H.R.2312 — Tipped Employee Protection Act

House Roll Call

H.R.2312

Roll 21 • Congress 119, Session 2 • Jan 13, 2026 6:04 PM • Result: Failed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.2312 — Tipped Employee Protection Act |

|---|---|

| Vote question | On Motion to Recommit |

| Vote type | Yea-and-Nay |

| Result | Failed |

| Totals | Yea 209 / Nay 215 / Present 0 / Not Voting 7 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 0 | 215 | 0 | 3 |

| D | 209 | 0 | 0 | 4 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Motion to Recommit

Bill Analysis

HR 2312 – Tipped Employee Protection Act (119th Congress)

HR 2312 amends the Fair Labor Standards Act of 1938 (FLSA) to strengthen protections for tipped workers and narrow employers’ ability to use the “tip credit” (the practice of paying a sub-minimum cash wage and counting tips toward the federal minimum wage).

Core provisions

- Clarifies and tightens the definition of a “tipped employee” and “tipped occupation,” generally requiring that an employee’s primary duties involve work that regularly produces tips.

- Restricts employers from taking a tip credit for time spent on non-tipped or minimally tipped work beyond a specified threshold (e.g., related side work or duties that do not directly generate tips). Time above that threshold must be paid at the full minimum wage without use of a tip credit.

- Codifies limits on “dual jobs” situations, where an employee performs both tipped and non-tipped roles (e.g., server and janitor), to prevent employers from applying the tip credit to clearly non-tipped work.

- Strengthens protections against unlawful retention or diversion of tips by employers, managers, or supervisors, and may expand remedies for violations (such as back pay, liquidated damages, and civil penalties).

Agencies and authorities

- The U.S. Department of Labor (DOL), particularly the Wage and Hour Division, is directed to enforce the revised standards, update regulations and guidance, and conduct outreach to employers and workers.

- DOL may receive explicit authority to issue rules clarifying permissible and impermissible uses of tip credits and tip pools.

Who is affected

- Beneficiaries: Tipped workers in restaurants, hospitality, personal services, and similar sectors, who gain clearer entitlement to full minimum wage for non-tipped work and stronger protection of their tips.

- Regulated entities: Employers using the FLSA tip credit, including restaurants, hotels, bars, salons, and similar establishments.

Timelines

- The bill typically specifies an effective date (e.g., 60–180 days after enactment) for the new standards and may set deadlines for DOL rulemaking and guidance.

- As of the latest action, House floor proceedings on HR 2312 have been postponed under Rule XIX; the bill has not been enacted and remains pending.

Yea (209)

