H.R.23 — Family and Small Business Taxpayer Protection Act

House Roll Call

H.R.23

Roll 25 • Congress 118, Session 1 • Jan 9, 2023 9:23 PM • Result: Passed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.23 — Family and Small Business Taxpayer Protection Act |

|---|---|

| Vote question | On Passage |

| Vote type | Yea-and-Nay |

| Result | Passed |

| Totals | Yea 221 / Nay 210 / Present 0 / Not Voting 3 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 221 | 0 | 0 | 1 |

| D | 0 | 210 | 0 | 2 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Passage

Bill Analysis

The Family and Small Business Taxpayer Protection Act (HR 23) aims to enhance taxpayer protections, particularly for families and small businesses, by implementing several key provisions. The bill seeks to limit the Internal Revenue Service’s (IRS) ability to conduct audits and increase transparency regarding its enforcement activities.

One of the central features of HR 23 is the establishment of stricter guidelines for IRS audits, particularly those targeting low- and middle-income taxpayers. The bill mandates that the IRS must provide clear justifications for audits and requires additional oversight to ensure that audits are conducted fairly and equitably. This provision is designed to alleviate concerns among taxpayers about potential harassment or disproportionate scrutiny based on income levels.

Additionally, HR 23 proposes to allocate funding to bolster taxpayer assistance programs. This includes enhancing resources for taxpayer education and outreach initiatives, which aim to help families and small businesses better understand their tax obligations and rights. The bill emphasizes the importance of taxpayer support services, particularly for those who may be unfamiliar with the tax system.

The legislation also includes provisions to protect taxpayers from aggressive collection practices. It prohibits the IRS from seizing bank accounts or other assets without prior notice and requires the agency to provide a clear process for taxpayers to contest such actions.

Beneficiaries of HR 23 include individual taxpayers, particularly those from low- and middle-income brackets, as well as small business owners who may face challenges navigating the tax system. The bill aims to create a more equitable tax environment by reducing the burden of audits and enhancing taxpayer support.

As of the latest action, HR 23 has been read a second time and is currently placed on the Senate Legislative Calendar under General Orders, indicating it is awaiting further consideration. The timeline for potential enactment remains uncertain as it progresses through the legislative process.

Yea (221)

