H.R.2988 — Protecting Prudent Investment of Retirement Savings Act

House Roll Call

H.R.2988

Roll 30 • Congress 119, Session 2 • Jan 15, 2026 10:36 AM • Result: Failed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.2988 — Protecting Prudent Investment of Retirement Savings Act |

|---|---|

| Vote question | On Motion to Recommit |

| Vote type | Yea-and-Nay |

| Result | Failed |

| Totals | Yea 206 / Nay 210 / Present 0 / Not Voting 15 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 0 | 209 | 0 | 9 |

| D | 206 | 1 | 0 | 6 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Motion to Recommit

Bill Analysis

HR 2988 – Protecting Prudent Investment of Retirement Savings Act (119th Congress)

HR 2988 amends the Employee Retirement Income Security Act of 1974 (ERISA) to restrict how fiduciaries of private-sector retirement plans (e.g., 401(k)s, pension plans) may consider environmental, social, and governance (ESG) factors in investment decisions and proxy voting.

Core provisions and effects:

Fiduciary standard clarification: Codifies that ERISA fiduciaries must base investment decisions and proxy voting solely on “pecuniary” (financial) factors that materially affect risk and return. It bars subordinating participants’ financial interests to non-financial objectives, including social, environmental, or political goals.

Limits on ESG use: Prohibits treating ESG or similar non-pecuniary factors as determinative in selecting investments, investment options, or exercising shareholder rights. ESG may be considered only when demonstrably tied to economic value and risk/return, not as a collateral or tie‑breaking factor.

Proxy voting and shareholder rights: Requires that proxy voting and other exercise of shareholder rights be managed under the same pecuniary-only standard. Plan fiduciaries may not vote proxies or engage in corporate governance activities to advance non-financial policy preferences.

Default investment options (QDIAs): Tightens rules for qualified default investment alternatives by requiring that default options also be selected based exclusively on pecuniary considerations, effectively restricting default ESG-themed funds unless justified strictly on financial grounds.

Regulatory direction: Directs the Department of Labor (DOL) to align its regulations and guidance with the amended ERISA standard, limiting future DOL authority to permit broader ESG consideration. DOL must interpret and enforce fiduciary duties consistent with a strict financial-materiality test.

Who is affected:

- Regulated: ERISA-covered plan sponsors, plan fiduciaries, investment managers, and proxy advisory firms working for ERISA plans.

- Beneficiaries: Participants and beneficiaries of private retirement plans, whose accounts must be managed under the clarified pecuniary-only standard.

Funding and timelines: The bill does not create new programs or appropriations; implementation occurs through DOL rulemaking and enforcement under existing administrative resources and timelines following enactment.

Yea (206)

