H.R.2988 — Protecting Prudent Investment of Retirement Savings Act

House Roll Call

H.R.2988

Roll 31 • Congress 119, Session 2 • Jan 15, 2026 10:43 AM • Result: Passed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.2988 — Protecting Prudent Investment of Retirement Savings Act |

|---|---|

| Vote question | On Passage |

| Vote type | Yea-and-Nay |

| Result | Passed |

| Totals | Yea 213 / Nay 205 / Present 0 / Not Voting 13 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 210 | 0 | 0 | 8 |

| D | 3 | 205 | 0 | 5 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Passage

Bill Analysis

HR 2988 – Protecting Prudent Investment of Retirement Savings Act (119th Congress)

HR 2988 amends the Employee Retirement Income Security Act of 1974 (ERISA) to restrict how fiduciaries of private-sector retirement plans (e.g., 401(k)s, pension plans) may consider environmental, social, and governance (ESG) or similar non-pecuniary factors in investment decisions and proxy voting.

Core policy change

- Codifies that ERISA fiduciaries must base investment decisions and proxy voting solely on “pecuniary” (financial) factors—i.e., factors expected to have a material effect on risk or return.

- Prohibits subordinating participants’ and beneficiaries’ financial interests to non-financial objectives, including social, political, or ideological goals.

- Limits use of “tie-breaker” rules: if two investments are economically indistinguishable, fiduciaries may not use ESG or other non-pecuniary factors as a deciding criterion in a way that sacrifices expected return or increases risk.

- Requires that proxy voting and other shareholder rights be exercised only when the fiduciary reasonably determines such action is expected to enhance or protect the economic value of the investment.

Agencies and authorities

- Primarily affects the U.S. Department of Labor (DOL), which enforces ERISA.

- Constrains DOL’s regulatory authority by embedding a stricter pecuniary-only standard in statute, limiting future rulemakings that would permit broader ESG consideration.

- May require DOL to revise or withdraw any existing guidance or regulations inconsistent with the new statutory standard.

Who is affected

- Regulated: ERISA plan fiduciaries (plan sponsors, investment committees, asset managers acting as fiduciaries, proxy advisors when acting under fiduciary mandates).

- Beneficiaries: Participants and beneficiaries in private-sector retirement plans, whose accounts and plan assets are to be managed under the clarified pecuniary standard.

- Indirectly affected: Asset managers and financial product providers offering ESG-themed or impact-oriented investments to ERISA plans.

Funding and timelines

- The bill does not create new federal spending programs or dedicated appropriations; implementation is absorbed within DOL’s existing enforcement and regulatory resources.

- Effective dates and any transition or compliance periods would be set by the statutory text and subsequent DOL guidance or rulemaking; the bill’s main impact is immediate clarification and tightening of fiduciary standards once enacted.

Yea (213)