MO • R • Yea

GA • R • Yea

NV • R • Yea

ND • R • Yea

TX • R • Yea

TX • R • Yea

NE • R • Yea

IN • R • Yea

OH • R • Yea

IN • R • Yea

KY • R • Yea

FL • R • Yea

OR • R • Yea

MI • R • Yea

OK • R • Yea

AZ • R • Yea

FL • R • Yea

NC • R • Yea

CO • R • Yea

IL • R • Yea

OK • R • Yea

FL • R • Yea

CO • R • Yea

IN • R • Yea

TN • R • Yea

TX • R • Yea

MO • R • Yea

CA • R • Yea

FL • R • Yea

OH • R • Yea

AL • R • Yea

TX • R • Yea

GA • R • Yea

OR • R • Yea

AZ • R • Yea

VA • R • Yea

TX • R • Yea

GA • R • Yea

OK • R • Yea

GA • R • Yea

KY • R • Yea

AZ • R • Yea

AR • R • Yea

UT • R • Yea

NY • R • Yea

OH • R • Yea

TX • R • Yea

TN • R • Yea

FL • R • Yea

FL • R • Yea

CA • R • Yea

SC • R • Yea

FL • R • Yea

NC • R • Yea

TX • R • Yea

MN • R • Yea

KS • R • Yea

MS • R • Yea

TX • R • Yea

IA • R • Yea

GA • R • Yea

MN • R • Yea

MN • R • Yea

WI • R • Yea

PA • R • Yea

TN • R • Yea

NE • R • Yea

NC • R • Yea

FL • R • Yea

SC • R • Yea

ID • R • Yea

FL • R • Yea

WI • R • Yea

NY • R • Yea

CA • R • Yea

FL • R • Yea

TX • R • Yea

VA • R • Yea

TX • R • Yea

AZ • R • Yea

TX • R • Yea

MO • R • Yea

LA • R • Yea

TN • R • Yea

GA • R • Yea

VA • R • Yea

WI • R • Yea

MS • R • Yea

KY • R • Yea

WY • R • Yea

MD • R • Yea

TN • R • Yea

OK • R • Yea

LA • R • Yea

AR • R • Yea

IA • R • Yea

IN • R • Yea

NC • R • Yea

MI • R • Yea

TX • R • Yea

CA • R • Yea

TX • R • Yea

MI • R • Yea

OH • R • Yea

LA • R • Yea

SD • R • Yea

OH • R • Yea

OH • R • Yea

PA • R • Yea

NJ • R • Yea

PA • R • Yea

MS • R • Yea

VA • R • Yea

CA • R • Yea

CA • R • Yea

TN • R • Yea

IL • R • Yea

NY • R • Yea

CA • R • Yea

CO • R • Yea

NY • R • Yea

OH • R • Yea

KS • R • Yea

NY • R • Yea

FL • R • Yea

AZ • R • Yea

LA • R • Yea

GA • R • Yea

OK • R • Yea

MO • R • Yea

FL • R • Yea

TX • R • Yea

SC • R • Yea

NY • R • Yea

KS • R • Yea

KY • R • Yea

FL • R • Yea

CA • R • Yea

TX • R • Yea

MI • R • Yea

CA • R • Yea

GA • R • Yea

NC • R • Yea

PA • R • Yea

WV • R • Yea

IL • R • Yea

OH • R • Yea

IA • R • Yea

FL • R • Yea

NY • R • Yea

MI • R • Yea

WV • R • Yea

AL • R • Yea

UT • R • Yea

TX • R • Yea

NC • R • Yea

TX • R • Yea

WA • R • Yea

SC • R • Yea

IA • R • Yea

CA • R • Yea

TN • R • Yea

UT • R • Yea

AL • R • Yea

IN • R • Yea

PA • R • Yea

TX • R • Yea

FL • R • Yea

PA • R • Yea

WA • R • Yea

KY • R • Yea

AL • R • Yea

TN • R • Yea

MT • R • Yea

NC • R • Yea

TX • R • Yea

FL • R • Yea

FL • R • Yea

NY • R • Yea

LA • R • Yea

AZ • R • Yea

GA • R • Yea

TX • R • Yea

TX • R • Yea

ID • R • Yea

NJ • R • Yea

NE • R • Yea

MO • R • Yea

PA • R • Yea

IN • R • Yea

MN • R • Yea

CA • R • Yea

NY • R • Yea

WI • R • Yea

FL • R • Yea

UT • R • Yea

AL • R • Yea

NY • R • Yea

PA • R • Yea

WI • R • Yea

SC • R • Yea

OH • R • Yea

CA • R • Yea

NJ • D • Yea

TX • R • Yea

WI • R • Yea

MO • R • Yea

MI • R • Yea

FL • R • Yea

TX • R • Yea

FL • R • Yea

OH • R • Yea

AR • R • Yea

TX • R • Yea

NY • R • Yea

SC • R • Yea

VA • R • Yea

AR • R • Yea

IN • R • Yea

MT • R • Yea

Nay (210)

