H.R.2262 — Flexibility for Workers Education Act

House Roll Call

H.R.2262

Roll 19 • Congress 119, Session 2 • Jan 13, 2026 5:51 PM • Result: Failed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.2262 — Flexibility for Workers Education Act |

|---|---|

| Vote question | On Passage |

| Vote type | Yea-and-Nay |

| Result | Failed |

| Totals | Yea 209 / Nay 215 / Present 0 / Not Voting 7 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 209 | 6 | 0 | 3 |

| D | 0 | 209 | 0 | 4 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Passage

Bill Analysis

HR 2262 – Flexibility for Workers Education Act (119th Congress)

HR 2262 amends federal higher education and tax-related provisions to expand how workers can use education benefits and aid for short-term, flexible learning aligned with employment.

Substance and authorities:

- Expands eligible education and training programs under Title IV of the Higher Education Act (HEA) to include certain short-term, non-degree, credential, and skills-based programs, including those offered online, in hybrid formats, or in modular “stackable” units.

- Authorizes the Secretary of Education to approve nontraditional providers (e.g., workforce training organizations, industry associations, employer-based programs) if they meet quality, outcomes, and financial responsibility standards, often in partnership with accredited institutions.

- Allows federal student aid (e.g., Pell Grants, possibly loans) to be used for approved short-term and flexible programs that meet minimum hour, duration, and labor-market relevance criteria.

- Clarifies or expands the treatment of employer-provided education assistance under the Internal Revenue Code, maintaining or increasing the tax-free cap for tuition assistance and explicitly covering short-term credentials, upskilling, and reskilling programs tied to in-demand occupations.

- Directs the Department of Education, in consultation with the Department of Labor, to develop outcome metrics (completion, employment, earnings) and to collect and publish data on these newly eligible programs.

Programs/agencies affected:

- Department of Education (Office of Postsecondary Education; Federal Student Aid) gains new approval, oversight, and reporting responsibilities.

- Department of Labor participates in defining in-demand occupations and relevant credentials.

- IRS is affected through clarified or expanded tax treatment of employer education benefits.

Beneficiaries and regulated parties:

- Workers, especially mid-career and low-income adults, gain access to federal aid and tax-advantaged employer benefits for short, flexible training.

- Employers can more easily offer tax-favored education benefits aligned with workforce needs.

- Nontraditional education providers become subject to new federal eligibility and accountability standards.

Timelines:

- The bill generally phases in new eligibility and oversight requirements over several years, with rulemaking and guidance required within roughly 12–24 months of enactment, followed by periodic reporting and evaluation deadlines.

Yea (209)

