H.R.2270 — Empowering Employer Child and Elder Care Solutions Act

House Roll Call

H.R.2270

Roll 20 • Congress 119, Session 2 • Jan 13, 2026 5:57 PM • Result: Failed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.2270 — Empowering Employer Child and Elder Care Solutions Act |

|---|---|

| Vote question | On Motion to Recommit |

| Vote type | Yea-and-Nay |

| Result | Failed |

| Totals | Yea 209 / Nay 213 / Present 0 / Not Voting 9 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 0 | 213 | 0 | 5 |

| D | 209 | 0 | 0 | 4 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Motion to Recommit

Bill Analysis

H.R. 2270 – Empowering Employer Child and Elder Care Solutions Act (119th Congress)

H.R. 2270 is a tax-focused bill designed to expand and modernize employer-supported dependent care, including both child care and elder care. It primarily amends the Internal Revenue Code to increase incentives for employers to provide or subsidize care services for employees’ dependents.

Core provisions (inferred from title and typical structure of similar bills):

- Expands the existing employer-provided dependent care tax credit under IRC §45F (or a similar provision) by:

- Raising the maximum credit amount and/or percentage of qualified expenses employers can claim for providing on-site or near-site child care facilities, contracting with third-party providers, or subsidizing care costs.

- Explicitly including elder care and possibly other dependent care (e.g., disabled adult dependents) as eligible services, not just child care.

- Broadens the definition of “qualified dependent care services” to cover:

- Center-based and home-based child care.

- Adult day care, in-home elder care, and respite care arrangements that enable employees to work.

- May authorize or direct Treasury/IRS to:

- Issue guidance clarifying eligible arrangements (e.g., vouchers, contracts with networks of providers, backup care programs).

- Simplify compliance and documentation requirements for employers.

Funding and budget impact:

- Operates through tax expenditures rather than direct appropriations: it reduces federal revenue by increasing allowable tax credits/deductions.

- No new stand-alone agency is created; implementation and oversight rest with the Department of the Treasury/IRS.

Affected entities:

- Employers: Gain enhanced tax incentives to establish or expand dependent care benefits programs.

- Employees: Benefit indirectly through increased availability and affordability of employer-supported child and elder care.

- Care providers: Potentially see increased demand via employer contracts or voucher systems.

Timelines:

- Provisions would generally apply to taxable years beginning after a specified date (often the calendar year following enactment).

- IRS would be given a defined period (commonly 6–12 months) to issue implementing regulations and guidance.

Current status:

- Floor consideration has begun in the House, but further proceedings on H.R. 2270 have been postponed under House Rule XIX; it has not yet passed either chamber.

Yea (209)