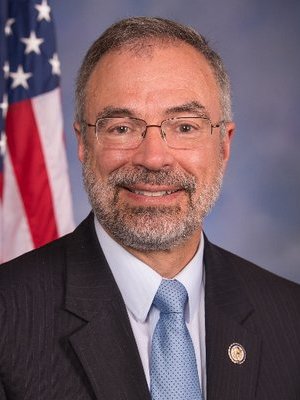

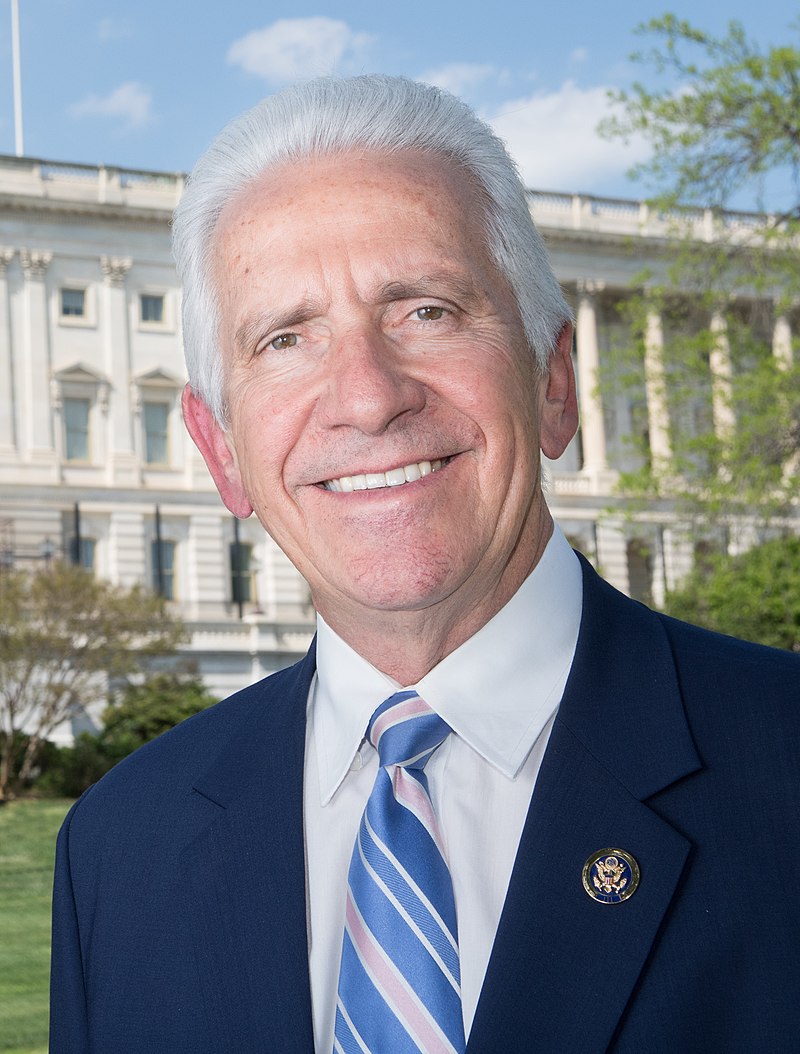

MO • R • Yea

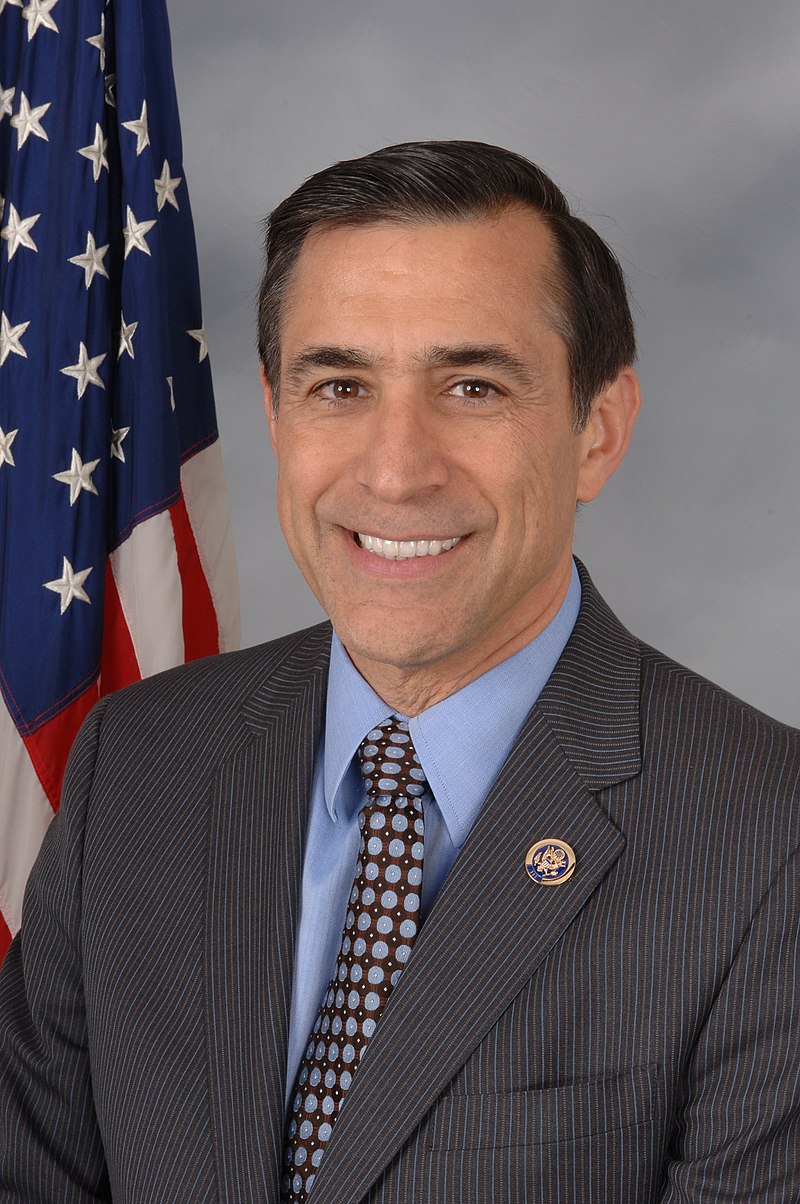

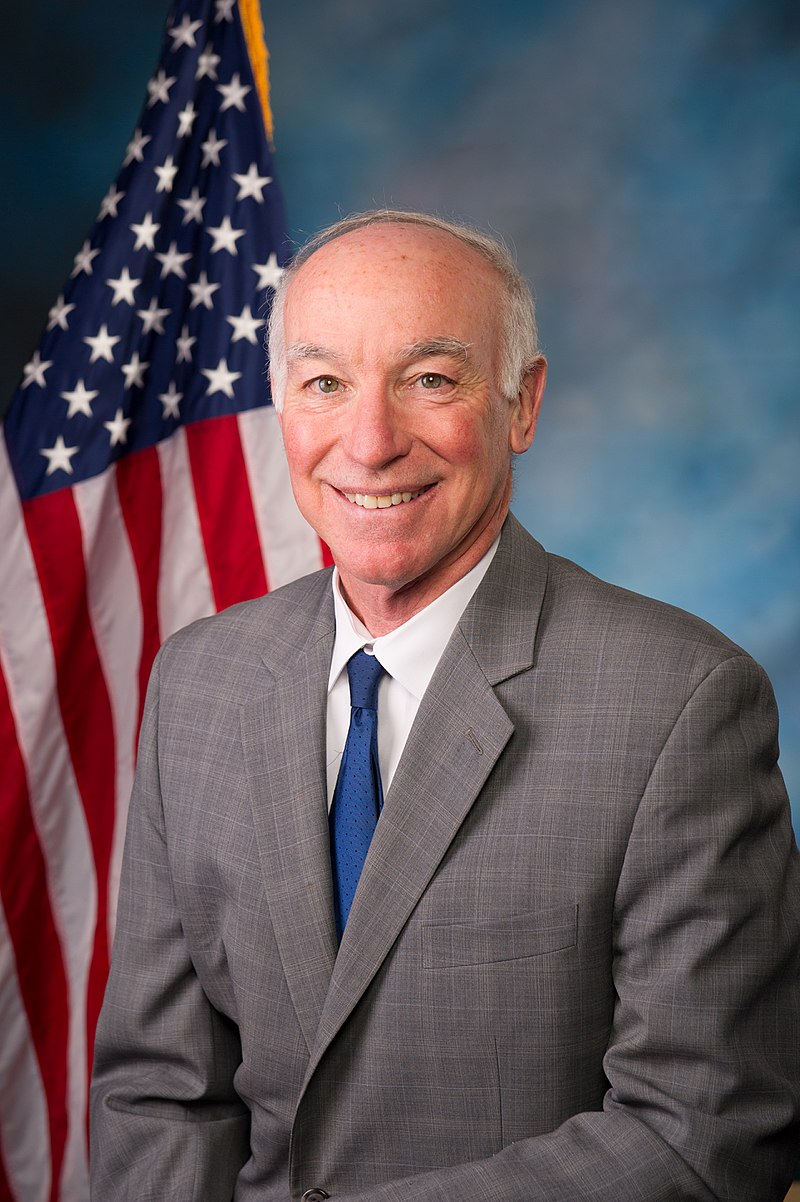

GA • R • Yea

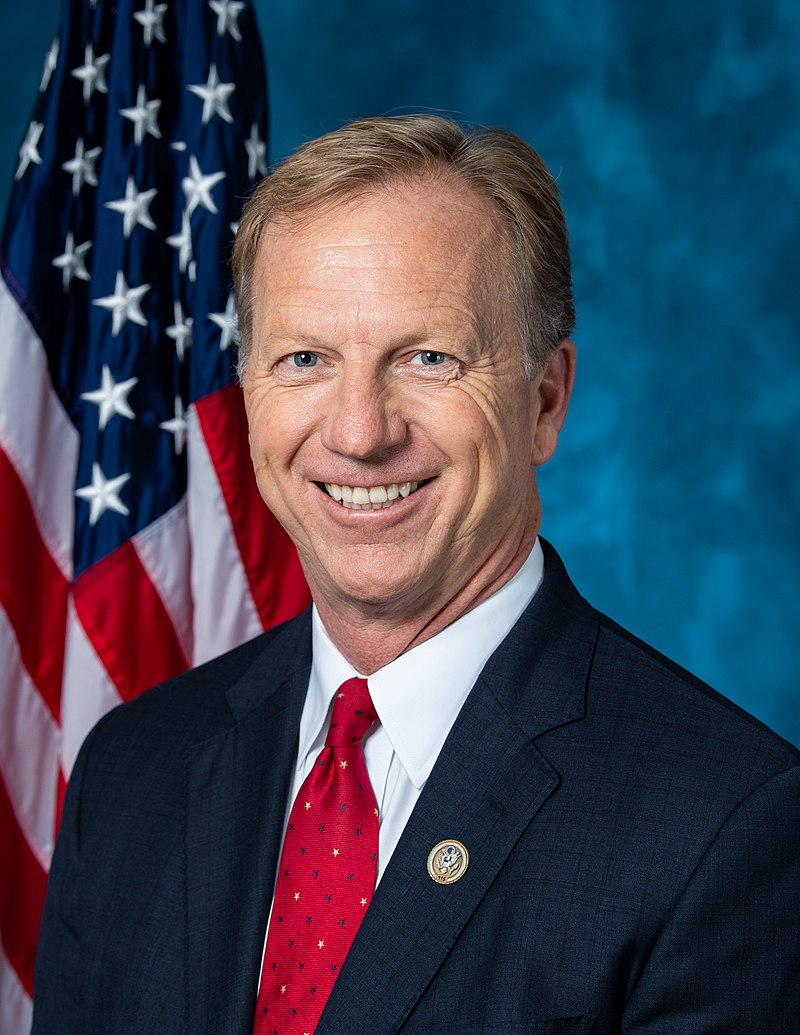

NV • R • Yea

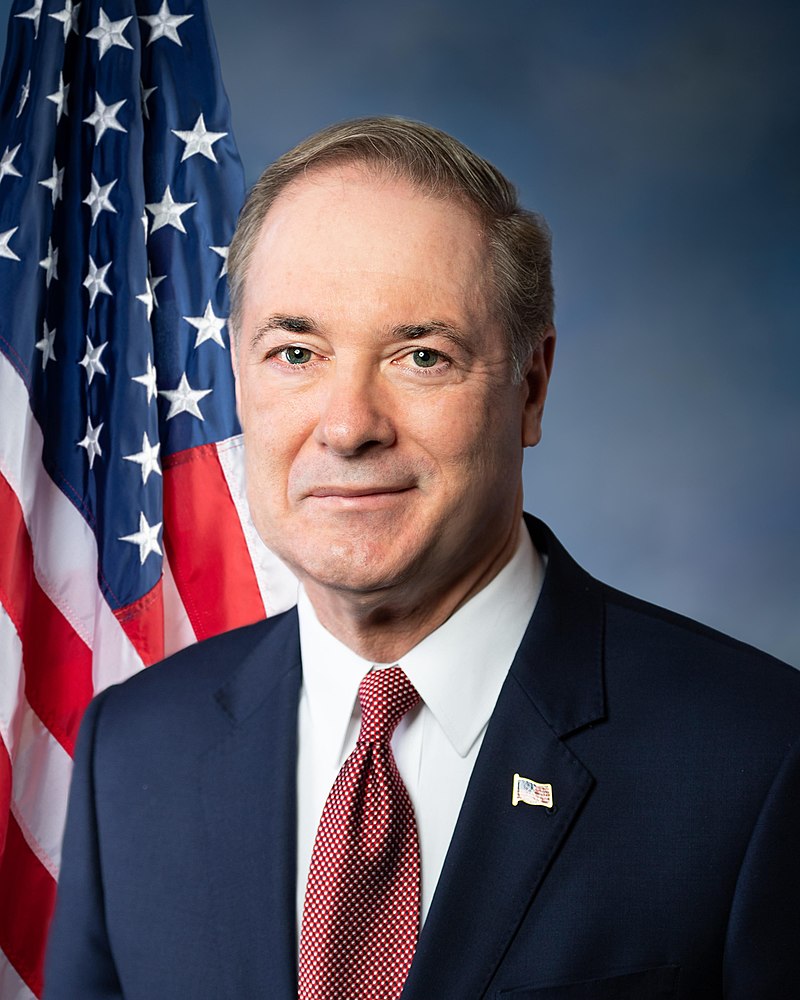

TX • R • Yea

TX • R • Yea

NE • R • Yea

OH • R • Yea

KY • R • Yea

MI • R • Yea

WA • R • Yea

FL • R • Yea

AK • R • Yea

OR • R • Yea

MI • R • Yea

OK • R • Yea

AZ • R • Yea

SC • R • Yea

FL • R • Yea

CO • R • Yea

IL • R • Yea

OK • R • Yea

PA • R • Yea