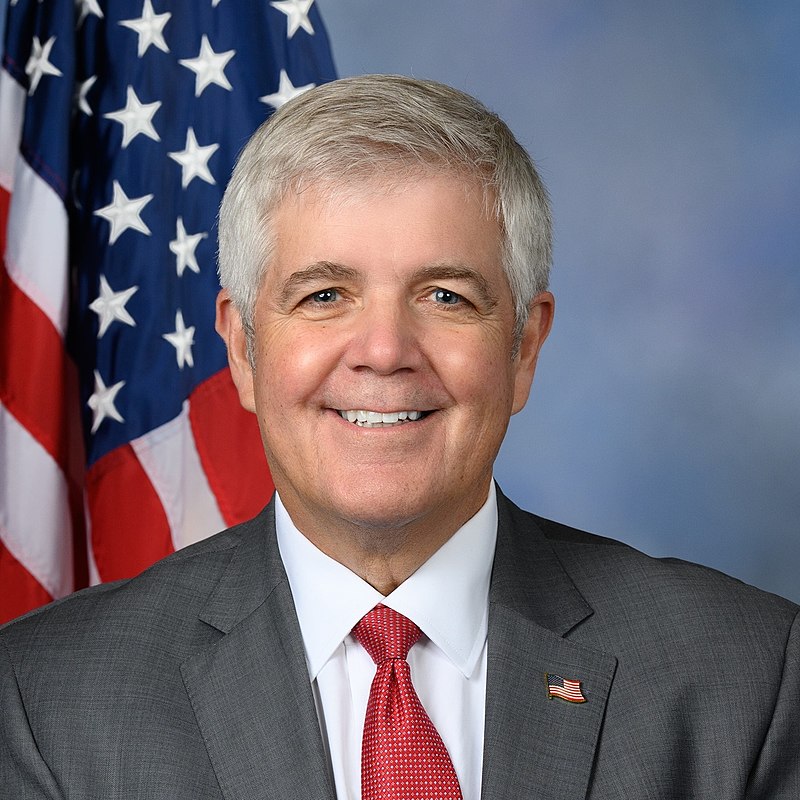

MO • R • Yea

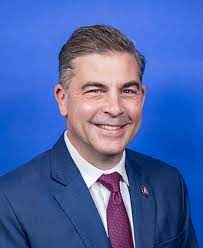

GA • R • Yea

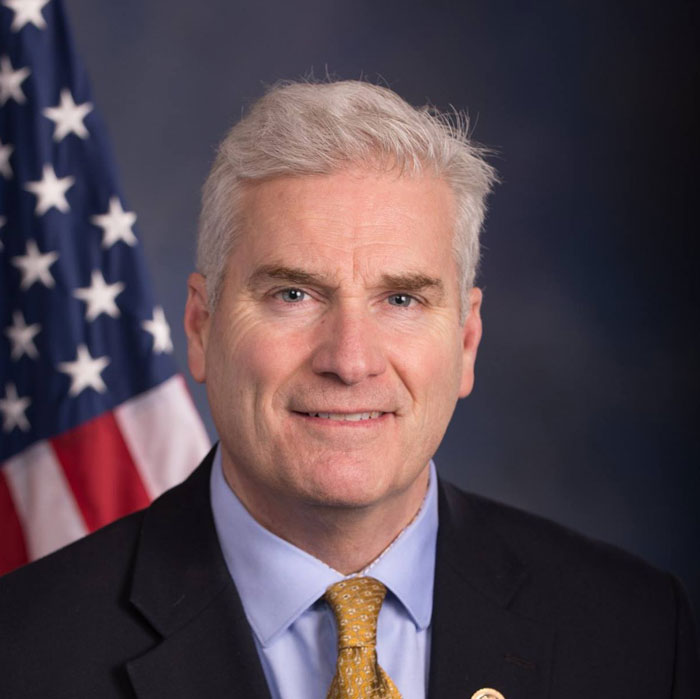

NV • R • Yea

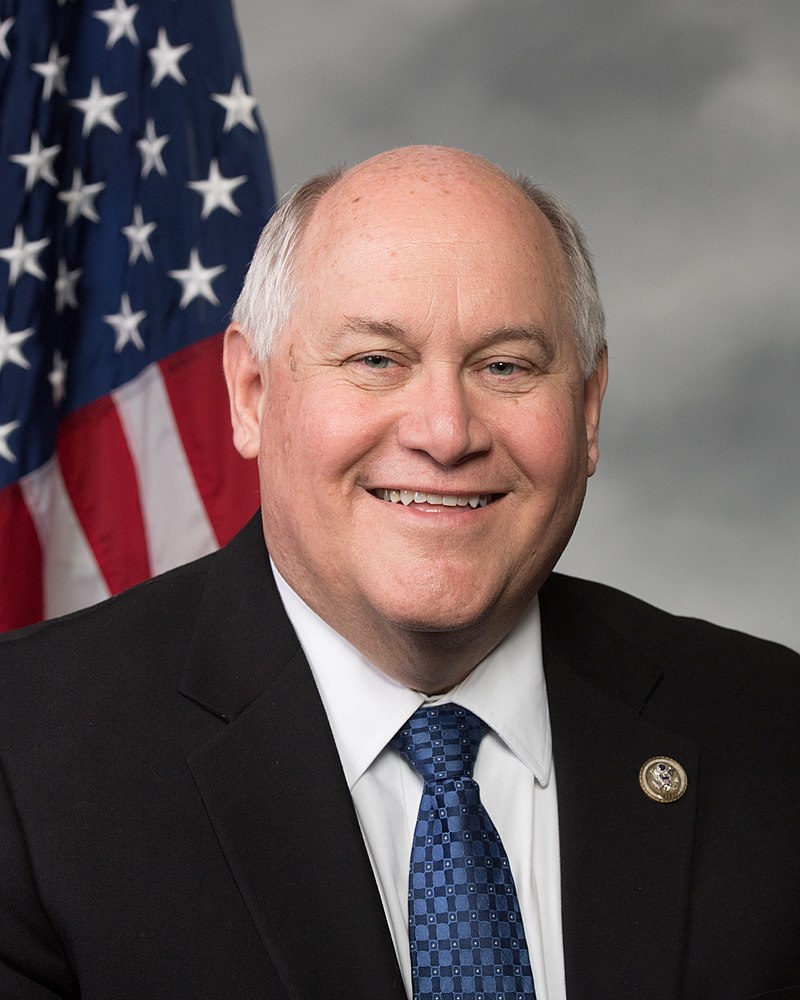

TX • R • Yea

TX • R • Yea

NE • R • Yea

IN • R • Yea

OH • R • Yea

KY • R • Yea

MI • R • Yea

WA • R • Yea

FL • R • Yea

AK • R • Yea

OR • R • Yea

MI • R • Yea

OK • R • Yea

AZ • R • Yea

SC • R • Yea

FL • R • Yea

CO • R • Yea

IL • R • Yea

OK • R • Yea

FL • R • Yea

TN • R • Yea

MO • R • Yea

CA • R • Yea

FL • R • Yea

OH • R • Yea

TX • R • Yea

GA • R • Yea

AZ • R • Yea

VA • R • Yea

TX • R • Yea

GA • R • Yea

OK • R • Yea

GA • R • Yea

KY • R • Yea

AZ • R • Yea

CO • R • Yea

AR • R • Yea

TX • R • Yea

OH • R • Yea

TX • R • Yea

TN • R • Yea

FL • R • Yea

FL • R • Yea

MT • R • Yea

FL • R • Yea

NC • R • Yea

TX • R • Yea

MN • R • Yea

KS • R • Yea

CO • R • Yea

MS • R • Yea

TX • R • Yea

ND • R • Yea

IA • R • Yea

FL • R • Yea

MN • R • Yea

MN • R • Yea

WI • R • Yea

TN • R • Yea

NE • R • Yea

CA • R • Yea

NC • R • Yea

FL • R • Yea

SC • R • Yea

ID • R • Yea

NY • R • Yea

TX • R • Yea

FL • R • Yea

TX • R • Yea

TX • R • Yea

TX • R • Yea

AZ • R • Yea

MO • R • Yea

VA • R • Yea

WI • R • Yea

MS • R • Yea

KY • R • Yea

WY • R • Yea

AZ • R • Yea

FL • R • Yea

NC • R • Yea

MD • R • Yea

NC • R • Yea

TN • R • Yea

OK • R • Yea

LA • R • Yea

AR • R • Yea

IA • R • Yea

IN • R • Yea

NC • R • Yea

MI • R • Yea

CO • R • Yea

CA • R • Yea

GA • R • Yea

TX • R • Yea

