H.R.2262 — Flexibility for Workers Education Act

House Roll Call

H.R.2262

Roll 18 • Congress 119, Session 2 • Jan 13, 2026 4:59 PM • Result: Failed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.2262 — Flexibility for Workers Education Act |

|---|---|

| Vote question | On Motion to Recommit |

| Vote type | Yea-and-Nay |

| Result | Failed |

| Totals | Yea 209 / Nay 213 / Present 0 / Not Voting 9 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 0 | 213 | 0 | 5 |

| D | 209 | 0 | 0 | 4 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Motion to Recommit

Bill Analysis

HR 2262 – Flexibility for Workers Education Act (119th Congress)

HR 2262 amends the Internal Revenue Code to expand and modernize tax-favored “529” education savings plans so they can be used more flexibly for workforce-oriented education and training.

Substantive changes and authorities:

- Broadens “qualified higher education expenses” to include a wider range of nondegree, skills-based, and short-term training programs, including certain credentialing, licensing, and industry-recognized certification programs.

- Authorizes use of 529 funds for specified workforce development expenses such as tuition, fees, books, and required equipment for eligible nontraditional programs, subject to federal standards for program quality and/or accreditation.

- May clarify or expand eligibility for expenses related to career and technical education (CTE), apprenticeships, and similar work-based learning, aligning with existing Department of Labor and Department of Education program definitions where referenced.

- Retains the basic tax treatment of 529 plans (tax-free growth and tax-free withdrawals for qualified expenses) but enlarges the category of what counts as “qualified,” thereby indirectly increasing the tax expenditure associated with these plans.

Agencies and programs affected:

- Treasury Department/IRS: tasked with implementing the revised definitions, issuing guidance, and updating forms and instructions for taxpayers and plan administrators.

- State-sponsored 529 plan administrators: must adjust plan documents, disclosures, and administrative systems to accommodate new eligible expense categories.

- Indirect coordination implications for the Departments of Education and Labor where statutory cross-references to eligible programs or recognized credentials are used.

Beneficiaries and regulated parties:

- Primary beneficiaries: workers, jobseekers, and families using 529 plans to finance upskilling, reskilling, or career changes through short-term or nondegree programs.

- Regulated/impacted entities: 529 plan providers, educational and training institutions, and credentialing bodies whose programs may newly qualify for 529 funding.

Timelines:

- Provisions generally take effect for distributions made after a specified date (typically tax years beginning after enactment), with IRS directed to issue implementing guidance within set timeframes following enactment.

