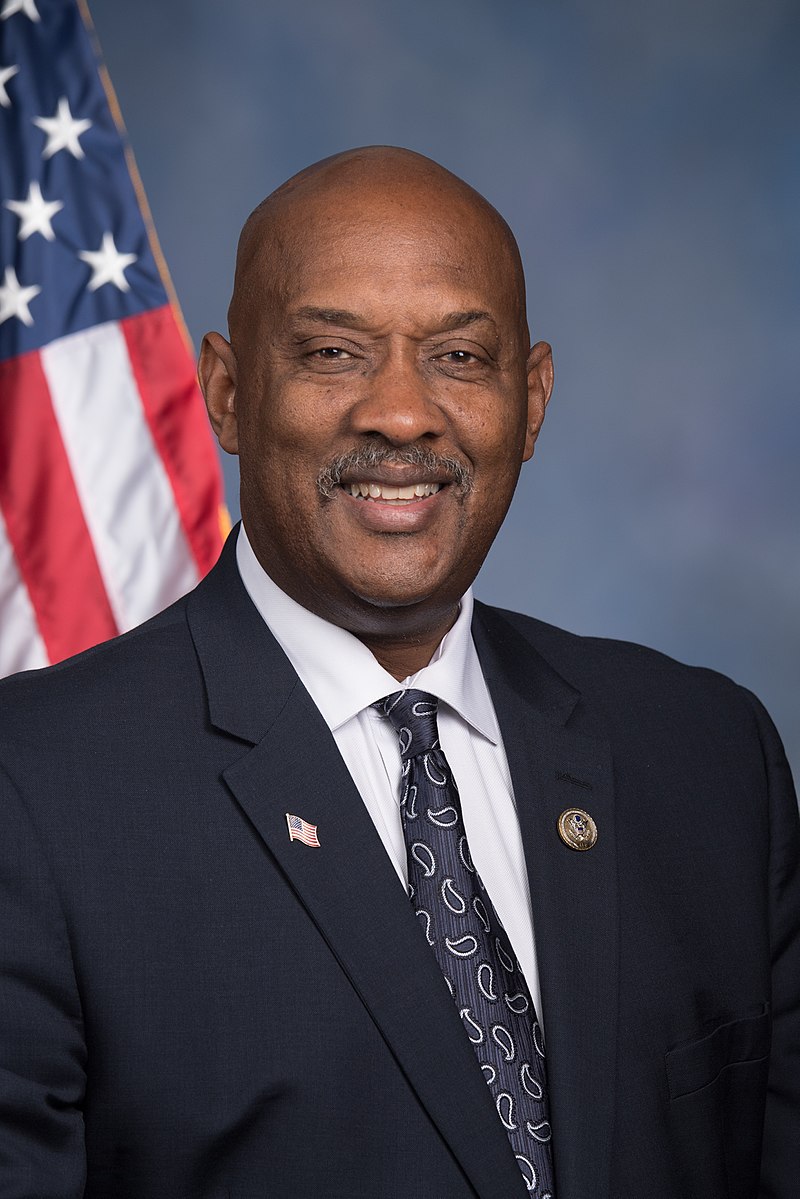

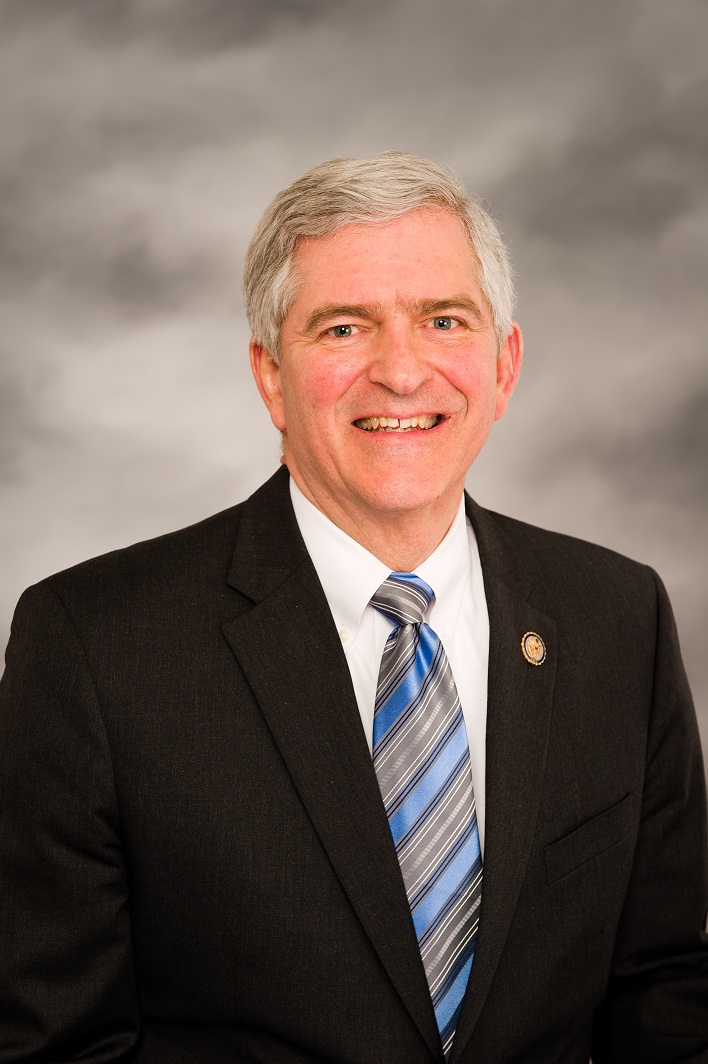

AL • R • Yea

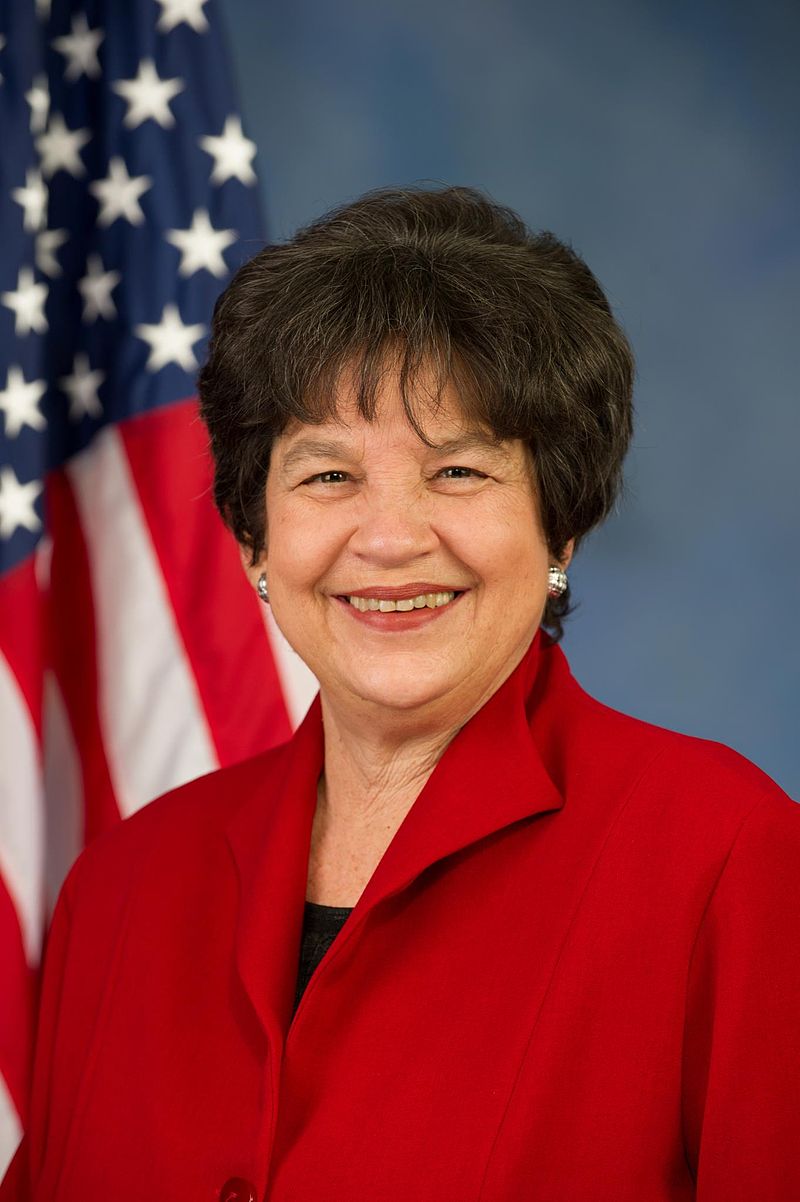

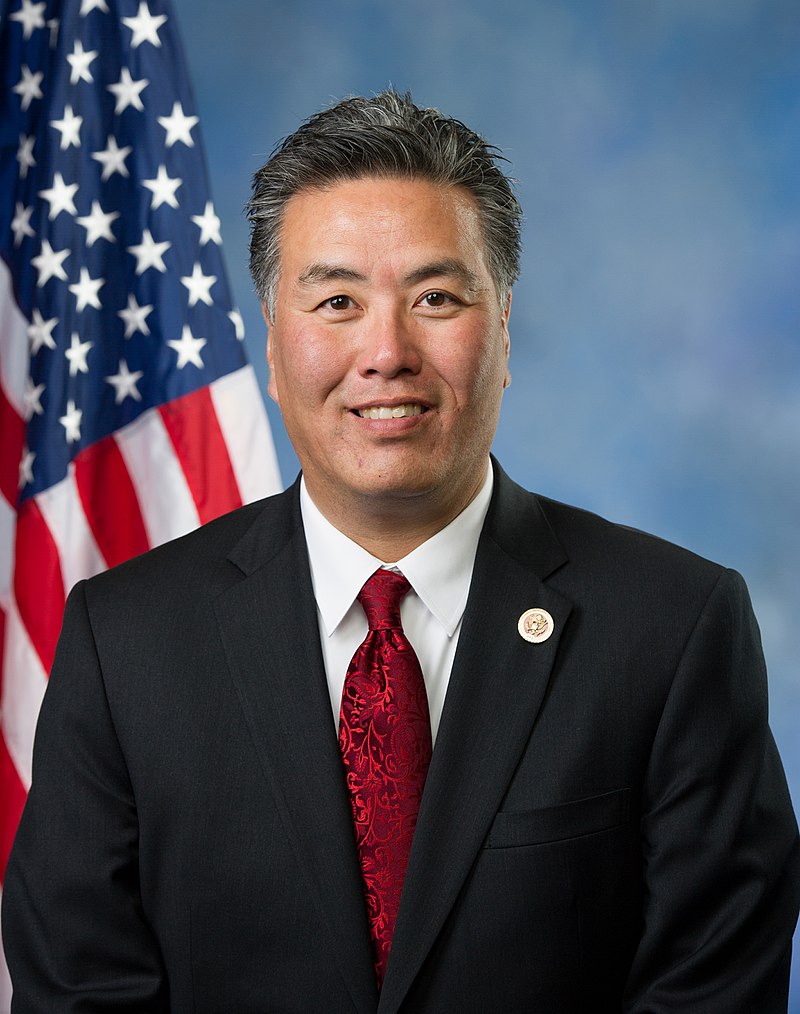

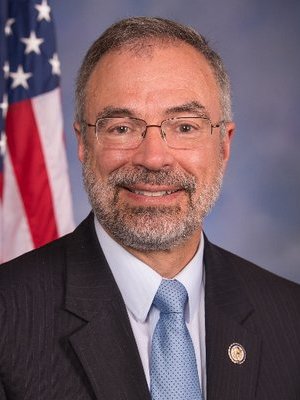

CA • D • Yea

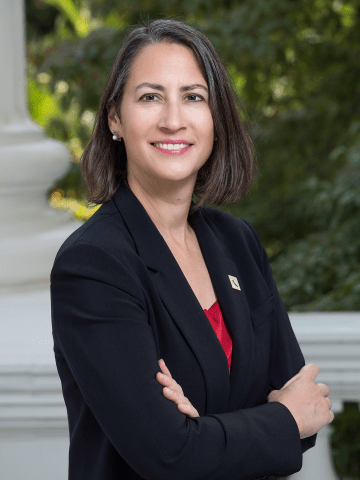

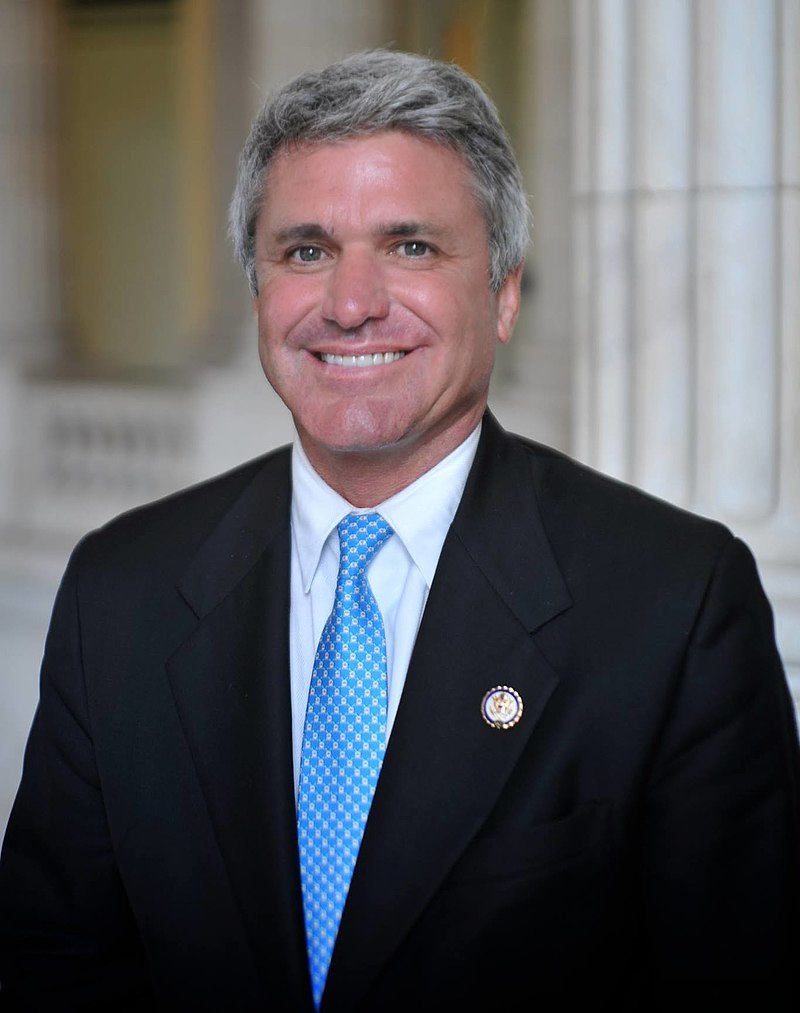

MO • R • Yea

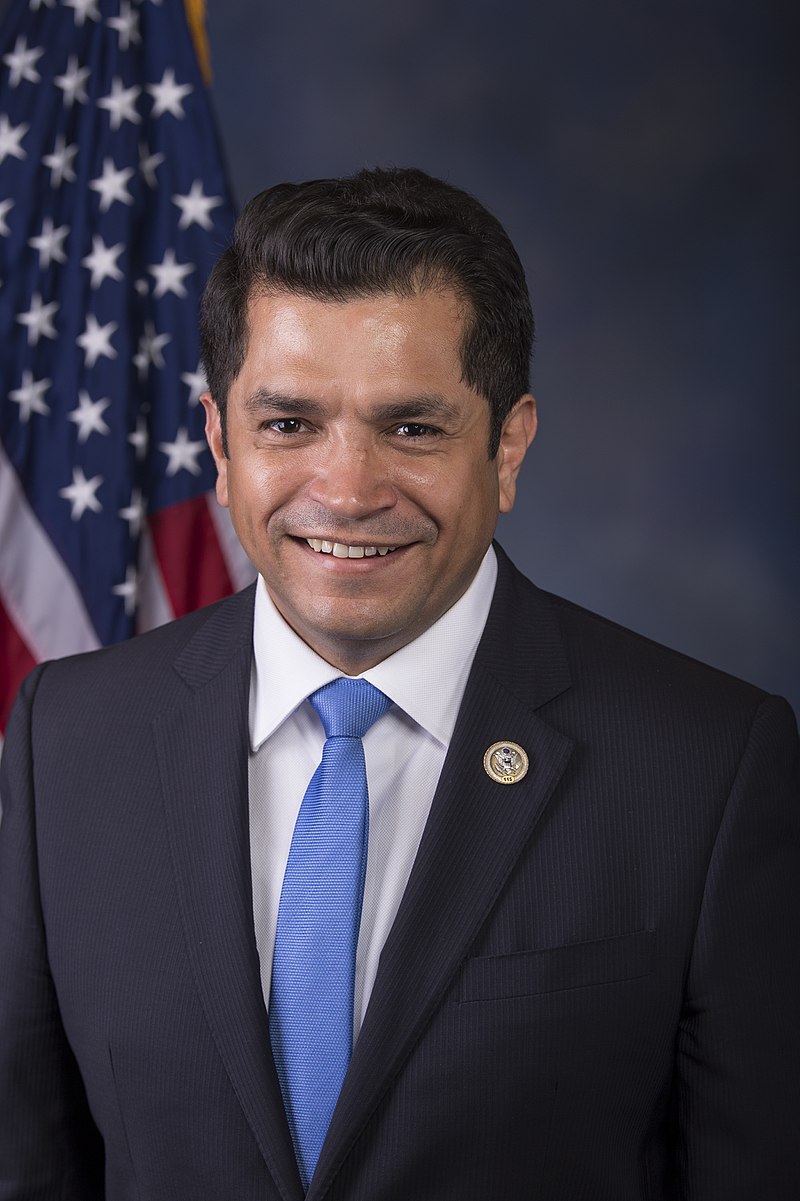

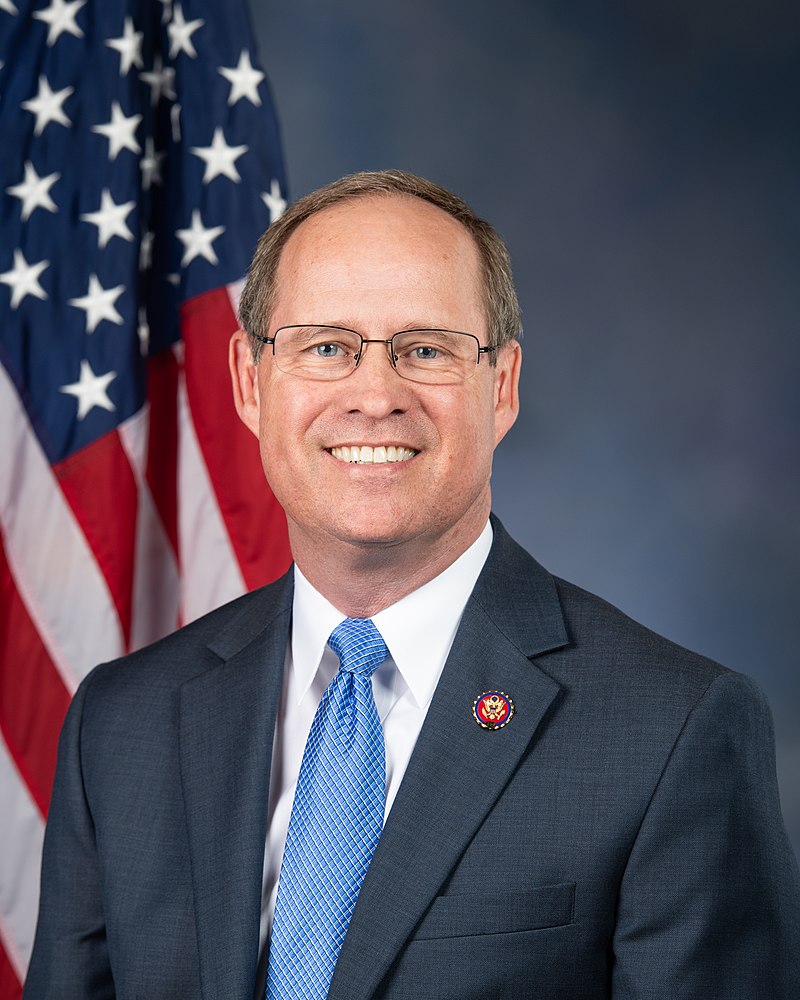

GA • R • Yea

RI • D • Yea

NV • R • Yea

AZ • D • Yea

TX • R • Yea

MA • D • Yea

TX • R • Yea

NE • R • Yea

OH • R • Yea

VT • D • Yea

KY • R • Yea

CA • D • Yea

MI • R • Yea

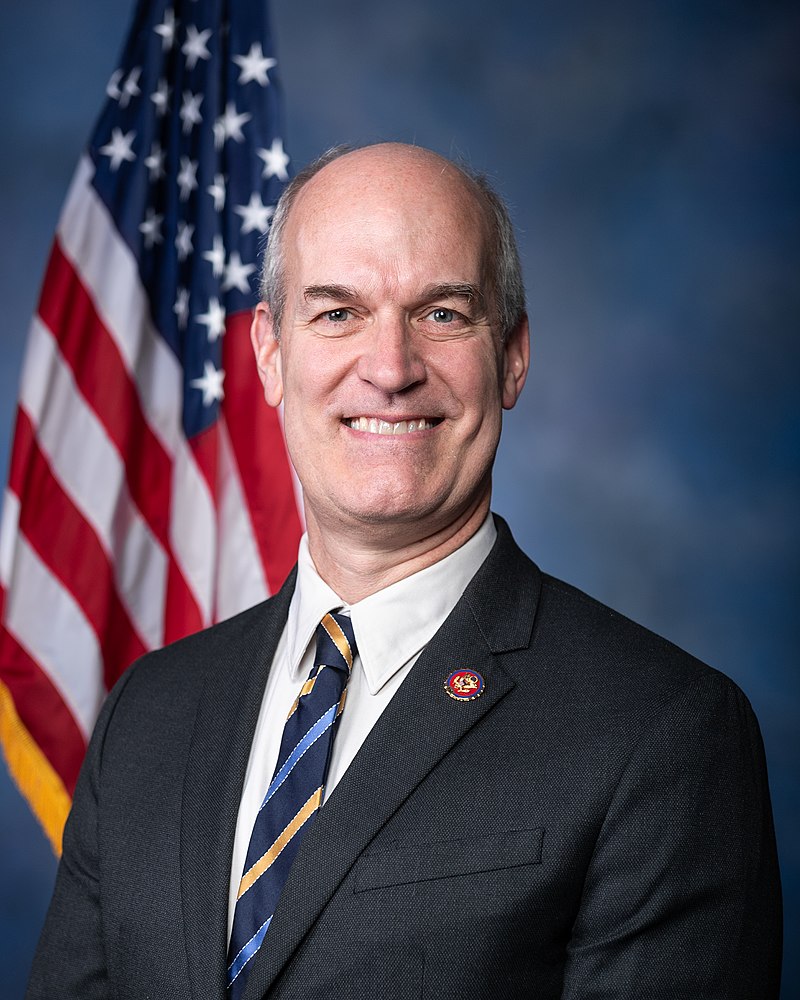

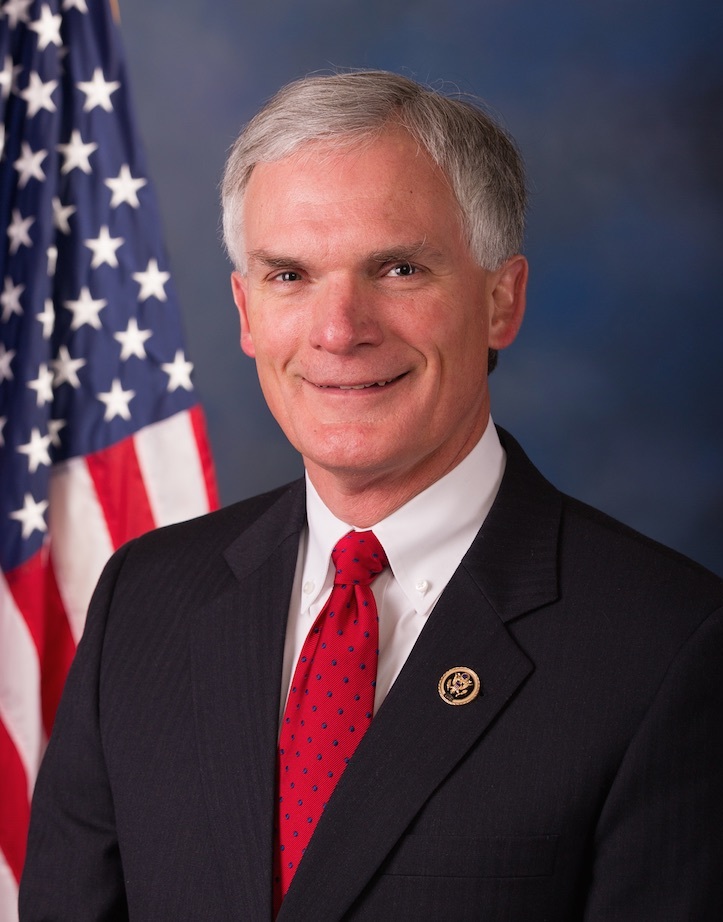

WA • R • Yea

FL • R • Yea

OH • D • Yea

AK • R • Yea

MO • D • Yea

OR • R • Yea

CA • D • Yea

MI • R • Yea

VA • D • Yea

OK • R • Yea

AZ • R • Yea

SC • R • Yea

FL • R • Yea