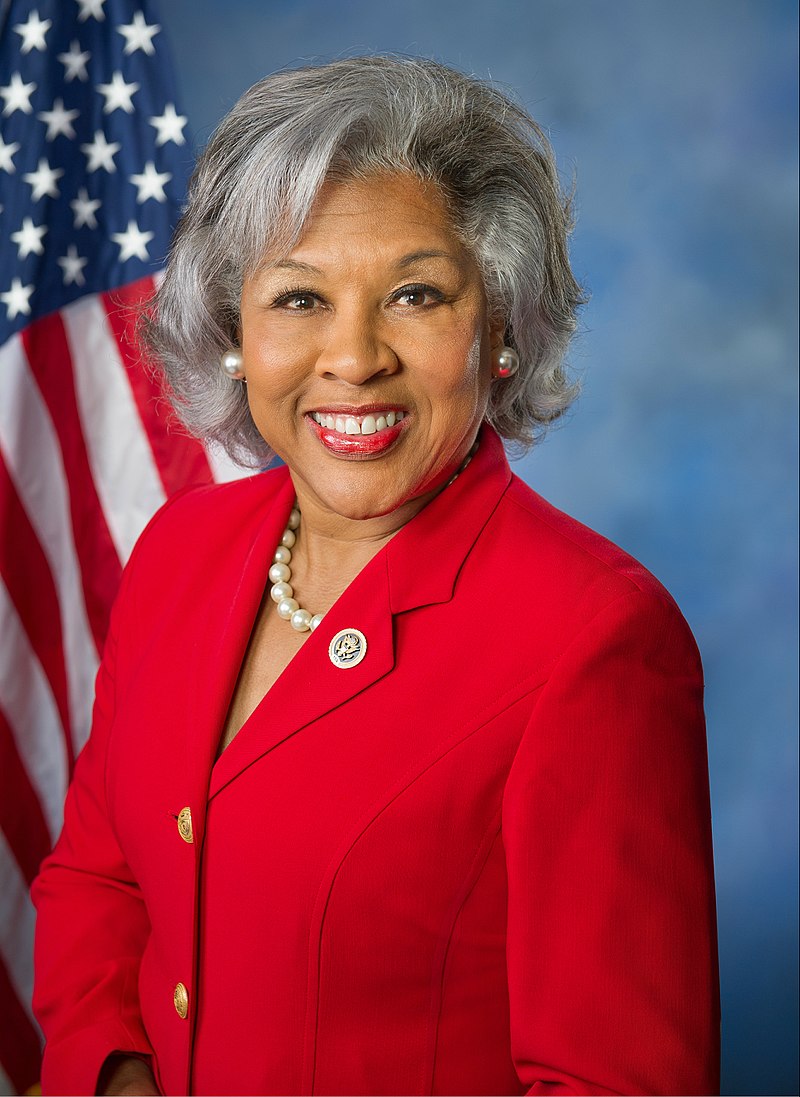

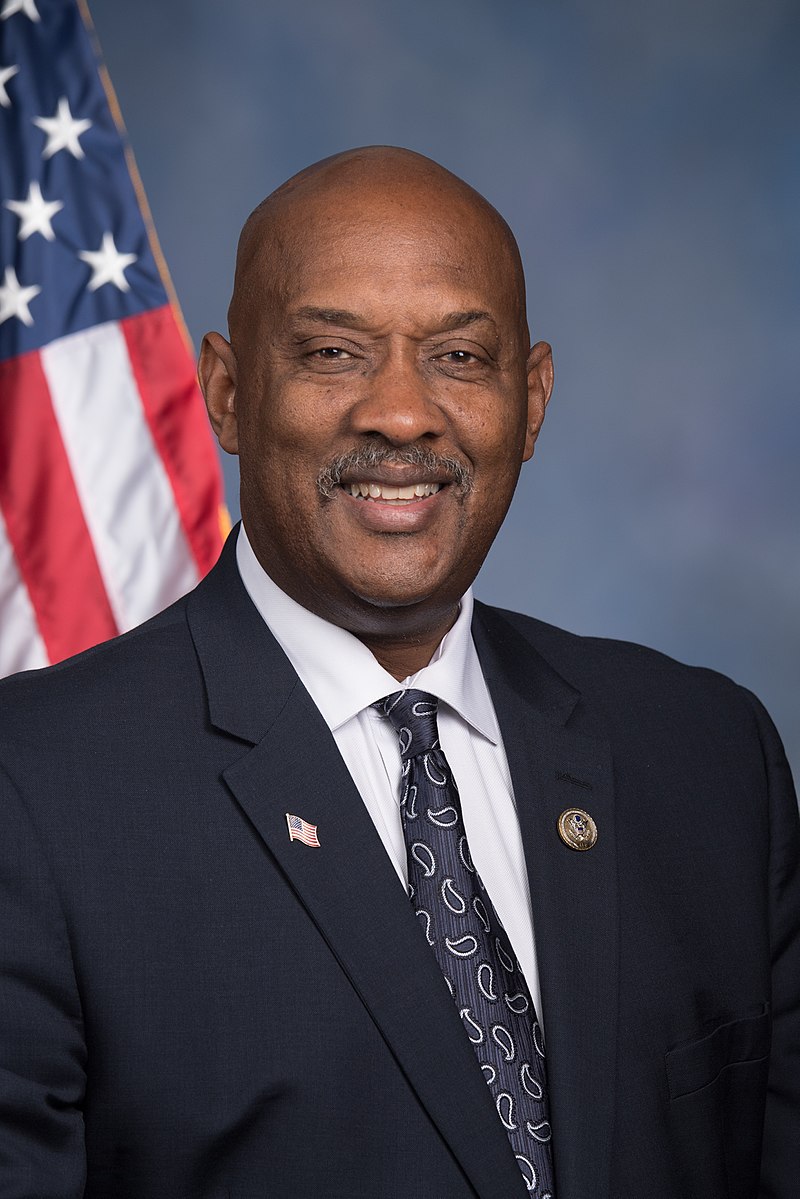

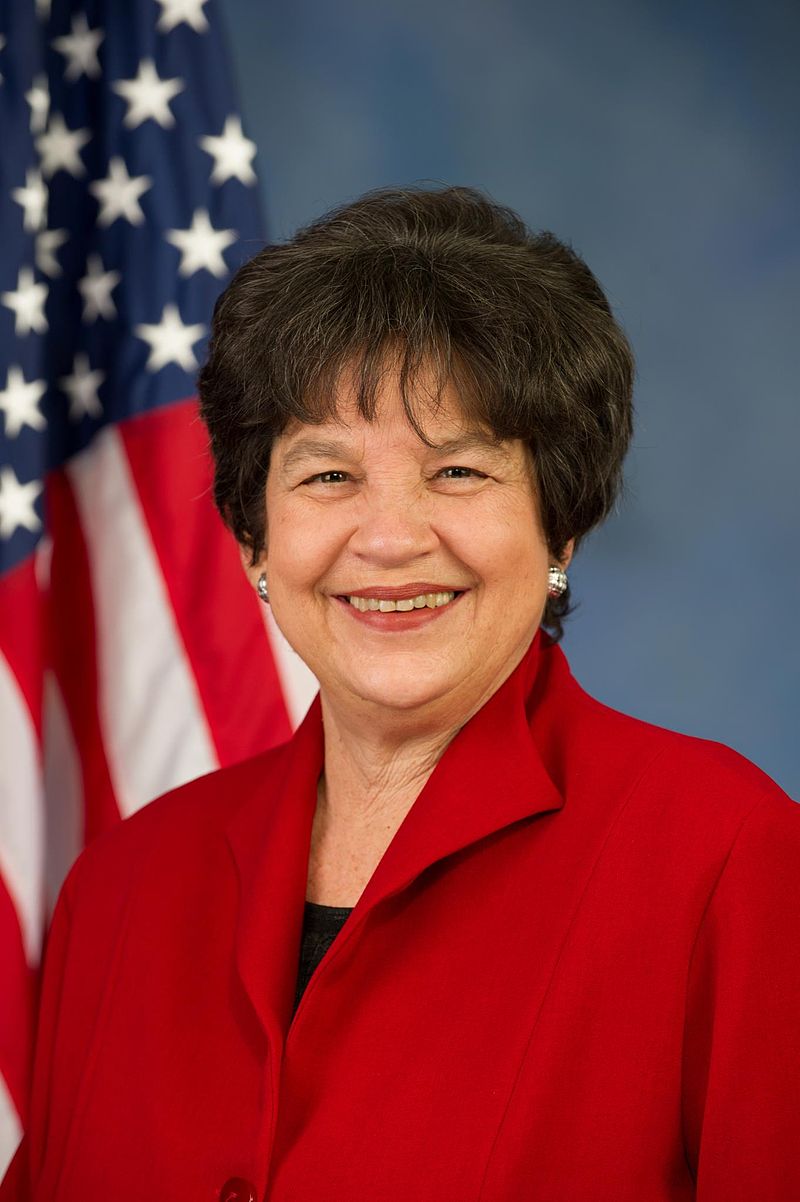

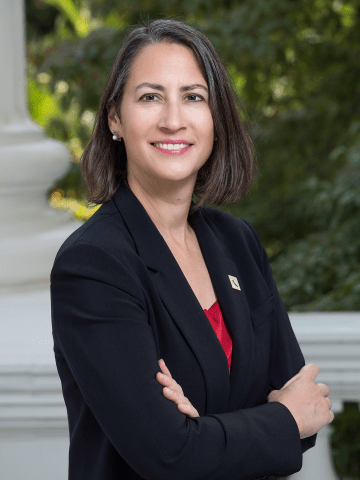

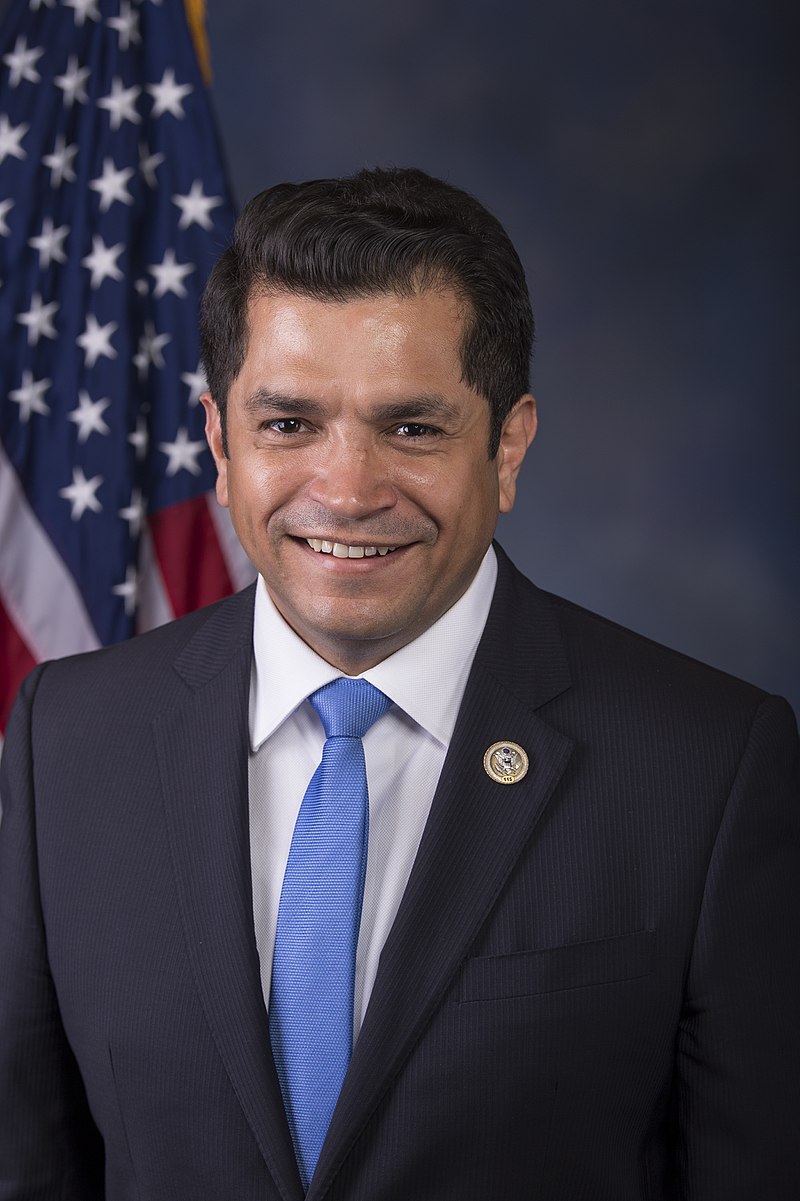

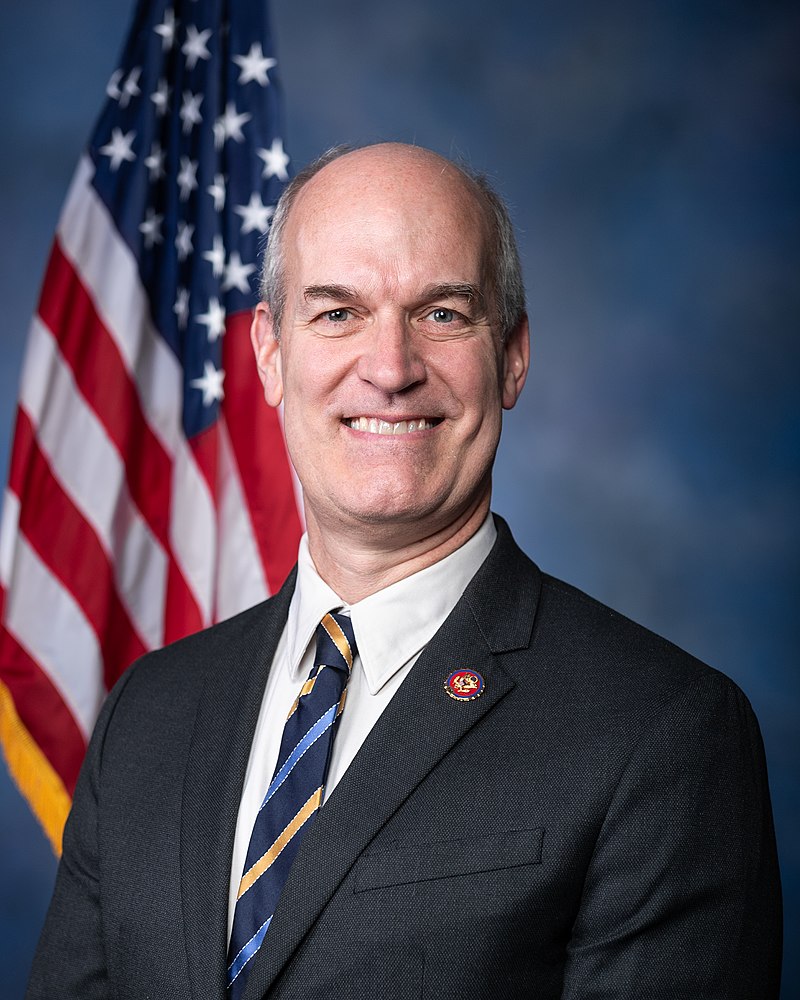

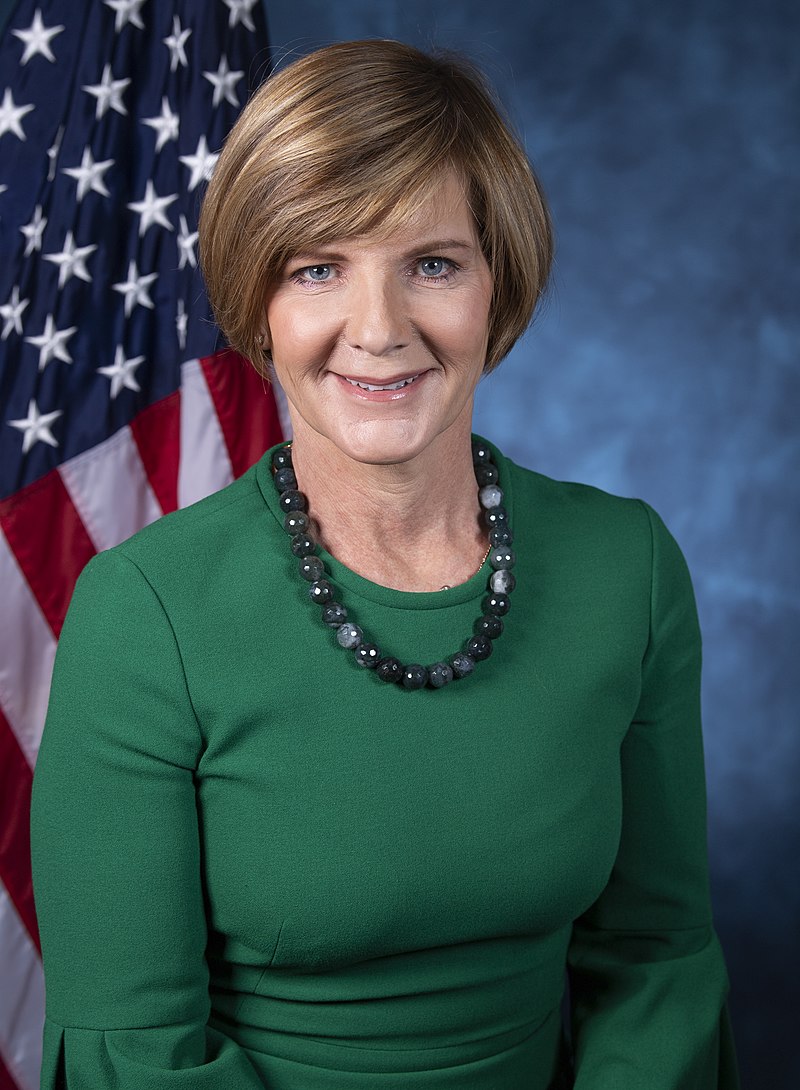

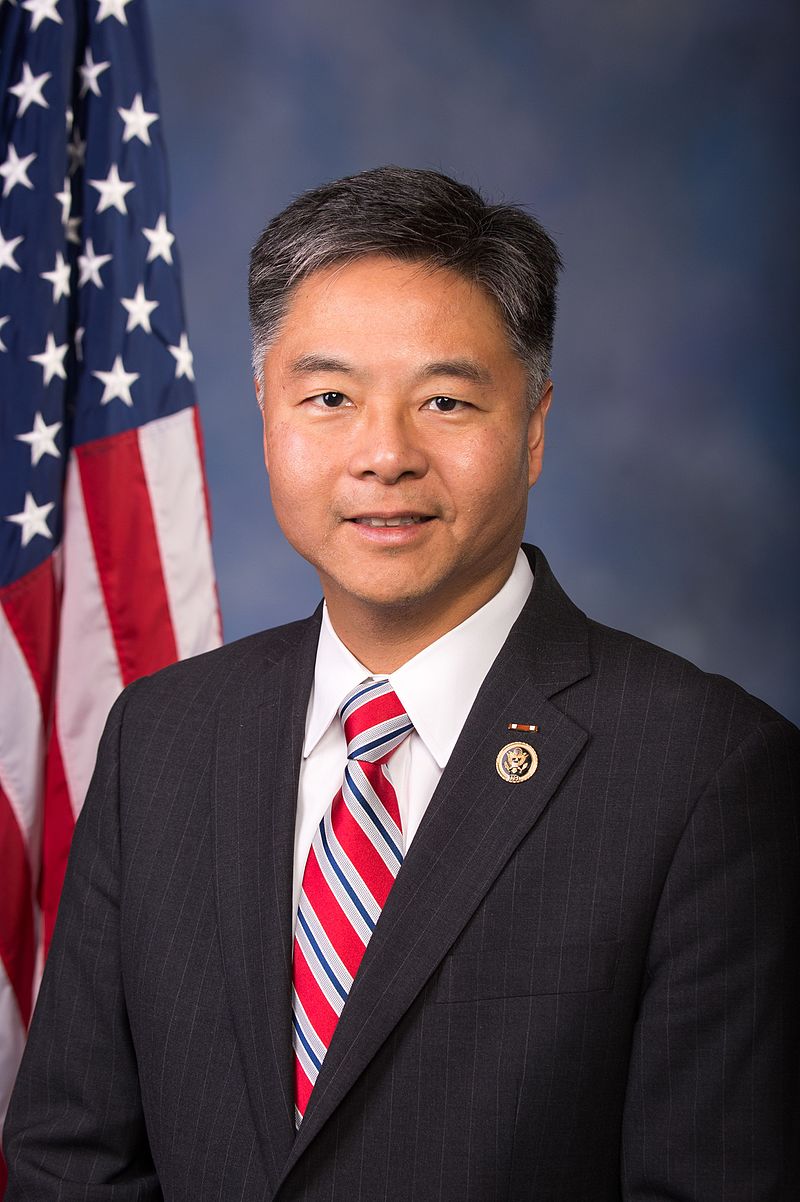

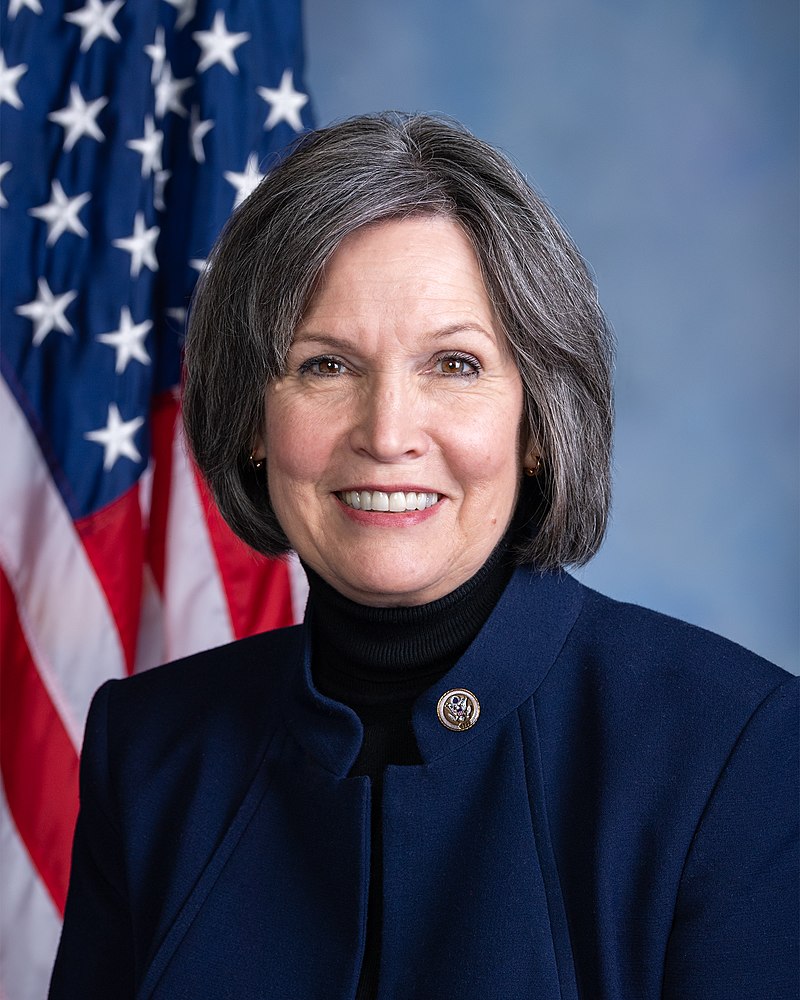

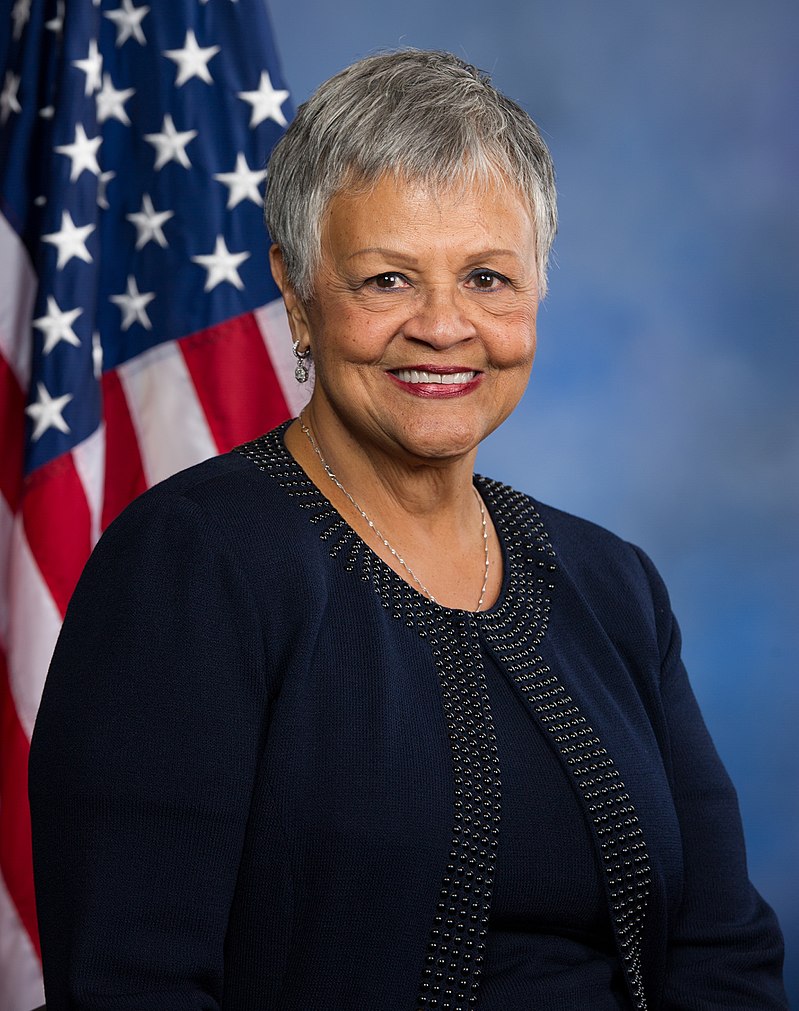

CA • D • Yea

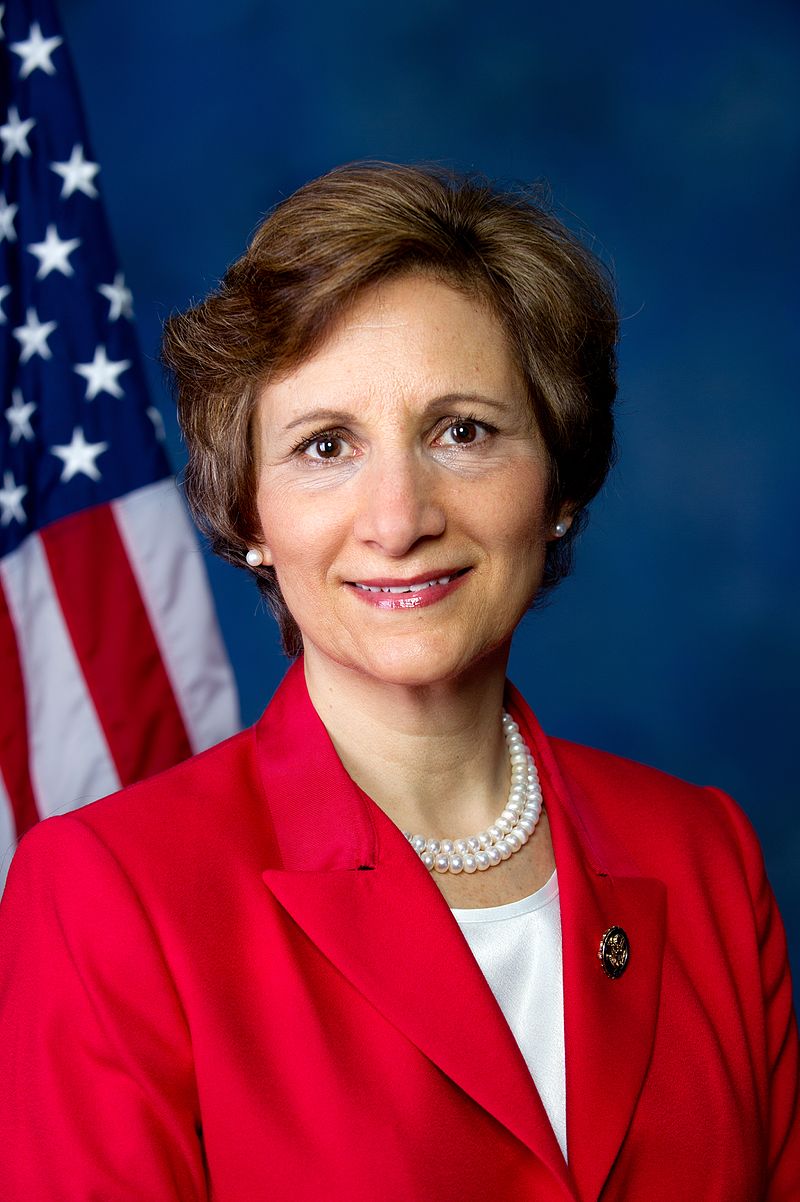

RI • D • Yea

AZ • D • Yea

MA • D • Yea

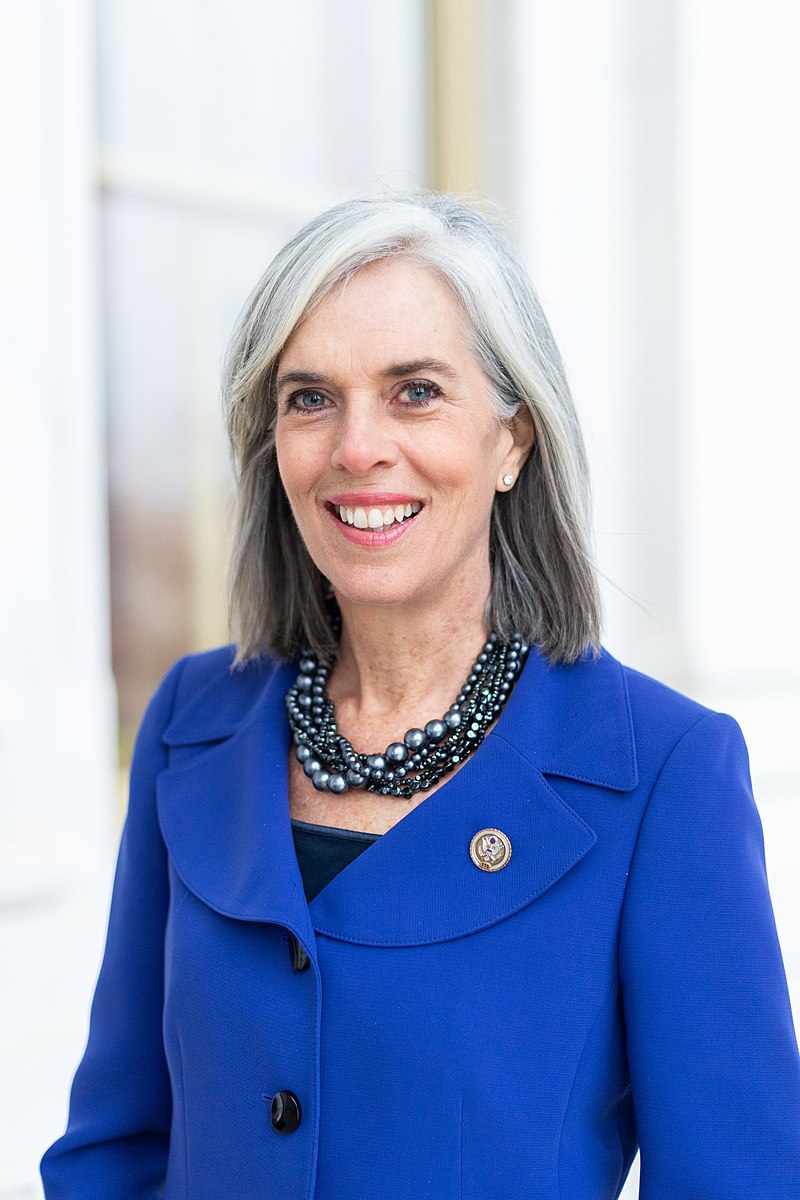

VT • D • Yea

CA • D • Yea

OH • D • Yea

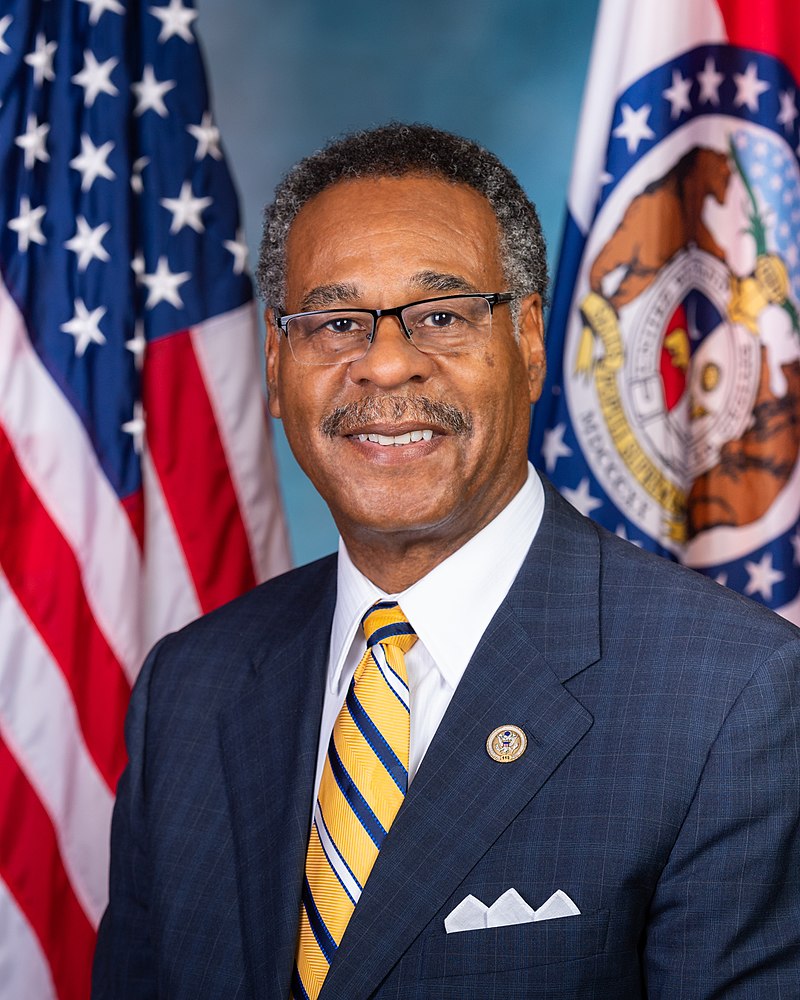

MO • D • Yea

CA • D • Yea

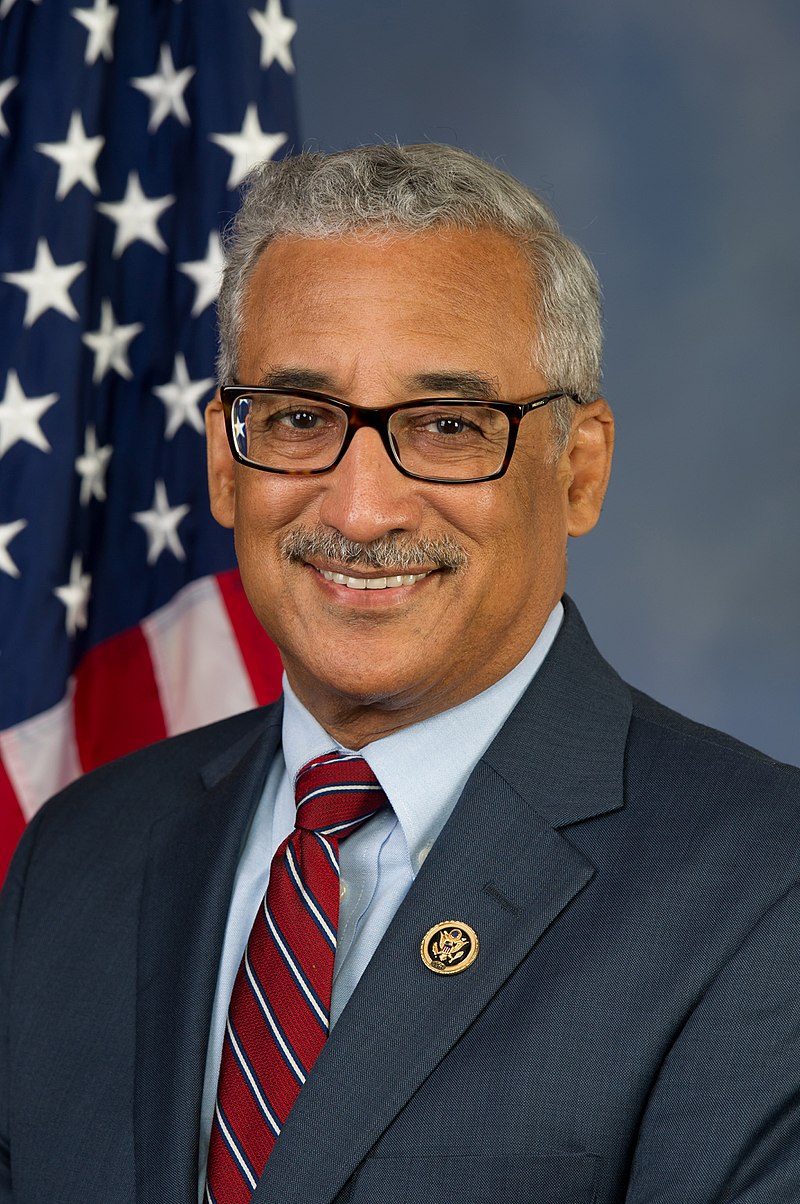

VA • D • Yea

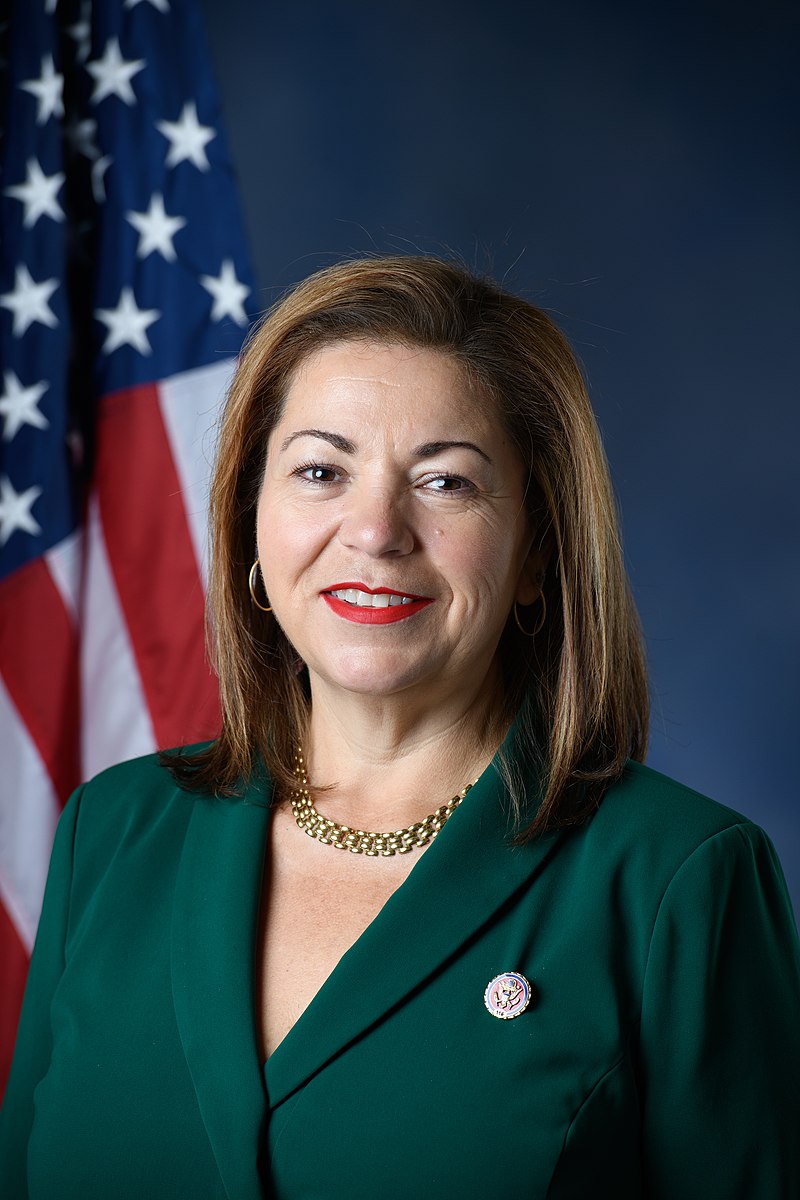

GA • D • Yea

OR • D • Yea

PA • D • Yea

OH • D • Yea

CA • D • Yea

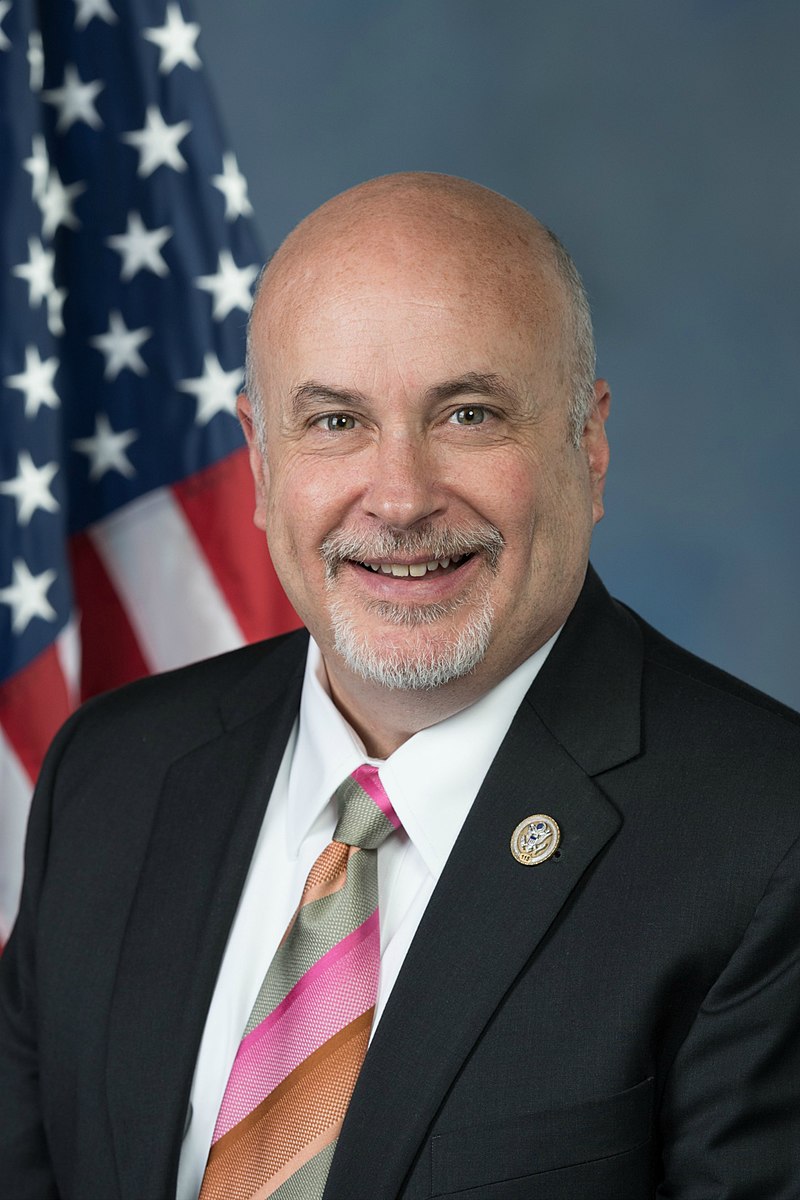

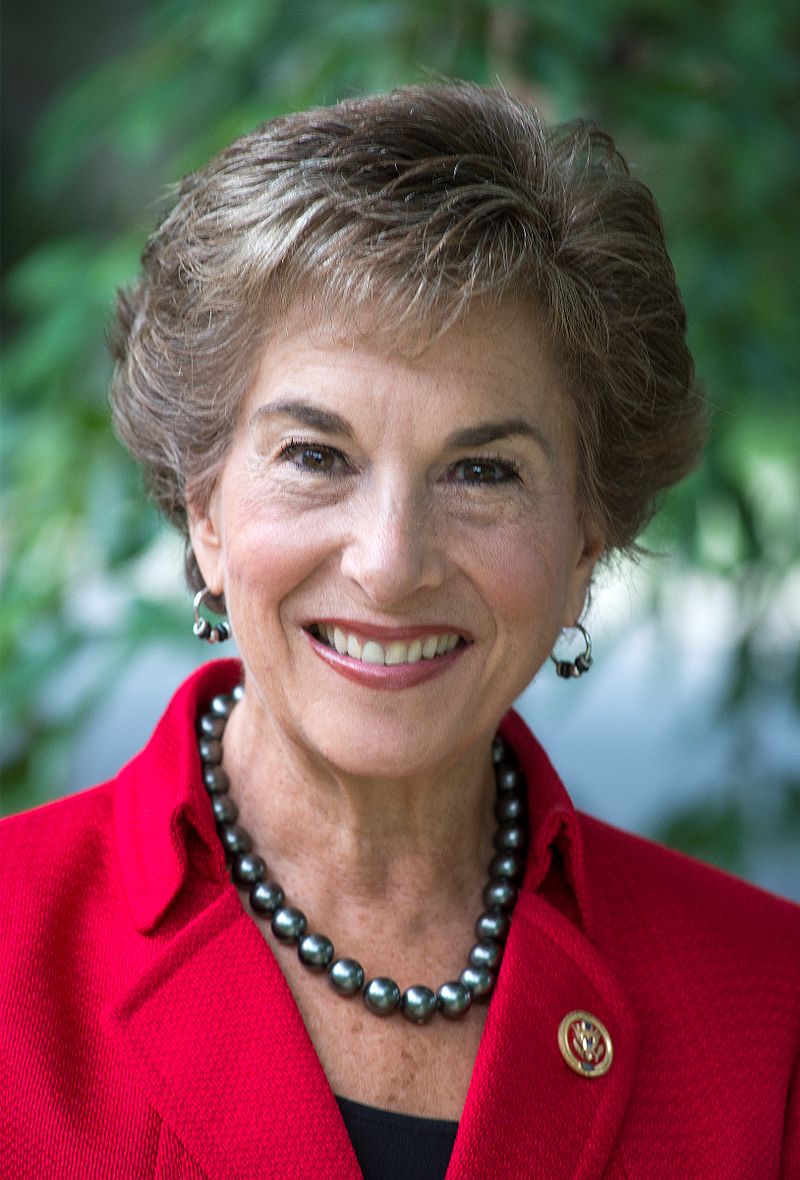

IL • D • Yea

OR • D • Yea

CA • D • Yea

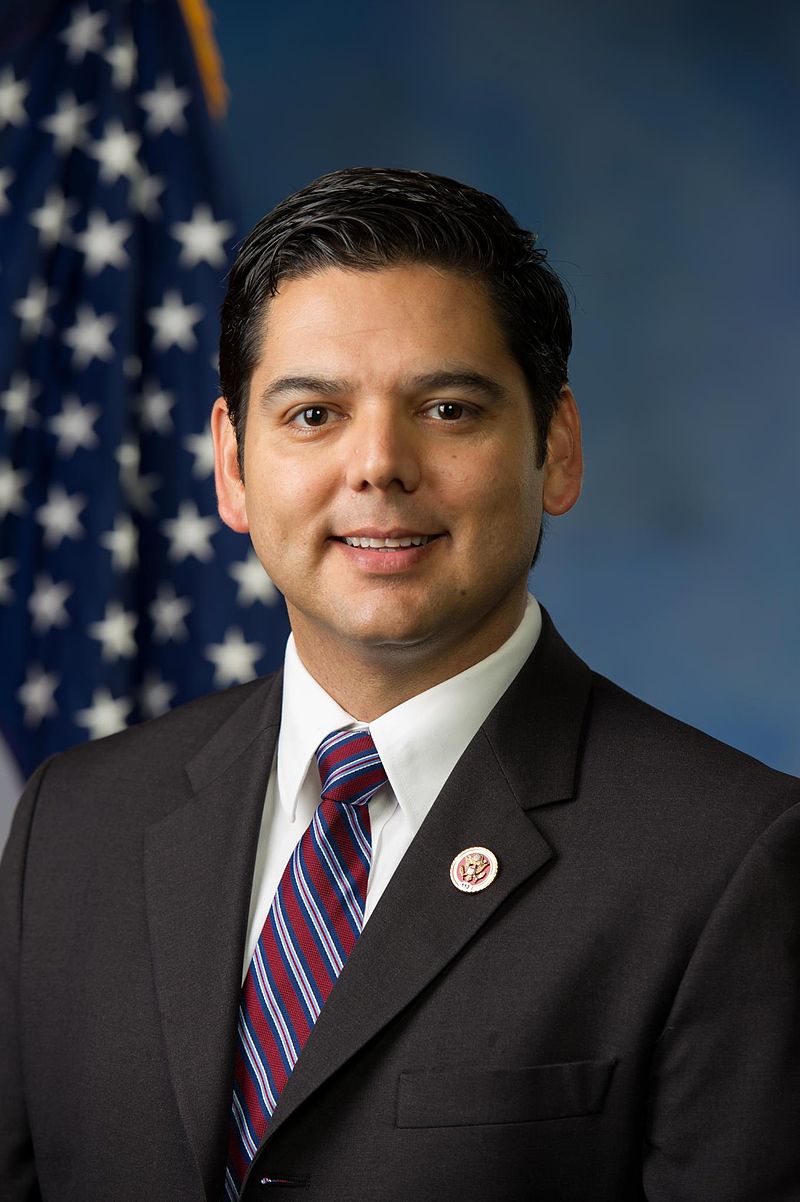