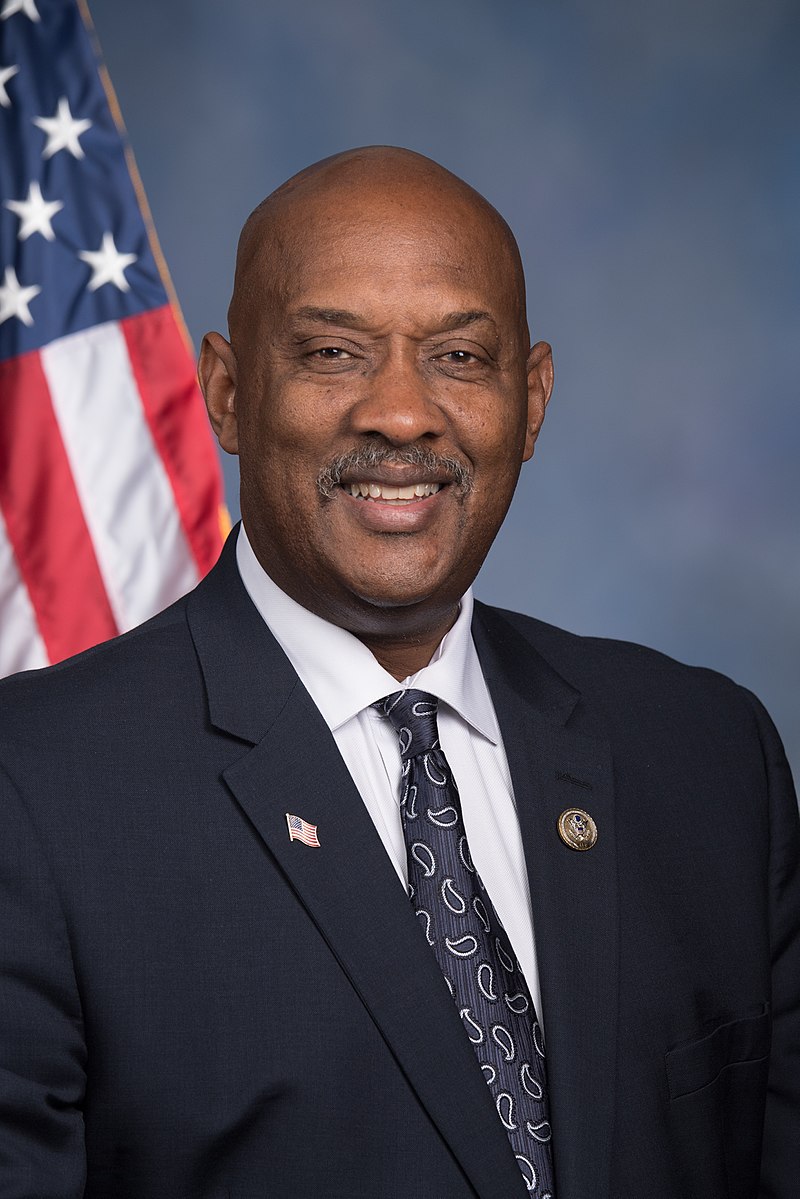

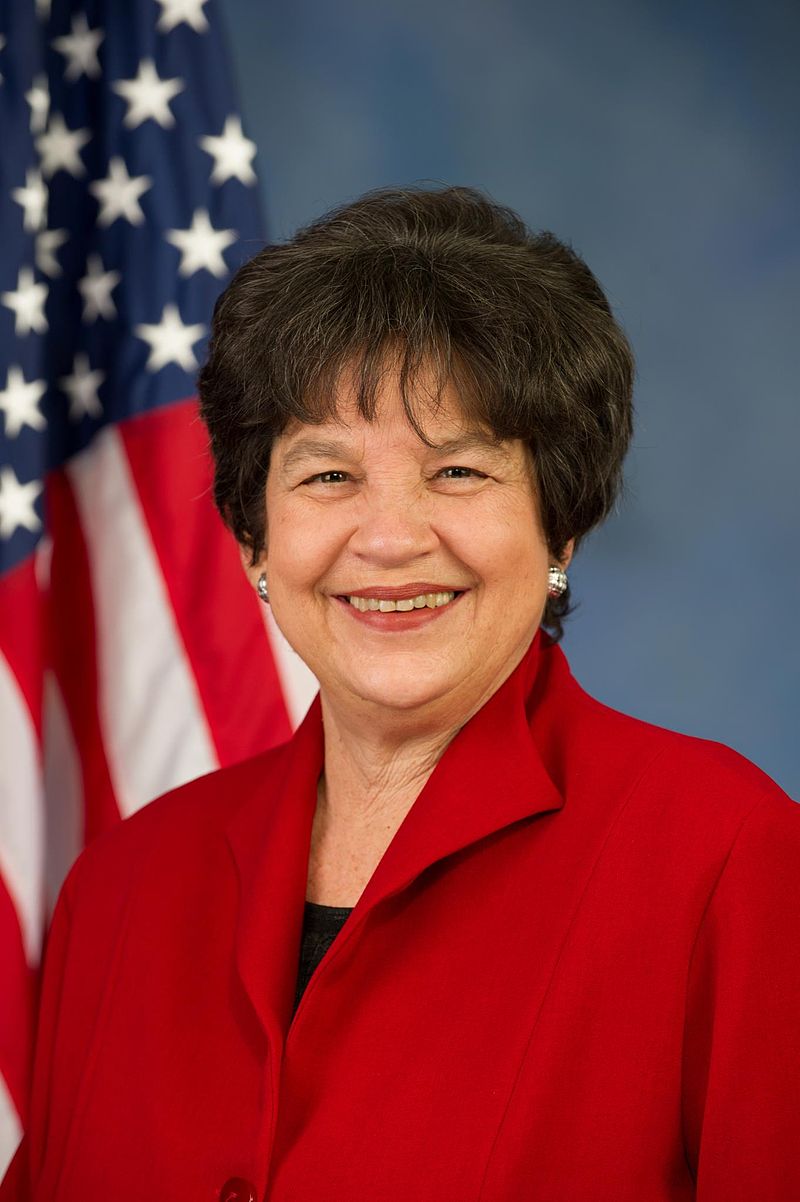

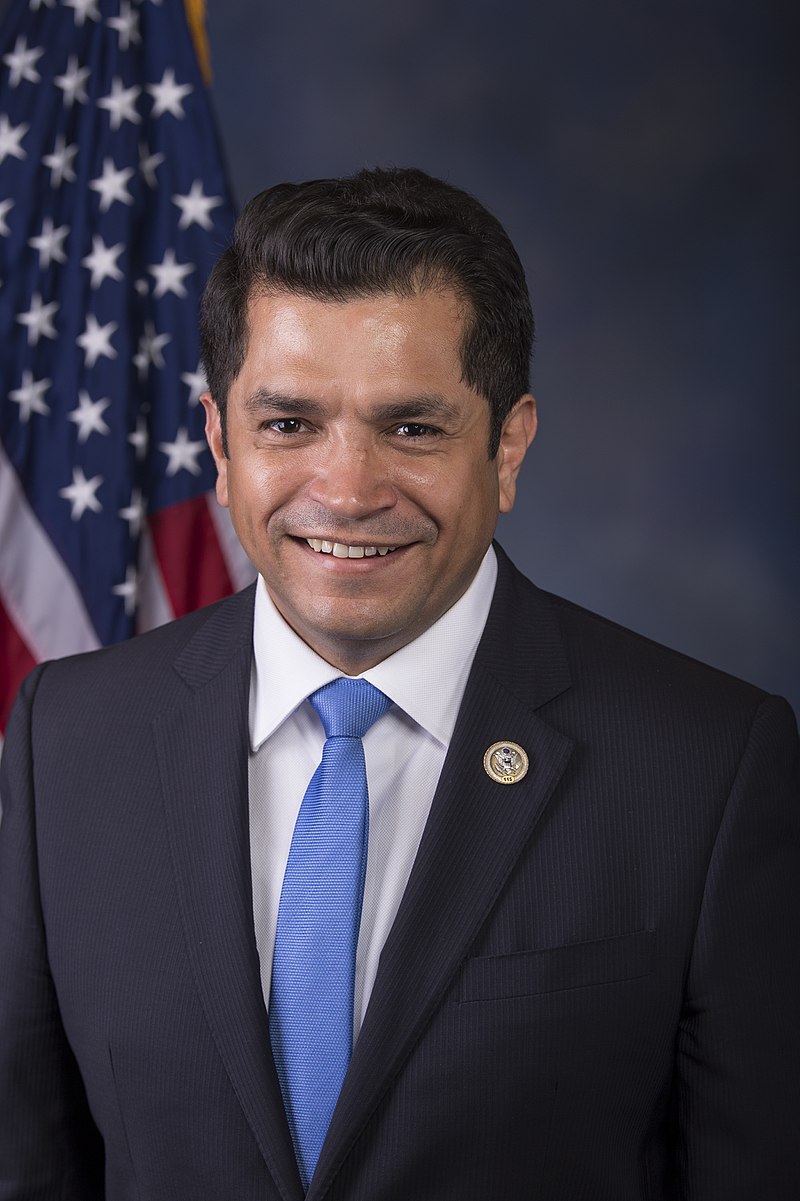

Yea (209)