GA • D • Yea

CO • R • Yea

OR • D • Yea

IL • R • Yea

PA • D • Yea

PA • R • Yea

OH • D • Yea

CA • D • Yea

FL • R • Yea

IL • D • Yea

TN • R • Yea

MO • R • Yea

OR • D • Yea

CA • R • Yea

FL • R • Yea

CA • D • Yea

OH • R • Yea

IN • D • Yea

TX • R • Yea

GA • R • Yea

LA • D • Yea

HI • D • Yea

IL • D • Yea

FL • D • Yea

TX • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

NY • D • Yea

MO • D • Yea

VA • R • Yea

TX • R • Yea

SC • D • Yea

GA • R • Yea

TN • D • Yea

OK • R • Yea

GA • R • Yea

KY • R • Yea

NJ • D • Yea

CA • D • Yea

CA • D • Yea

CT • D • Yea

MN • D • Yea

AZ • R • Yea

CO • R • Yea

AR • R • Yea

CO • D • Yea

TX • D • Yea

IL • D • Yea

NC • D • Yea

TX • R • Yea

PA • D • Yea

CO • D • Yea

CT • D • Yea

WA • D • Yea

PA • D • Yea

CA • D • Yea

TN • R • Yea

OR • D • Yea

FL • R • Yea

MI • D • Yea