NC • D • Nay

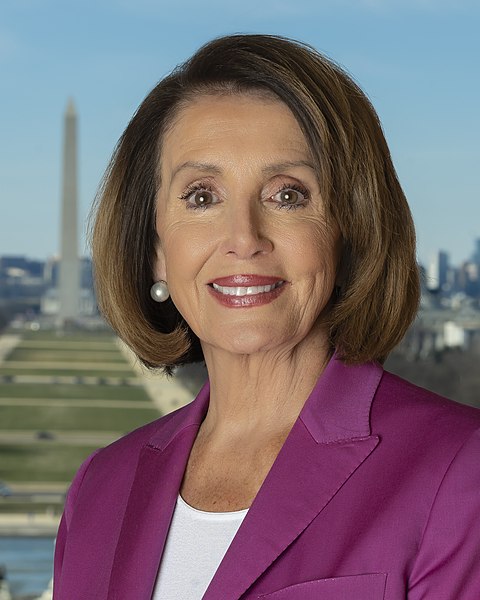

CA • D • Nay

TX • D • Nay

MA • D • Nay

VT • D • Nay

CA • D • Nay

OH • D • Nay

CA • D • Nay

VA • D • Nay

GA • D • Nay

OR • D • Nay

DE • D • Nay

OR • D • Nay

NY • D • Nay

PA • D • Nay

OH • D • Nay

CA • D • Nay

IL • D • Nay

MO • D • Nay

CO • D • Nay

CA • D • Nay

CA • D • Nay

IN • D • Nay

LA • D • Nay

PA • D • Nay

TX • D • Nay

HI • D • Nay

IL • D • Nay

FL • D • Nay

TX • D • Nay

CA • D • Nay

RI • D • Nay

MA • D • Nay

NY • D • Nay

MO • D • Nay

SC • D • Nay

TN • D • Nay

VA • D • Nay

CA • D • Nay

CA • D • Nay

CT • D • Nay

MN • D • Nay

TX • D • Nay

CO • D • Nay

TX • D • Nay

KS • D • Nay

IL • D • Nay

NC • D • Nay

PA • D • Nay

CO • D • Nay

CT • D • Nay

WA • D • Nay

PA • D • Nay

CA • D • Nay

MI • D • Nay

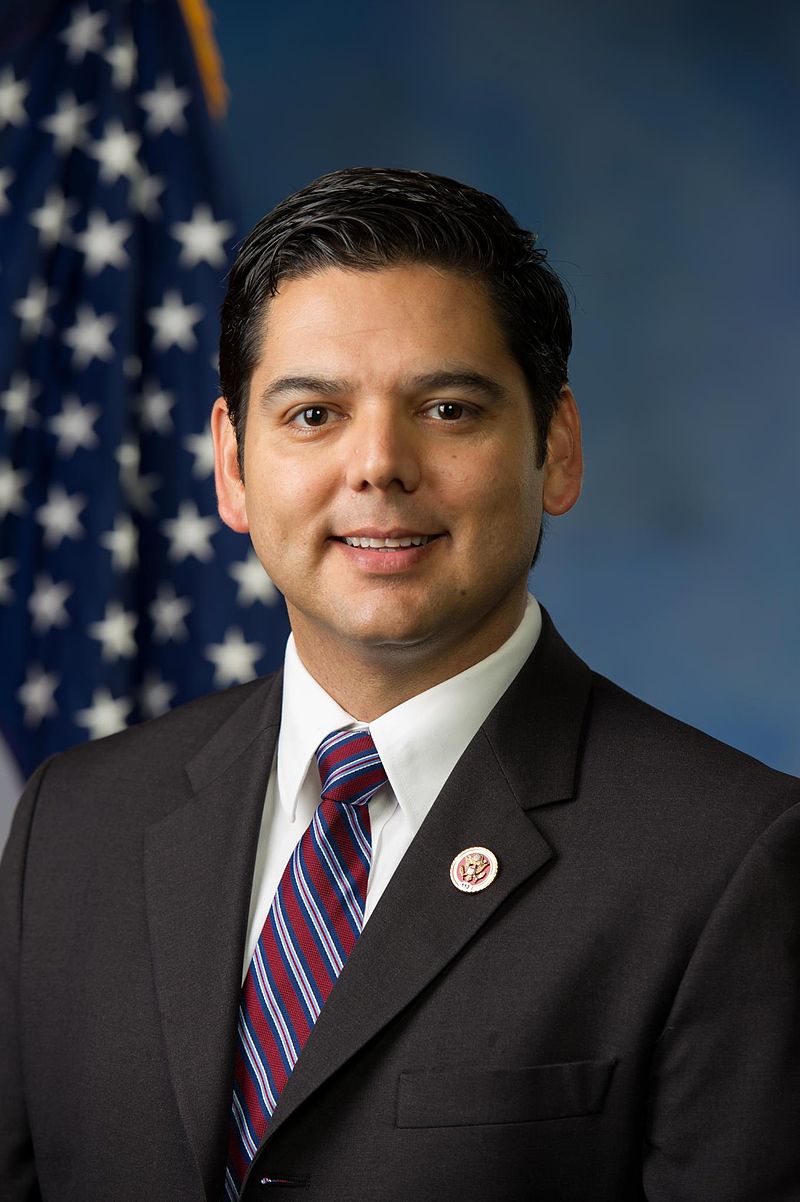

TX • D • Nay

TX • D • Nay

CA • D • Nay

NY • D • Nay

PA • D • Nay

TX • D • Nay

IL • D • Nay

NC • D • Nay

FL • D • Nay

FL • D • Nay

AZ • D • Nay

CA • D • Nay

TX • D • Nay