FL • R • Yea

TN • R • Yea

MO • R • Yea

CA • R • Yea

FL • R • Yea

OH • R • Yea

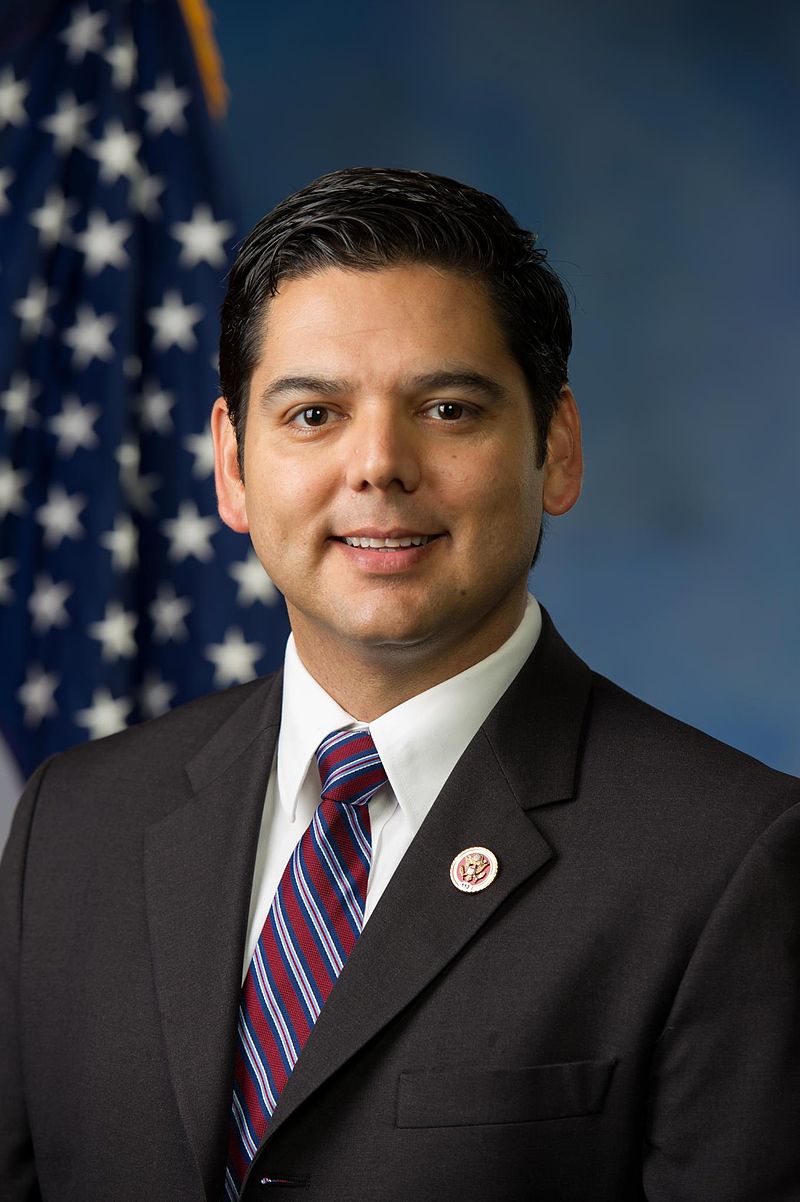

IN • D • Yea

TX • R • Yea

GA • R • Yea

AZ • R • Yea

VA • R • Yea

TX • R • Yea

GA • R • Yea

OK • R • Yea

GA • R • Yea

KY • R • Yea

AZ • R • Yea

CO • R • Yea

AR • R • Yea

TX • R • Yea

TX • D • Yea

OH • R • Yea

TX • R • Yea

TN • R • Yea

FL • R • Yea

FL • R • Yea

MT • R • Yea

FL • R • Yea

NC • R • Yea

TX • R • Yea

MN • R • Yea

KS • R • Yea

CO • R • Yea

MS • R • Yea

TX • R • Yea

ND • R • Yea

IA • R • Yea