TX • D • Yea

FL • R • Yea

MT • R • Yea

FL • R • Yea

NC • R • Yea

MD • D • Yea

TX • R • Yea

MN • R • Yea

TX • D • Yea

NY • D • Yea

KS • R • Yea

PA • D • Yea

CO • R • Yea

MS • R • Yea

TX • R • Yea

ND • R • Yea

IA • R • Yea

LA • D • Yea

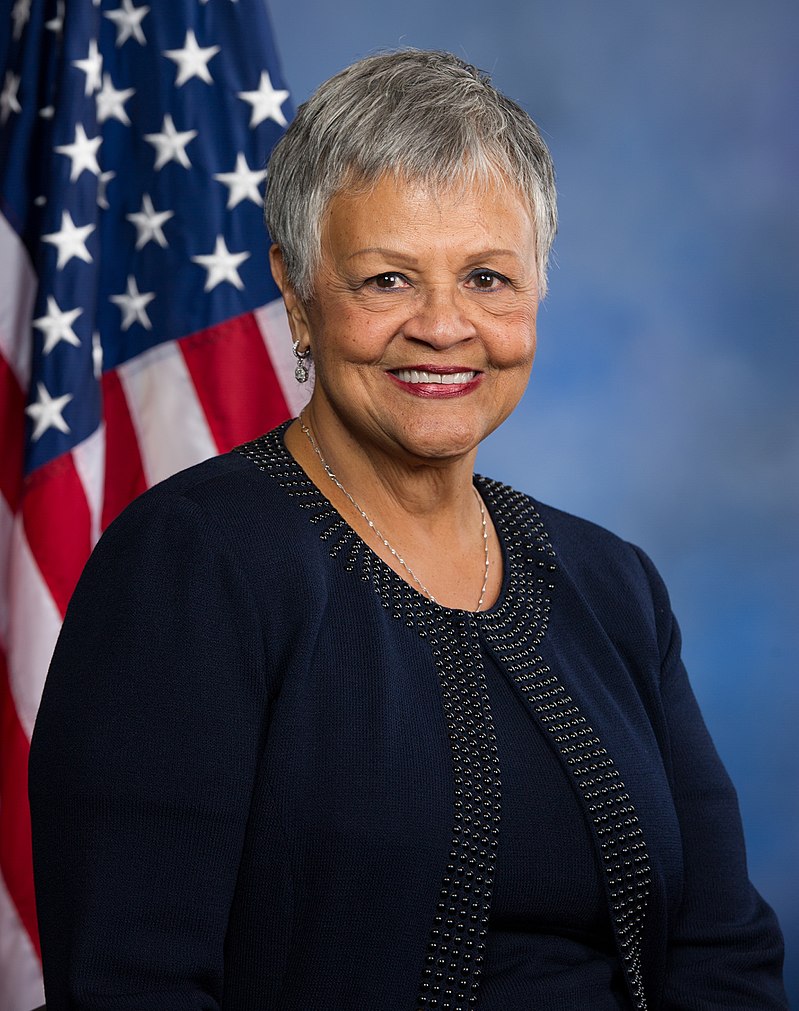

AL • D • Yea

FL • R • Yea

MN • R • Yea

MN • R • Yea

WI • R • Yea

PA • R • Yea

TN • R • Yea

NE • R • Yea

IL • D • Yea

NC • D • Yea

NC • R • Yea

FL • D • Yea

FL • R • Yea

CA • D • Yea

FL • D • Yea

SC • R • Yea

ID • R • Yea

CA • D • Yea

NY • R • Yea

TX • D • Yea

CA • D • Yea

IL • D • Yea

TX • R • Yea

NY • D • Yea

ME • D • Yea

NY • D • Yea

TX • R • Yea

CA • D • Yea

TX • R • Yea

TX • D • Yea

TX • R • Yea

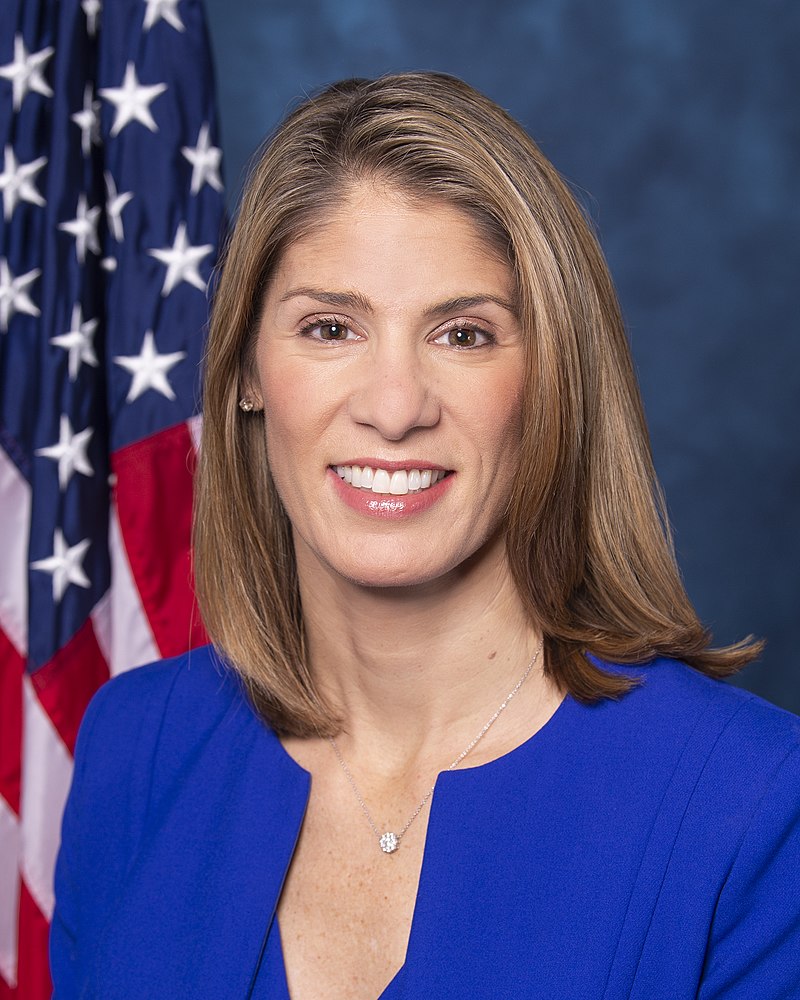

NH • D • Yea

AZ • R • Yea

NJ • D • Yea

MO • R • Yea

CA • D • Yea

TX • D • Yea

VA • R • Yea