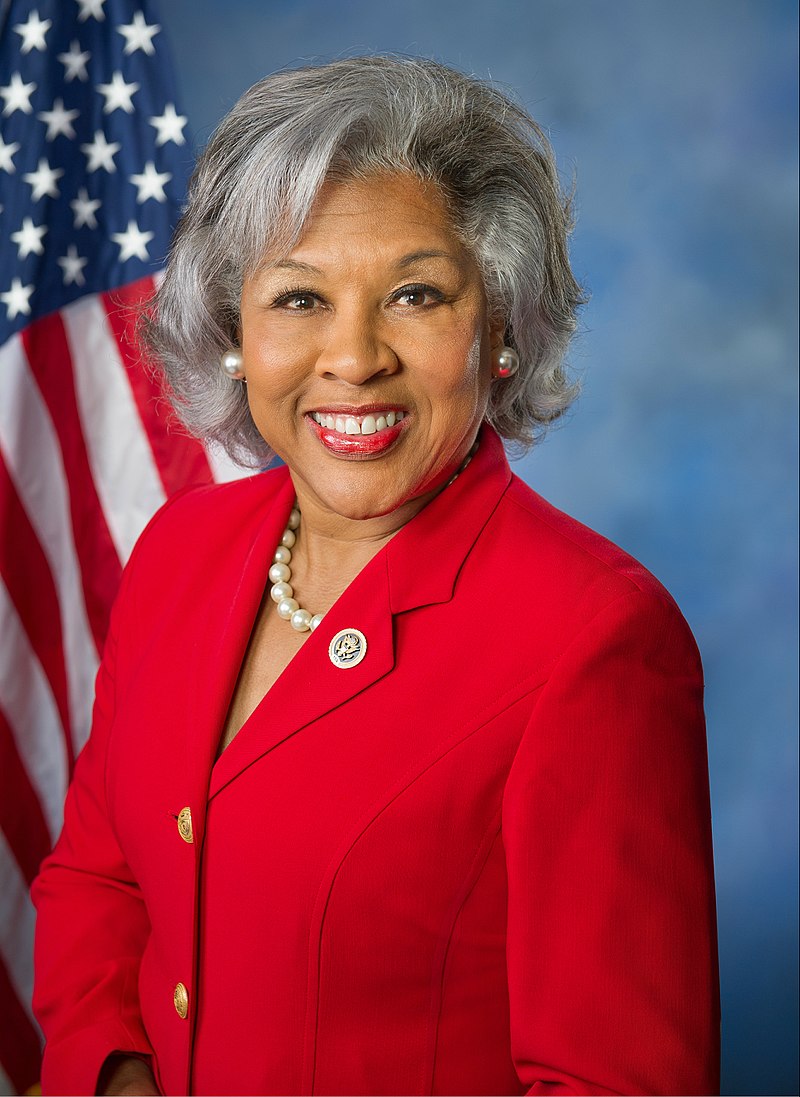

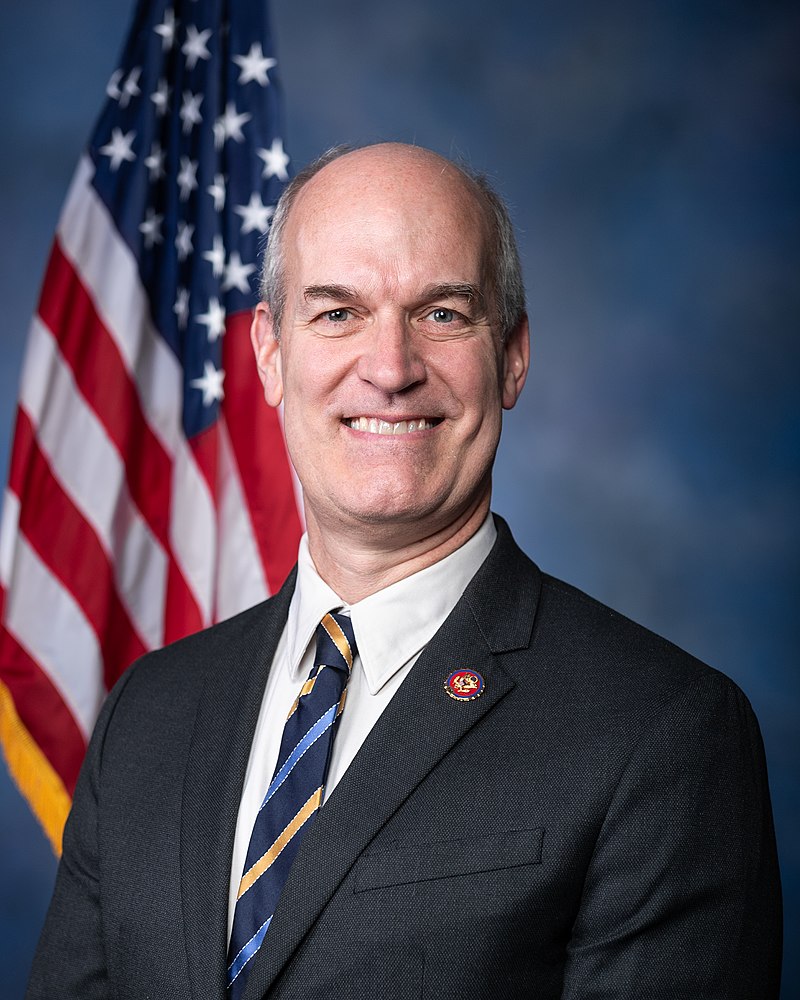

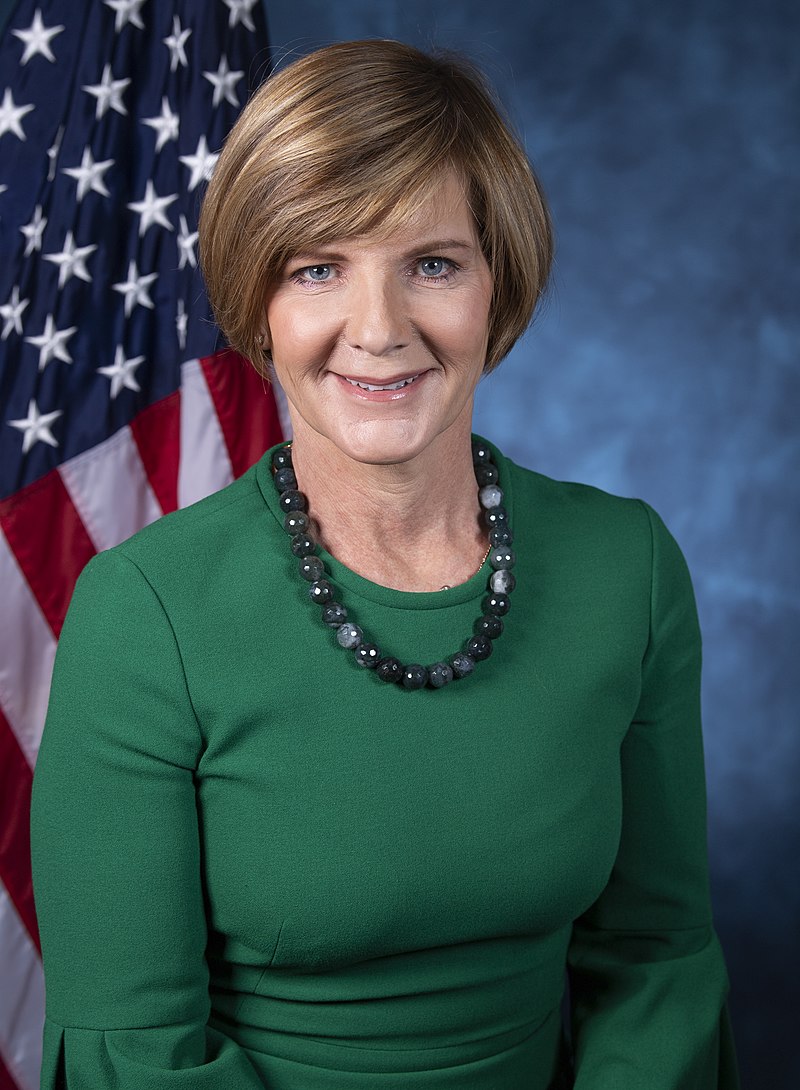

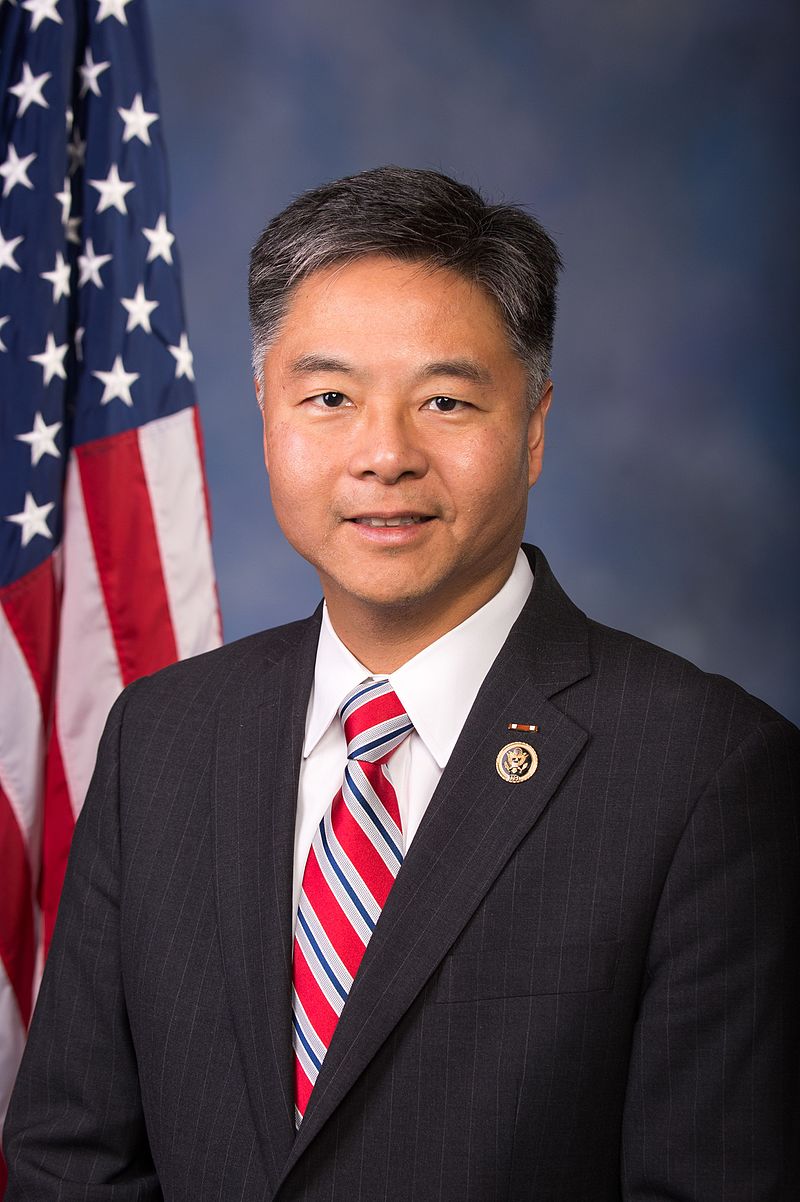

CA • D • Yea

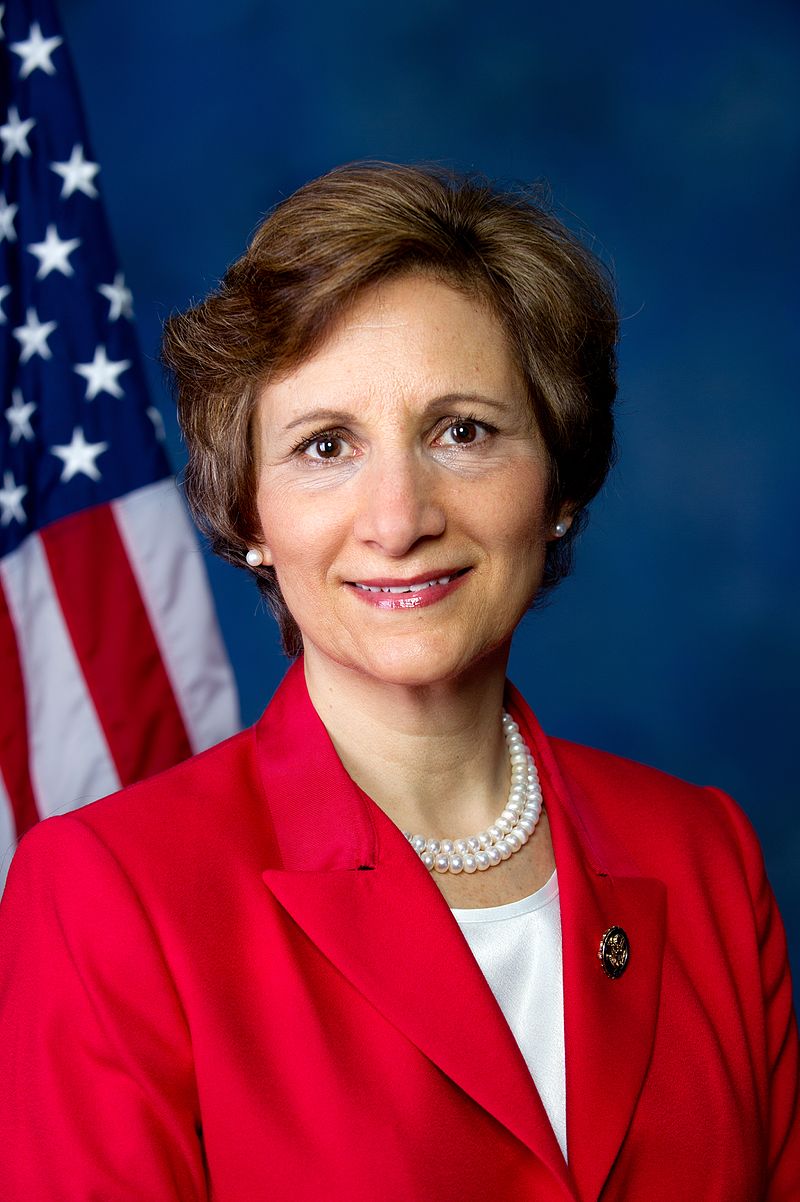

RI • D • Yea

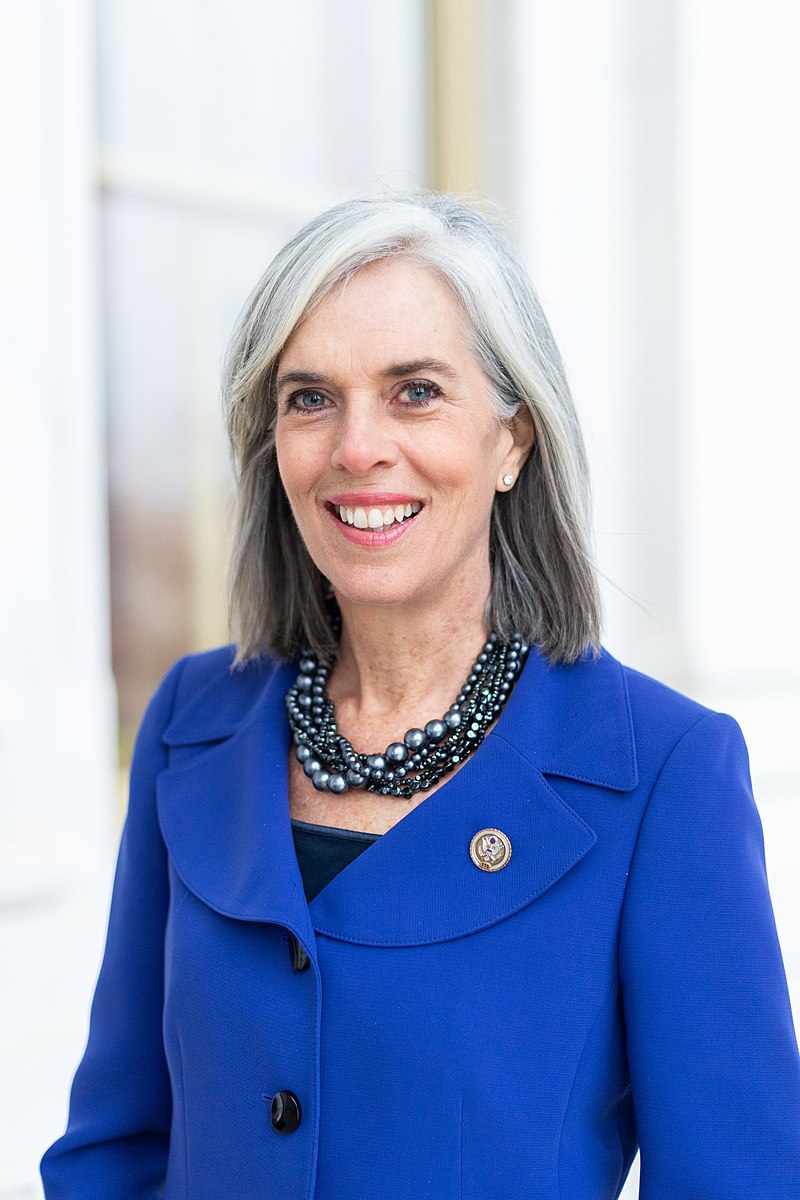

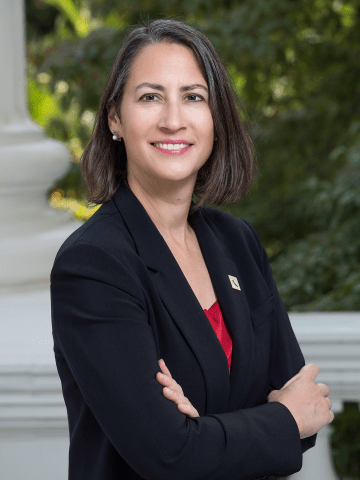

AZ • D • Yea

MA • D • Yea

VT • D • Yea

CA • D • Yea

OH • D • Yea

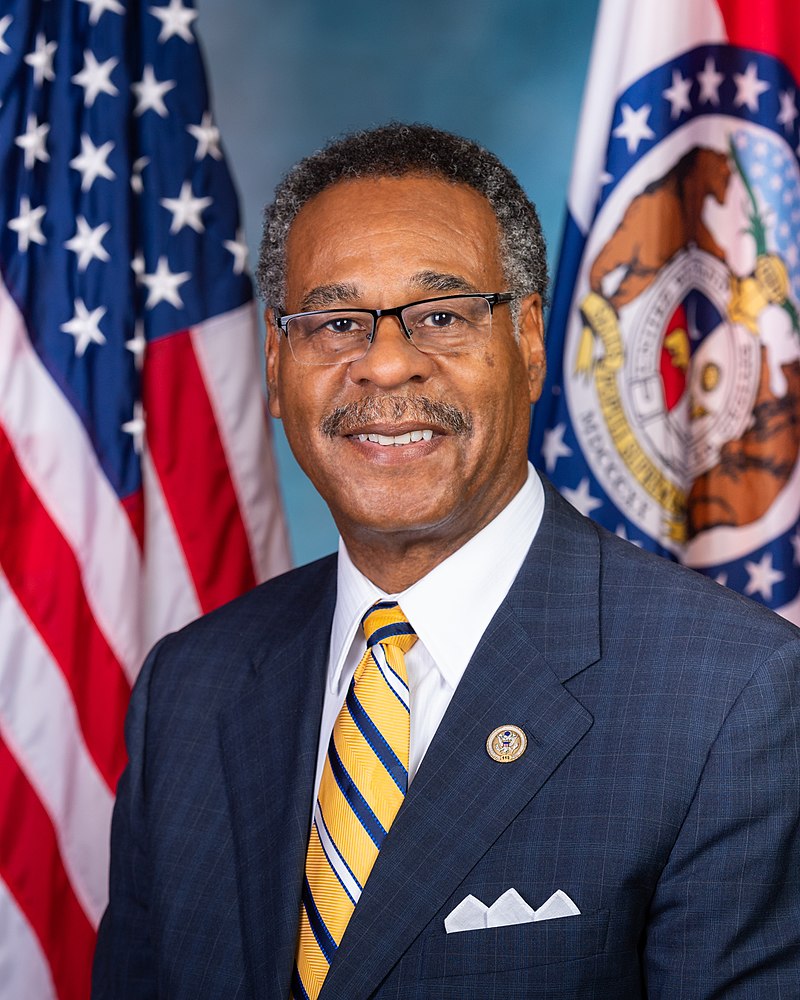

MO • D • Yea

CA • D • Yea

VA • D • Yea

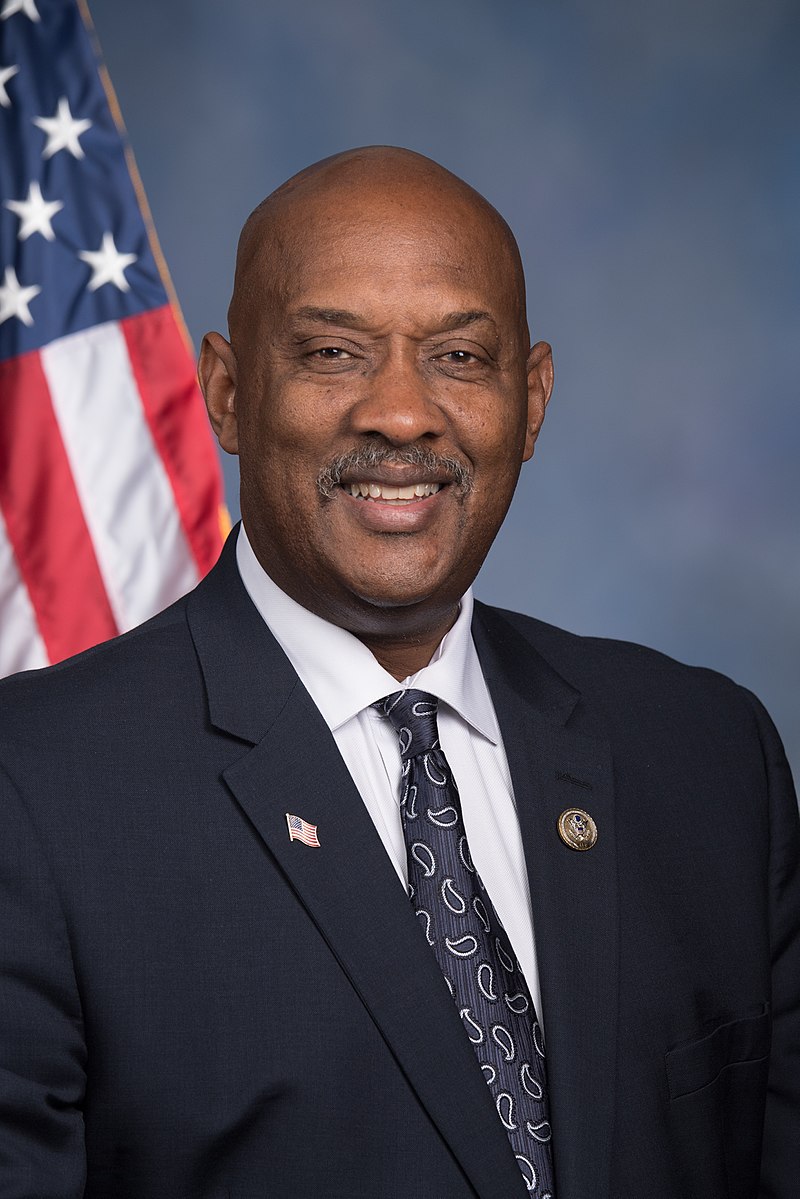

GA • D • Yea

OR • D • Yea

PA • D • Yea

OH • D • Yea

CA • D • Yea