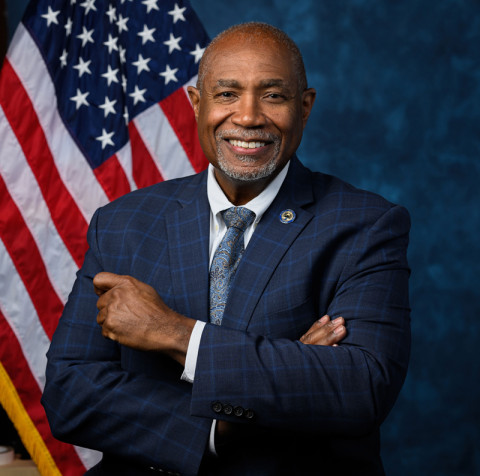

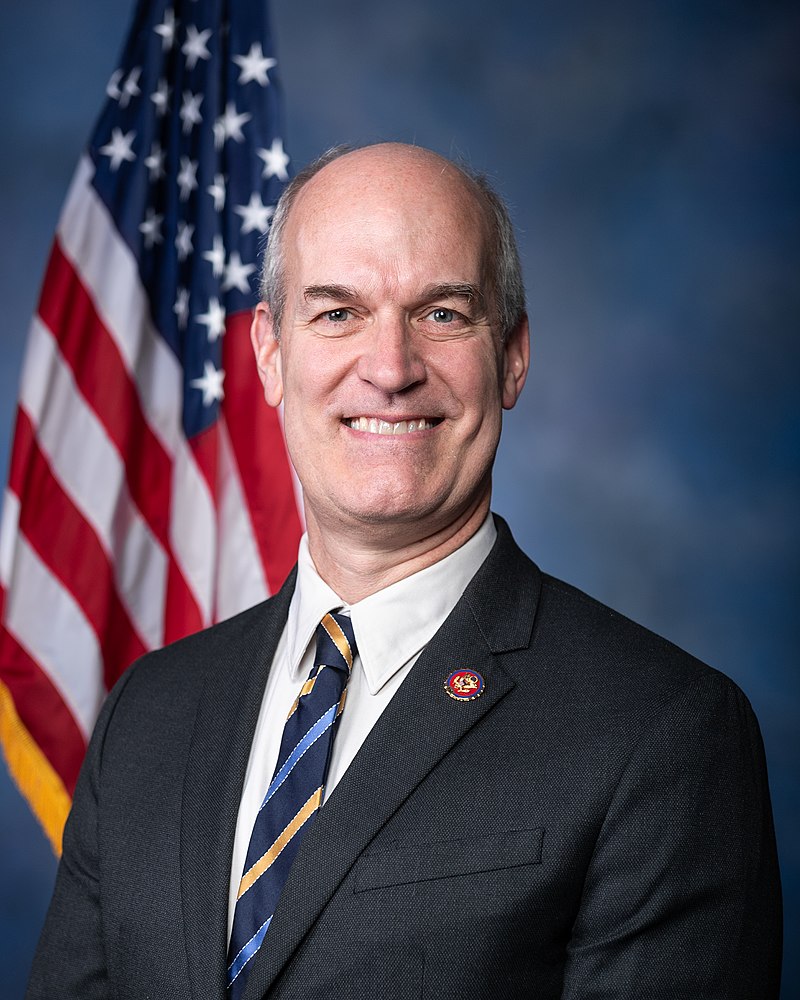

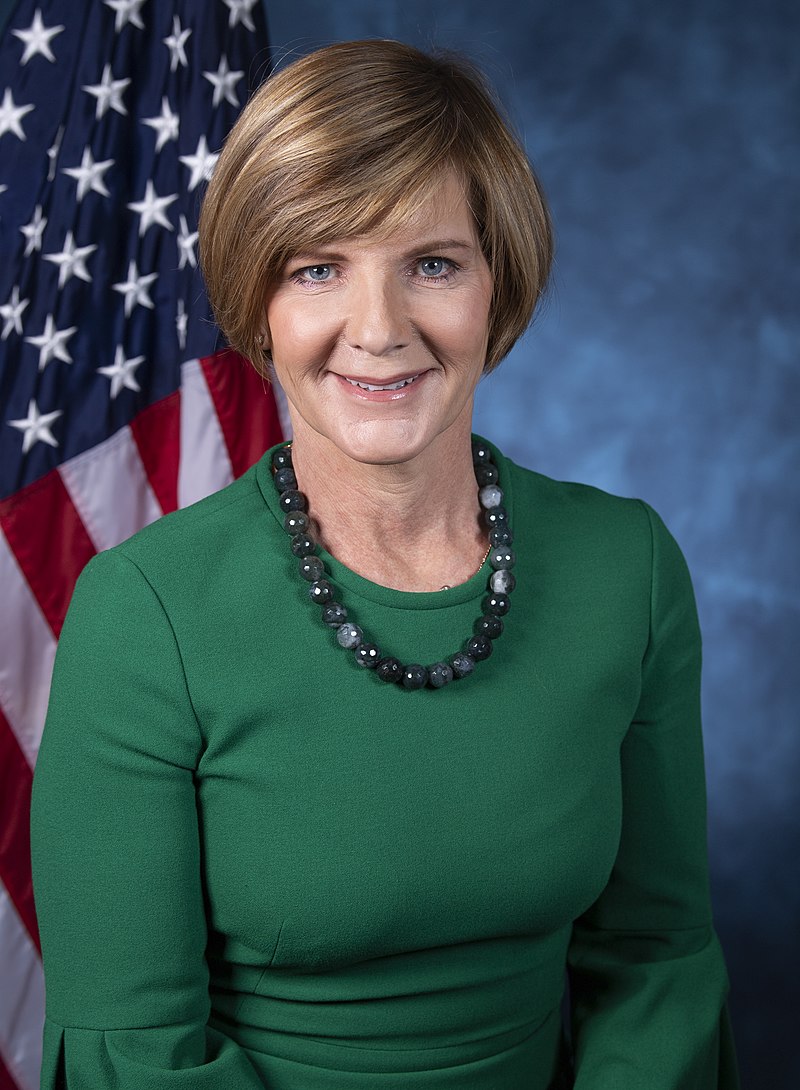

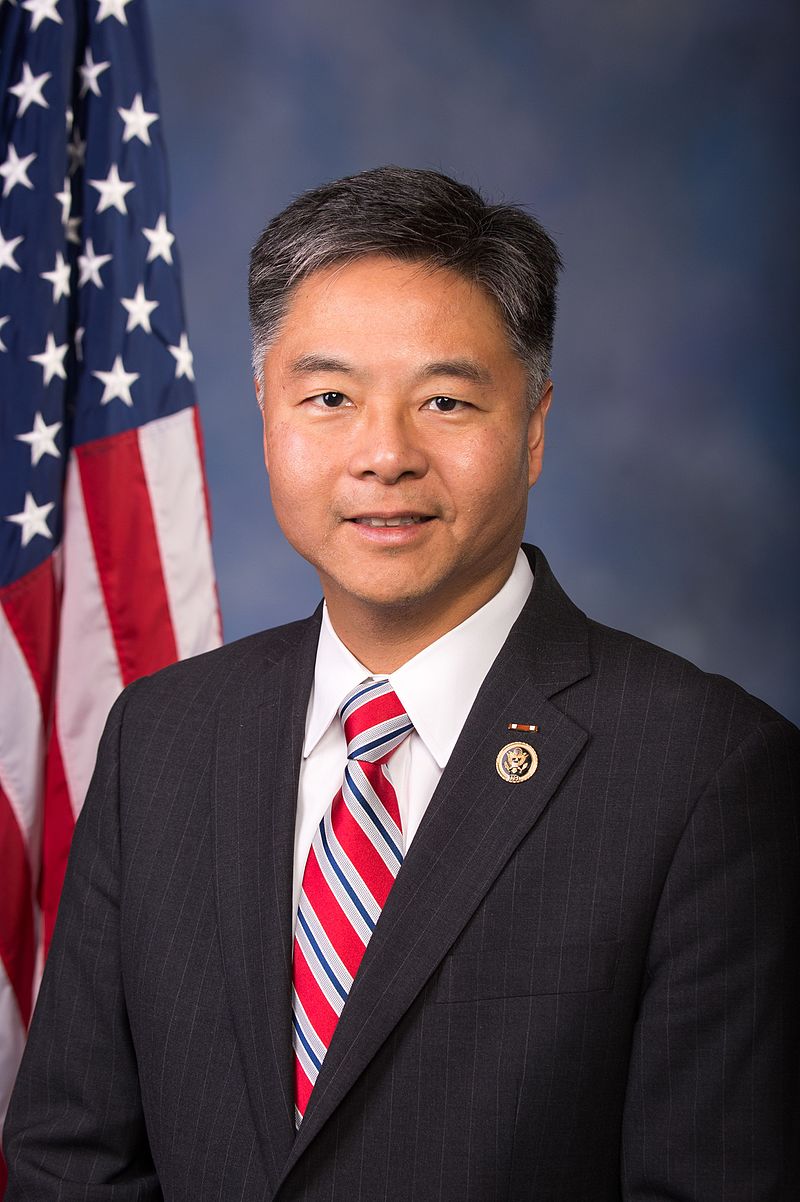

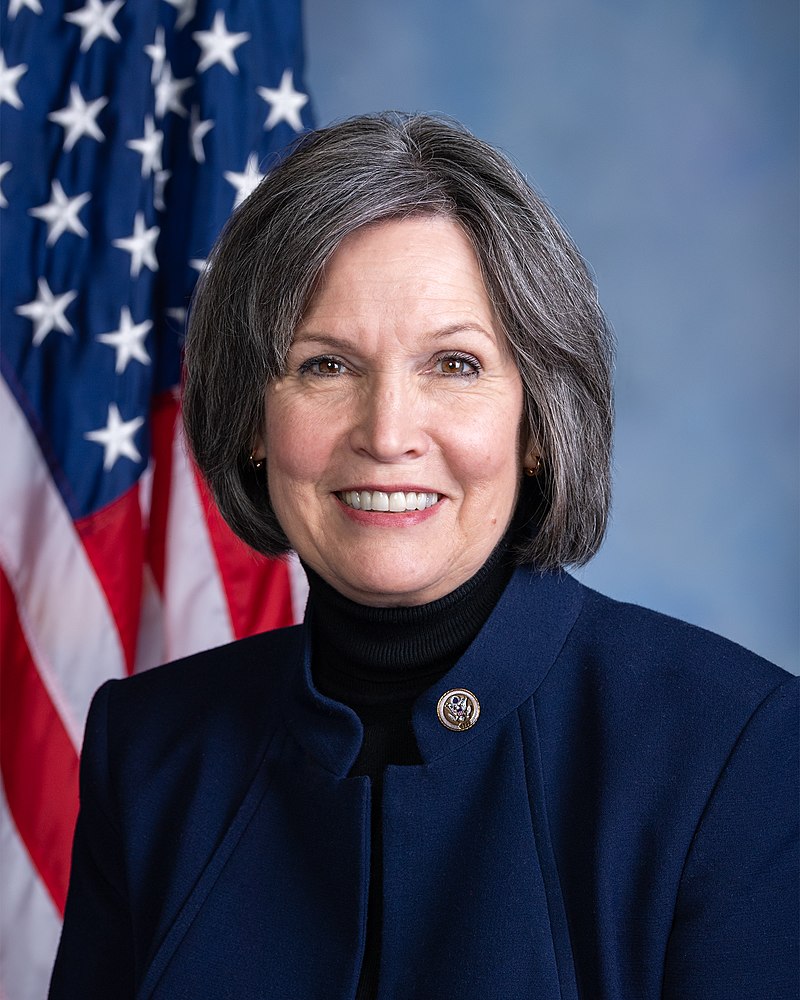

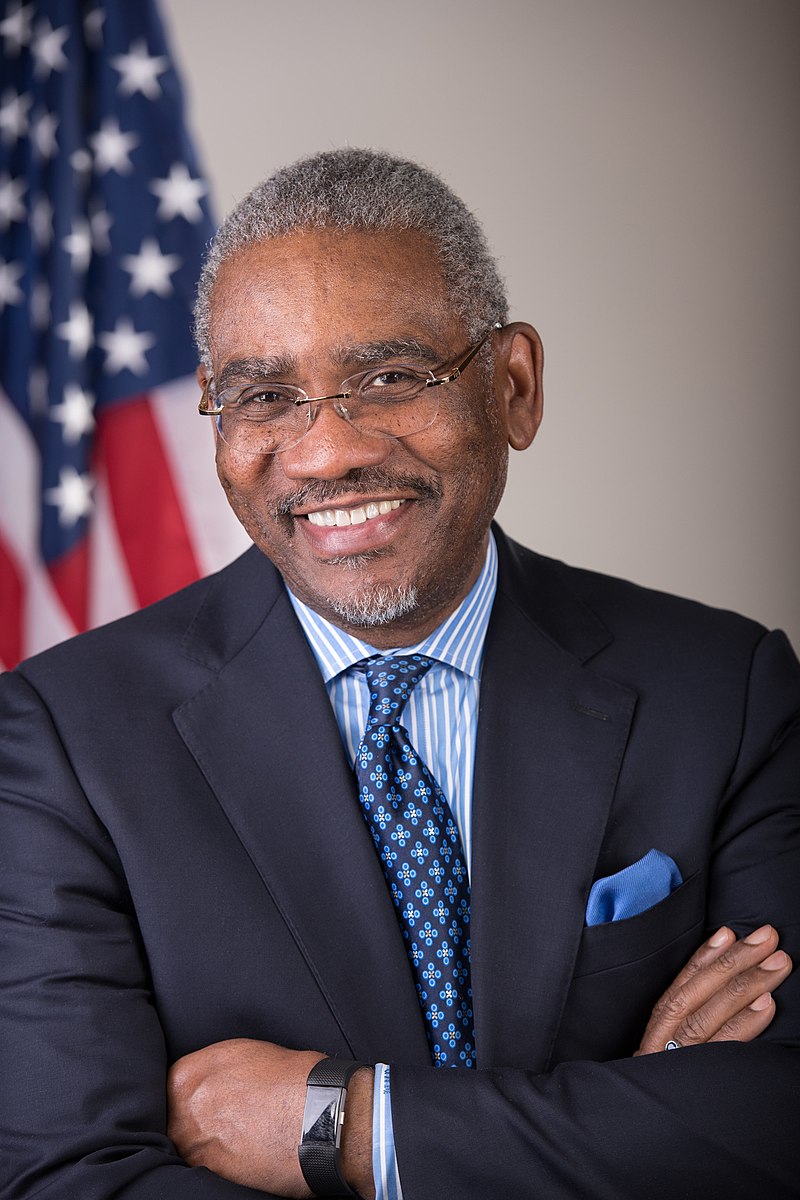

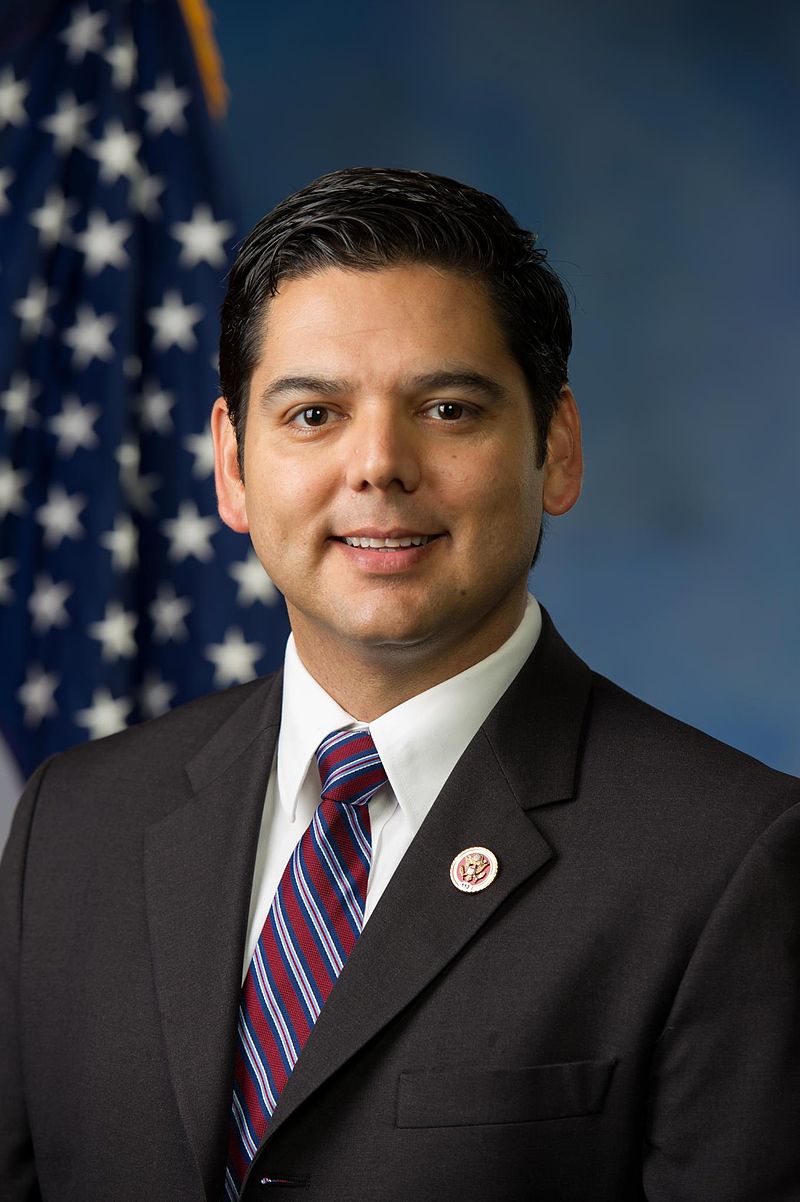

CA • D • Yea

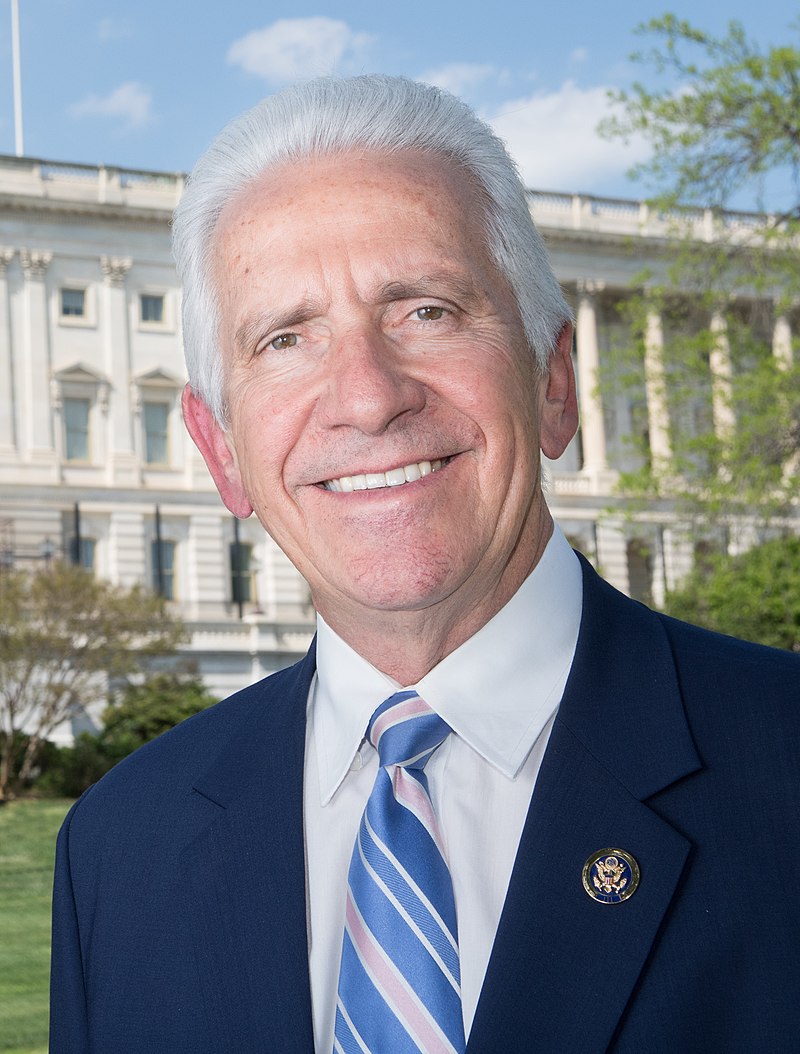

RI • D • Yea

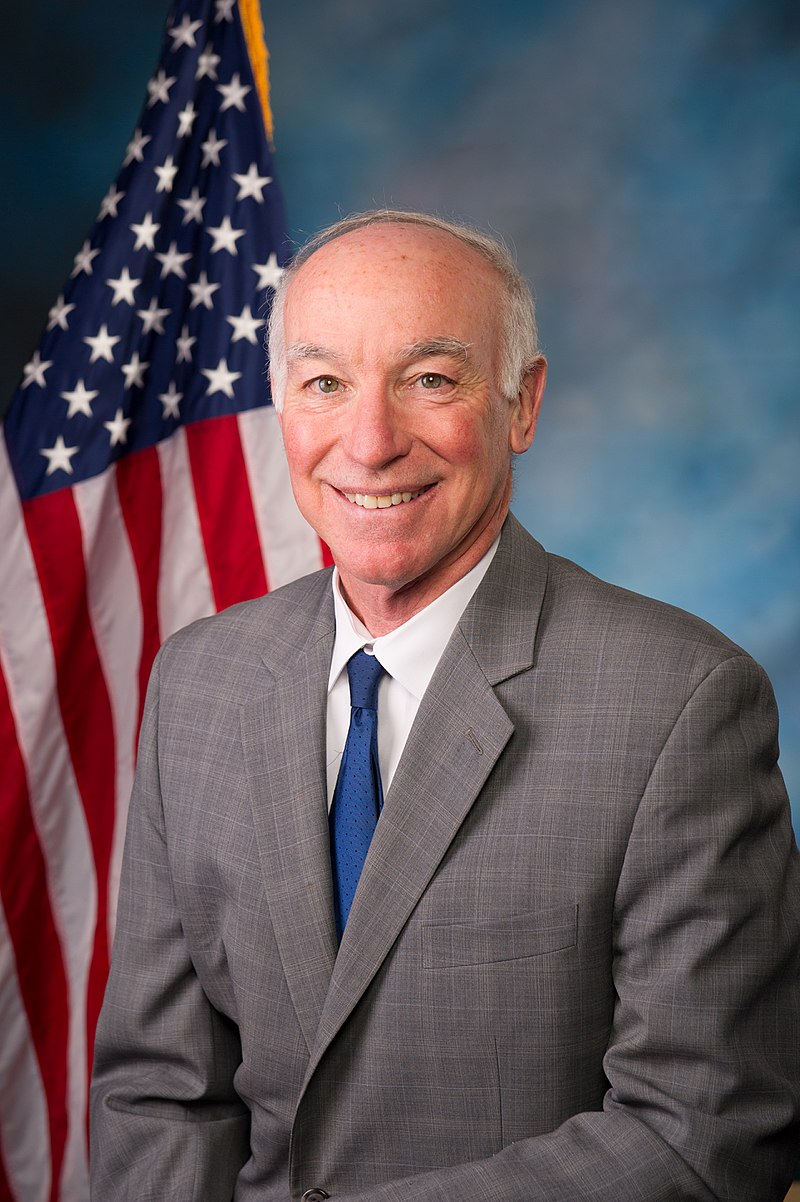

AZ • D • Yea

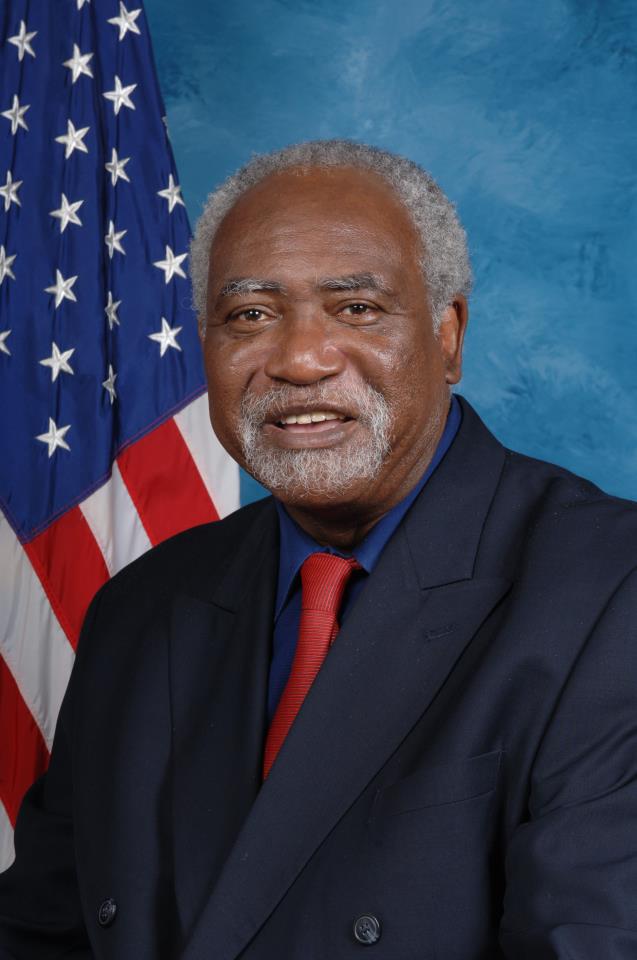

MA • D • Yea

VT • D • Yea

CA • D • Yea

OH • D • Yea

MO • D • Yea

CA • D • Yea

VA • D • Yea

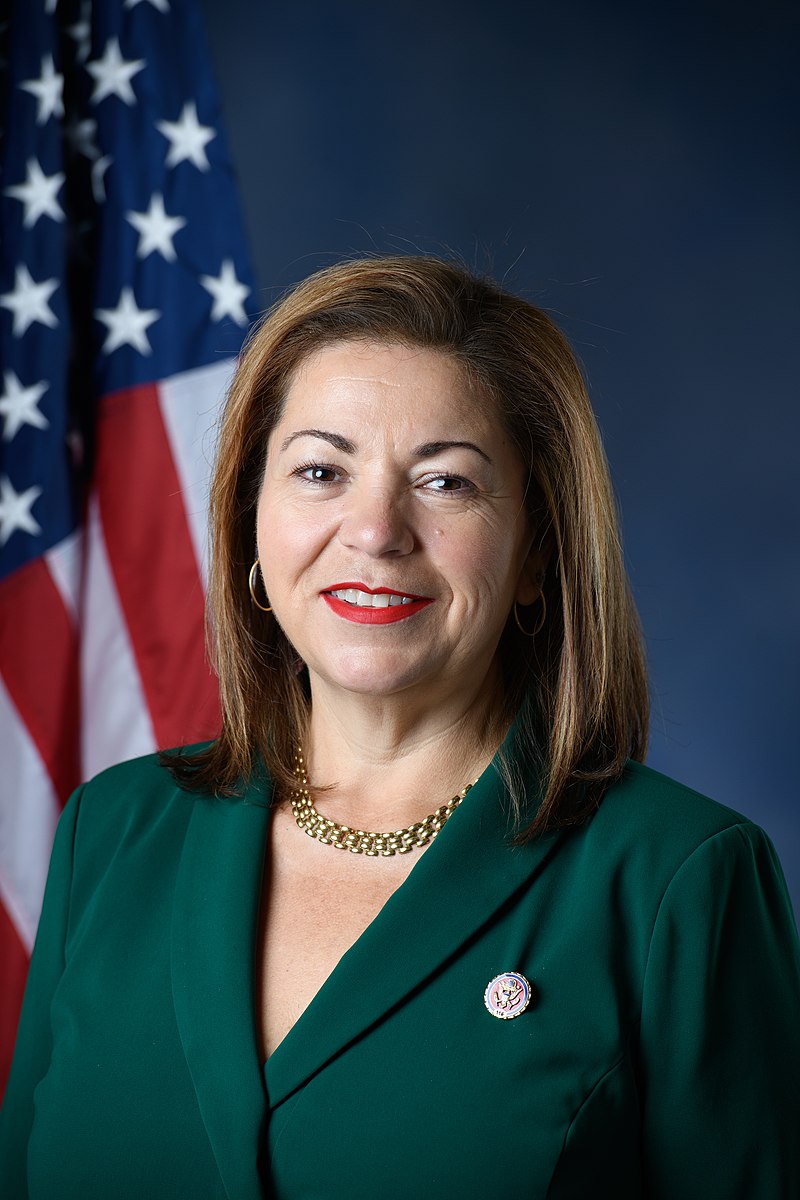