AZ • D • Yea

WI • R • Yea

MS • R • Yea

KY • R • Yea

WY • R • Yea

AZ • R • Yea

CA • D • Yea

FL • R • Yea

NC • R • Yea

TN • R • Yea

CT • D • Yea

OK • R • Yea

LA • R • Yea

CT • D • Yea

IA • R • Yea

NV • D • Yea

IN • R • Yea

MD • D • Yea

OR • D • Yea

NC • R • Yea

CO • R • Yea

CA • R • Yea

GA • R • Yea

TX • R • Yea

IL • D • Yea

CA • D • Yea

MI • R • Yea

NY • D • Yea

GA • D • Yea

LA • R • Yea

SD • R • Yea

TX • D • Yea

OH • R • Yea

OH • R • Yea

PA • R • Yea

CA • D • Yea

OH • D • Yea

NJ • R • Yea

MA • D • Yea

PA • R • Yea

IL • D • Yea

MS • R • Yea

NY • D • Yea

UT • R • Yea

CA • D • Yea

VA • R • Yea

CA • R • Yea

CA • R • Yea

IL • D • Yea

TN • R • Yea

IL • R • Yea

NY • R • Yea

OH • D • Yea

NY • R • Yea

WA • D • Yea

CT • D • Yea

NY • D • Yea

OH • R • Yea

NV • D • Yea

FL • R • Yea

PA • D • Yea

NM • D • Yea