IN • D • Yea

LA • D • Yea

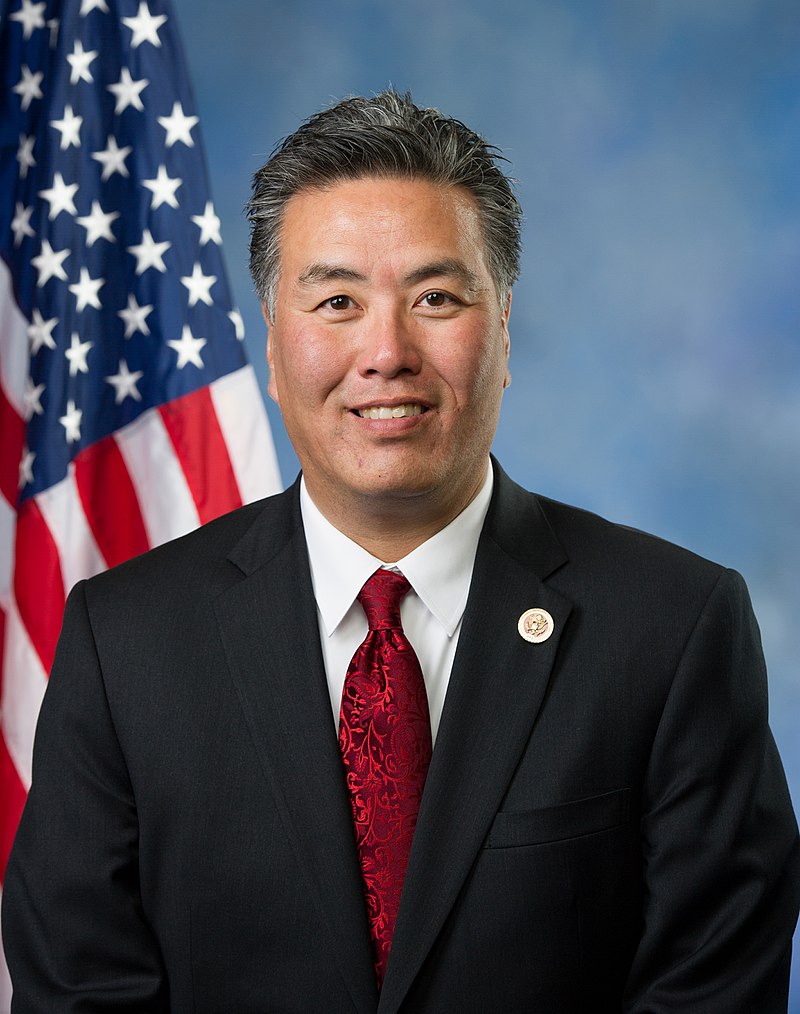

HI • D • Yea

IL • D • Yea

FL • D • Yea

TX • D • Yea

FL • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

NY • D • Yea

MO • D • Yea

SC • D • Yea

TN • D • Yea

NJ • D • Yea

CA • D • Yea

CA • D • Yea

CT • D • Yea

MN • D • Yea

TX • D • Yea

CO • D • Yea

TX • D • Yea

KS • D • Yea

IL • D • Yea

NC • D • Yea

PA • D • Yea

CO • D • Yea

CT • D • Yea

WA • D • Yea

PA • D • Yea

CA • D • Yea

OR • D • Yea

MI • D • Yea

TX • D • Yea

MD • D • Yea

TX • D • Yea

NY • D • Yea

PA • D • Yea

LA • D • Yea

AL • D • Yea

TX • D • Yea

IL • D • Yea

NC • D • Yea

FL • D • Yea

CA • D • Yea

FL • D • Yea

CA • D • Yea

TX • D • Yea

CA • D • Yea

IL • D • Yea

NY • D • Yea

ME • D • Yea

NY • D • Yea

CA • D • Yea

TX • D • Yea

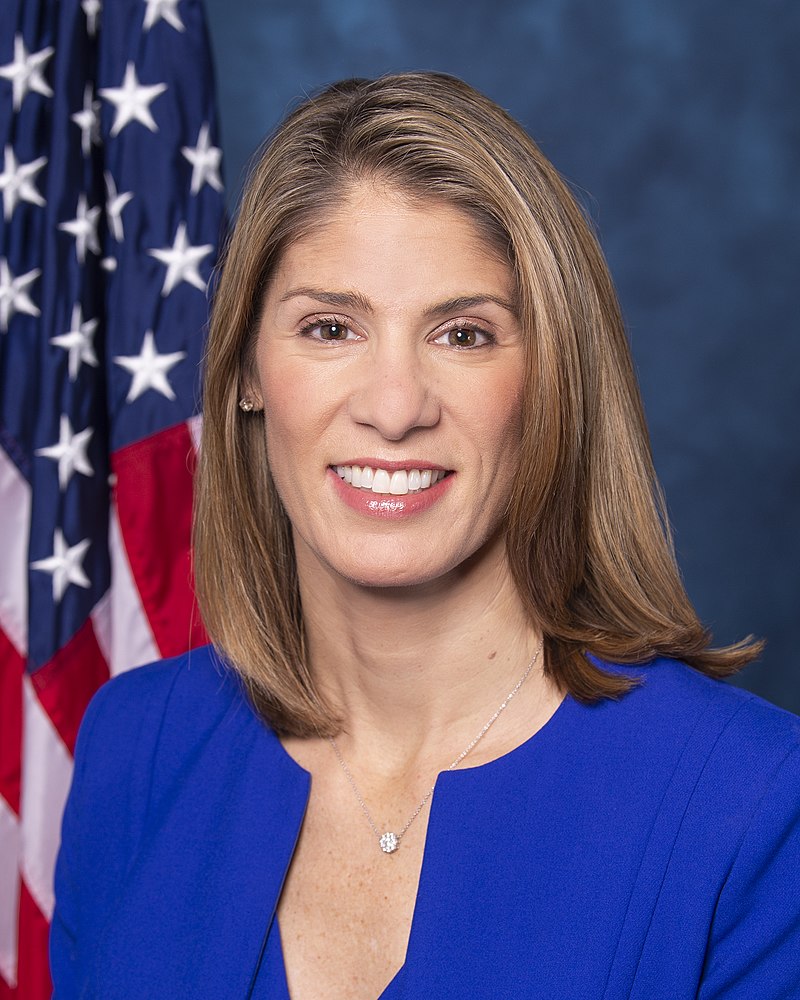

NH • D • Yea

NJ • D • Yea

CA • D • Yea

TX • D • Yea

AZ • D • Yea

CA • D • Yea

CT • D • Yea

CT • D • Yea

NV • D • Yea

PA • D • Yea

MD • D • Yea