GA • D • Yea

OR • D • Yea

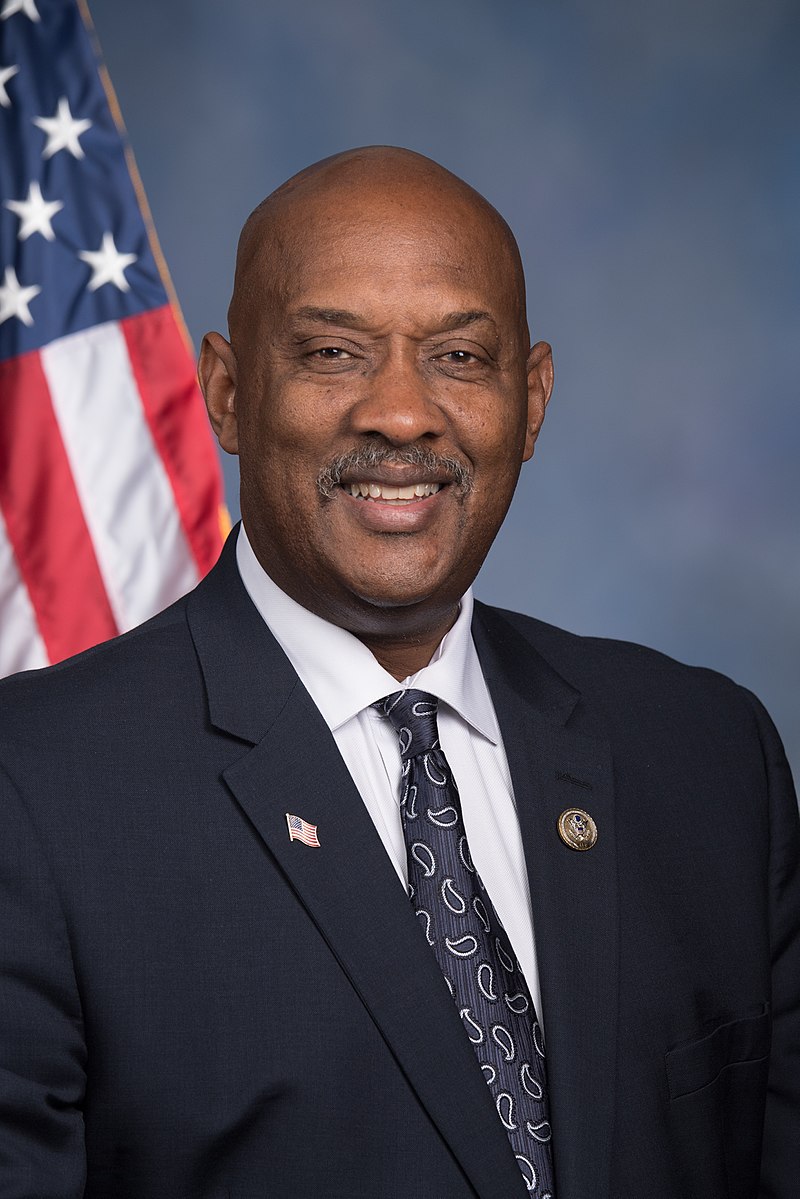

PA • D • Yea

OH • D • Yea

CA • D • Yea

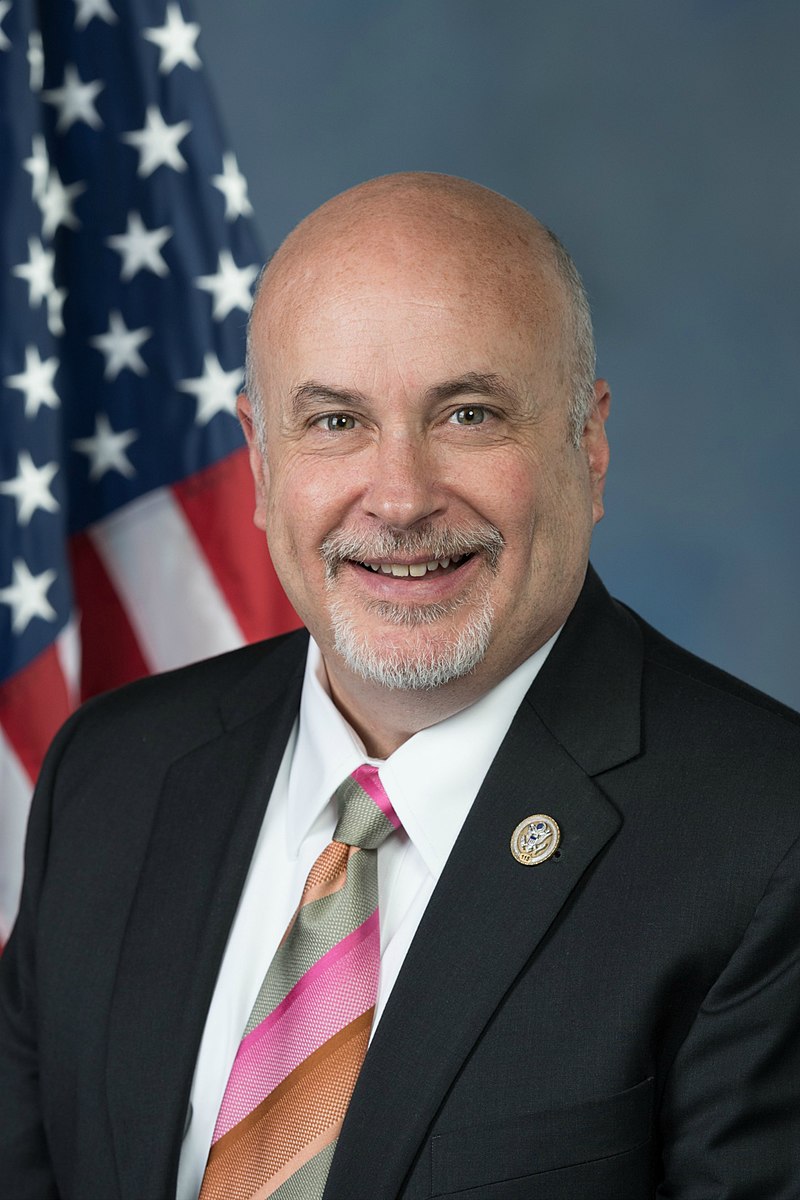

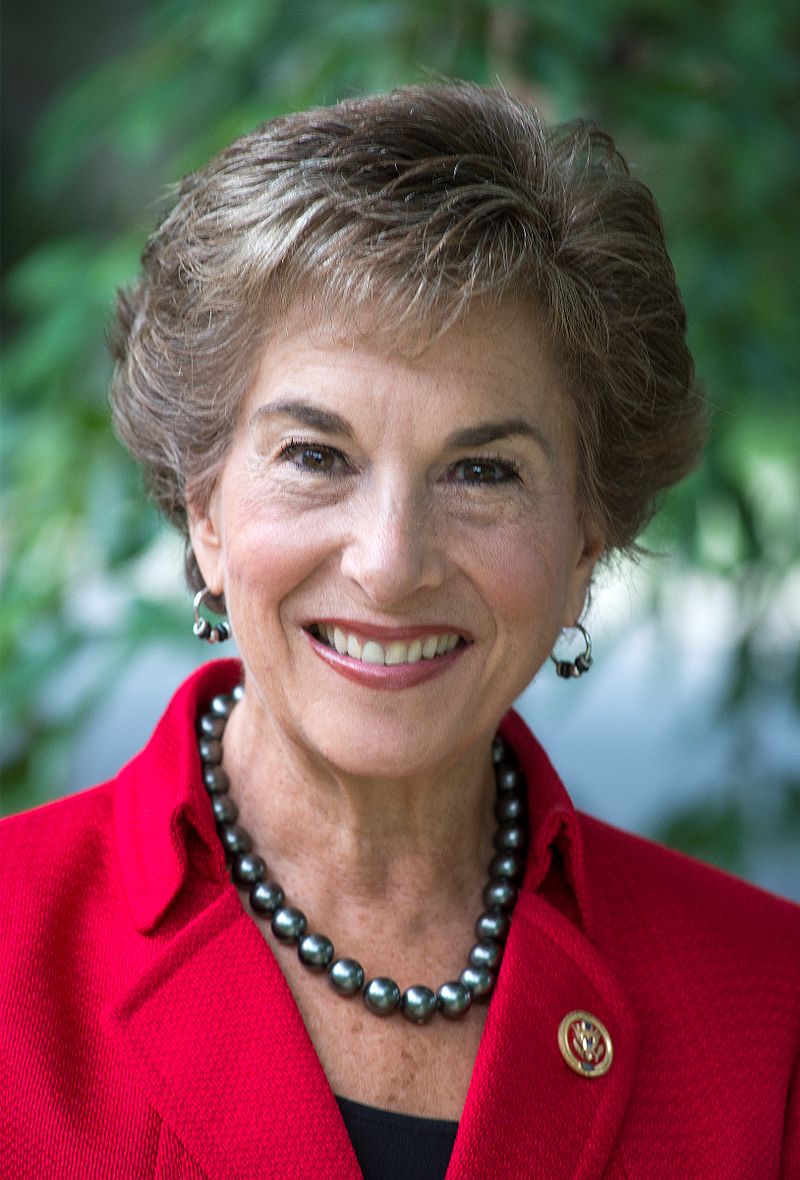

IL • D • Yea

OR • D • Yea

CA • D • Yea

IN • D • Yea

LA • D • Yea

HI • D • Yea

IL • D • Yea

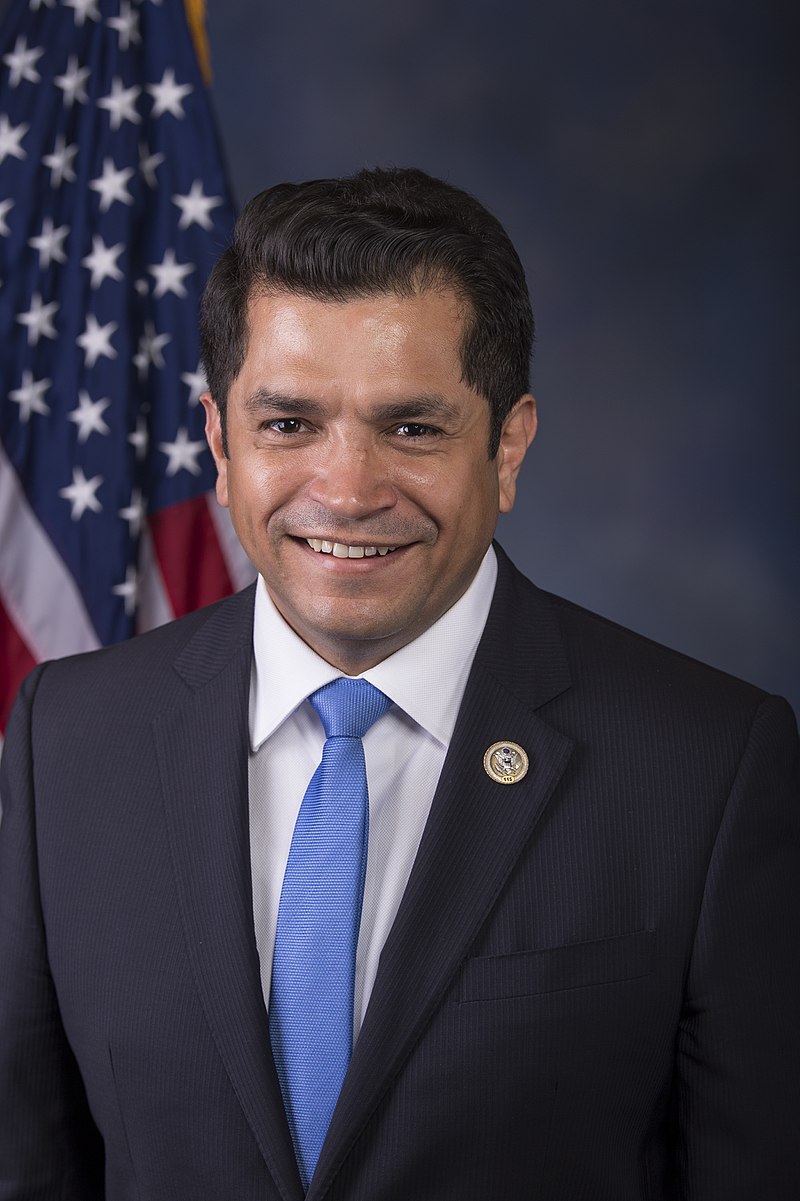

TX • D • Yea

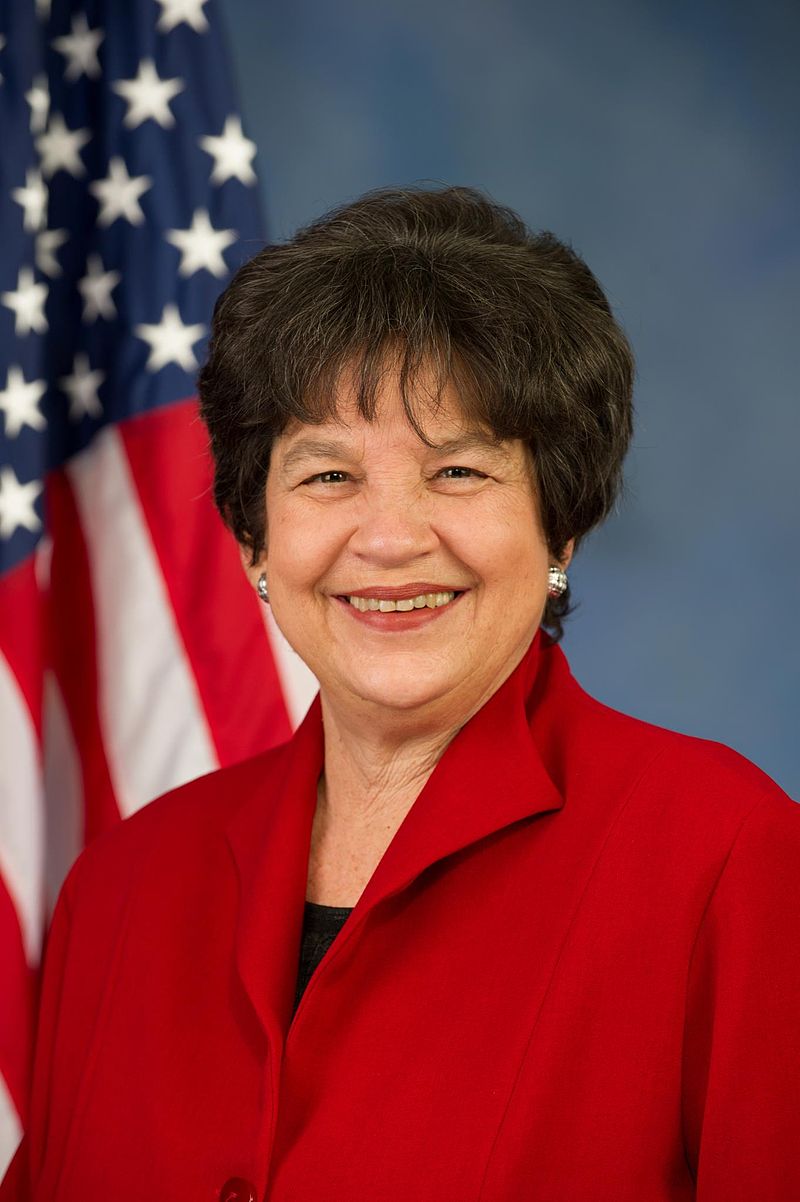

FL • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

NY • D • Yea

MO • D • Yea

SC • D • Yea

TN • D • Yea

NJ • D • Yea

CA • D • Yea

CA • D • Yea

CT • D • Yea

MN • D • Yea

TX • D • Yea

CO • D • Yea