MI • R • Yea

LA • R • Yea

SD • R • Yea

OH • R • Yea

OH • R • Yea

PA • R • Yea

NJ • R • Yea

PA • R • Yea

MS • R • Yea

UT • R • Yea

VA • R • Yea

CA • R • Yea

CA • R • Yea

NC • R • Yea

TN • R • Yea

IL • R • Yea

NY • R • Yea

OH • R • Yea

NY • R • Yea

FL • R • Yea

LA • R • Yea

GA • R • Yea

OK • R • Yea

FL • R • Yea

TX • R • Yea

SC • R • Yea

PA • R • Yea

NY • R • Yea

UT • R • Yea

KS • R • Yea

KY • R • Yea

FL • R • Yea

TX • R • Yea

MI • R • Yea

CA • R • Yea

GA • R • Yea

NC • R • Yea

VA • R • Yea

IN • R • Yea

PA • R • Yea

WV • R • Yea

IL • R • Yea

OH • R • Yea

IA • R • Yea

FL • R • Yea

MI • R • Yea

AL • R • Yea

UT • R • Yea

NC • R • Yea

TX • R • Yea

TX • R • Yea

WA • R • Yea

SC • R • Yea

IA • R • Yea

CA • R • Yea

TN • R • Yea

MO • R • Yea

UT • R • Yea

AL • R • Yea

FL • R • Yea

PA • R • Yea

TX • R • Yea

PA • R • Yea

KY • R • Yea

AL • R • Yea

TN • R • Yea

NC • R • Yea

TX • R • Yea

OH • R • Yea

FL • R • Yea

FL • R • Yea

LA • R • Yea

KS • R • Yea

AZ • R • Yea

GA • R • Yea

TX • R • Yea

TX • R • Yea

IN • R • Yea

ID • R • Yea

NE • R • Yea

MO • R • Yea

PA • R • Yea

IN • R • Yea

MN • R • Yea

NY • R • Yea

WI • R • Yea

FL • R • Yea

AL • R • Yea

IN • R • Yea

OH • R • Yea

NY • R • Yea

PA • R • Yea

WI • R • Yea

SC • R • Yea

OH • R • Yea

CA • R • Yea

TX • R • Yea

TN • R • Yea

MO • R • Yea

MI • R • Yea

TX • R • Yea

FL • R • Yea

AR • R • Yea

WI • R • Yea

TX • R • Yea

SC • R • Yea

VA • R • Yea

AR • R • Yea

IN • R • Yea

MT • R • Yea

Nay (215)