OR • D • Yea

CA • D • Yea

MD • D • Yea

IL • D • Yea

CA • D • Yea

WA • D • Yea

NY • D • Yea

GA • D • Yea

TX • D • Yea

CA • D • Yea

OH • D • Yea

MA • D • Yea

IL • D • Yea

NY • D • Yea

CA • D • Yea

IL • D • Yea

OH • D • Yea

WA • D • Yea

CT • D • Yea

NY • D • Yea

NV • D • Yea

PA • D • Yea

NM • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

RI • D • Yea

NY • D • Yea

CA • D • Yea

GA • D • Yea

DE • D • Yea

MD • D • Yea

VA • D • Yea

MN • D • Yea

MI • D • Yea

KY • D • Yea

MA • D • Yea

NJ • D • Yea

NY • D • Yea

NJ • D • Yea

NY • D • Yea

MD • D • Yea

CA • D • Yea

WI • D • Yea

NY • D • Yea

MN • D • Yea

FL • D • Yea

MA • D • Yea

IN • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CO • D • Yea

NJ • D • Yea

NY • D • Yea

MD • D • Yea

MN • D • Yea

NJ • D • Yea

CA • D • Yea

NH • D • Yea

CA • D • Yea

WA • D • Yea

CA • D • Yea

CO • D • Yea

ME • D • Yea

WI • D • Yea

NJ • D • Yea

MA • D • Yea

IL • D • Yea

IL • D • Yea

WA • D • Yea

MD • D • Yea