TX • D • Yea

KS • D • Yea

IL • D • Yea

NC • D • Yea

PA • D • Yea

CO • D • Yea

CT • D • Yea

WA • D • Yea

PA • D • Yea

CA • D • Yea

OR • D • Yea

MI • D • Yea

TX • D • Yea

MD • D • Yea

TX • D • Yea

NY • D • Yea

PA • D • Yea

LA • D • Yea

AL • D • Yea

TX • D • Yea

IL • D • Yea

NC • D • Yea

FL • D • Yea

CA • D • Yea

FL • D • Yea

CA • D • Yea

TX • D • Yea

CA • D • Yea

IL • D • Yea

NY • D • Yea

ME • D • Yea

NY • D • Yea

CA • D • Yea

TX • D • Yea

NH • D • Yea

NJ • D • Yea

CA • D • Yea

TX • D • Yea

AZ • D • Yea

CA • D • Yea

CT • D • Yea

CT • D • Yea

NV • D • Yea

PA • D • Yea

MD • D • Yea

OR • D • Yea

CA • D • Yea

MD • D • Yea

IL • D • Yea

CA • D • Yea

WA • D • Yea

NY • D • Yea

GA • D • Yea

TX • D • Yea

CA • D • Yea

OH • D • Yea

MA • D • Yea

IL • D • Yea

NY • D • Yea

CA • D • Yea

IL • D • Yea

OH • D • Yea

WA • D • Yea

CT • D • Yea

NY • D • Yea

NV • D • Yea

PA • D • Yea

NM • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

RI • D • Yea

NY • D • Yea

CA • D • Yea

GA • D • Yea

DE • D • Yea

MD • D • Yea

VA • D • Yea

MN • D • Yea

MI • D • Yea

KY • D • Yea

MA • D • Yea

NJ • D • Yea

NY • D • Yea

NJ • D • Yea

NY • D • Yea