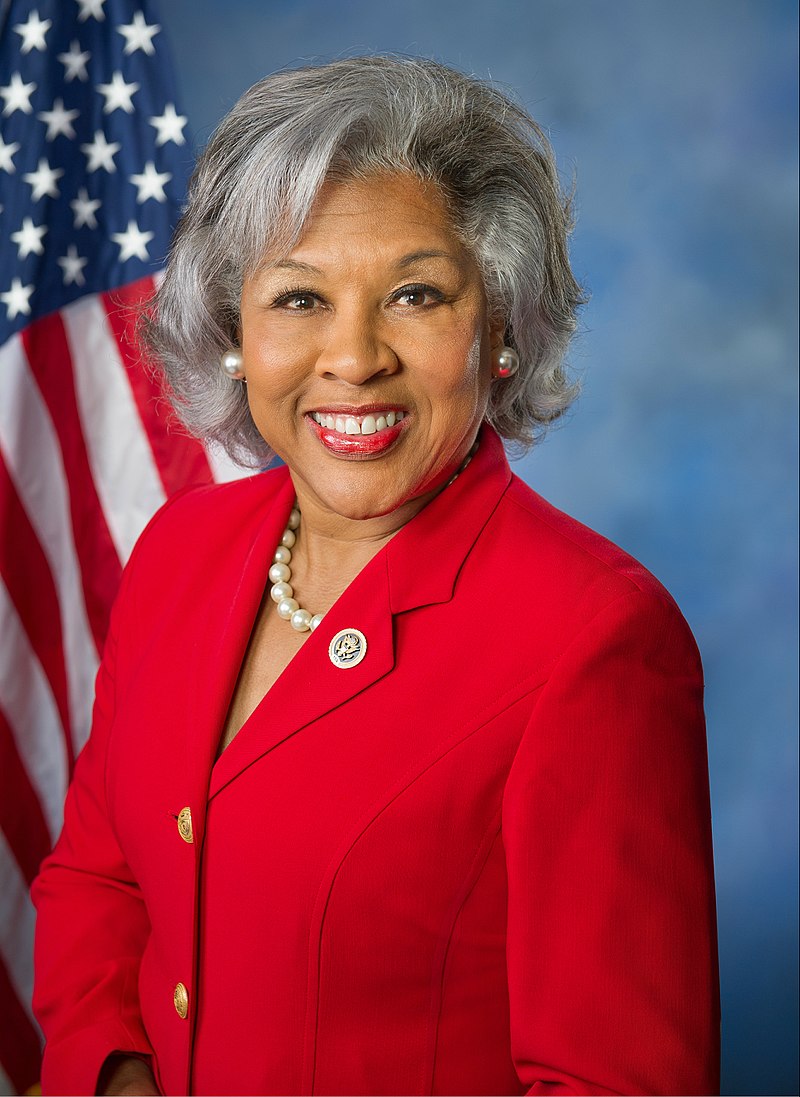

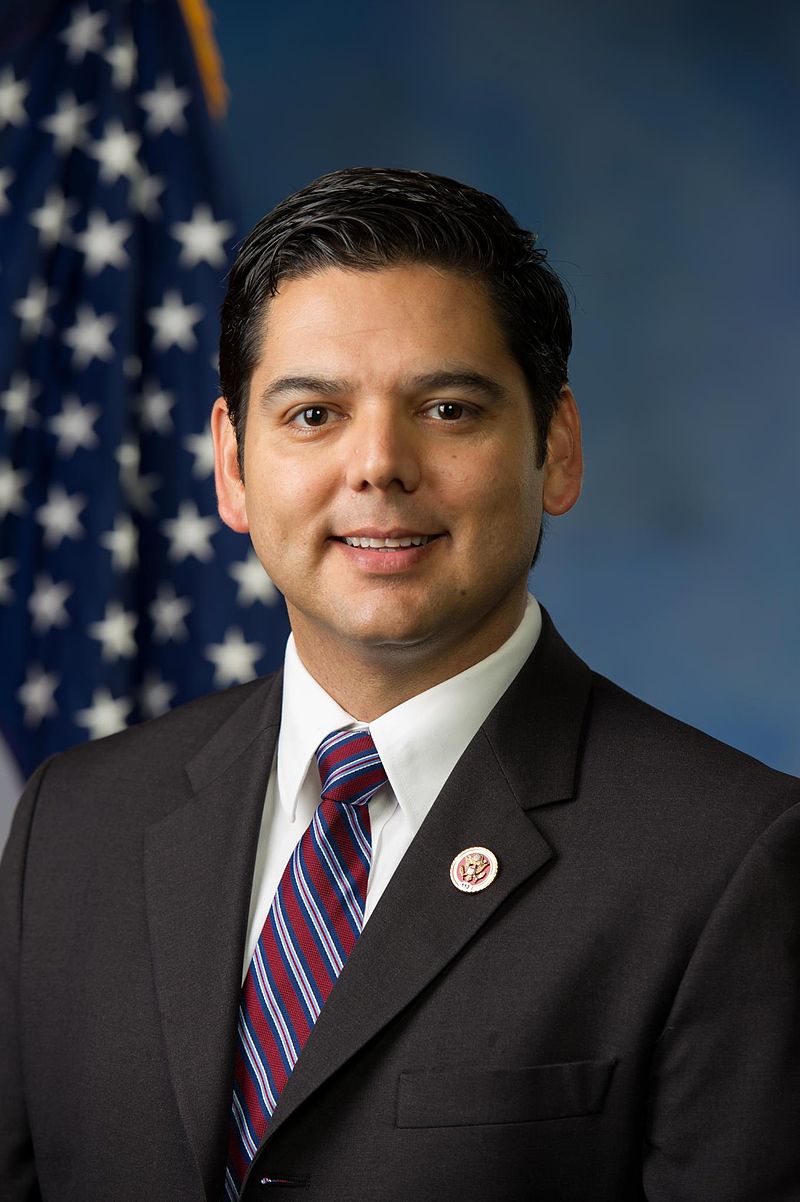

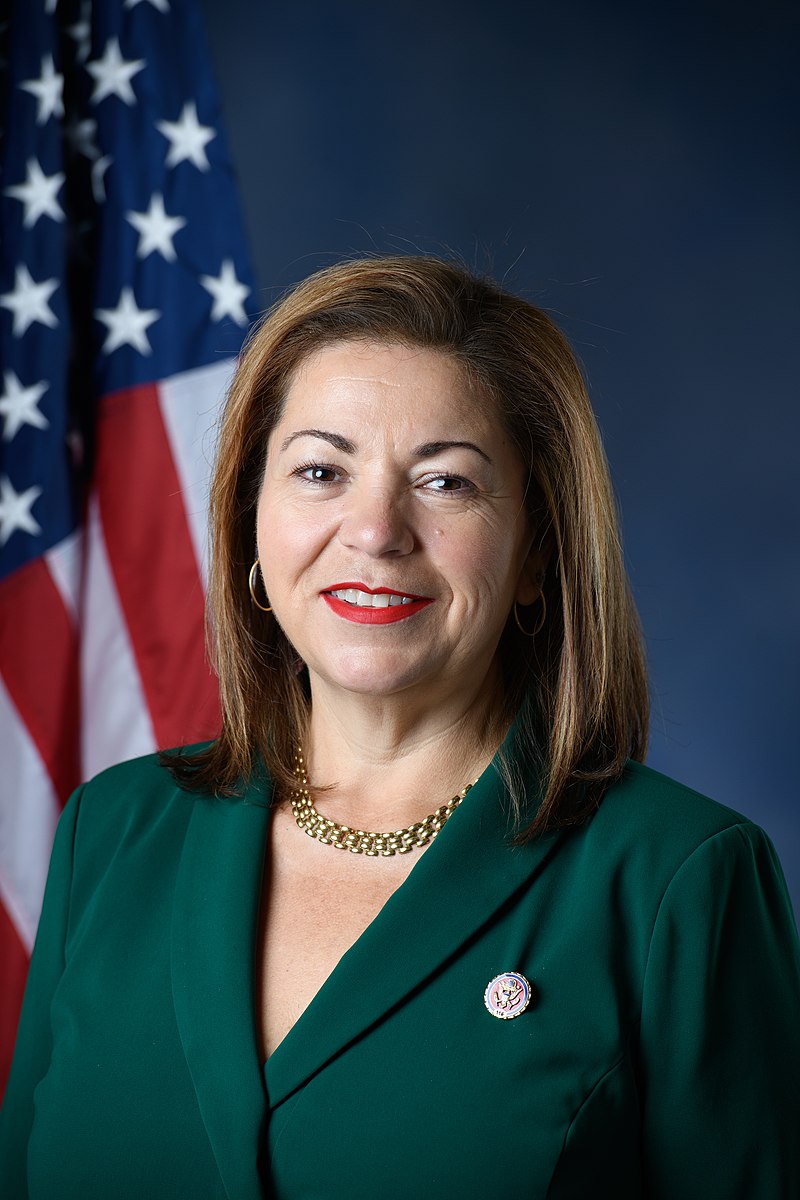

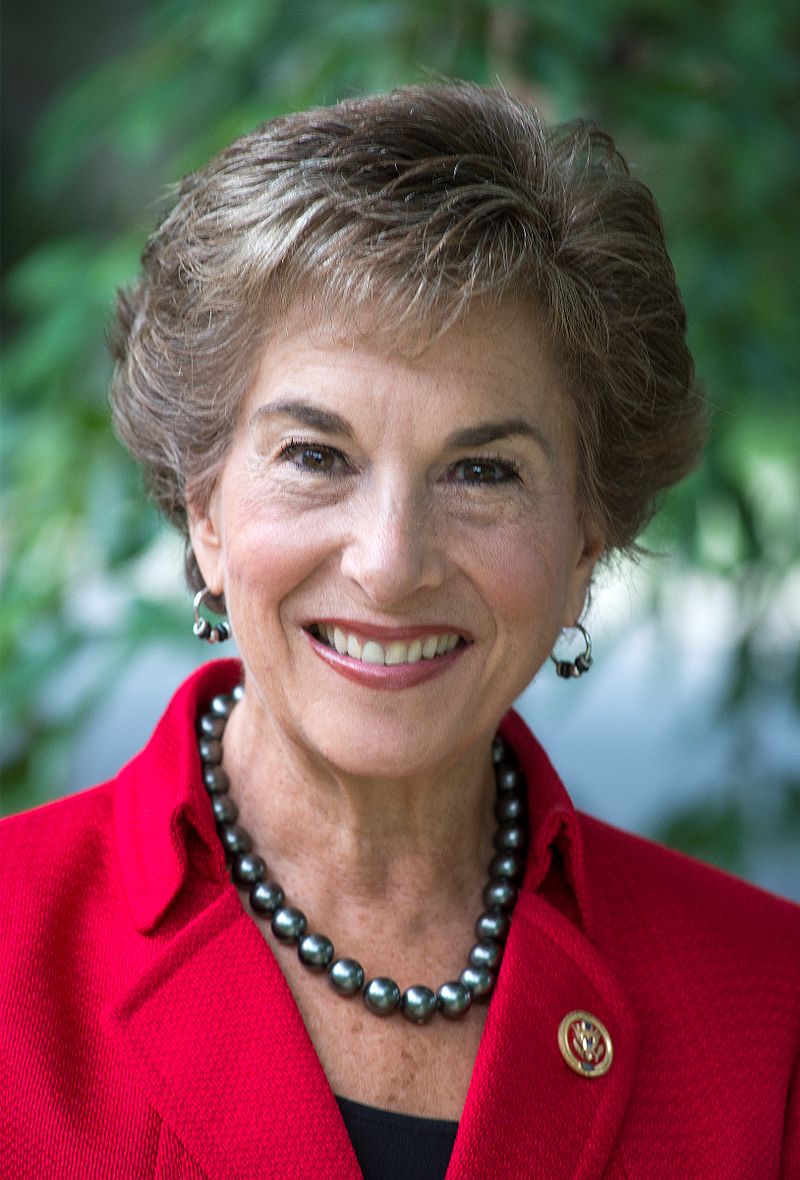

CA • D • Yea

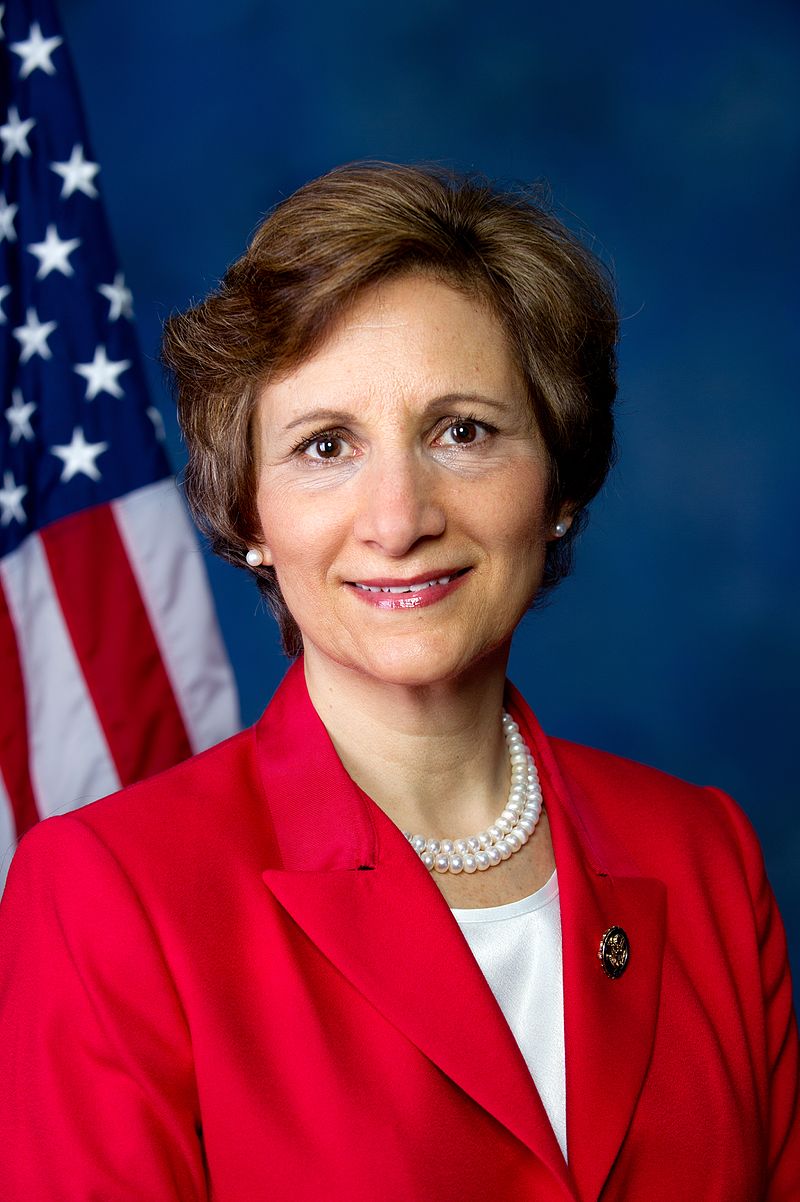

RI • D • Yea

AZ • D • Yea

MA • D • Yea

VT • D • Yea

CA • D • Yea

OH • D • Yea

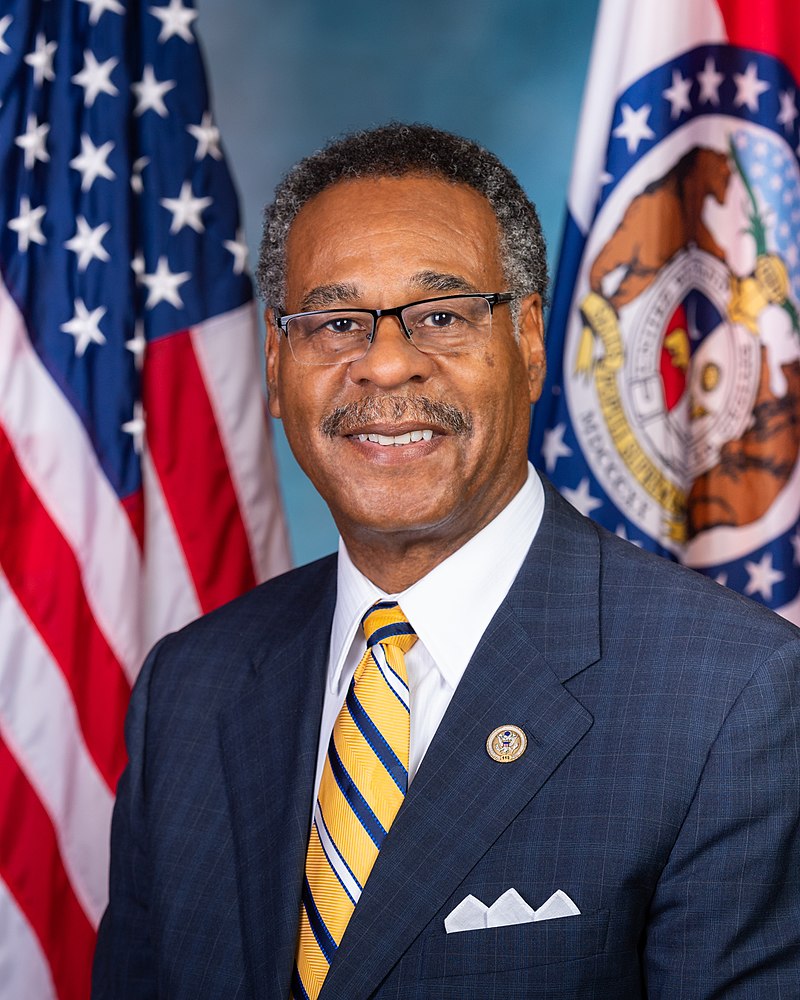

MO • D • Yea

CA • D • Yea

VA • D • Yea

GA • D • Yea

OR • D • Yea

PA • D • Yea

OH • D • Yea

CA • D • Yea

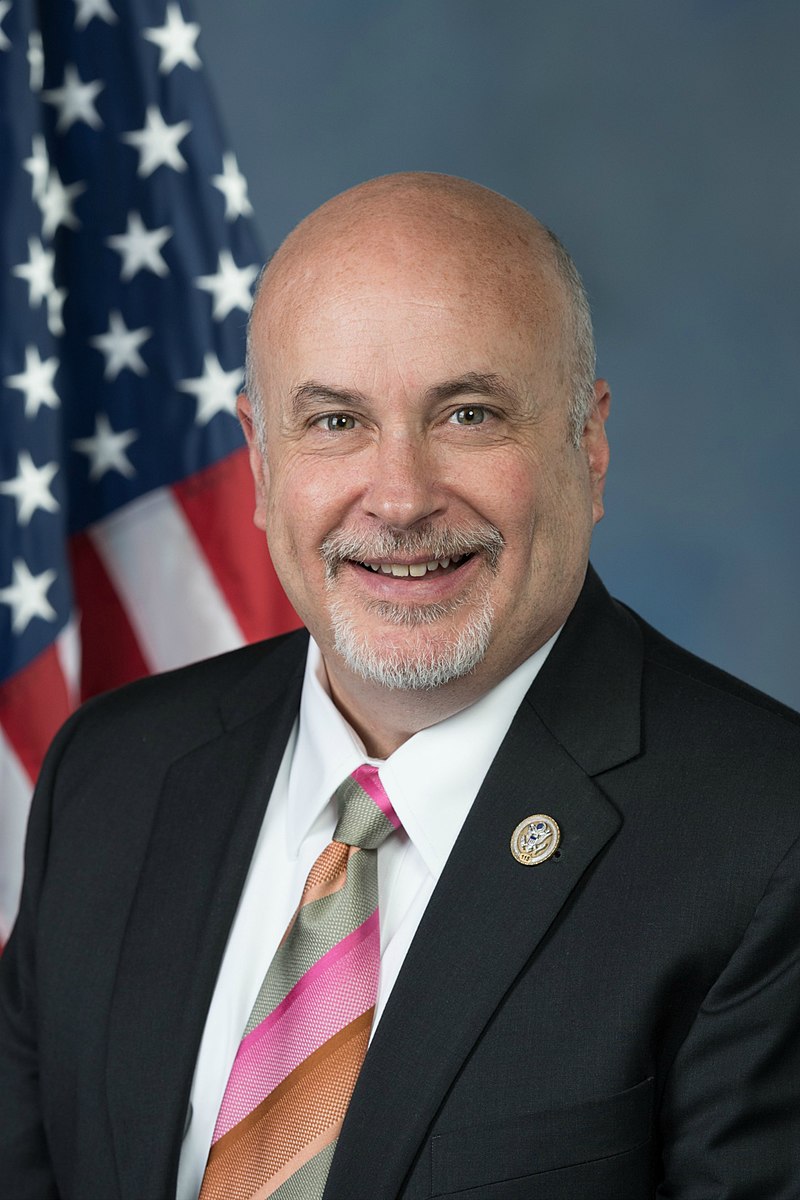

IL • D • Yea

OR • D • Yea

CA • D • Yea

IN • D • Yea

LA • D • Yea

HI • D • Yea

IL • D • Yea

FL • D • Yea

TX • D • Yea