NY • D • Yea

CA • D • Yea

NC • D • Yea

CA • D • Yea

NY • D • Yea

OR • D • Yea

CA • D • Yea

PA • D • Yea

IL • D • Yea

IL • D • Yea

MI • D • Yea

WA • D • Yea

VA • D • Yea

GA • D • Yea

AL • D • Yea

CA • D • Yea

CA • D • Yea

WA • D • Yea

IL • D • Yea

FL • D • Yea

NM • D • Yea

AZ • D • Yea

MI • D • Yea

WA • D • Yea

VA • D • Yea

NY • D • Yea

CA • D • Yea

MI • D • Yea

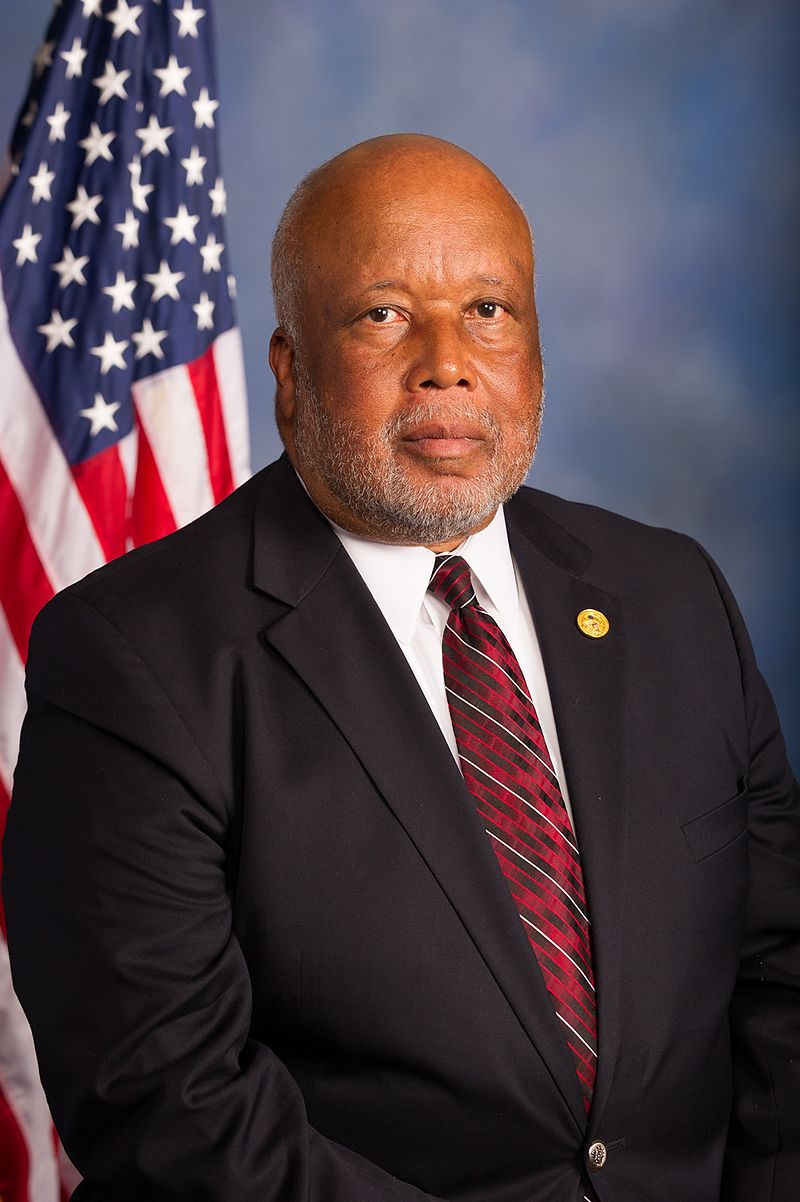

MS • D • Yea

CA • D • Yea

NV • D • Yea

MI • D • Yea

HI • D • Yea

NY • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CA • D • Yea

IL • D • Yea

CA • D • Yea

NM • D • Yea

TX • D • Yea

NY • D • Yea

VA • D • Yea

VA • D • Yea

FL • D • Yea

CA • D • Yea

NJ • D • Yea

CA • D • Yea

GA • D • Yea

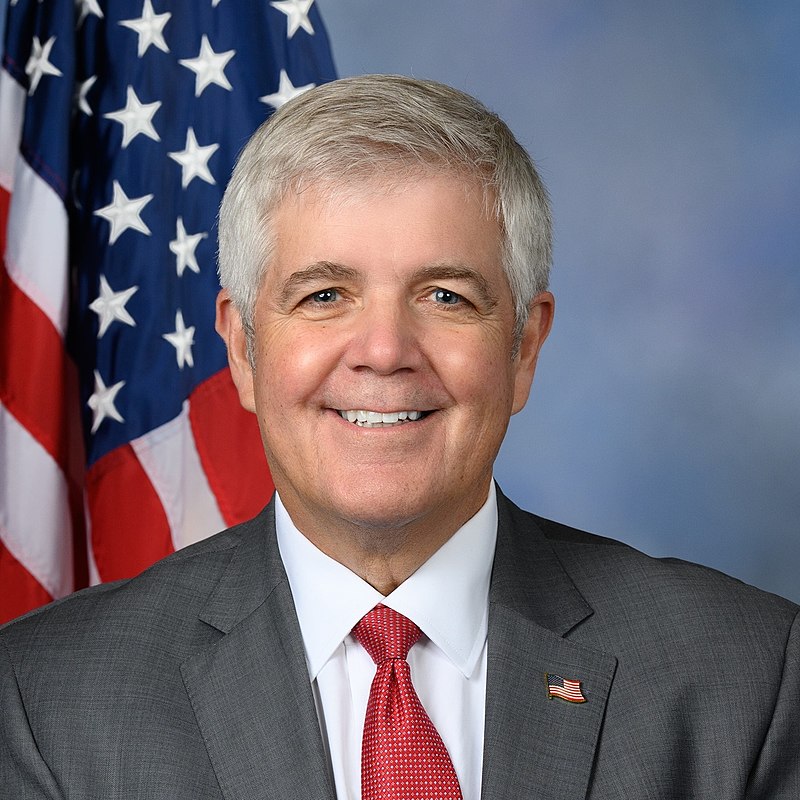

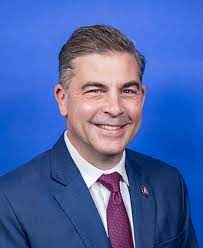

Nay (215)

AL • R • Nay

MO • R • Nay

GA • R • Nay

NV • R • Nay

TX • R • Nay

TX • R • Nay

NE • R • Nay

IN • R • Nay

OH • R • Nay

KY • R • Nay

MI • R • Nay

WA • R • Nay

FL • R • Nay