MD • D • Yea

CA • D • Yea

WI • D • Yea

NY • D • Yea

MN • D • Yea

IN • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CO • D • Yea

NY • D • Yea

MD • D • Yea

MN • D • Yea

NJ • D • Yea

CA • D • Yea

NH • D • Yea

CA • D • Yea

WA • D • Yea

CA • D • Yea

CO • D • Yea

ME • D • Yea

WI • D • Yea

NJ • D • Yea

MA • D • Yea

IL • D • Yea

IL • D • Yea

WA • D • Yea

MD • D • Yea

NY • D • Yea

CA • D • Yea

NC • D • Yea

CA • D • Yea

NY • D • Yea

OR • D • Yea

CA • D • Yea

PA • D • Yea

IL • D • Yea

IL • D • Yea

MI • D • Yea

WA • D • Yea

VA • D • Yea

GA • D • Yea

AL • D • Yea

CA • D • Yea

CA • D • Yea

WA • D • Yea

IL • D • Yea

FL • D • Yea

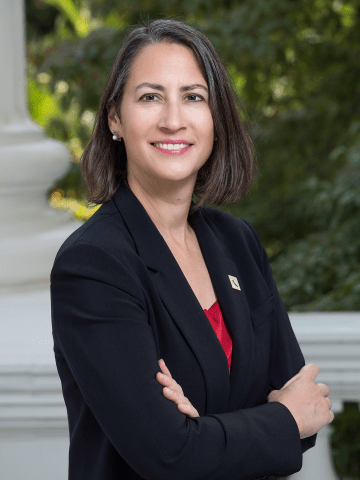

NM • D • Yea

AZ • D • Yea

MI • D • Yea

WA • D • Yea

VA • D • Yea

NY • D • Yea

OH • D • Yea

CA • D • Yea

MI • D • Yea

MS • D • Yea

CA • D • Yea

NV • D • Yea

MI • D • Yea

HI • D • Yea

NY • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CA • D • Yea

IL • D • Yea

CA • D • Yea

NM • D • Yea

NY • D • Yea

VA • D • Yea

VA • D • Yea

FL • D • Yea

CA • D • Yea

NJ • D • Yea

CA • D • Yea

GA • D • Yea

FL • D • Yea

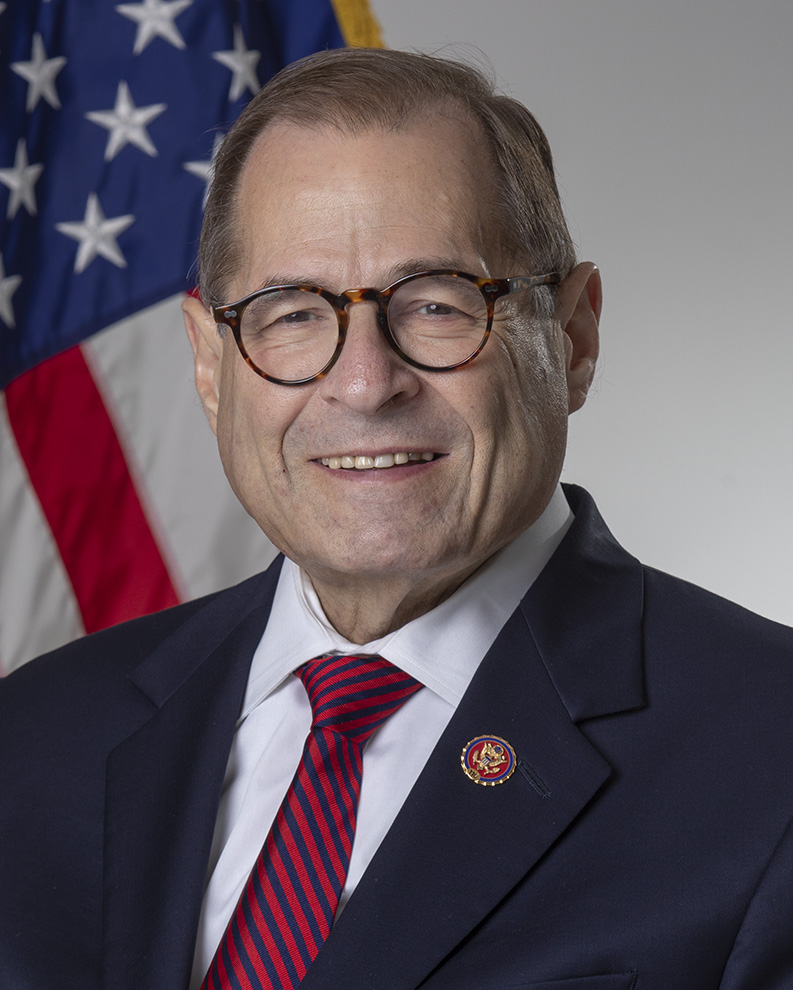

Nay (210)