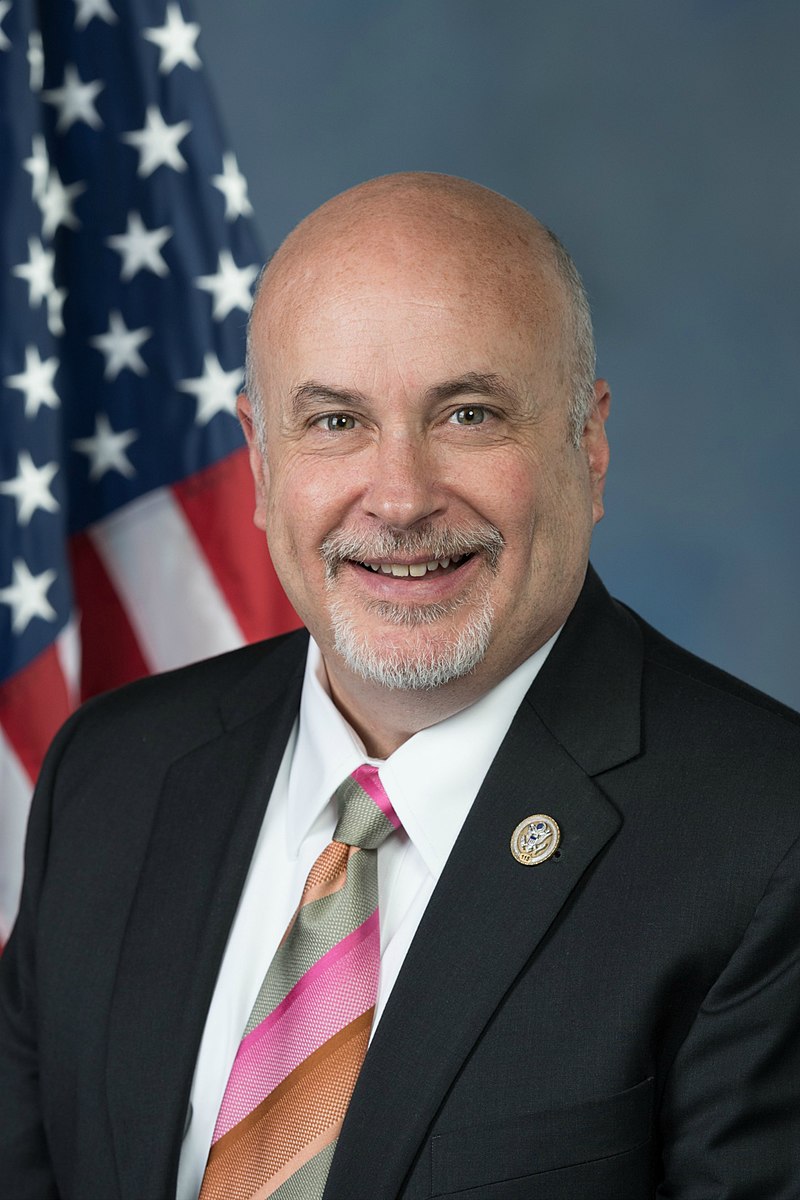

IL • D • Yea

OR • D • Yea

CA • D • Yea

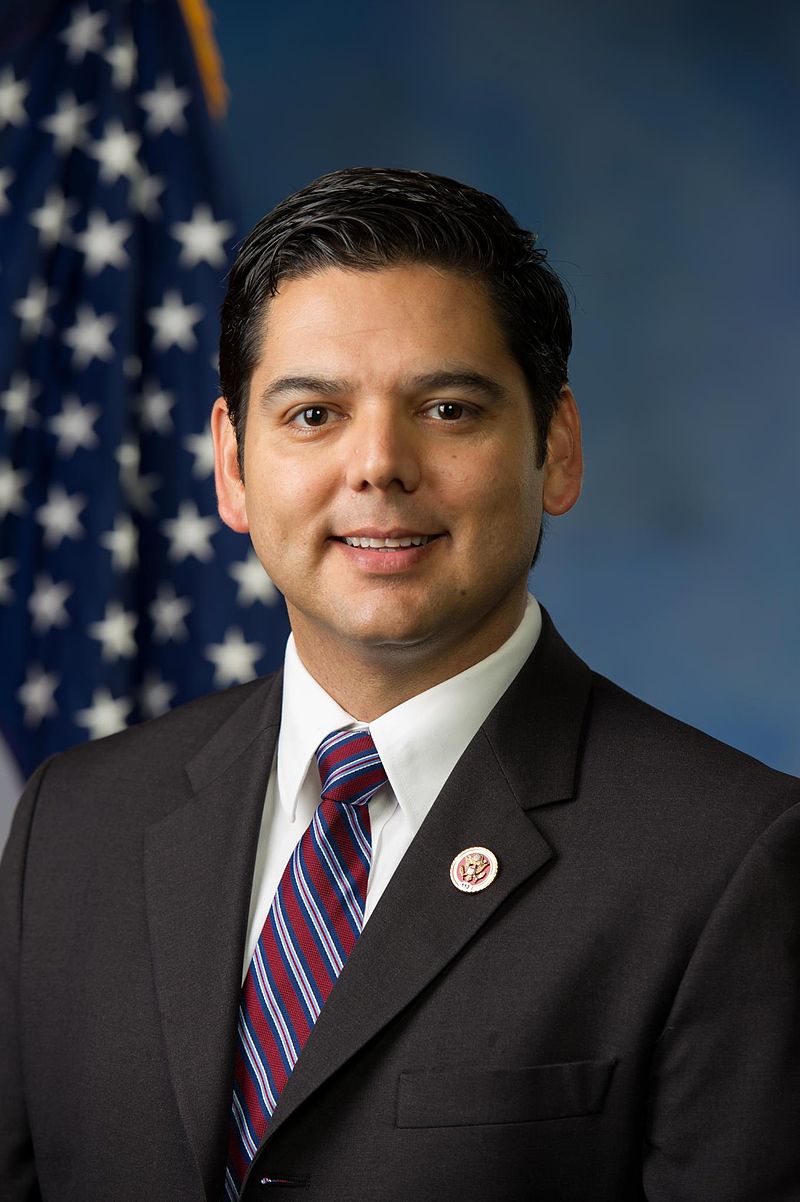

IN • D • Yea

LA • D • Yea

HI • D • Yea

IL • D • Yea

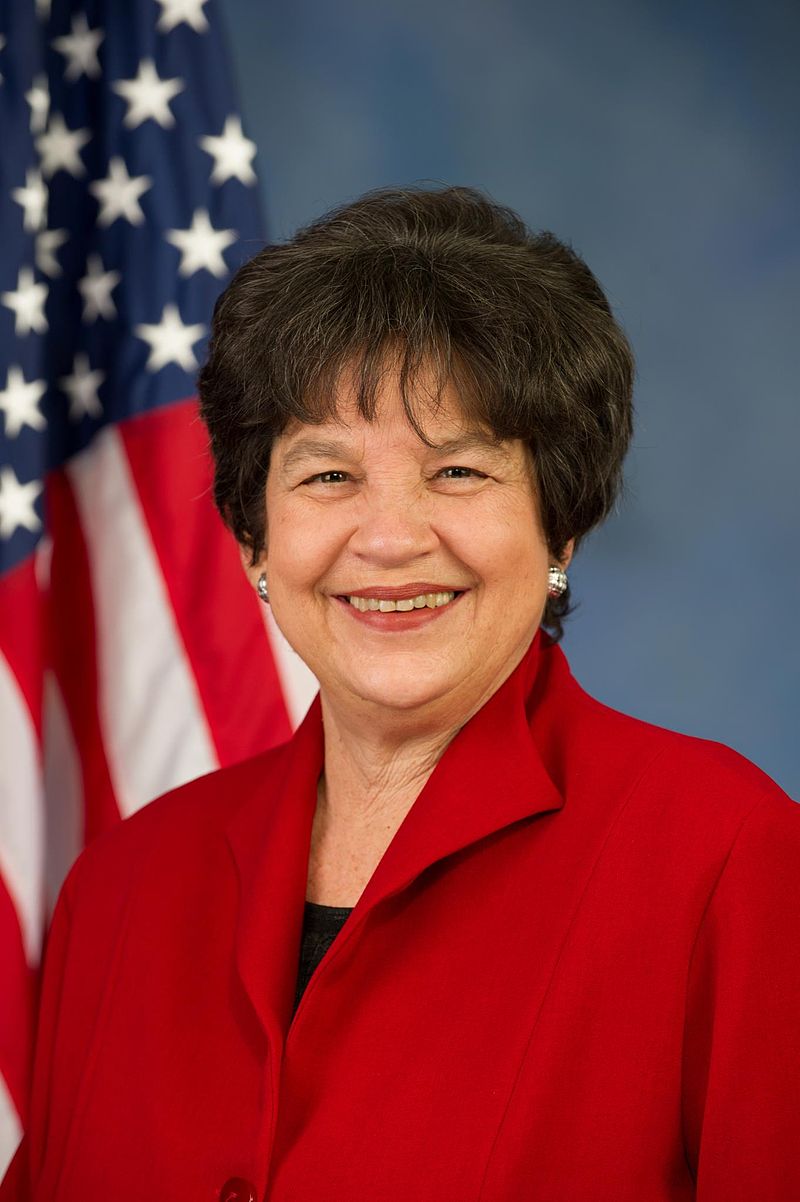

FL • D • Yea

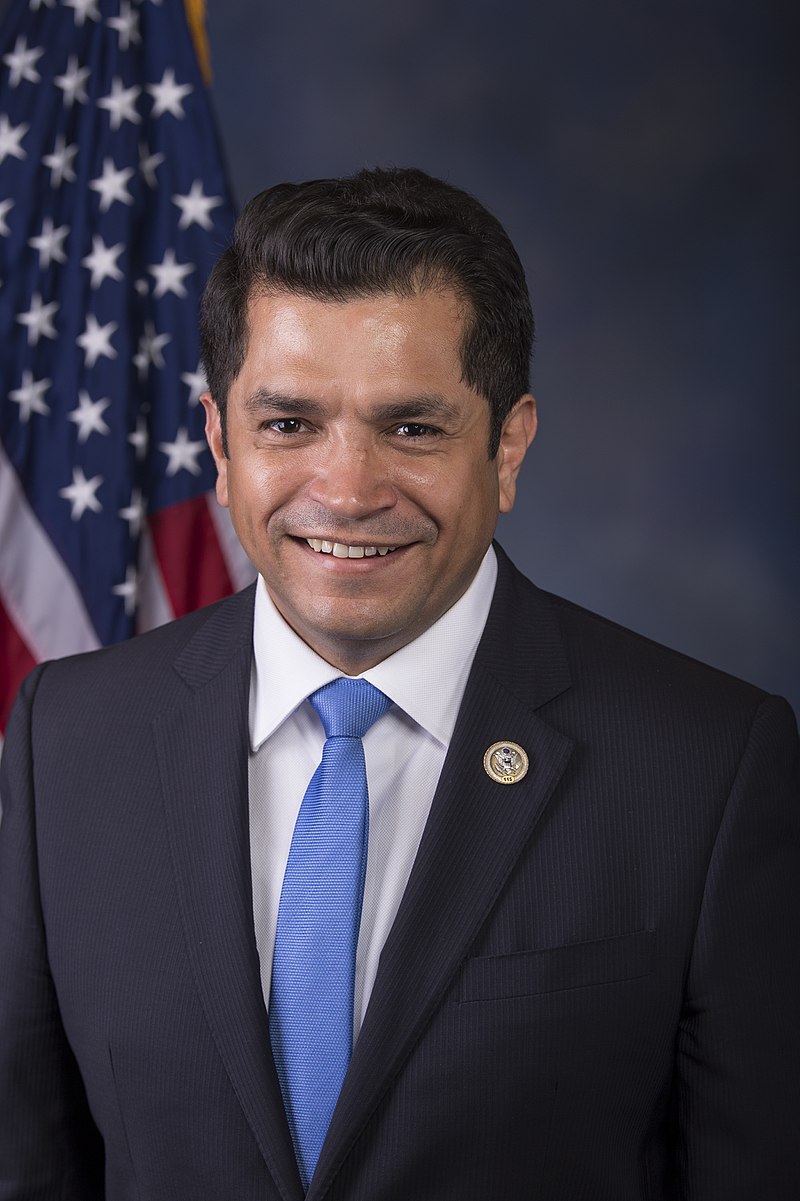

TX • D • Yea

FL • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

NY • D • Yea

MO • D • Yea

SC • D • Yea

TN • D • Yea

NJ • D • Yea

CA • D • Yea

CA • D • Yea

CT • D • Yea

MN • D • Yea

TX • D • Yea

CO • D • Yea

TX • D • Yea

KS • D • Yea

IL • D • Yea

NC • D • Yea

PA • D • Yea

CO • D • Yea