FL • R • Yea

MN • R • Yea

MN • R • Yea

WI • R • Yea

PA • R • Yea

TN • R • Yea

NE • R • Yea

CA • R • Yea

NC • R • Yea

FL • R • Yea

SC • R • Yea

ID • R • Yea

NY • R • Yea

TX • R • Yea

FL • R • Yea

TX • R • Yea

TX • R • Yea

TX • R • Yea

AZ • R • Yea

MO • R • Yea

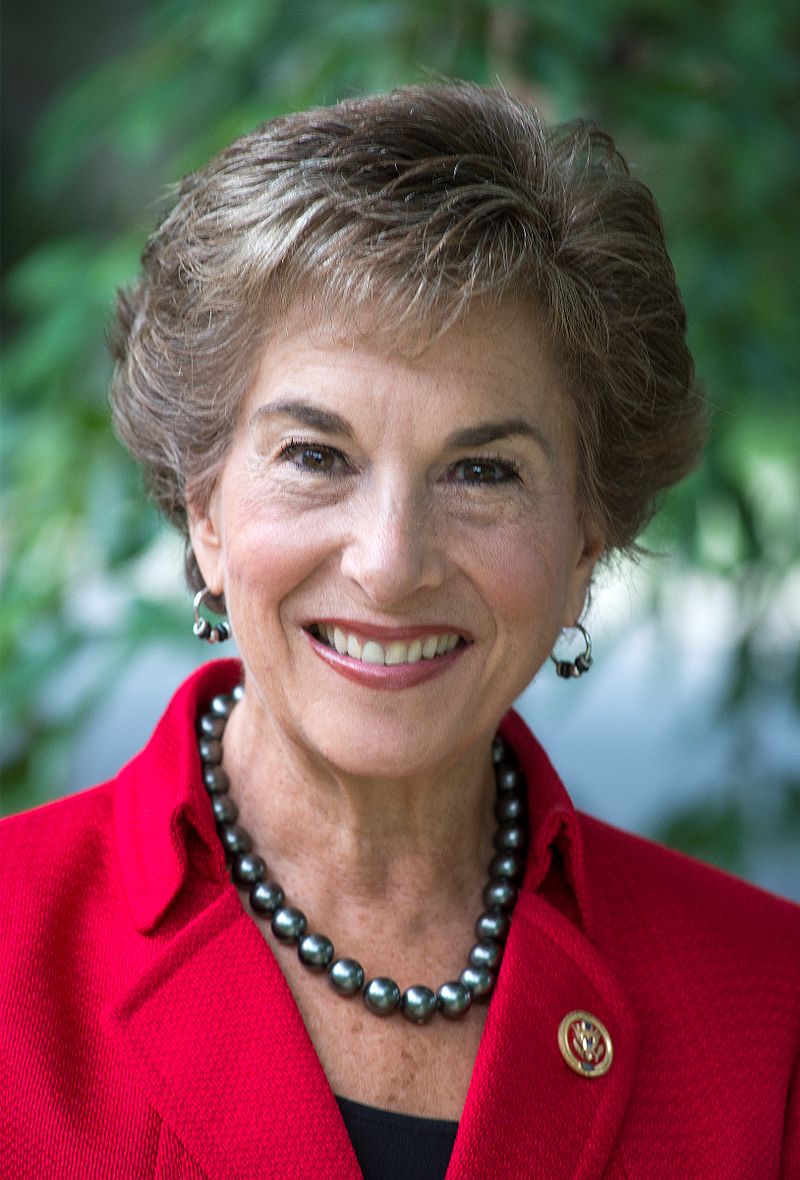

CA • D • Yea

VA • R • Yea

WI • R • Yea

MS • R • Yea

KY • R • Yea

WY • R • Yea

AZ • R • Yea

FL • R • Yea

NC • R • Yea

MD • R • Yea

NC • R • Yea

TN • R • Yea

OK • R • Yea

LA • R • Yea

AR • R • Yea

IA • R • Yea

IN • R • Yea