LA • R • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

GA • R • Yea

OK • R • Yea

TX • R • Yea

MA • D • Yea

SC • R • Yea

RI • D • Yea

NY • R • Yea

UT • R • Yea

KS • R • Yea

NY • D • Yea

KY • R • Yea

CA • D • Yea

GA • D • Yea

DE • D • Yea

MI • R • Yea

VA • D • Yea

CA • R • Yea

MN • D • Yea

GA • R • Yea

MI • D • Yea

NC • R • Yea

KY • D • Yea

MA • D • Yea

VA • R • Yea

NJ • D • Yea

NY • D • Yea

NJ • D • Yea

NY • D • Yea

IN • R • Yea

PA • R • Yea

MD • D • Yea

WV • R • Yea

IL • R • Yea

OH • R • Yea

IA • R • Yea

FL • R • Yea

CA • D • Yea

MI • R • Yea

WI • D • Yea

AL • R • Yea

UT • R • Yea

WV • R • Yea

NC • R • Yea

TX • R • Yea

NY • D • Yea

MN • D • Yea

FL • D • Yea

MA • D • Yea

IN • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CO • D • Yea

WA • R • Yea

NJ • D • Yea

SC • R • Yea

IA • R • Yea

CA • R • Yea

TN • R • Yea

MD • D • Yea

MN • D • Yea

MO • R • Yea

UT • R • Yea

NJ • D • Yea

AL • R • Yea

CA • D • Yea

NH • D • Yea

FL • R • Yea

WA • D • Yea

PA • R • Yea

CA • D • Yea

CO • D • Yea

TX • R • Yea

ME • D • Yea

NJ • D • Yea

MA • D • Yea

IL • D • Yea

WA • D • Yea

MD • D • Yea

PA • R • Yea

NY • D • Yea

CA • D • Yea

KY • R • Yea

TN • R • Yea

NC • D • Yea

NC • R • Yea

TX • R • Yea

CA • D • Yea

OH • R • Yea

FL • R • Yea

NY • D • Yea

FL • R • Yea

OR • D • Yea

CA • D • Yea

LA • R • Yea

PA • D • Yea

IL • D • Yea

KS • R • Yea

IL • D • Yea

WA • D • Yea

AZ • R • Yea

VA • D • Yea

GA • D • Yea

GA • R • Yea

TX • R • Yea

AL • D • Yea

CA • D • Yea

CA • D • Yea

ID • R • Yea

WA • D • Yea

NJ • R • Yea

NE • R • Yea

MO • R • Yea

IL • D • Yea

FL • D • Yea

NM • D • Yea

AZ • D • Yea

WI • R • Yea