CT • D • Yea

WA • D • Yea

PA • D • Yea

CA • D • Yea

OR • D • Yea

MI • D • Yea

TX • D • Yea

MD • D • Yea

TX • D • Yea

NY • D • Yea

PA • D • Yea

LA • D • Yea

AL • D • Yea

TX • D • Yea

IL • D • Yea

NC • D • Yea

FL • D • Yea

CA • D • Yea

FL • D • Yea

CA • D • Yea

TX • D • Yea

CA • D • Yea

IL • D • Yea

NY • D • Yea

ME • D • Yea

NY • D • Yea

CA • D • Yea

TX • D • Yea

NH • D • Yea

NJ • D • Yea

CA • D • Yea

TX • D • Yea

AZ • D • Yea

CA • D • Yea

CT • D • Yea

CT • D • Yea

NV • D • Yea

PA • D • Yea

MD • D • Yea

OR • D • Yea

CA • D • Yea

MD • D • Yea

IL • D • Yea

CA • D • Yea

WA • D • Yea

NY • D • Yea

GA • D • Yea

TX • D • Yea

CA • D • Yea

OH • D • Yea

MA • D • Yea

IL • D • Yea

NY • D • Yea

CA • D • Yea

IL • D • Yea

OH • D • Yea

WA • D • Yea

CT • D • Yea

NY • D • Yea

NV • D • Yea

PA • D • Yea

NM • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

RI • D • Yea

NY • D • Yea

CA • D • Yea

GA • D • Yea

DE • D • Yea

MD • D • Yea

VA • D • Yea

MN • D • Yea

MI • D • Yea

KY • D • Yea

MA • D • Yea

NJ • D • Yea

NY • D • Yea

NJ • D • Yea

NY • D • Yea

MD • D • Yea

CA • D • Yea

WI • D • Yea

NY • D • Yea