CA • D • Nay

IL • D • Nay

ME • D • Nay

NY • D • Nay

CA • D • Nay

TX • D • Nay

NJ • D • Nay

TX • D • Nay

AZ • D • Nay

CA • D • Nay

CT • D • Nay

NY • D • Nay

CT • D • Nay

NV • D • Nay

PA • D • Nay

MD • D • Nay

OR • D • Nay

CA • D • Nay

MD • D • Nay

NC • D • Nay

IL • D • Nay

TX • D • Nay

CA • D • Nay

WA • D • Nay

NY • D • Nay

GA • D • Nay

CA • D • Nay

OH • D • Nay

MA • D • Nay

IL • D • Nay

CA • D • Nay

MI • D • Nay

WA • D • Nay

NJ • D • Nay

IL • D • Nay

NH • D • Nay

OH • D • Nay

WA • D • Nay

CT • D • Nay

CA • D • Nay

PA • D • Nay

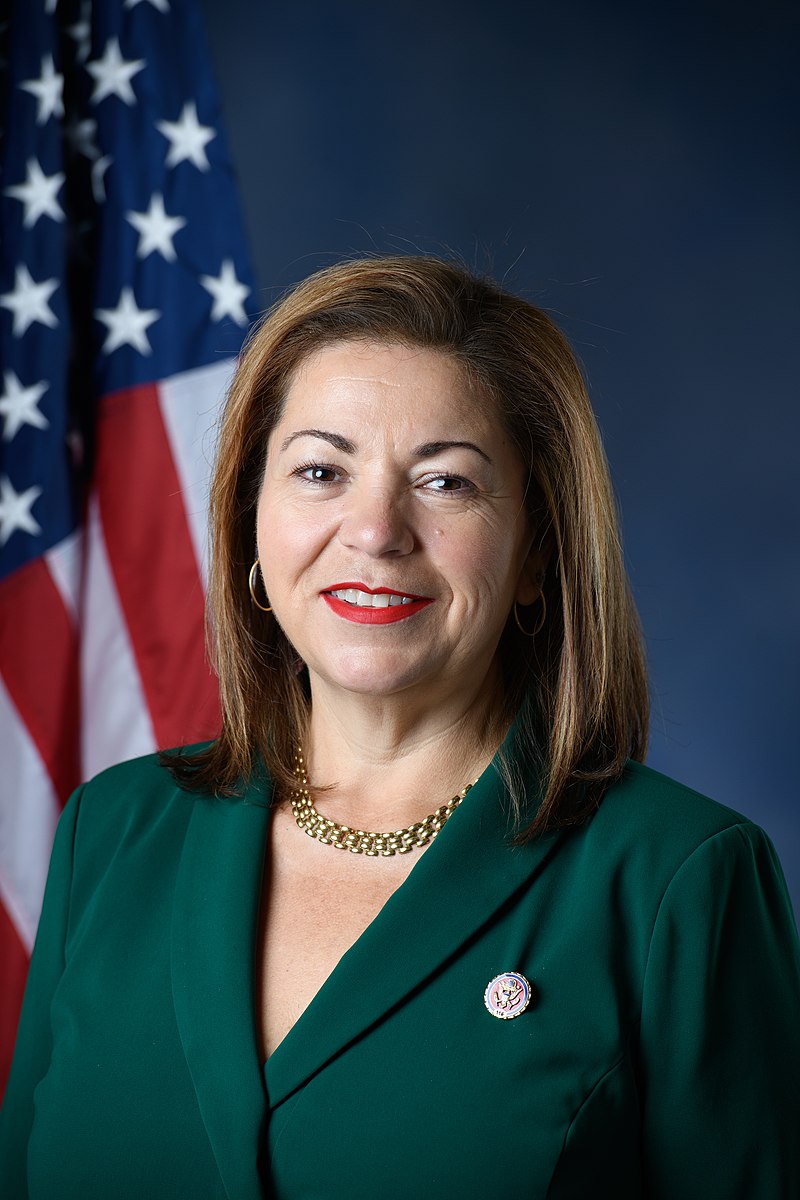

NM • D • Nay

CA • D • Nay

CA • D • Nay

CA • D • Nay

MA • D • Nay

RI • D • Nay

NC • D • Nay

CA • D • Nay

GA • D • Nay

MN • D • Nay

KY • D • Nay

MA • D • Nay

NY • D • Nay

NJ • D • Nay

NY • D • Nay

MD • D • Nay

WI • D • Nay

NY • D • Nay

FL • D • Nay

MA • D • Nay

IN • D • Nay

CA • D • Nay

NY • D • Nay

CA • D • Nay

MA • D • Nay

CO • D • Nay

NC • D • Nay

NJ • D • Nay

NY • D • Nay

MN • D • Nay