FL • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

NY • D • Yea

MO • D • Yea

SC • D • Yea

TN • D • Yea

NJ • D • Yea

CA • D • Yea

CA • D • Yea

CT • D • Yea

MN • D • Yea

TX • D • Yea

CO • D • Yea

TX • D • Yea

KS • D • Yea

IL • D • Yea

NC • D • Yea

PA • D • Yea

CO • D • Yea

CT • D • Yea

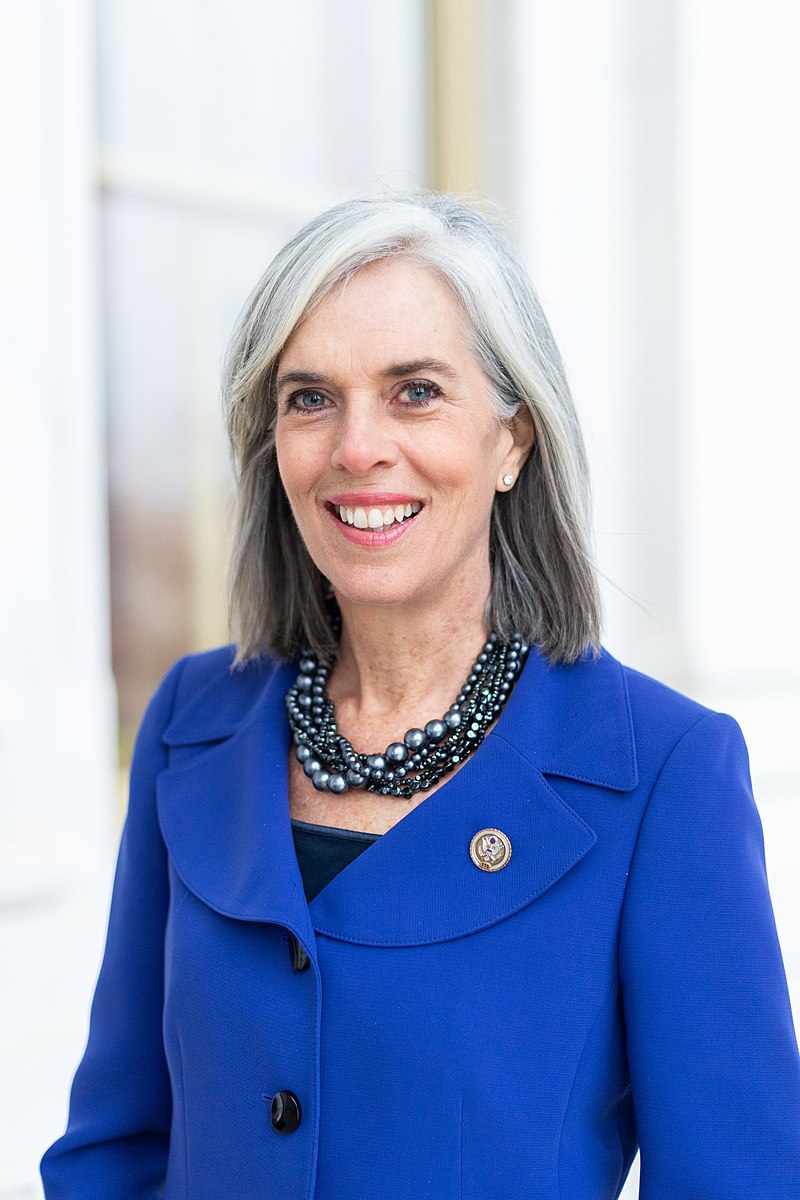

WA • D • Yea

PA • D • Yea

CA • D • Yea

OR • D • Yea

MI • D • Yea

TX • D • Yea

MD • D • Yea

TX • D • Yea

NY • D • Yea

PA • D • Yea

LA • D • Yea

AL • D • Yea

TX • D • Yea

IL • D • Yea

NC • D • Yea

FL • D • Yea

CA • D • Yea

FL • D • Yea

CA • D • Yea

TX • D • Yea

CA • D • Yea

IL • D • Yea