NC • R • Yea

MI • R • Yea

CO • R • Yea

CA • R • Yea

GA • R • Yea

TX • R • Yea

MI • R • Yea

LA • R • Yea

SD • R • Yea

OH • R • Yea

OH • R • Yea

PA • R • Yea

NJ • R • Yea

PA • R • Yea

MS • R • Yea

UT • R • Yea

VA • R • Yea

CA • R • Yea

CA • R • Yea

NC • R • Yea

TN • R • Yea

IL • R • Yea

NY • R • Yea

NY • R • Yea

OH • R • Yea

NY • R • Yea

FL • R • Yea

LA • R • Yea

GA • R • Yea

OK • R • Yea

FL • R • Yea

TX • R • Yea

PA • R • Yea

NY • R • Yea

UT • R • Yea

KS • R • Yea

KY • R • Yea

FL • R • Yea

TX • R • Yea

MI • R • Yea

CA • R • Yea

GA • R • Yea

NC • R • Yea

VA • R • Yea

IN • R • Yea

PA • R • Yea

WV • R • Yea

IL • R • Yea

OH • R • Yea

IA • R • Yea

FL • R • Yea

MI • R • Yea

AL • R • Yea

UT • R • Yea

WV • R • Yea

NC • R • Yea

TX • R • Yea

WA • R • Yea

IA • R • Yea

CA • R • Yea

TN • R • Yea

MO • R • Yea

UT • R • Yea

AL • R • Yea

FL • R • Yea

PA • R • Yea

TX • R • Yea

PA • R • Yea

KY • R • Yea

AL • R • Yea

TN • R • Yea

NC • R • Yea

TX • R • Yea

OH • R • Yea

FL • R • Yea

FL • R • Yea

LA • R • Yea

KS • R • Yea

AZ • R • Yea

GA • R • Yea