NC • D • Nay

CA • D • Nay

RI • D • Nay

AZ • D • Nay

MA • D • Nay

VT • D • Nay

CA • D • Nay

OH • D • Nay

MO • D • Nay

CA • D • Nay

VA • D • Nay

GA • D • Nay

OR • D • Nay

PA • D • Nay

PA • R • Nay

OH • D • Nay

CA • D • Nay

IL • D • Nay

OR • D • Nay

CA • D • Nay

IN • D • Nay

LA • D • Nay

HI • D • Nay

IL • D • Nay

FL • D • Nay

TX • D • Nay

FL • D • Nay

CA • D • Nay

CA • D • Nay

MA • D • Nay

NY • D • Nay

MO • D • Nay

SC • D • Nay

TN • D • Nay

NJ • D • Nay

CA • D • Nay

CA • D • Nay

CT • D • Nay

MN • D • Nay

TX • D • Nay

CO • D • Nay

TX • D • Nay

KS • D • Nay

IL • D • Nay

NC • D • Nay

PA • D • Nay

CO • D • Nay

CT • D • Nay

WA • D • Nay

PA • D • Nay

CA • D • Nay

OR • D • Nay

MI • D • Nay

TX • D • Nay

MD • D • Nay

TX • D • Nay

NY • D • Nay

PA • D • Nay

LA • D • Nay

AL • D • Nay

PA • R • Nay

TX • D • Nay

IL • D • Nay

NC • D • Nay

FL • D • Nay

CA • D • Nay

FL • D • Nay

CA • D • Nay

TX • D • Nay

CA • D • Nay

IL • D • Nay

NY • D • Nay

ME • D • Nay

NY • D • Nay

CA • D • Nay

TX • D • Nay

NH • D • Nay

NJ • D • Nay

CA • D • Nay

TX • D • Nay

AZ • D • Nay

CA • D • Nay

CT • D • Nay

CT • D • Nay

NV • D • Nay

PA • D • Nay

MD • D • Nay

OR • D • Nay

CA • D • Nay

MD • D • Nay

IL • D • Nay

CA • D • Nay

WA • D • Nay

NY • D • Nay

GA • D • Nay

TX • D • Nay

CA • D • Nay

OH • D • Nay

MA • D • Nay

IL • D • Nay

NY • D • Nay

CA • D • Nay

IL • D • Nay

NY • R • Nay

OH • D • Nay

WA • D • Nay

CT • D • Nay

NY • D • Nay

NV • D • Nay

PA • D • Nay

NM • D • Nay

CA • D • Nay

CA • D • Nay

CA • D • Nay

CA • D • Nay

MA • D • Nay

RI • D • Nay

NY • D • Nay

CA • D • Nay

GA • D • Nay

DE • D • Nay

MD • D • Nay

VA • D • Nay

MN • D • Nay

MI • D • Nay

KY • D • Nay

MA • D • Nay

NJ • D • Nay

NY • D • Nay

NJ • D • Nay

NY • D • Nay

MD • D • Nay

CA • D • Nay

WI • D • Nay

WV • R • Nay

NY • D • Nay

MN • D • Nay

FL • D • Nay

MA • D • Nay

IN • D • Nay

CA • D • Nay

NY • D • Nay

MA • D • Nay

CO • D • Nay

NJ • D • Nay

NY • D • Nay

MD • D • Nay

MN • D • Nay

NJ • D • Nay

CA • D • Nay

NH • D • Nay

CA • D • Nay

WA • D • Nay

CA • D • Nay

CO • D • Nay

ME • D • Nay

WI • D • Nay

NJ • D • Nay

MA • D • Nay

IL • D • Nay

IL • D • Nay

WA • D • Nay

MD • D • Nay

NY • D • Nay

CA • D • Nay

NC • D • Nay

CA • D • Nay

NY • D • Nay

OR • D • Nay

CA • D • Nay

PA • D • Nay

IL • D • Nay

IL • D • Nay

MI • D • Nay

WA • D • Nay

VA • D • Nay

GA • D • Nay

AL • D • Nay

CA • D • Nay

CA • D • Nay

WA • D • Nay

NJ • R • Nay

IL • D • Nay

FL • D • Nay

NM • D • Nay

AZ • D • Nay

MI • D • Nay

WA • D • Nay

VA • D • Nay

NY • D • Nay

CA • D • Nay

MI • D • Nay

MS • D • Nay

CA • D • Nay

NV • D • Nay

MI • D • Nay

HI • D • Nay

NY • D • Nay

CA • D • Nay

NY • D • Nay

MA • D • Nay

CA • D • Nay

IL • D • Nay

NJ • D • Nay

CA • D • Nay

NM • D • Nay

TX • D • Nay

NY • D • Nay

VA • D • Nay

VA • D • Nay

FL • D • Nay

CA • D • Nay

NJ • D • Nay

CA • D • Nay

GA • D • Nay

Not Voting (7)

TX • D • Not Voting

TX • R • Not Voting

NC • R • Not Voting

CA • D • Not Voting

OH • D • Not Voting

WI • R • Not Voting

FL • D • Not Voting