NY • D • Yea

ME • D • Yea

NY • D • Yea

CA • D • Yea

TX • D • Yea

NH • D • Yea

NJ • D • Yea

CA • D • Yea

TX • D • Yea

AZ • D • Yea

CA • D • Yea

CT • D • Yea

CT • D • Yea

NV • D • Yea

PA • D • Yea

MD • D • Yea

OR • D • Yea

CA • D • Yea

MD • D • Yea

IL • D • Yea

CA • D • Yea

WA • D • Yea

NY • D • Yea

GA • D • Yea

TX • D • Yea

CA • D • Yea

OH • D • Yea

MA • D • Yea

IL • D • Yea

NY • D • Yea

CA • D • Yea

IL • D • Yea

OH • D • Yea

WA • D • Yea

CT • D • Yea

NY • D • Yea

NV • D • Yea

PA • D • Yea

NM • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

RI • D • Yea

NY • D • Yea

CA • D • Yea

GA • D • Yea

DE • D • Yea

MD • D • Yea

VA • D • Yea

MN • D • Yea

MI • D • Yea

KY • D • Yea

MA • D • Yea

NJ • D • Yea

NY • D • Yea

NJ • D • Yea

NY • D • Yea

MD • D • Yea

CA • D • Yea

WI • D • Yea

NY • D • Yea

MN • D • Yea

FL • D • Yea

MA • D • Yea

IN • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CO • D • Yea

NJ • D • Yea

NY • D • Yea

MD • D • Yea

MN • D • Yea

NJ • D • Yea

CA • D • Yea

NH • D • Yea

CA • D • Yea

WA • D • Yea

CA • D • Yea

CO • D • Yea

ME • D • Yea

WI • D • Yea

NJ • D • Yea

MA • D • Yea

IL • D • Yea

IL • D • Yea

WA • D • Yea

MD • D • Yea

NY • D • Yea

CA • D • Yea

NC • D • Yea

CA • D • Yea

NY • D • Yea

OR • D • Yea

CA • D • Yea

PA • D • Yea

IL • D • Yea

IL • D • Yea

MI • D • Yea

WA • D • Yea

VA • D • Yea

GA • D • Yea

AL • D • Yea

CA • D • Yea

CA • D • Yea

WA • D • Yea

IL • D • Yea

FL • D • Yea

NM • D • Yea

AZ • D • Yea

MI • D • Yea

WA • D • Yea

VA • D • Yea

NY • D • Yea

CA • D • Yea

MI • D • Yea

MS • D • Yea

CA • D • Yea

NV • D • Yea

MI • D • Yea

HI • D • Yea

NY • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CA • D • Yea

IL • D • Yea

CA • D • Yea

NM • D • Yea

TX • D • Yea

NY • D • Yea

VA • D • Yea

VA • D • Yea

FL • D • Yea

CA • D • Yea

NJ • D • Yea

CA • D • Yea

GA • D • Yea

Nay (213)