MN • D • Yea

FL • D • Yea

MA • D • Yea

IN • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CO • D • Yea

NJ • D • Yea

NY • D • Yea

MD • D • Yea

MN • D • Yea

NJ • D • Yea

CA • D • Yea

NH • D • Yea

CA • D • Yea

WA • D • Yea

CA • D • Yea

CO • D • Yea

ME • D • Yea

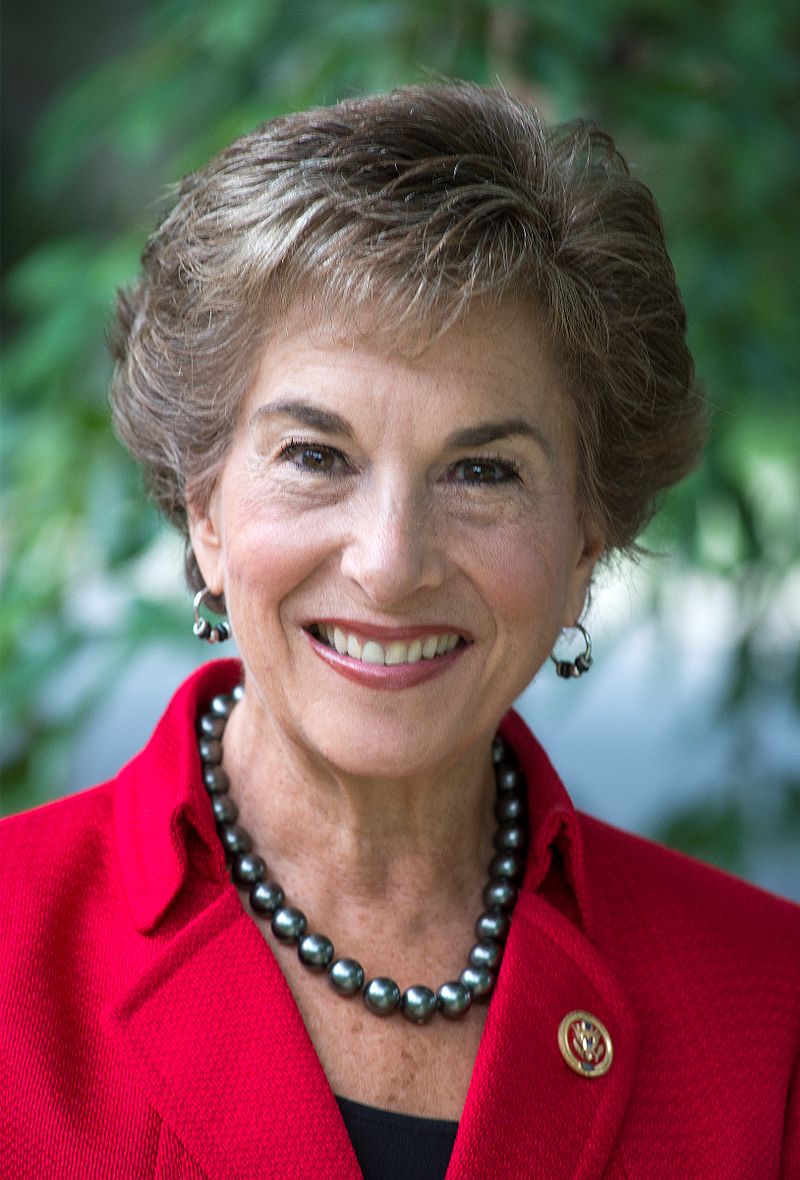

WI • D • Yea

NJ • D • Yea

MA • D • Yea

IL • D • Yea

IL • D • Yea

WA • D • Yea

MD • D • Yea

NY • D • Yea

CA • D • Yea

NC • D • Yea

CA • D • Yea

NY • D • Yea

OR • D • Yea

CA • D • Yea

PA • D • Yea

IL • D • Yea

IL • D • Yea

MI • D • Yea

WA • D • Yea