AK • R • Nay

OR • R • Nay

MI • R • Nay

OK • R • Nay

AZ • R • Nay

SC • R • Nay

FL • R • Nay

CO • R • Nay

IL • R • Nay

OK • R • Nay

PA • R • Nay

FL • R • Nay

TN • R • Nay

MO • R • Nay

CA • R • Nay

FL • R • Nay

OH • R • Nay

TX • R • Nay

GA • R • Nay

AZ • R • Nay

VA • R • Nay

TX • R • Nay

GA • R • Nay

OK • R • Nay

GA • R • Nay

KY • R • Nay

AZ • R • Nay

CO • R • Nay

AR • R • Nay

TX • R • Nay

OH • R • Nay

TX • R • Nay

TN • R • Nay

FL • R • Nay

FL • R • Nay

MT • R • Nay

FL • R • Nay

NC • R • Nay

TX • R • Nay

MN • R • Nay

KS • R • Nay

CO • R • Nay

MS • R • Nay

TX • R • Nay

ND • R • Nay

IA • R • Nay

FL • R • Nay

MN • R • Nay

MN • R • Nay

WI • R • Nay

PA • R • Nay

TN • R • Nay

NE • R • Nay

CA • R • Nay

NC • R • Nay

FL • R • Nay

SC • R • Nay

ID • R • Nay

NY • R • Nay

TX • R • Nay

FL • R • Nay

TX • R • Nay

TX • R • Nay

TX • R • Nay

AZ • R • Nay

MO • R • Nay

VA • R • Nay

WI • R • Nay

MS • R • Nay

KY • R • Nay

WY • R • Nay

AZ • R • Nay