FL • R • Yea

MI • D • Yea

WA • D • Yea

AL • R • Yea

IN • R • Yea

VA • D • Yea

NY • D • Yea

OH • D • Yea

CA • D • Yea

OH • R • Yea

NY • R • Yea

MI • D • Yea

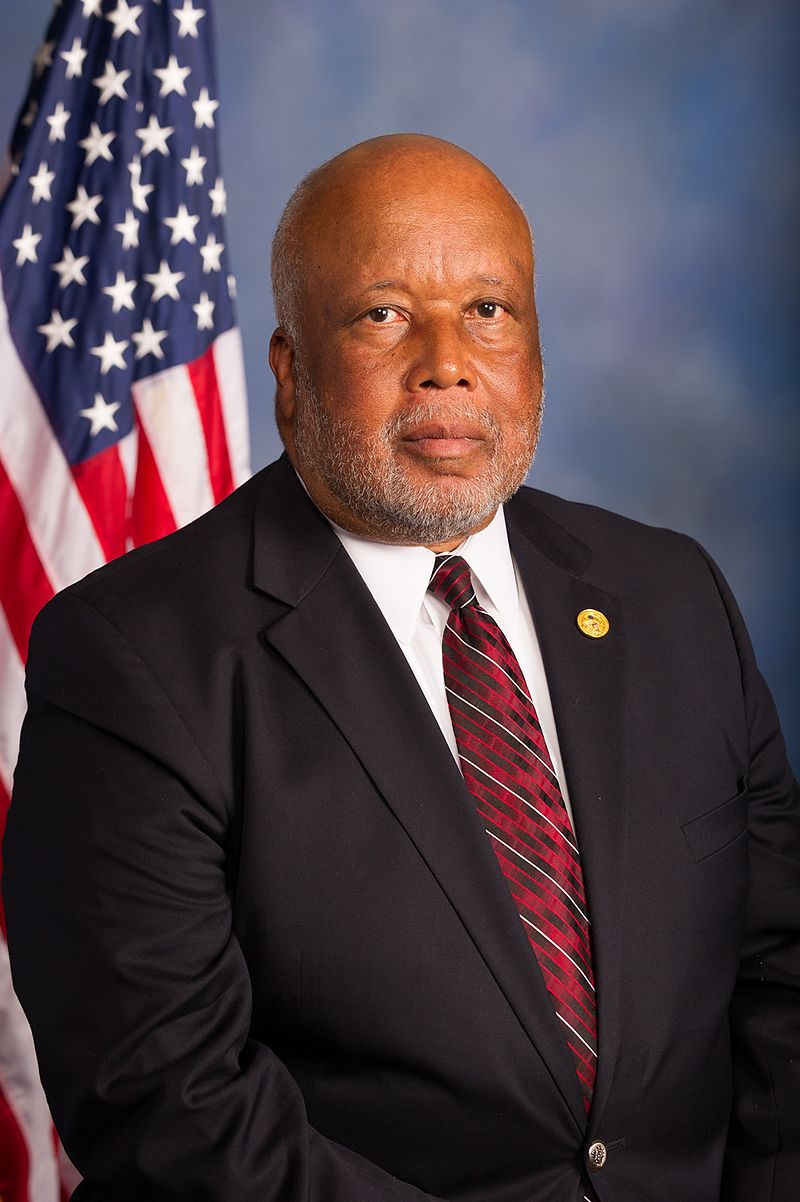

MS • D • Yea

CA • D • Yea

PA • R • Yea

SC • R • Yea

NV • D • Yea

MI • D • Yea

HI • D • Yea

NY • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CA • D • Yea

OH • R • Yea

IL • D • Yea

CA • R • Yea

NJ • D • Yea

TX • R • Yea

TN • R • Yea

WI • R • Yea

CA • D • Yea

NM • D • Yea

TX • D • Yea

NY • D • Yea

VA • D • Yea

MI • R • Yea

VA • D • Yea

CA • D • Yea

NJ • D • Yea

TX • R • Yea

FL • R • Yea

AR • R • Yea

CA • D • Yea

WI • R • Yea

GA • D • Yea

TX • R • Yea

SC • R • Yea

VA • R • Yea

IN • R • Yea

MT • R • Yea

Nay (8)

OK • R • Nay

KS • D • Nay

OH • R • Nay

TX • D • Nay

NC • R • Nay

NC • R • Nay

TX • R • Nay

IN • R • Nay

Not Voting (40)

IN • R • Not Voting

TX • D • Not Voting

FL • D • Not Voting

AZ • R • Not Voting

TX • R • Not Voting

TX • D • Not Voting

CA • R • Not Voting

FL • R • Not Voting

MD • R • Not Voting

AR • R • Not Voting

PA • D • Not Voting

CA • D • Not Voting

MI • R • Not Voting

TX • R • Not Voting

MD • D • Not Voting

WA • D • Not Voting

NY • R • Not Voting

FL • R • Not Voting

PA • R • Not Voting

FL • R • Not Voting

TX • R • Not Voting

MD • D • Not Voting

NC • R • Not Voting

TX • R • Not Voting

NY • D • Not Voting

CA • D • Not Voting

WI • D • Not Voting

IL • D • Not Voting

AL • R • Not Voting

MI • D • Not Voting

IN • R • Not Voting

PA • R • Not Voting

MN • R • Not Voting

NY • R • Not Voting

CA • D • Not Voting

WI • R • Not Voting

MO • R • Not Voting

FL • D • Not Voting

FL • D • Not Voting

AR • R • Not Voting