TX • R • Yea

TX • R • Yea

IN • R • Yea

ID • R • Yea

NJ • R • Yea

NE • R • Yea

MO • R • Yea

PA • R • Yea

IN • R • Yea

MN • R • Yea

NY • R • Yea

WI • R • Yea

FL • R • Yea

AL • R • Yea

IN • R • Yea

OH • R • Yea

NY • R • Yea

PA • R • Yea

WI • R • Yea

SC • R • Yea

OH • R • Yea

CA • R • Yea

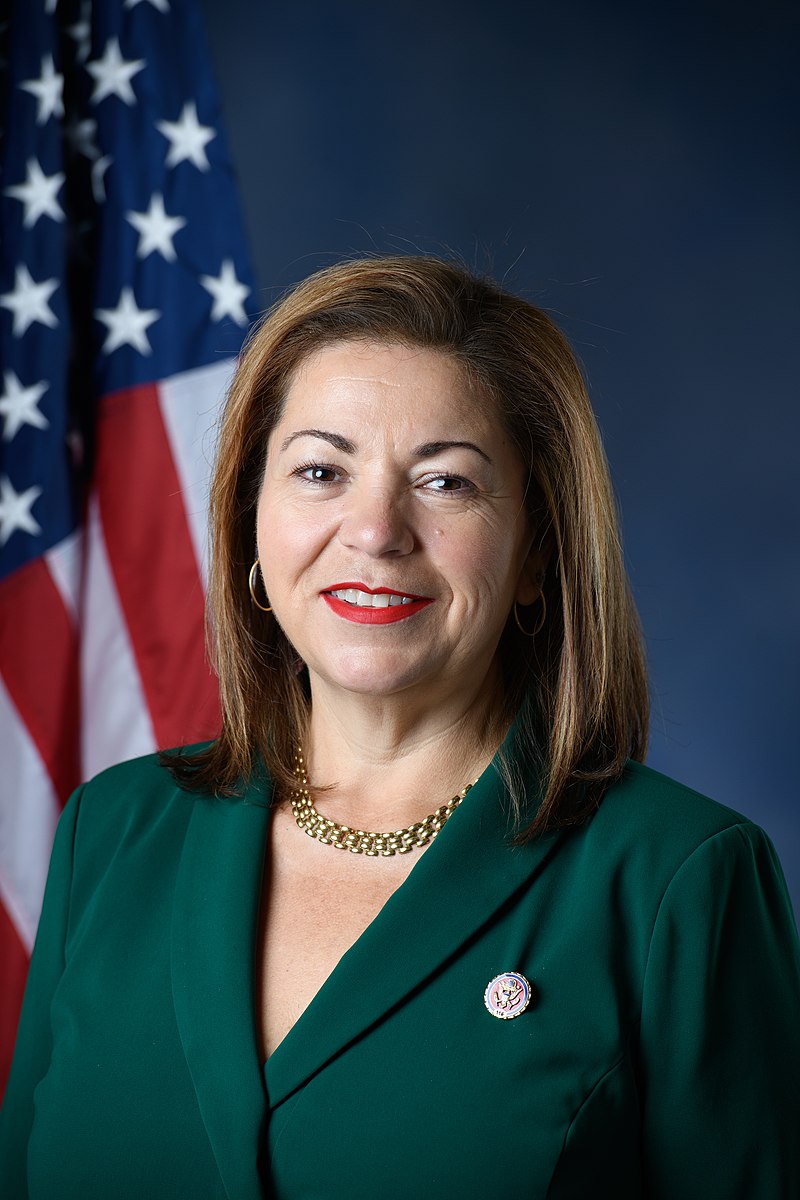

NJ • D • Yea

TX • R • Yea

TN • R • Yea

MO • R • Yea

MI • R • Yea

TX • R • Yea

FL • R • Yea

AR • R • Yea

WI • R • Yea

TX • R • Yea

SC • R • Yea

VA • R • Yea

IN • R • Yea

MT • R • Yea

Nay (205)