AL • R • Nay

MO • R • Nay

GA • R • Nay

NV • R • Nay

TX • R • Nay

TX • R • Nay

NE • R • Nay

OH • R • Nay

KY • R • Nay

MI • R • Nay

WA • R • Nay

FL • R • Nay

AK • R • Nay

OR • R • Nay

MI • R • Nay

OK • R • Nay

AZ • R • Nay

SC • R • Nay

FL • R • Nay

CO • R • Nay

IL • R • Nay

OK • R • Nay

PA • R • Nay

FL • R • Nay

TN • R • Nay

MO • R • Nay

CA • R • Nay

FL • R • Nay

OH • R • Nay

TX • R • Nay

GA • R • Nay

AZ • R • Nay

VA • R • Nay

TX • R • Nay

GA • R • Nay

OK • R • Nay

GA • R • Nay

KY • R • Nay

AZ • R • Nay

CO • R • Nay

AR • R • Nay

TX • R • Nay

OH • R • Nay

TX • R • Nay

TN • R • Nay

FL • R • Nay

FL • R • Nay

MT • R • Nay

FL • R • Nay

NC • R • Nay

TX • R • Nay

MN • R • Nay

KS • R • Nay

CO • R • Nay

MS • R • Nay

TX • R • Nay

ND • R • Nay

IA • R • Nay

FL • R • Nay

MN • R • Nay

MN • R • Nay

WI • R • Nay

PA • R • Nay

TN • R • Nay

NE • R • Nay

CA • R • Nay

NC • R • Nay

FL • R • Nay

SC • R • Nay

ID • R • Nay

NY • R • Nay

TX • R • Nay

FL • R • Nay

TX • R • Nay

TX • R • Nay

TX • R • Nay

AZ • R • Nay

MO • R • Nay

VA • R • Nay

WI • R • Nay

MS • R • Nay

KY • R • Nay

WY • R • Nay

AZ • R • Nay

FL • R • Nay

NC • R • Nay

MD • R • Nay

NC • R • Nay

TN • R • Nay

OK • R • Nay

LA • R • Nay

AR • R • Nay

IA • R • Nay

IN • R • Nay

NC • R • Nay

MI • R • Nay

CO • R • Nay

CA • R • Nay

GA • R • Nay

TX • R • Nay

MI • R • Nay

LA • R • Nay

SD • R • Nay

OH • R • Nay

OH • R • Nay

PA • R • Nay

NJ • R • Nay

PA • R • Nay

MS • R • Nay

UT • R • Nay

VA • R • Nay

CA • R • Nay

CA • R • Nay

NC • R • Nay

TN • R • Nay

IL • R • Nay

NY • R • Nay

NY • R • Nay

OH • R • Nay

NY • R • Nay

FL • R • Nay

LA • R • Nay

GA • R • Nay

OK • R • Nay

FL • R • Nay

TX • R • Nay

PA • R • Nay

NY • R • Nay

UT • R • Nay

KS • R • Nay

KY • R • Nay

FL • R • Nay

TX • R • Nay

MI • R • Nay

CA • R • Nay

GA • R • Nay

NC • R • Nay

VA • R • Nay

IN • R • Nay

PA • R • Nay

WV • R • Nay

IL • R • Nay

OH • R • Nay

IA • R • Nay

FL • R • Nay

MI • R • Nay

AL • R • Nay

UT • R • Nay

WV • R • Nay

NC • R • Nay

TX • R • Nay

FL • D • Nay

WA • R • Nay

IA • R • Nay

CA • R • Nay

TN • R • Nay

MO • R • Nay

UT • R • Nay

AL • R • Nay

FL • R • Nay

PA • R • Nay

TX • R • Nay

PA • R • Nay

KY • R • Nay

AL • R • Nay

TN • R • Nay

NC • R • Nay

TX • R • Nay

OH • R • Nay

FL • R • Nay

FL • R • Nay

LA • R • Nay

KS • R • Nay

AZ • R • Nay

GA • R • Nay

TX • R • Nay

TX • R • Nay

IN • R • Nay

ID • R • Nay

NJ • R • Nay

NE • R • Nay

MO • R • Nay

PA • R • Nay

IN • R • Nay

MN • R • Nay

NY • R • Nay

WI • R • Nay

AL • R • Nay

IN • R • Nay

OH • R • Nay

NY • R • Nay

PA • R • Nay

WI • R • Nay

SC • R • Nay

OH • R • Nay

CA • R • Nay

NJ • D • Nay

TX • R • Nay

TN • R • Nay

MO • R • Nay

MI • R • Nay

TX • R • Nay

FL • R • Nay

AR • R • Nay

WI • R • Nay

TX • R • Nay

SC • R • Nay

VA • R • Nay

IN • R • Nay

MT • R • Nay

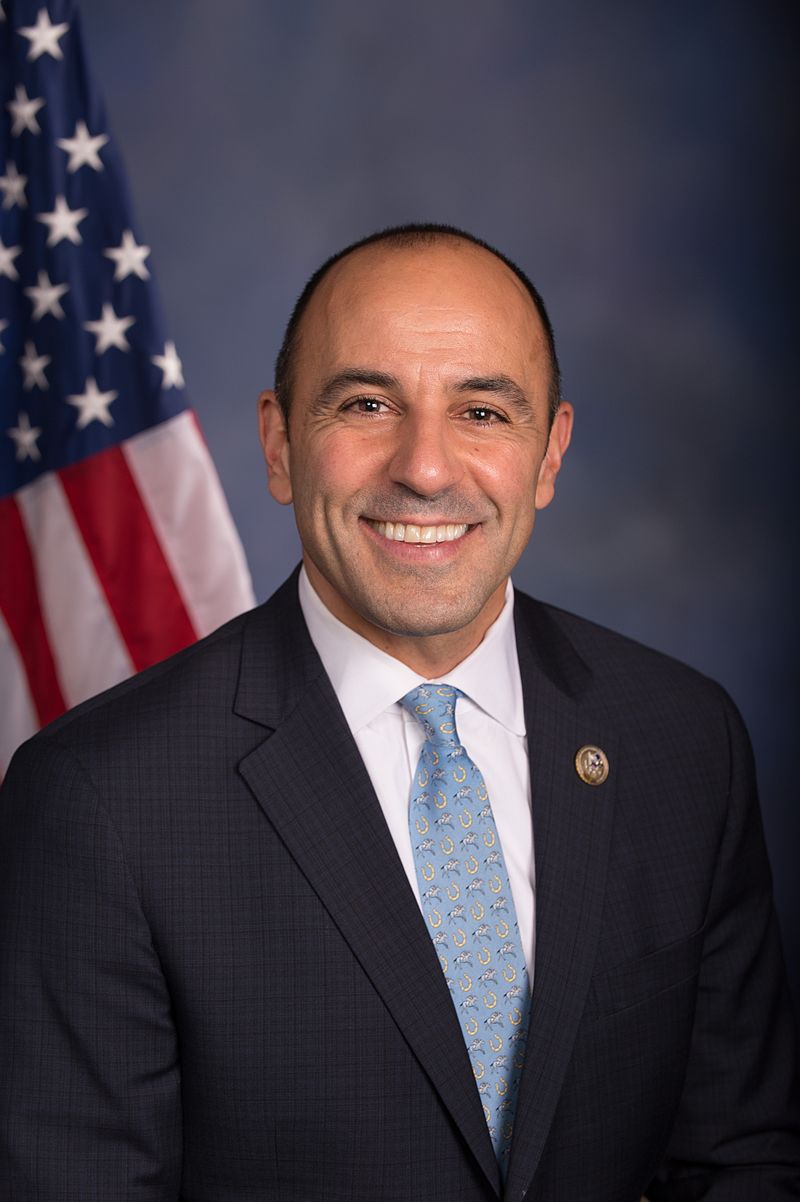

Not Voting (15)

IN • R • Not Voting

TX • D • Not Voting

FL • D • Not Voting

TX • R • Not Voting

SC • R • Not Voting

MA • D • Not Voting

NC • R • Not Voting

TX • R • Not Voting

NJ • D • Not Voting

SC • R • Not Voting

FL • R • Not Voting

CA • D • Not Voting

WI • R • Not Voting

TX • D • Not Voting

AR • R • Not Voting