AL • R • Nay

MO • R • Nay

GA • R • Nay

NV • R • Nay

TX • R • Nay

TX • R • Nay

NE • R • Nay

IN • R • Nay

OH • R • Nay

KY • R • Nay

MI • R • Nay

WA • R • Nay

FL • R • Nay

AK • R • Nay

OR • R • Nay

MI • R • Nay

OK • R • Nay

AZ • R • Nay

SC • R • Nay

FL • R • Nay

CO • R • Nay

IL • R • Nay

OK • R • Nay

PA • R • Nay

FL • R • Nay

TN • R • Nay

MO • R • Nay

CA • R • Nay

FL • R • Nay

OH • R • Nay

TX • R • Nay

GA • R • Nay

AZ • R • Nay

VA • R • Nay

TX • R • Nay

GA • R • Nay

OK • R • Nay

GA • R • Nay

KY • R • Nay

AZ • R • Nay

CO • R • Nay

AR • R • Nay

TX • R • Nay

OH • R • Nay

TX • R • Nay

TN • R • Nay

FL • R • Nay

FL • R • Nay

MT • R • Nay

NC • R • Nay

TX • R • Nay

MN • R • Nay

KS • R • Nay

CO • R • Nay

MS • R • Nay

TX • R • Nay

ND • R • Nay

IA • R • Nay

FL • R • Nay

MN • R • Nay

MN • R • Nay

WI • R • Nay

PA • R • Nay

TN • R • Nay

NE • R • Nay

CA • R • Nay

NC • R • Nay

FL • R • Nay

SC • R • Nay

ID • R • Nay

NY • R • Nay

TX • R • Nay

FL • R • Nay

TX • R • Nay

TX • R • Nay

TX • R • Nay

AZ • R • Nay

MO • R • Nay

VA • R • Nay

WI • R • Nay

MS • R • Nay

KY • R • Nay

WY • R • Nay

AZ • R • Nay

FL • R • Nay

NC • R • Nay

MD • R • Nay

NC • R • Nay

TN • R • Nay

OK • R • Nay

LA • R • Nay

AR • R • Nay

IA • R • Nay

IN • R • Nay

NC • R • Nay

MI • R • Nay

CO • R • Nay

CA • R • Nay

GA • R • Nay

TX • R • Nay

MI • R • Nay

LA • R • Nay

SD • R • Nay

OH • R • Nay

OH • R • Nay

PA • R • Nay

NJ • R • Nay

PA • R • Nay

MS • R • Nay

UT • R • Nay

VA • R • Nay

CA • R • Nay

CA • R • Nay

NC • R • Nay

TN • R • Nay

IL • R • Nay

NY • R • Nay

NY • R • Nay

OH • R • Nay

NY • R • Nay

FL • R • Nay

LA • R • Nay

GA • R • Nay

OK • R • Nay

FL • R • Nay

TX • R • Nay

SC • R • Nay

PA • R • Nay

NY • R • Nay

UT • R • Nay

KS • R • Nay

KY • R • Nay

FL • R • Nay

TX • R • Nay

MI • R • Nay

CA • R • Nay

GA • R • Nay

NC • R • Nay

VA • R • Nay

IN • R • Nay

PA • R • Nay

WV • R • Nay

IL • R • Nay

OH • R • Nay

IA • R • Nay

FL • R • Nay

MI • R • Nay

AL • R • Nay

UT • R • Nay

WV • R • Nay

NC • R • Nay

TX • R • Nay

TX • R • Nay

WA • R • Nay

SC • R • Nay

IA • R • Nay

CA • R • Nay

TN • R • Nay

MO • R • Nay

UT • R • Nay

AL • R • Nay

FL • R • Nay

PA • R • Nay

TX • R • Nay

PA • R • Nay

KY • R • Nay

TN • R • Nay

NC • R • Nay

TX • R • Nay

OH • R • Nay

FL • R • Nay

FL • R • Nay

LA • R • Nay

KS • R • Nay

AZ • R • Nay

GA • R • Nay

TX • R • Nay

TX • R • Nay

IN • R • Nay

ID • R • Nay

NJ • R • Nay

NE • R • Nay

MO • R • Nay

PA • R • Nay

IN • R • Nay

MN • R • Nay

NY • R • Nay

WI • R • Nay

FL • R • Nay

AL • R • Nay

IN • R • Nay

OH • R • Nay

NY • R • Nay

PA • R • Nay

WI • R • Nay

SC • R • Nay

OH • R • Nay

CA • R • Nay

NJ • D • Nay

TX • R • Nay

TN • R • Nay

MO • R • Nay

MI • R • Nay

TX • R • Nay

FL • R • Nay

AR • R • Nay

WI • R • Nay

TX • R • Nay

SC • R • Nay

VA • R • Nay

AR • R • Nay

IN • R • Nay

MT • R • Nay

Not Voting (9)

TX • D • Not Voting

FL • R • Not Voting

TX • R • Not Voting

NC • R • Not Voting

AL • R • Not Voting

CA • D • Not Voting

OH • D • Not Voting

WI • R • Not Voting

FL • D • Not Voting