FL • R • Nay

NC • R • Nay

MD • R • Nay

NC • R • Nay

TN • R • Nay

OK • R • Nay

LA • R • Nay

AR • R • Nay

IA • R • Nay

IN • R • Nay

NC • R • Nay

MI • R • Nay

CO • R • Nay

CA • R • Nay

GA • R • Nay

TX • R • Nay

MI • R • Nay

LA • R • Nay

SD • R • Nay

OH • R • Nay

OH • R • Nay

PA • R • Nay

NJ • R • Nay

PA • R • Nay

MS • R • Nay

UT • R • Nay

VA • R • Nay

CA • R • Nay

CA • R • Nay

NC • R • Nay

TN • R • Nay

IL • R • Nay

NY • R • Nay

NY • R • Nay

OH • R • Nay

NY • R • Nay

FL • R • Nay

LA • R • Nay

GA • R • Nay

OK • R • Nay

FL • R • Nay

TX • R • Nay

SC • R • Nay

PA • R • Nay

NY • R • Nay

UT • R • Nay

KS • R • Nay

KY • R • Nay

FL • R • Nay

TX • R • Nay

MI • R • Nay

CA • R • Nay

GA • R • Nay

NC • R • Nay

VA • R • Nay

IN • R • Nay

PA • R • Nay

WV • R • Nay

IL • R • Nay

OH • R • Nay

IA • R • Nay

FL • R • Nay

MI • R • Nay

AL • R • Nay

UT • R • Nay

WV • R • Nay

NC • R • Nay

TX • R • Nay

TX • R • Nay

WA • R • Nay

SC • R • Nay

IA • R • Nay