VA • D • Yea

GA • D • Yea

AL • D • Yea

CA • D • Yea

CA • D • Yea

WA • D • Yea

IL • D • Yea

FL • D • Yea

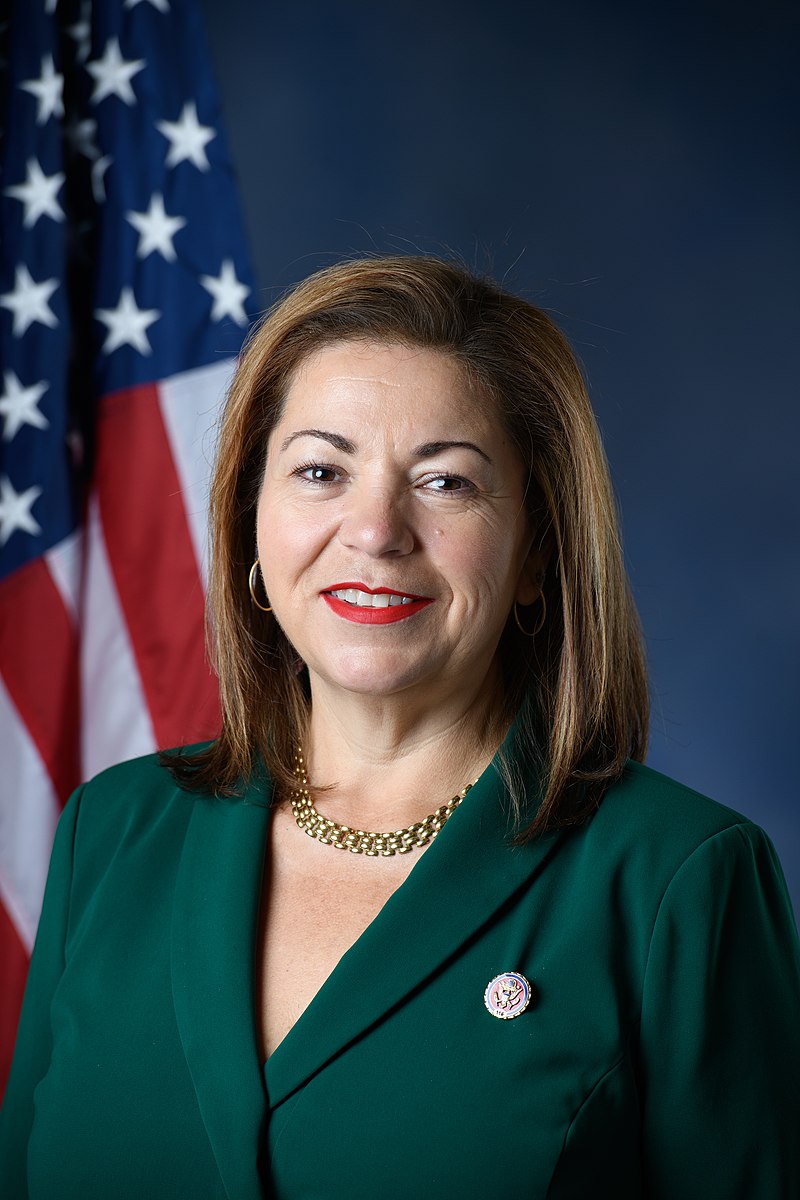

NM • D • Yea

AZ • D • Yea

MI • D • Yea

WA • D • Yea

VA • D • Yea

NY • D • Yea

CA • D • Yea

MI • D • Yea

MS • D • Yea

CA • D • Yea

NV • D • Yea

MI • D • Yea

HI • D • Yea

NY • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CA • D • Yea

IL • D • Yea

CA • D • Yea

NM • D • Yea

TX • D • Yea

NY • D • Yea

VA • D • Yea

VA • D • Yea

FL • D • Yea

CA • D • Yea

NJ • D • Yea

CA • D • Yea

GA • D • Yea

Nay (213)