NC • D • Nay

CA • D • Nay

RI • D • Nay

AZ • D • Nay

MA • D • Nay

VT • D • Nay

CA • D • Nay

OH • D • Nay

MO • D • Nay

CA • D • Nay

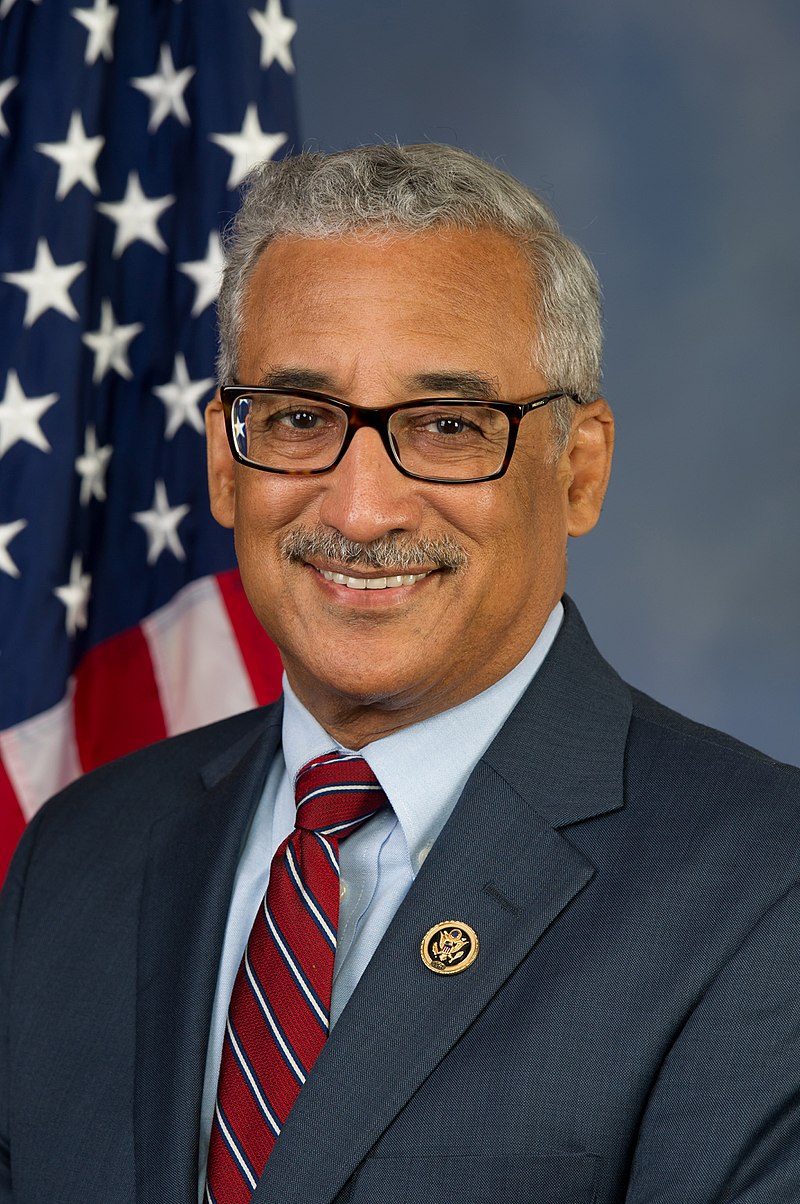

VA • D • Nay

GA • D • Nay

OR • D • Nay

PA • D • Nay

OH • D • Nay

CA • D • Nay

IL • D • Nay

OR • D • Nay

CA • D • Nay

LA • D • Nay

HI • D • Nay

IL • D • Nay

TX • D • Nay

FL • D • Nay

CA • D • Nay

CA • D • Nay

MA • D • Nay

NY • D • Nay

MO • D • Nay

SC • D • Nay

TN • D • Nay

NJ • D • Nay

CA • D • Nay

CA • D • Nay

CT • D • Nay

MN • D • Nay

TX • D • Nay

CO • D • Nay

KS • D • Nay

IL • D • Nay

NC • D • Nay

PA • D • Nay

CO • D • Nay

CT • D • Nay

WA • D • Nay

PA • D • Nay

CA • D • Nay

OR • D • Nay

MI • D • Nay

TX • D • Nay

MD • D • Nay

TX • D • Nay

NY • D • Nay

PA • D • Nay

LA • D • Nay

AL • D • Nay

TX • D • Nay

IL • D • Nay

NC • D • Nay

FL • D • Nay

CA • D • Nay

FL • D • Nay

CA • D • Nay

TX • D • Nay

CA • D • Nay

IL • D • Nay

NY • D • Nay

ME • D • Nay

NY • D • Nay

CA • D • Nay

TX • D • Nay

NH • D • Nay

NJ • D • Nay

TX • D • Nay

AZ • D • Nay

CA • D • Nay

CT • D • Nay

CT • D • Nay

NV • D • Nay

PA • D • Nay

MD • D • Nay

OR • D • Nay

CA • D • Nay

MD • D • Nay

IL • D • Nay

CA • D • Nay

WA • D • Nay

NY • D • Nay

GA • D • Nay

TX • D • Nay

CA • D • Nay

OH • D • Nay

MA • D • Nay

IL • D • Nay

NY • D • Nay

CA • D • Nay

IL • D • Nay

OH • D • Nay

WA • D • Nay

CT • D • Nay

NY • D • Nay

NV • D • Nay

PA • D • Nay

NM • D • Nay

CA • D • Nay

CA • D • Nay

CA • D • Nay

CA • D • Nay

MA • D • Nay

RI • D • Nay

NY • D • Nay

CA • D • Nay

GA • D • Nay

DE • D • Nay

MD • D • Nay

VA • D • Nay

MN • D • Nay

MI • D • Nay

KY • D • Nay

MA • D • Nay

NJ • D • Nay

NY • D • Nay

NJ • D • Nay

NY • D • Nay

MD • D • Nay

CA • D • Nay

WI • D • Nay

NY • D • Nay

MN • D • Nay

FL • D • Nay

IN • D • Nay

CA • D • Nay

NY • D • Nay

MA • D • Nay

CO • D • Nay

NY • D • Nay

MD • D • Nay

MN • D • Nay

NJ • D • Nay

CA • D • Nay

NH • D • Nay

CA • D • Nay

WA • D • Nay

CA • D • Nay

CO • D • Nay

ME • D • Nay

WI • D • Nay

NJ • D • Nay

MA • D • Nay

IL • D • Nay

IL • D • Nay

WA • D • Nay

MD • D • Nay

NY • D • Nay

CA • D • Nay

NC • D • Nay

CA • D • Nay

NY • D • Nay

OR • D • Nay

CA • D • Nay

PA • D • Nay

IL • D • Nay

IL • D • Nay

MI • D • Nay

WA • D • Nay

VA • D • Nay

GA • D • Nay

AL • D • Nay

CA • D • Nay

CA • D • Nay

WA • D • Nay

IL • D • Nay

FL • D • Nay

NM • D • Nay

AZ • D • Nay

MI • D • Nay

WA • D • Nay

VA • D • Nay

NY • D • Nay

OH • D • Nay

CA • D • Nay

MI • D • Nay

MS • D • Nay

CA • D • Nay

NV • D • Nay

MI • D • Nay

HI • D • Nay

NY • D • Nay

CA • D • Nay

NY • D • Nay

MA • D • Nay

CA • D • Nay

IL • D • Nay

CA • D • Nay

NM • D • Nay

TX • D • Nay

NY • D • Nay

VA • D • Nay

VA • D • Nay

FL • D • Nay

CA • D • Nay

NJ • D • Nay

CA • D • Nay

GA • D • Nay

FL • D • Nay

Not Voting (13)

IN • R • Not Voting

TX • D • Not Voting

FL • D • Not Voting

TX • R • Not Voting

SC • R • Not Voting

MA • D • Not Voting

NC • R • Not Voting

TX • R • Not Voting

NJ • D • Not Voting

SC • R • Not Voting

CA • D • Not Voting

WI • R • Not Voting

AR • R • Not Voting