CA • R • Nay

TN • R • Nay

MO • R • Nay

UT • R • Nay

AL • R • Nay

FL • R • Nay

PA • R • Nay

TX • R • Nay

PA • R • Nay

KY • R • Nay

AL • R • Nay

TN • R • Nay

NC • R • Nay

TX • R • Nay

OH • R • Nay

FL • R • Nay

FL • R • Nay

LA • R • Nay

KS • R • Nay

AZ • R • Nay

GA • R • Nay

TX • R • Nay

TX • R • Nay

IN • R • Nay

ID • R • Nay

NJ • R • Nay

NE • R • Nay

MO • R • Nay

PA • R • Nay

IN • R • Nay

MN • R • Nay

NY • R • Nay

WI • R • Nay

FL • R • Nay

AL • R • Nay

IN • R • Nay

OH • R • Nay

NY • R • Nay

PA • R • Nay

WI • R • Nay

SC • R • Nay

OH • R • Nay

CA • R • Nay

NJ • D • Nay

TX • R • Nay

TN • R • Nay

MO • R • Nay

MI • R • Nay

TX • R • Nay

FL • R • Nay

AR • R • Nay

WI • R • Nay

TX • R • Nay

SC • R • Nay

VA • R • Nay

AR • R • Nay

IN • R • Nay

MT • R • Nay

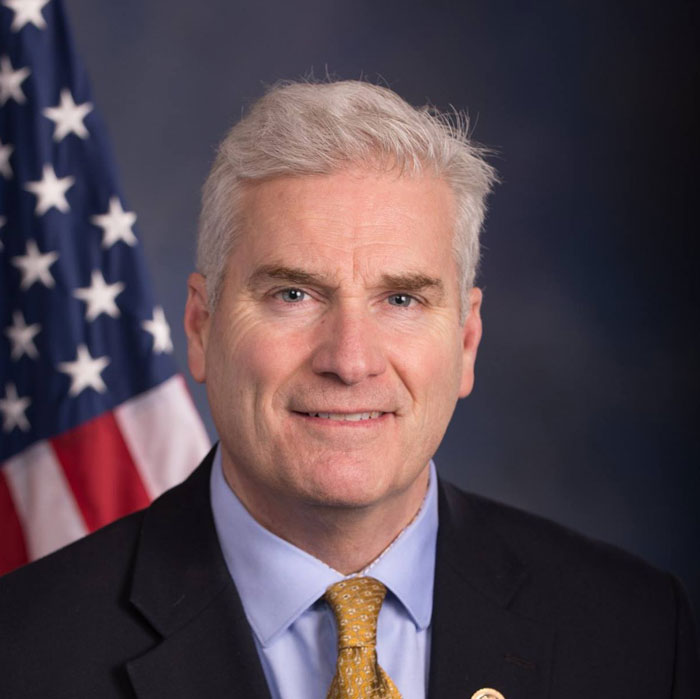

Not Voting (7)

TX • D • Not Voting

TX • R • Not Voting

NC • R • Not Voting

CA • D • Not Voting

OH • D • Not Voting

WI • R • Not Voting

FL • D • Not Voting