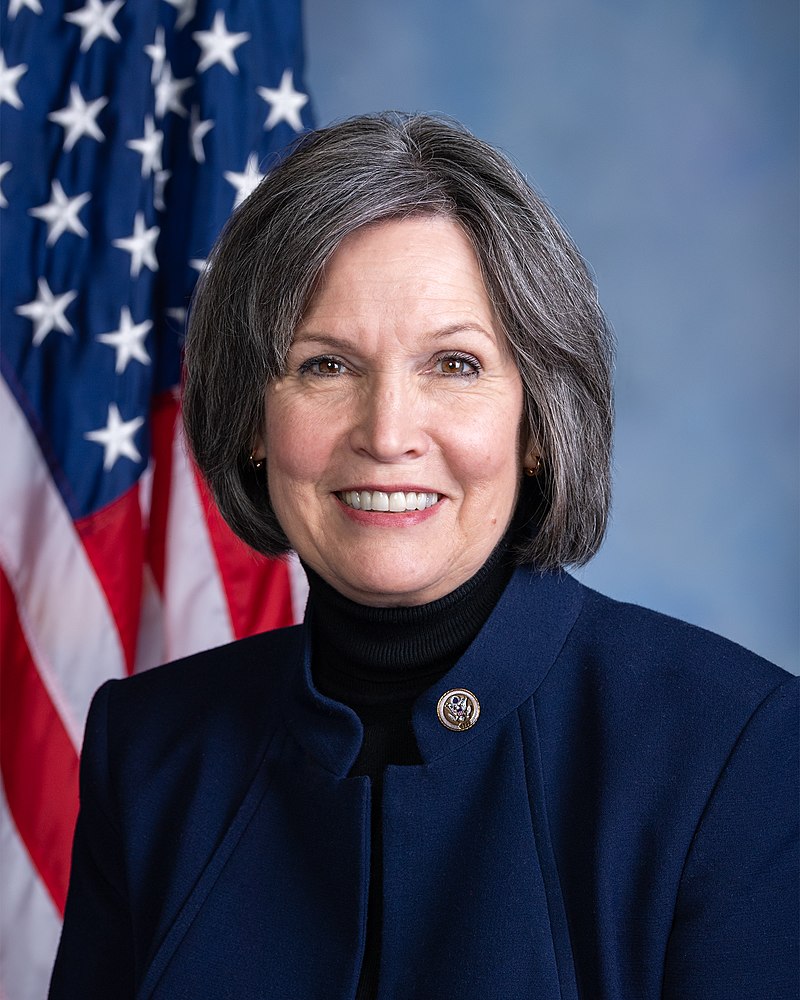

AL • R • Nay

MO • R • Nay

GA • R • Nay

NV • R • Nay

TX • R • Nay

TX • R • Nay

NE • R • Nay

IN • R • Nay

OH • R • Nay

KY • R • Nay

MI • R • Nay

WA • R • Nay

FL • R • Nay

AK • R • Nay

OR • R • Nay

MI • R • Nay

OK • R • Nay

AZ • R • Nay

SC • R • Nay

FL • R • Nay

CO • R • Nay

IL • R • Nay

OK • R • Nay

PA • R • Nay

FL • R • Nay

TN • R • Nay

MO • R • Nay

CA • R • Nay

FL • R • Nay

OH • R • Nay

TX • R • Nay

GA • R • Nay

AZ • R • Nay

VA • R • Nay

TX • R • Nay

GA • R • Nay

OK • R • Nay

GA • R • Nay

KY • R • Nay

AZ • R • Nay

CO • R • Nay

AR • R • Nay

TX • R • Nay

OH • R • Nay

TX • R • Nay

TN • R • Nay

FL • R • Nay

FL • R • Nay

MT • R • Nay

FL • R • Nay

NC • R • Nay

TX • R • Nay

MN • R • Nay

KS • R • Nay

CO • R • Nay

MS • R • Nay

TX • R • Nay

IA • R • Nay

FL • R • Nay

MN • R • Nay

MN • R • Nay

WI • R • Nay

PA • R • Nay

TN • R • Nay

NE • R • Nay

CA • R • Nay

NC • R • Nay

FL • R • Nay

SC • R • Nay

NY • R • Nay

TX • R • Nay

FL • R • Nay

TX • R • Nay

TX • R • Nay

TX • R • Nay

AZ • R • Nay

MO • R • Nay

VA • R • Nay

WI • R • Nay

MS • R • Nay

KY • R • Nay

WY • R • Nay

AZ • R • Nay

FL • R • Nay

NC • R • Nay

MD • R • Nay

NC • R • Nay

TN • R • Nay

OK • R • Nay

LA • R • Nay

AR • R • Nay

IA • R • Nay

IN • R • Nay

NC • R • Nay

MI • R • Nay

CO • R • Nay

CA • R • Nay

GA • R • Nay

TX • R • Nay

MI • R • Nay

LA • R • Nay

SD • R • Nay

OH • R • Nay

OH • R • Nay

PA • R • Nay

NJ • R • Nay

PA • R • Nay

MS • R • Nay

UT • R • Nay

VA • R • Nay

CA • R • Nay

CA • R • Nay

NC • R • Nay

TN • R • Nay

IL • R • Nay

NY • R • Nay

NY • R • Nay

OH • R • Nay

NY • R • Nay

FL • R • Nay

LA • R • Nay

GA • R • Nay

OK • R • Nay

FL • R • Nay

TX • R • Nay

SC • R • Nay

PA • R • Nay

NY • R • Nay

UT • R • Nay

KS • R • Nay

KY • R • Nay

FL • R • Nay

TX • R • Nay

MI • R • Nay

CA • R • Nay

GA • R • Nay

NC • R • Nay

VA • R • Nay

IN • R • Nay

PA • R • Nay

WV • R • Nay

IL • R • Nay

OH • R • Nay

IA • R • Nay

FL • R • Nay

MI • R • Nay

AL • R • Nay

UT • R • Nay

WV • R • Nay

NC • R • Nay

TX • R • Nay

TX • R • Nay

WA • R • Nay

SC • R • Nay

IA • R • Nay

CA • R • Nay

TN • R • Nay

MO • R • Nay

UT • R • Nay

AL • R • Nay

FL • R • Nay

PA • R • Nay

TX • R • Nay

PA • R • Nay

KY • R • Nay

AL • R • Nay

TN • R • Nay

NC • R • Nay

TX • R • Nay

OH • R • Nay

FL • R • Nay

FL • R • Nay

LA • R • Nay

KS • R • Nay

AZ • R • Nay

GA • R • Nay

TX • R • Nay

TX • R • Nay

IN • R • Nay

ID • R • Nay

NJ • R • Nay

NE • R • Nay

MO • R • Nay

PA • R • Nay

IN • R • Nay

MN • R • Nay

NY • R • Nay

WI • R • Nay

FL • R • Nay

AL • R • Nay

IN • R • Nay

OH • R • Nay

NY • R • Nay

PA • R • Nay

WI • R • Nay

SC • R • Nay

OH • R • Nay

CA • R • Nay

NJ • D • Nay

TX • R • Nay

TN • R • Nay

MO • R • Nay

MI • R • Nay

TX • R • Nay

FL • R • Nay

AR • R • Nay

WI • R • Nay

TX • R • Nay

SC • R • Nay

VA • R • Nay

AR • R • Nay

IN • R • Nay

MT • R • Nay

Not Voting (9)

TX • D • Not Voting

ND • R • Not Voting

ID • R • Not Voting

TX • R • Not Voting

NC • R • Not Voting

CA • D • Not Voting

OH • D • Not Voting

WI • R • Not Voting

FL • D • Not Voting