NJ • D • Nay

CA • D • Nay

NH • D • Nay

NJ • D • Nay

NJ • D • Nay

CA • D • Nay

AK • D • Nay

WA • D • Nay

CA • D • Nay

CO • D • Nay

MN • D • Nay

ME • D • Nay

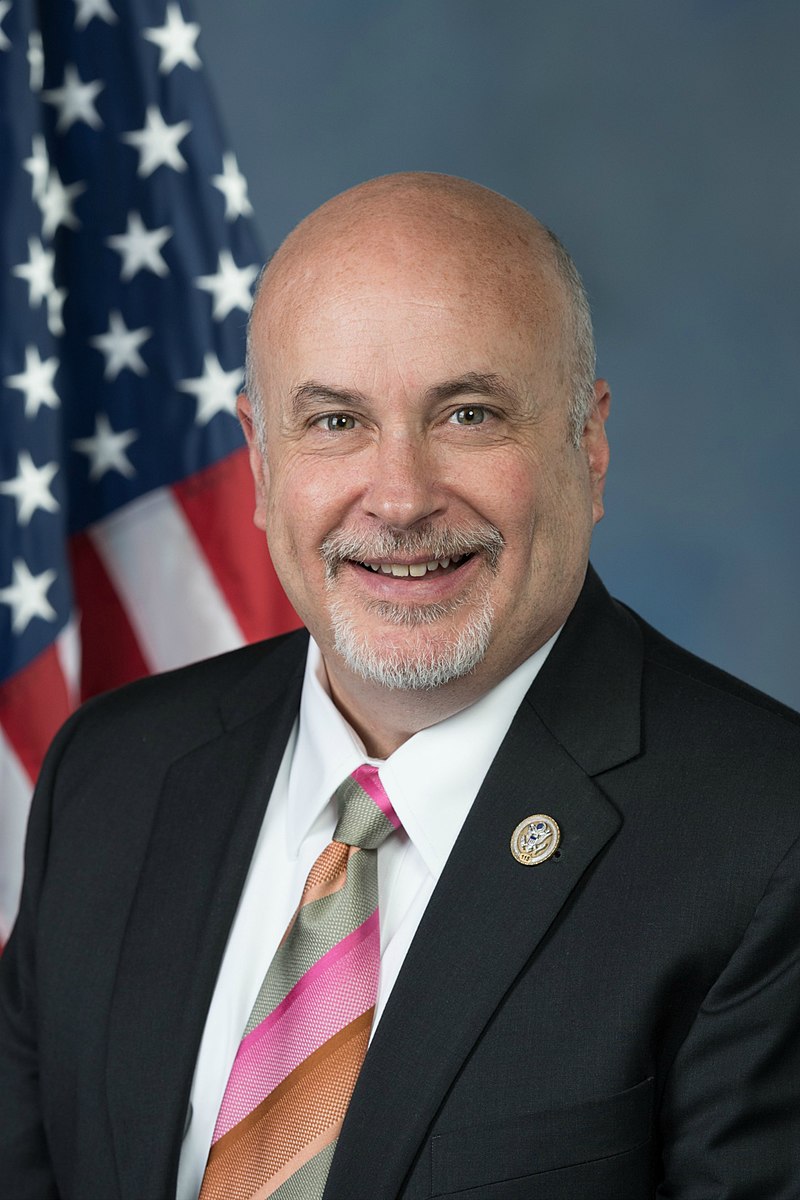

WI • D • Nay

CA • D • Nay

MA • D • Nay

IL • D • Nay

IL • D • Nay

MD • D • Nay

NC • D • Nay

CA • D • Nay

MD • D • Nay

NY • D • Nay

OR • D • Nay

CA • D • Nay

MD • D • Nay

PA • D • Nay

IL • D • Nay

CA • D • Nay

IL • D • Nay

MI • D • Nay

WA • D • Nay

VA • D • Nay

GA • D • Nay

AL • D • Nay

CA • D • Nay

NJ • D • Nay

MI • D • Nay

WA • D • Nay

IL • D • Nay

FL • D • Nay

VA • D • Nay

NM • D • Nay

AZ • D • Nay

MI • D • Nay

WA • D • Nay

CA • D • Nay

OH • D • Nay

CA • D • Nay

MI • D • Nay

MS • D • Nay

CA • D • Nay

NV • D • Nay

MI • D • Nay

HI • D • Nay

NY • D • Nay

CA • D • Nay

NY • D • Nay

MA • D • Nay

MD • D • Nay

IL • D • Nay

CA • D • Nay

NM • D • Nay

TX • D • Nay

NY • D • Nay

FL • D • Nay

CA • D • Nay

NJ • D • Nay

VA • D • Nay

PA • D • Nay

GA • D • Nay

FL • D • Nay